Permian Basin natural gas will soon take on a protagonist role south of the U.S. border where numerous liquefaction facilities planned on Mexico’s northwest Pacific Coast will process significant volumes for re-export to premium LNG consuming markets in Asia.

Mexico’s push for LNG exporting glory hinges on completion of liquefaction plants and crucial pipelines from the Permian, buildouts that are expected to happen concurrently as the next wave of U.S. liquefaction capacity prepares to comes online toward the end of this decade.

If all goes according to plan, Mexico will soon be a net exporter of LNG, no longer relying on costly LNG imports.

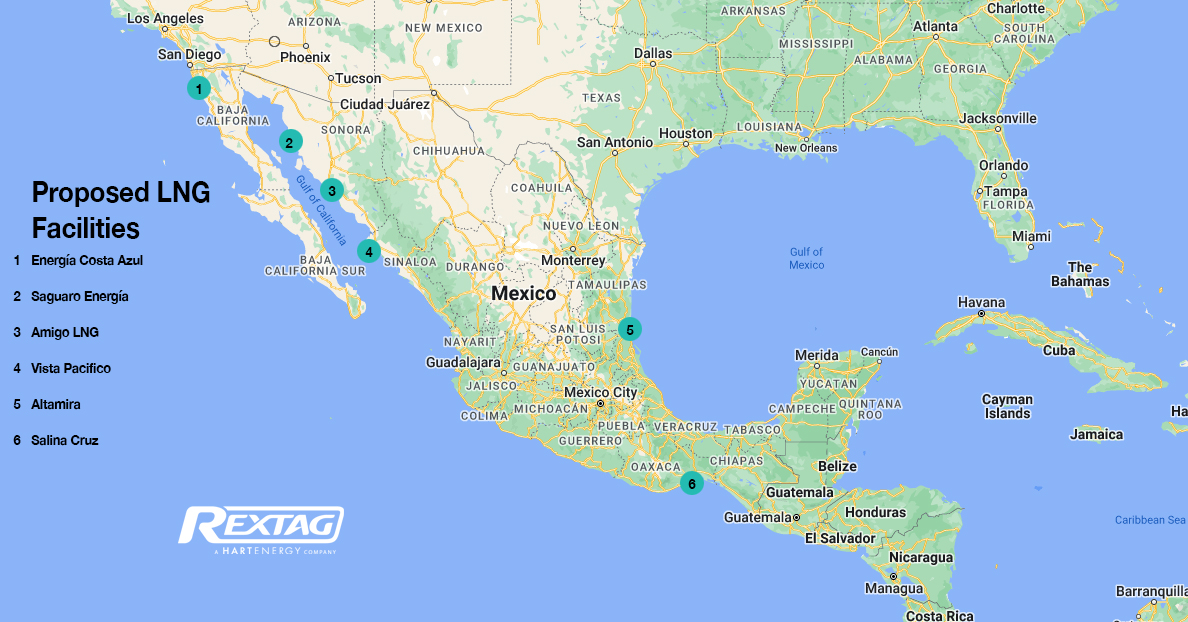

Initial Permian feedgas volumes could reach gas-hungry Asian markets as early as summer 2025, according to San Diego-based Sempra, whose affiliate Sempra Infrastructure is nearing completion of its Energía Costa Azul (ECA LNG) Phase 1 project north of Ensenada in Baja California, Mexico.

