Powder River Basin E&P Peak Resources priced an IPO of 4.7 million common units at between $13 and $15 per share. (Source: Shutterstock.com, Business Wire)

Power River Basin E&P Peak Resources aims to raise more than $57 million through an initial public offering.

Durango, Colorado-based Peak Resources LP plans to sell 4.7 million Class A common units representing limited partnership interests in Peak, the company updated investors on Oct. 15.

The IPO price is expected to be between $13 and $15 per share, with gross proceeds ranging between $61.1 million and $70.5 million, before deducting underwriting discounts and commissions.

The IPO follows a smattering of companies that have gone public or are seeking to test the public markets this year. In early October, Utica Shale oil producer Infinity Natural Resources filed IPO paperwork. Other companies have had varying success with IPOs, including BKV Corp., LandBridge Co. and Tamboran Resources.

Aethon Energy Management LLC, which has not filed an IPO, has said the company is considering its options, including a reverse merger or a public offering.

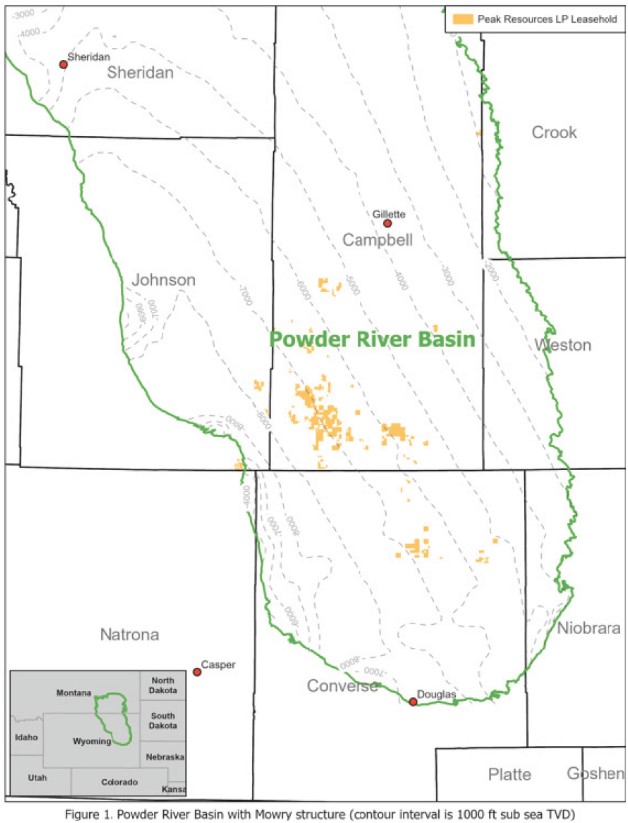

Infinity promises to be at the smaller end of the IPO market, and not just based on its market price. At of the end of June, Peak held approximately 45,000 net (65,000 gross) acres in the Powder, primarily within Cambell and Converse counties, Wyoming.

Peak first filed preliminary paperwork for a potential IPO in September. Peak Resources will be organized as an MLP, joining two companies from last year to IPO within that structure: Williston Basin E&P TXO Partners LP and the Midcontinent’s Mach Natural Resources LP.

Janney Montgomery Scott is the lead book-running manager for the offering. Roth Capital Partners and TCBI Securities Inc., doing business as Texas Capital Securities, are active joint book-running managers, and Seaport Global Securities is co-manager.

Peak Resources has granted the underwriters a 30-day option to acquire an additional 705,000 Class A common units. The units being offered represent a 32.2% limited partner interest in Peak, or a 35.4% interest if underwriters exercise their option to acquire more units.

The E&P has applied to list its common units on the NYSE American under the ticker symbol “PRB.” The company “will not consummate this offering unless our Class A common units are approved for listing” on the exchange, Peak said in regulatory filings.

The company expects to generate net proceeds of approximately $57.2 million—and $66.4 million if underwriters exercise their option in full—based on the IPO midpoint of $14/share.

