Exxon Mobil and Chevron, supermajors dominating the North American energy space, are now jostling for South America.

The two are pursuing arbitration over a portfolio-changing opportunity offshore Guyana in the prolific Guyana-Suriname Basin. A resolution could come later this year.

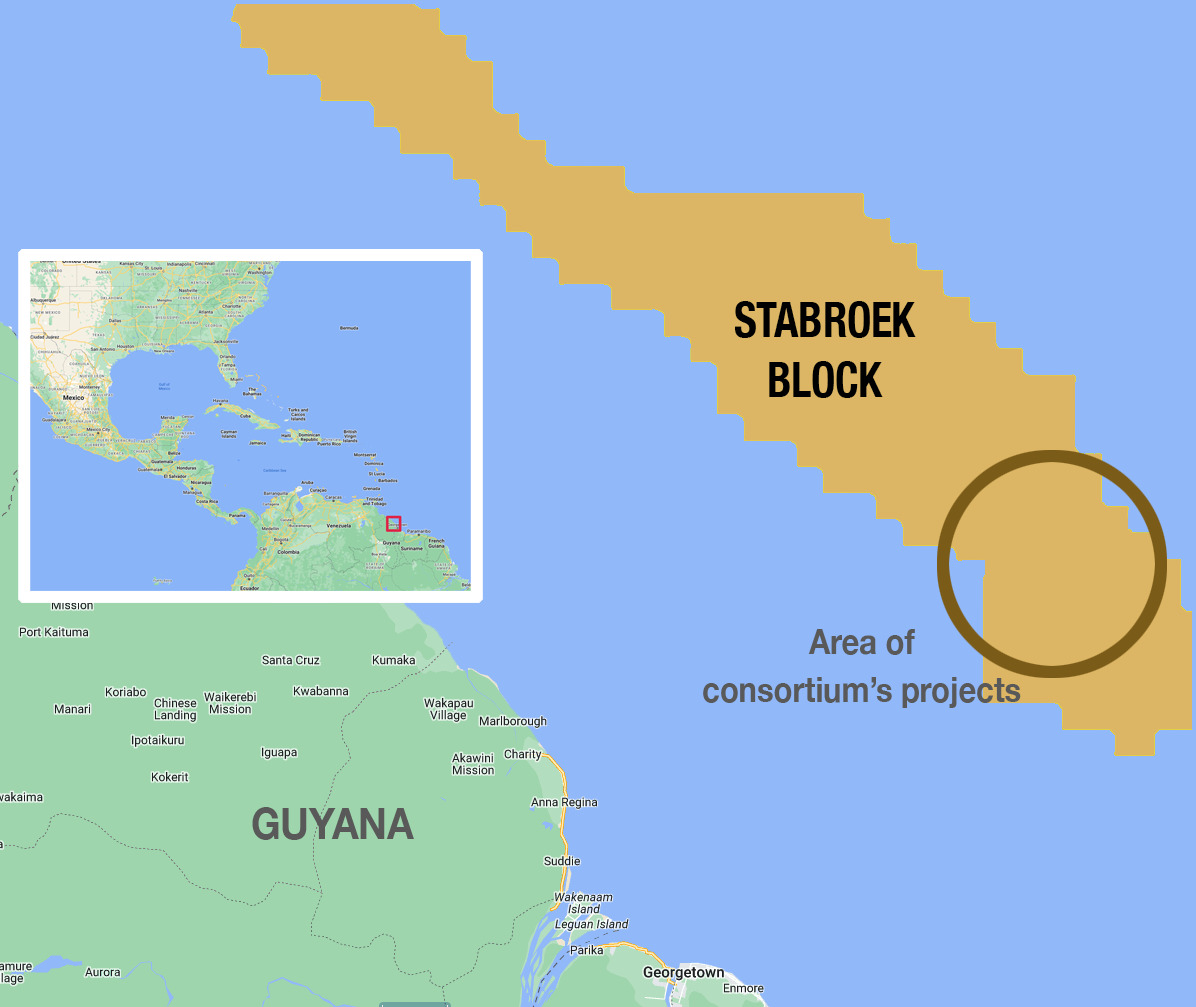

The Stabroek Block offshore Guyana is Exxon’s most promising asset. There, Exxon (45% interest) leads a consortium that includes Hess Corp. (30%) and China National Offshore Oil Corp., or CNOOC (25%). Exploration started in 2015 and first oil was reached in December 2019.

So far, the companies have found recoverable resources in Stabroek of over 11 Bboe. Production is expected to reach 1.3 MMbbl/d by 2027 from six developments that will utilize six FPSOs. As many as 10 FPSOs may be needed to develop the resource base.

But Exxon’s tenure in Guyana hasn’t been without issues. In its early days, Exxon was accused of striking a sweetheart deal with the prior government, which had zero experience negotiating oil contracts. Later, issues related to flaring drew more negative attention.

Now, the issue is Stabroek.

Chevron’s $53 billion purchase of Hess, announced in October 2023, is the second-largest deal among U.S. companies in the last 12 months. The deal involves assets in the Bakken Shale, but also gives the company a foothold in Guyana. The purchase has been delayed because Exxon and CNOOC both claim right of first refusal on Hess’ interest in Guyana. Hess shareholders approved the deal in late May.

Exxon and Chevron have endured a love-hate relationship with South American governments. That’s been true in Argentina, Brazil and Ecuador, as well as Guyana. The most recent example is next door to Guyana, in Venezuela, and involves perceived links between the American companies and Washington.

On the love side, the government of Venezuela’s President Nicolás Maduro views Chevron as a darling. Cash-strapped PDVSA hasn’t been able to return production to the 3.2 MMbbl/d range seen in 1997, owing to years of oil rents mismanagement and the heavy weight of U.S. sanctions.

But production has risen from lows during the COVID-19 pandemic to average 817,000 bbl/d in first-quarter 2024, according to OPEC, in great part due to the so-called “efecto Chevron,” or Chevron effect.

U.S. restrictions on Venezuela don’t apply to Chevron, which has a special license issued by the U.S. Office of Foreign Assets Control (OFAC) that allows the company to operate there.

On the hate side, Exxon may be the most despised international oil company to have ever operated in Venezuela.

One reason is that Exxon took its wrongful asset expropriation cases in the mid-2000s to international arbitration.

The second reason is that the Maduro government perceives the supermajor as backing Guyana’s claim to the Essequibo region over Venezuela’s.

Can Exxon and Chevron really make a love connection in Guyana? Will Chevron’s presence in Guyana ease tensions between Guyana and Venezuela?

The drama continues to unfold.

Recommended Reading

Trump Administration to Open More Alaska Acres for Oil, Gas Drilling

2025-03-20 - U.S. Interior Secretary Doug Burgum said the agency plans to reopen the 82% of Alaska's National Petroleum Reserve that is available for leasing for development.

Electron Gold Rush: ‘White Hot’ Power Market Shifts into High Gear

2025-03-06 - Tech companies are scrambling for electrons as AI infrastructure comes online and gas and midstream companies need to be ready, Energy Exemplar CEO says.

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

TGS to Reprocess Seismic Data in India’s Krishna-Godavari Basin

2025-01-28 - TGS will reprocess 3D seismic data, including 10,900 sq km of open acreage available in India’s upcoming 10th Open Acreage Licensing Policy (OALP) bid round blocks.

Artificial Lift Firm Flowco Prices IPO Above Guidance at $427MM

2025-01-15 - Flowco Holdings priced its IPO at $24 per share, above its original guidance. The oilfield services firm will begin trading on the New York Stock Exchange on Jan. 16.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.