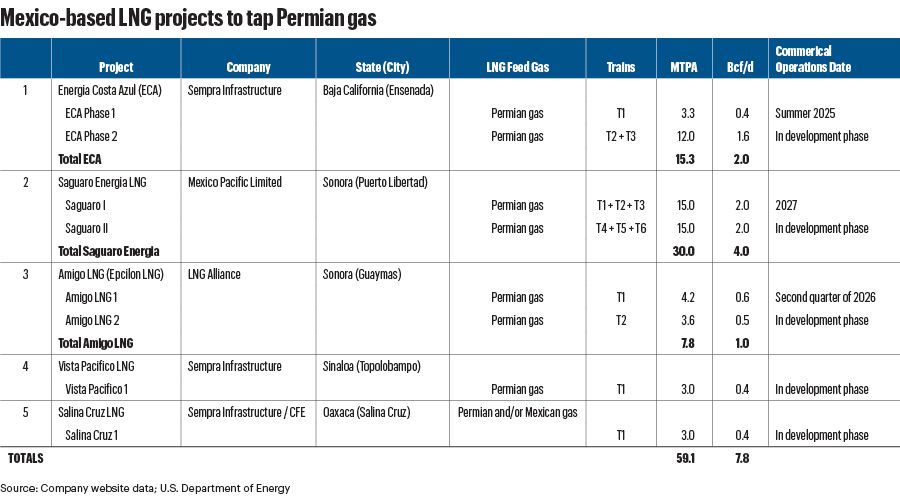

Mexico is betting big on LNG exports, especially from its Pacific Coast. If five projects proposed by Sempra Infrastructure, Mexico Pacific and LNG Alliance Pte Ltd. Singapore move forward, they will assist Mexico in bringing to market 59 million tonnes per annum (mtpa) of liquefaction capacity, or around 7.8 Bcf/d, according to data compiled by Oil and Gas Investor (OGI).

Such a figure will convert Mexico into the third-largest LNG exporter in the Americas, trailing only the U.S. and Canada, according to a Rystad Energy analysis of current, approved and proposed projects.

Mexico is also contemplating export facility developments off the country’s Atlantic Coast, too. However, these developments will be better positioned to serve European destinations.

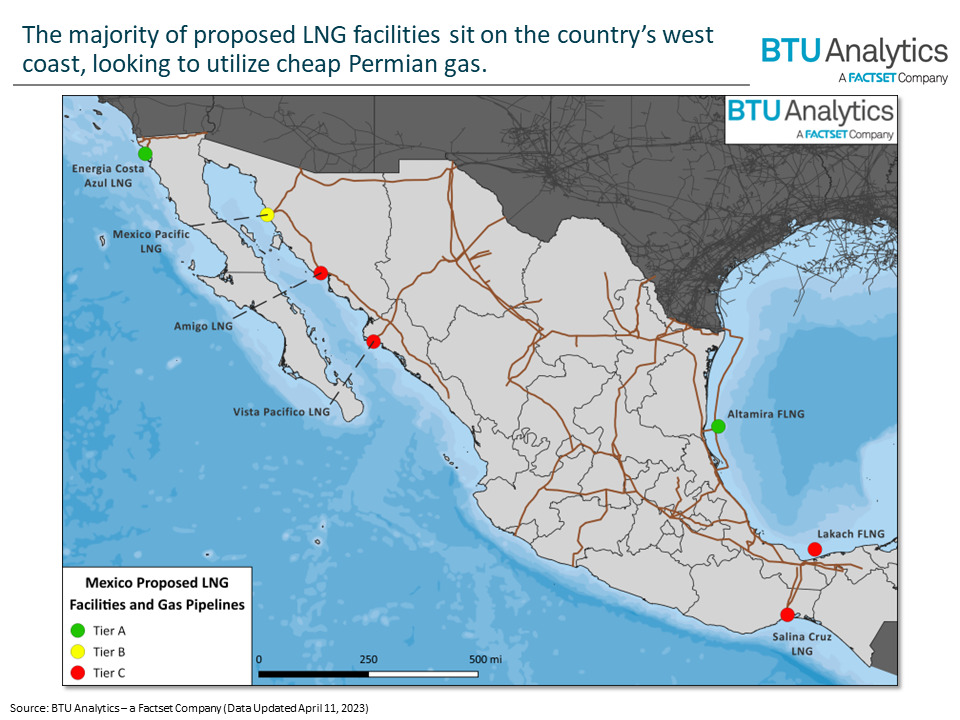

“Projects on the West Coast of Mexico have the advantage of avoiding the Panama Canal when exporting cargoes, which is becoming an increasingly important advantage,” Josephine Mills, Enverus Intelligence Research senior associate, told OGI. “However, projects on the west Coast don’t have the ease of access to Haynesville, Appalachia and Eagle Ford gas that Gulf Coast projects have.”

