Fresh off closing its $2.1 billion SilverBow Resources acquisition, Crescent CEO David Rockecharlie told investors, “we are just getting started.” (Source: Shutterstock, Crescent Energy)

Big buyer Crescent Energy isn’t done with dealmaking yet, after bringing in Eagle Ford Shale neighbor SilverBow Resources’ 91,000 boe/d for $2.1 billion in stock, cash and debt assumption on July 30.

“Currently we have one of the largest pipelines of M&A opportunity in our recent history,” CEO David Rockecharlie told investors during an Aug. 6 earnings call.

He added, “We are looking forward to delivering more value from our existing asset base and future acquisitions. We are a proven growth-through-acquisition company.”

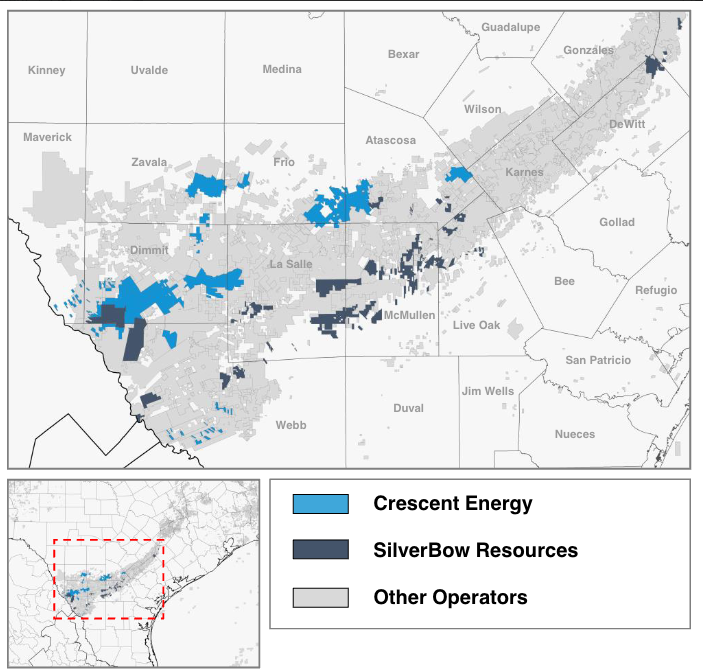

From a small start in 2021, Crescent is the No. 2 Eagle Ford operator today behind ConocoPhillips after closing on SilverBow, Rockecharlie noted.

“And we are just getting started,” he said.

In particular, the Eagle Ford is of key interest. “[It] remains one of the most fragmented basins in the U.S. and we see meaningful opportunity there with our increased scale, strong operating and financial performance and solid balance sheet,” he said.

Crescent has three rigs drilling the Eagle Ford currently and one in the Uinta.

Backstory

Crescent was born in 2021 from the all-stock merger of private investment firm KKR’s Energy Real Assets group’s E&P, Independence Energy LLC, with publicly held Contango Oil & Gas.

Independence operated in the Eagle Ford, Rockies, Permian and Midcontinent. Contango’s portfolio was in the Midcontinent, Permian and Rockies.

Post-closing, Crescent exited the Permian and Midcontinent.

Its current E&P portfolio is exclusively in the Eagle Ford in South Texas and in the Uinta Basin in Utah. It also has an EOR and carbon capture, utilization and sequestration unit in Wyoming.

Since adding the SilverBow property, Crescent holds 458,000 net acres in the Eagle Ford, 95% operated.

In the Uinta, it has 145,000 net acres, 100% operated.

Would Crescent divest too?

A securities analyst asked on the Aug. 6 call if Crescent is ready to transact immediately should an M&A deal present itself.

Rockecharlie said, “Very simply, we feel like we'll be ready to go when the market presents itself.”

Absorbing the SilverBow operations isn’t an impediment to taking in another property. Integration was underway before closing last week, so it is expected “to happen relatively quickly,” he said.

Would Crescent consider selling any of its portfolio too?

Brandi Kendall, Crescent CFO, said it wouldn’t need to for fiscal reasons. “We feel really good with where the balance sheet is today.”

Clay Rynd, Crescent’s executive vice president, investments, said, “We’re both in the acquisition business and the divestiture business. So you've seen us divest assets, particularly non-core assets, over time and do that opportunistically when we think the buyer sees value that we can't capture.”

He added that Crescent has made $150 million of divestments in the past 18 months.

But “we're not a forced seller of assets into a tough tape,” Rynd said.

Rockecharlie noted that all Big Three debt-rating services—Fitch Ratings, Moody’s Ratings and S&P Global Ratings—recently assigned positive outlooks on Crescent’s debt credit score, although it’s not yet rated investment-grade.

“We've never been better positioned for future growth through accretive returns-driven M&A,” Rockecharlie said.

Recommended Reading

US Oil Rig Count Rises to Highest Since June

2025-04-04 - Baker Hughes said oil rigs rose by five to 489 this week, their highest since June, while gas rigs fell by seven, the most in a week since May 2023, to 96, their lowest since September.

Black Gold, LGX Find Multiple Pay Zones in Western Indiana

2025-04-04 - Black Gold Exploration Corp. and LGX Energy Corp. are working to start production at the Fritz 2-30 oil and gas well in Indiana within 60 days.

Pennsylvania City to Turn Coal-Powered Plant into Gas-Fired Data Center Campus

2025-04-03 - Construction on the Homer City Generating Station is expected to start in 2026.

BP’s Cypre Development Off Trinidad and Tobago Delivers First Gas

2025-04-03 - BP Trinidad and Tobago said the Cypre development is projected to deliver approximately 45,000 boe/d at peak.

Sitio Fights for its Place Atop the M&R Sector

2025-04-02 - The minerals and royalties space is primed for massive growth and consolidation with Sitio aiming for the front of the pack.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.