Private E&P Sage Butte Energy, which operates in the Powder River Basin, is less interested in the Permian Basin, citing the cost of entry. (Source: Sage Butte Energy)

Producing some 7,000 boe/d net now from the Powder River Basin, privately held Sage Butte Energy and its financial backer are looking to add more acreage—and possibly in other basins—executives told Hart Energy.

“We think we've got a really good mousetrap here that we're going to move into other areas of the basin and in the Lower 48,” said Doug De Filippi, a senior adviser to Houston’s Pan Capital Management and its E&P portfolio company, Sage Butte.

Daniel Fan, a Pan Capital partner and Sage Butte’s CEO, said oil acquisitions are the target but gas is interesting too. “We're agnostic,” Fan said.

Deals are likely in the Eagle Ford, Bakken, Rockies and the Midcontinent. And “maybe less so on the Permian,” De Filippi said.

“The Permian gets more [M&A] attention from a lot of companies and private equity, still. We want to be able to get the right asset for the right price.”

Gas basins are interesting as demand is expected to grow to meet AI data centers’ oversized power draw, De Filippi said. Appalachia is particularly interesting with the world’s largest concentration of data centers in the region.

“That could be another opportunity to monetize your gas volumes in that part of the world,” De Filippi said. “I think the Marcellus will have better days ahead of it. It could be a good time to make a move into that area.”

2023 Powder entry

Fan, De Filippi and several of the Pan Capital and Sage Butte team members came from Castleton Commodities, which built a large Haynesville Shale holding now known as TG Natural Resources as its minority partner, Tokyo Gas, took a majority position in the E&P.

Formed in 2011, Pan Capital was initially a gas-only hedge fund and is currently the largest gas hedge fund in the U.S. Over the years, it expanded to include oil trading and into E&P and midstream private equity. It currently has more than $3 billion in assets under management.

In 2023, Pan Capital’s OneRock Energy became Sage Butte upon acquiring Powder River Basin operator Northwoods Energy from Apollo Global Management.

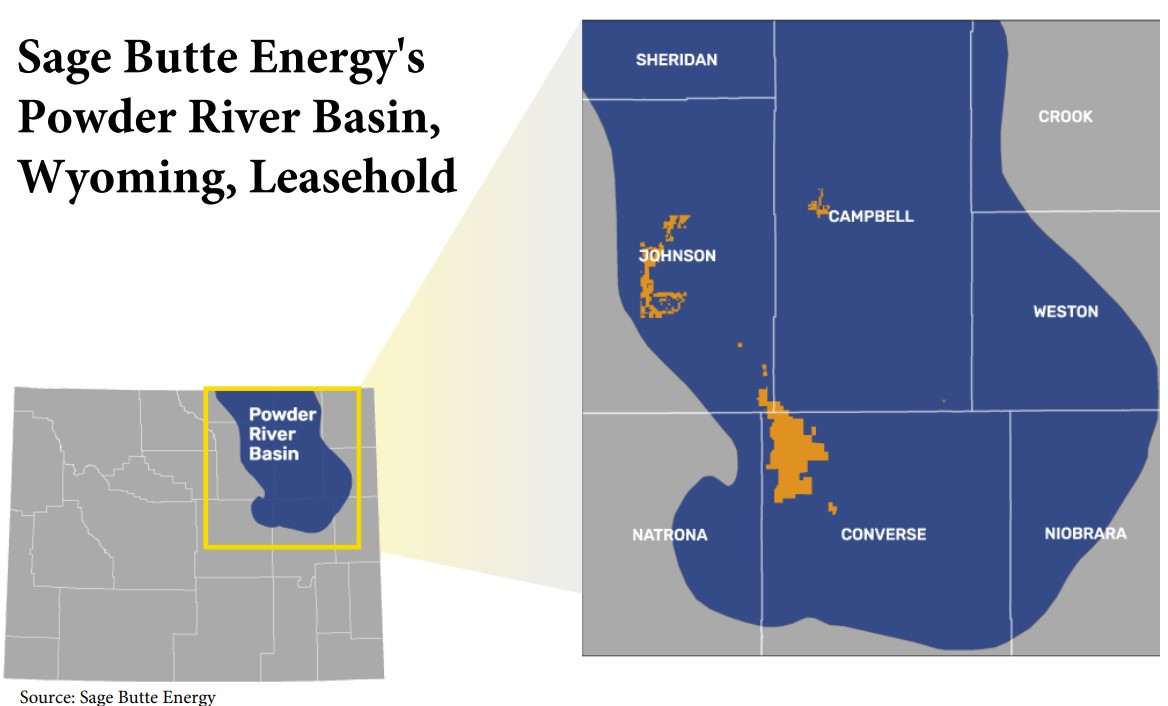

Northwoods had picked up most of its position in 2018 from SM Energy, gaining 112,200 net acres in Wyoming’s Converse, Johnson and Campbell counties producing 2,200 boe/d for $500 million.