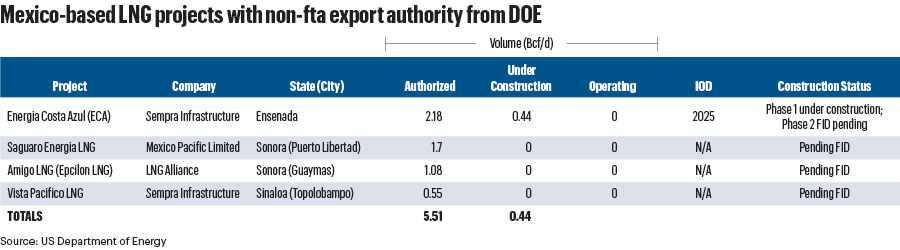

The Biden administration’s LNG pause on new export authorizations, announced on Jan. 26, impacts both Mexican and U.S. LNG projects.

“Any project exporting U.S. gas needs non-free trade agreement (non-FTA) and FTA licenses from the Department of Energy (DOE). Therefore, Mexican LNG projects exporting U.S. gas are subject to the Biden pause as well,” Mills said.

Biden’s policy gives the DOE time to review applications for permits to export LNG to non-FTA countries as well as update its economic and environmental analysis to determine the public interest value of the applications.

“The advantage to Mexico is that it is closer to Asia, so you save on transportation costs, not on construction,” Benjamin Nolan, Stifel managing director, told OGI.

Russia’s invasion of Ukraine in 2022 led to a drastic decline in Russian energy exports to Europe and the U.K. and prompted a major energy crunch. The U.S., which just started exporting LNG in 2016, was able to provide LNG to many countries, including England, France and Spain.

Europe, but also the growing population in Asia, continue to explore ways to guarantee their energy security. North America—the U.S., Canada and Mexico—is shaping up to be a dominant LNG exporting region, despite continued competition from Qatar and Australia.

“The U.S. and Qatar will provide around 50% of total LNG production by 2029, a rapid increase from their 40% combined share in 2023. This looming supply concentration raises Asian LNG buyers’ political and operational risks, especially given the exposure of U.S. and Qatari LNG production to potential shipping chokepoints: the Panama Canal and the Strait of Hormuz,” Ruaraidh Montgomery, Welligence Energy Analytics global head of research, told OGI.

“Asian LNG buyers are therefore currently actively evaluating supporting western Mexican LNG export projects. These projects can offer quicker and cheaper LNG shipping routes into Asia, while avoiding the potential shipping bottleneck of the Panama Canal,” Montgomery said.

The U.S. and Mexico are already major trading partners. On July 1, 2020, they entered into the United States-Mexico-Canada Agreement (USMCA), which replaced the North America Free Trade Agreement (NAFTA), and in 2022, the trade of U.S. goods and services with Mexico totaled an estimated $855.1 billion, according to the Office of U.S. Trade Representative.

And Mexico—a major manufacturing hub and member of OPEC+—is no stranger to piped gas from the Permian, which it has long imported to fulfill domestic demand.

Permian producers exported an average 5.8 Bcf/d of piped gas to Mexico in the week ended April 3, according to the Energy Information Administration (EIA). And this demand isn’t expected to retreat anytime soon, according to Mexico’s Federal Electricity Commission (CFE).

As such, Mexico is on the very cusp of finding a dual use for its Permian imports.

“Mexico is poised to commence initial LNG exports in 2024,” Sergio Chapa, Poten & Partners’ LNG analyst, told OGI in reference to possible cargoes flowing this year from New Fortress Energy’s first fast LNG installation, FLNG 1, in Altamira, Mexico. The project, also referred to as Altamira LNG, is a partnership with CFE to liquefy gas supplied by the Sur de Texas-Tuxpan pipeline and will help create a new FLNG hub off the East Coast of Mexico.

Permian gas to Asia

Mexico’s reliance on U.S. shale will be crucial as the Latin American country seeks export opportunities. And there is benefit to Permian producers that want to fulfill rising demand for LNG not only in Asia, but worldwide.