Peak Resources plans to use most of the IPO proceeds to repay debt: $40.9 million of net proceeds will be used to repay a portion of borrowings under Peak’s current credit facility.

Another $600,000 will be used to pay bonuses to certain executives in conjunction with the offering.

The remaining $15.7 million will be held by Peak in reserve for general partnership purposes, including paying distributions, if needed.

Peak said it is currently negotiating a new credit facility that could allow the company to fully repay its existing credit agreement. If the company is unable to obtain binding commitments for a new debt facility, Peak will use $15 million of the remaining $15.7 million in net proceeds from the offering to repay the balance on the existing credit agreement.

As of Sept. 30, Peak had $54.25 million in outstanding borrowings under its current credit facility.

Peak Resources is backed by Yorktown Energy Partners and HarbourVest Partners.

RELATED

Jack Vaughn-Led Peak Resources Files for Powder River Basin IPO

Powering up the Powder

Peak, led by shale industry veteran Jack E. Vaughn, would be the first E&P with significant Powder River Basin holdings to IPO since Cinco Resources filed an S-1 in 2012, according to Securities & Exchange Commission records. Cinco withdrew the plan in 2013 and was acquired in 2015 by Riley Exploration Group.

Peak produced an average 2,749 boe/d during the 12 months ended June 30, including 1,606 bbl/d of crude production and 6.86 MMcf/d of natural gas output.

The company projects its Powder production to rise to an average of 3,269 boe/d during the 12 months ending June 30, 2025, and 4,728 boe/d during full-year 2025.

Peak has drilled and operates 56 net (104 gross) producing horizontal wells in the Powder, and the company has one net well awaiting completion. The company also holds interests in four net (83 gross) non-operated horizontal wells led by other leading Powder producers, including EOG Resources, Devon Energy, Anschutz Exploration and Ballard Petroleum.

Peak has been most active in the Niobrara and Mowry intervals but also holds undeveloped upside in the Parkman, Shannon and Turner reservoirs. The company has identified 530 net (1,770 gross) horizontal locations for future drilling.

Peak reported total net revenue from oil and gas sales of $54.13 million during 2023 but recorded a net loss of $85.39 million for the year.

Peak spent approximately $10.5 million on development costs during 2023 and has budgeted capex of $8.6 million for 2024. But the company aims to boost development spending up to $75.9 million in 2025 using proceeds from the IPO and cash flow from operations.

The company aims to ramp up drilling in the coming years. Peak plans to complete one horizontal well and start drilling three new net wells this year.

In 2025, Peak plans to drill five net (seven gross) wells and complete eight net (11 gross) wells. And in 2026, the company will drill 12 net (15 gross) wells and complete 11 net (12 gross) wells.

Jack E. Vaugn, chairman and CEO, founded Peak in 2011. It was his fourth iteration of Peak E&P, after building and flipping startups in the Barnett Shale, the Bakken and the Anadarko Basin’s Granite Wash play.

Previously, Vaughn worked at EnerVest Management Partners and operated San Juan Basin coalbed methane property for it and GE Capital Oil & Gas. He began his career in 1968 with Amoco Oil, now part of BP.

Vaughn served on the board of Bonanza Creek Energy, a predecessor company of Colorado-based E&P Civitas Resources.

RELATED

Powder in the Hole: Devon May Fire up its PRB in Coming Years

Recommended Reading

IBAT CEO: Lithium Extraction in Smackover ‘Almost Child's Play’

2025-03-24 - Iris Jancik, the CEO of International Battery Metals, said the company aims to work with oil and gas companies to explore lithium extraction projects.

Exclusive: India’s Cairn to Deliver First Shale Well in Summer

2025-03-23 - India's Cairn Oil & Gas, part of Vedanta Group, plans to deliver its first shale well using U.S. shale techniques honed by oilfield service companies, in June or July.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.