At the time of the 2023 sale to Sage Butte, Northwoods held more than 160,000 mostly contiguous net acres in the three counties, producing 5,000 boe/d.

Structural complexity

The now 163,000-net-acre Sage Butte property holds pay in the deepest part of the Powder. It’s nearly all HBP in Converse County and mostly HBP in Johnson County except for some long-term leases on federal land.

To further grow Sage Butte, Fan said, “we would like to find anchor assets with running room like in the Powder River Basin.”

But the Permian “is going to be pretty challenged from that perspective, given how expensive the acreage,” he added.

Leasehold is less expensive in the Permian’s fringe—outside of the Tier 1 and Tier 2 areas. But the subsurface there can be more geologically complex, primarily due to encountering faulting, Fan said.

“The formation may come and go,” he said. “So if it gradually changes, sometimes we look at it. But if the structure complexity creates some challenge, we probably are going to avoid it.”

The Powder is also structurally complex, but Fan said it is in a way that’s less troublesome.

“Each formation is different, but the elevation actually doesn't change that much. It's not flat, but it's a gradual change. We can geo-steer, chasing the formation easily.”

Sage Butte currently focuses on the oily Niobrara and had one rig drilling at press time.

“In the future, we may chase the Mowry [Shale],” Fan said. “We definitely preserve other formations, both oil and gas, to develop in the future. The Mowry is more gassy; Niobrara is oil.”

EOG Resources, one of Sage Butte’s neighbors, is developing the Mowry. “We keep an eye on that,” Fan said. “At some point if there's a constructive gas price, we may shift to this, but not at this [pre-2025] $2 range.”

Powder, Uinta, GoM, Canada

Sage Butte’s drilling focus has been in Converse County where it has some 100,000 net acres. “In Johnson County, at some point we will probably look for some partners to develop it together,” Fan said.

Geologically, the two counties are fairly similar, “but the Johnson County acreage is in the early stage [of development], so it needs quite a bit of infrastructure.”

Sage Butte looks at the Uinta Basin too. “But the Uinta is different, right? It's not a subsurface issue; it's above ground. It's the takeaway. If we get into that basin, we will need some good above-ground experts to handle the waxy nature of the oil.”

It is open to buying in Canada, “but we’re not chasing it,” Fan said. As for the Gulf of Mexico, it’s a “no” for now. “It’s a different animal,” Fan said.

Otherwise, De Filippi said, “we have an expansion appetite beyond the Powder if it presents itself.”

And it can close quickly, he added. The platform acquisition of Northwoods was closed in weeks, post-signing the PSA.

“We can close in the next 45 days. We definitely move swiftly,” Fan said.

Recommended Reading

BP’s Eagle Ford Refracs Delivering EUR Uplift, ‘Triple-Digit’ Returns

2025-02-14 - BP’s shale segment, BPX Energy, is seeing EUR uplifts from Eagle Ford refracs “we didn’t really predict in shale,” CEO Murray Auchincloss told investors in fourth-quarter earnings.

Comstock Doubling Rigs as Western Haynesville Mega-Wells’ Cost Falls to $27MM

2025-02-19 - Operator Comstock Resources is ramping to four rigs in its half-million-net-acre, deep-gas play north of Houston where its wells IP as much as 40 MMcf/d. The oldest one has produced 18.4 Bcf in its first 33 months.

Chord Drills First 4-Mile Bakken Well, Eyes Non-Op Marcellus Sale

2025-02-28 - Chord Energy drilled and completed its first 4-mile Bakken well and plans to drill more this year. Chord is also considering a sale of non-op Marcellus interests in northeast Pennsylvania.

Shale Outlook Eagle Ford: Sustaining the Long Plateau in South Texas

2025-01-08 - The Eagle Ford lacks the growth profile of the Permian Basin, but thoughtful M&A and refrac projects are extending operator inventories.

Matador Touts Cotton Valley ‘Gas Bank’ Reserves as Prices Increase

2025-02-21 - Matador Resources focuses most of its efforts on the Permian’s Delaware Basin today. But the company still has vast untapped natural gas resources in Louisiana’s prolific Cotton Valley play, where it could look to drill as commodity prices increase.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.