The Permian Basin covers 86,000 miles and 52 counties across West Texas and southeastern New Mexico. Permian dry shale gas production averaged 17 Bcf/d in February, according to the EIA. And many analysts say it will continue to rise to meet demand from LNG developments on Mexico’s West Coast as well as others along the U.S. Gulf Coast. However, the biggest challenge relates to the build-out of takeaway capacity from the basin, Stifel’s Nolan said, adding that “the availability of the gas is not a problem.”

“That said, you do have a single source of gas, so as is the case with projects like that (versus something in Louisiana, for instance, where there are multiple pipelines), should something happen to interrupt gas inflows, there is no workaround,” Nolan said.

“[Enverus] forecasts the Permian to grow [about] 7.2 Bcf/d by 2030. However, [about] 5 Bcf/d of additional pipeline capacity is needed to achieve this growth,” Mills said. “Of note, the proposed Saguaro [Connector] Pipeline from the Permian to the Mexican border would add 2.8 Bcf/d of capacity. The pipeline would be met by the proposed Sierra Madre Pipeline in Mexico. However, these projects are waiting for the Saguaro LNG I facility to reach FID.”

“We see Mexican demand growing, providing an outlet for Permian growth. We forecast pipeline flows into Mexico from the Permian will increase ~2.5 Bcf/d by 2030,” East Daley Analytics told OGI. “Even with that growth outlook, we believe there will be sufficient capacity once Saguaro Connector is built in early 2029. With our current North American LNG outlook (DOE pause in effect), U.S. producers will be able to keep up with production with growth out of the Permian, Haynesville, Northeast and Eagle Ford.”

Mexico’s main problem, some analysts say, relates to its overreliance on Permian gas due to its inability to boost domestic production.

Mexico had gas reserves of 6.3 Tcf in 2020, enough to last around 5.9 years, and oil reserves of 6.1 MMbbl, enough to last around 8.7 years, according to BP’s Statistical Review of World Energy. Those figures and scenarios haven’t changed much since then. That’s because state-owned Petróleos Mexicanos (Pemex), Mexico’s main producer, continues to struggle to boost reserves and production under the financial weight of a $107 billion debt load at the end of 2023, as well as ongoing financial obligations to the government.

Sempra: ECA LNG Phase 1 sailing in 2025

Mexico’s first LNG cargoes with Permian feedgas to reach Asia will likely come from Sempra Infrastructure’s ECA LNG Phase 1 in Baja California. The strategic location of ECA LNG Phase 1 on Mexico’s West Coast is geographically positioned to connect Asia, the Pacific Basin and international LNG markets.

Sempra Infrastructure and its Mexican subsidiary, Infraestructura Energética Nova (IEnova), continues to move forward with ECA LNG Phase 1. There, work reached the 90% completion mark for its structural steel, Sempra Infrastructure told OGI in an emailed statement.

“Western Mexico also benefits from existing LNG infrastructure in Sempra’s ECA terminal. The terminal originally started up as an LNG import facility in 2008 and is currently being converted into an LNG export plant,” Welligence’s Montgomery said.

ECA LNG Phase 1 is on the site of Sempra Infrastructure’s existing ECA Regas facility, which still has long-term regasification contracts for 100% of its capacity through 2028. Sempra Infrastructure doesn’t expect construction or operations at ECA LNG Phase 1 to interrupt operations at its ECA Regas facility, and continues to target the summer of 2025 for the start of commercial operations.

ECA LNG Phase 1 will consist of one-train with a capacity of 3.25 mtpa and an initial offtake capacity of 2.5 mtpa. Sempra Infrastructure has an 83.4% working interest and France’s TotalEnergies has a 16.6% working interest.

Gas will be delivered to ECA LNG Phase 1 with the completion of the GRO pipeline expansion, which will have a capacity of 0.5 Bcf/d, according to Sempra Infrastructure. The GRO is on schedule to reach its targeted commercial operation date in the second half of 2024.

Sempra Infrastructure also has plans for ECA LNG Phase 2, which will consist of two trains and one LNG storage tank. ECA LNG Phase 2 will have 12 mtpa of export capacity and also source Permian feedgas. Sempra Infrastructure has already signed a heads of agreement with Houston-based ConocoPhillips, as well as memorandums of understanding with TotalEnergies and Japan’s Mitsui.

