Buzz, buzz, buzz. Collaboration. Buzz, buzz, buzz. Standardization. Buzz, buzz, buzz. Digitization. Buzz, buzz, buzz. The deepwater industry is emerging from the downturn. Buzz, buzz, wait, what?

The two-beat rhythm of collaboration and standardization rattled out by the upstream sector of the oil and gas industry for several years has recently gained a bit of an electronic vibrato with the joining of digitization to the composition. Are the “-tions” too legit to quit or just merely buzz?

As musician Howard Shore put it, “Composing is sort of an intuitive act; you have to put yourself in the right frame of mind.” The market downturn certainly caught the industry’s attention long enough to jar it into a more malleable mindset. Response was far quicker onshore than it was for the less nimble offshore, where field development projects are measured in years rather than weeks.

The relationship between onshore and offshore is dynamic; it is a relationship where one grudgingly gives way to the other when opportunities to excel arise. The market darling of late has been the unconventional tight oil plays, but change is in the air.

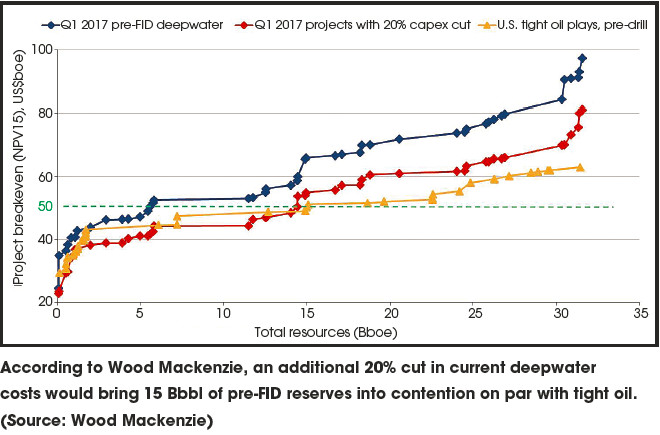

According to experts at Wood Mackenzie, the deepwater industry is emerging from the downturn leaner and more cost-competitive. The most attractive projects are now competing with U.S. tight oil plays, with the U.S. Gulf of Mexico leading the way, a news release stated.

“Wood Mackenzie estimates that on average global deepwater project costs have fallen just over 20% since 2014,” the release stated. “Assuming a 15% internal rate of return hurdle (NPV15), 5 Bbbl of presanction deepwater reserves now break even at $50/boe or lower. By comparison, there are 15 Bbbl of tight oil resource in undrilled wells with breakevens of $50/boe or lower at a 15% hurdle rate in Wood Mackenzie’s dataset.”

The playing field between tight oil and deep water is set to level out as there is still considerable scope to drive deepwater breakevens lower through leaner development principles and improved well designs, the release stated.

“We are at last beginning to see the first signs of recovery in deep water, driven primarily by cost reduction and portfolio high-grading,” said Angus Rodger, upstream research director for Asia-Pacific at Wood Mackenzie in the release. “Projects in the U.S. Gulf of Mexico in particular have made significant strides, with many reducing NPV15 breakevens from above $70/boe to below $50/boe.”

Rodger cites the steps the industry has taken to reevaluate project designs and improve well performance as having the greatest impact to bring breakevens down.

Collaboration, standardization and digitization certainly played a role in the project reevaluations, improved well performance and numerous steps made to weather the downturn. The “-tions” trio will continue to bang their drums as long as effectively possible. With just a little more time, maybe the band will grow by one to include a fourth: Solution.

Recommended Reading

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Chevron Targets Up to $8B in Free Cash Flow Growth Next Year, CEO Says

2025-01-08 - The No. 2 U.S. oil producer expects results to benefit from the start of new or expanded oil production projects in Kazakhstan, U.S. shale and the offshore U.S. Gulf of Mexico.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.