However, Sempra Infrastructure expects construction of ECA LNG Phase 2 to conflict with the operations at the ECA Regas facility. Any development decision would depend on the long-term financial benefits of continuing with its regasification services and existing contracts, Sempra said in a U.S. Securities and Exchange Commission (SEC) filing earlier this year.

Mexico Pacific: Saguaro Energía LNG I begins in 2027

Mexico Pacific’s Saguaro Energía LNG I and II projects are located in Puerto Libertad in Sonora, Mexico. Both facilities will offer Permian producers a relief valve for associated gas and connect the U.S.’ cheapest gas to Asia, the world’s largest demand center, says Mexico Pacific.

The location of the facilities will offer a 55% shorter shipping route, which translates into savings of $1/MMBtu or more and a 60% lower carbon emissions profile compared to Gulf Coast peers, according to Mexico Pacific.

“The Permian Basin is the largest and lowest-cost gas basin in the world with over 600 Tcf of remaining gas reserves. Production is forecast to grow from [about] 17 Bcf/d today to nearly 25 Bcf/d over the next 10 years—we would need nearly seven similarly-sized LNG projects to absorb this excess gas,” Mexico Pacific told OGI in an emailed statement.

Saguaro Energía I will include three trains with a processing capacity of 5 mtpa each (combined capacity of 15 mtpa). A final investment decision (FID) for each of the first three trains is imminent.

“We’re sold out across all three trains, fully permitted to commence construction on both the pipeline and terminal and are receiving strong support from capital markets, so we’re progressing strongly toward our initial T1 & T2 FID, and expect to take a subsequent T3 FID a mere three to six months later,” Mexico Pacific said.

Saguaro Energía I has the backing of Shell, Exxon Mobil and ConocoPhillips with key additional end-user customers secured, including Chinese firms Guangzhou Gas and Zhejiang Energy.

Last year, Mexico Pacific said Saguaro Energía I would involve a $15 billion investment and start up by year-end 2027. Quantum Capital Group is the controlling owner and lead sponsor of Mexico Pacific.

The anchor project, Saguaro Energía I, will source gas from Waha to be shipped along a 253-km pipeline on the U.S. side of the border and then connect with an 802-km pipeline on the Mexican side of the border. Both segments have capacity to handle 2.8 Bcf/d of gas.

“We consciously designed the Sierra Madre Pipeline to avoid environmentally sensitive areas, indigenous areas and population centers, which is a first in Mexico, perhaps all of North America,” Mexico Pacific said. “The pipeline will be buried, which also reduces fears of attacks or vandalism. Indeed, the northern regions of Chihuahua and Sonora have a great deal of pipeline infrastructure that continue to operate without issues.”

Welligence’s Montgomery said sabotage to the gas pipeline would be “extremely odd,” but reiterated that pipeline attacks do happen in Mexico. “But it’s the small fuel pipelines that are targeted in order to steal the fuel,” he said.

“We don’t believe the [U.S.] elections will change anything. It’s unlikely any of the two candidates would say no to any project that [Mexico’s President] Andrés Manuel López Obrador (AMLO) has already approved,” Montgomery said.

Mexico Pacific has already started development of its expansion project, Saguaro Energía II, also comprising of three trains and representing an incremental 15 mtpa of capacity.

Three other Mexico LNG projects to watch

Three other Mexico LNG projects—LNG Alliance’s Amigo LNG (Epcilon LNG); Sempra Infrastructure’s Vista Pacifico LNG; and Salina Cruz LNG, developed by Sempra Infrastructure and CFE—are on the radar.

Amigo LNG, located in Guaymas in Sonora, Mexico, continues to move forward. The project will consist of two trains with combined capacity of 7.8 mtpa. First cargos could still flow in 2027, LNG Alliance CEO Muthu Chezhian told OGI. Vista Pacifico LNG, located in Topolobampo in Sinaloa, Mexico, is envisioned to have a combined capacity of between 2 mtpa to 3 mtpa, according to Sempra Infrastructure, while Salina Cruz LNG located in Salina Cruz in Oaxaca, Mexico, is envisioned to have a combined capacity of around 3 mtpa, according to Sempra Infrastructure and CFE.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.