Each of the past three World Jigsaw Puzzle Champion winners assembled 500-piece Ravensburger scenes—tigers prowling jungles, blue-chaired outdoor cafes, pastel housing—in less than 40 minutes.

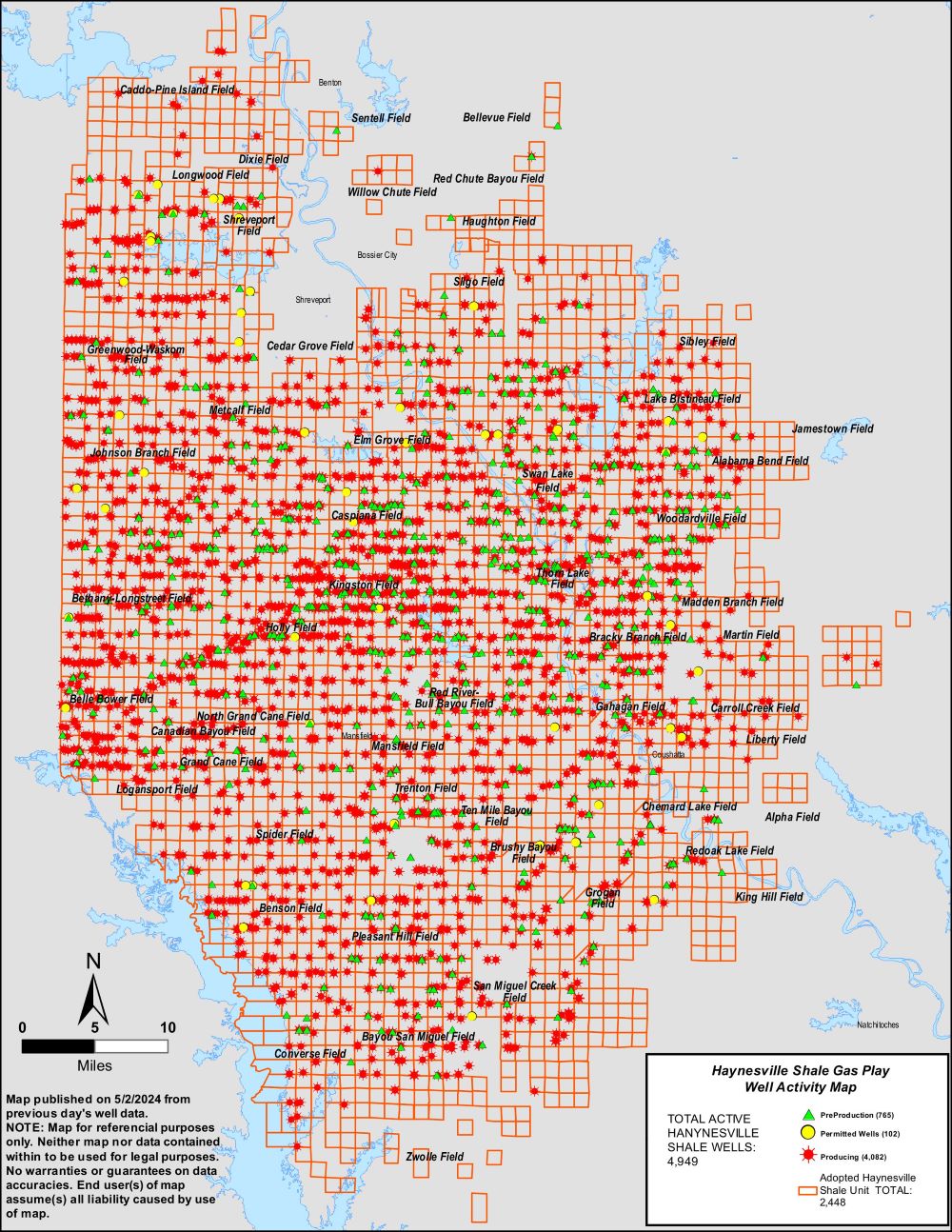

As impressive as that is, jigsawing a shale unit map of the Haynesville Shale would clearly be next level. For one, the Haynesville covers about 5.76 million square acres—each a potential piece. And Louisiana state activity maps show shale units in red, preproduction in green triangles. The overall effect is of a Christmassy Lite-Brite project gone too far.

Still, it’s what’s not there that could matter. The puzzle for private equity’s startups in all shales is to find the spots that don’t yet shine. And, regardless of the play, it won’t be easy after rampant M&A ransacked the Lower 48’s PE portfolio companies, along with some large publics.

Beginning early last year, Post Oak Energy Capital began supporting a number of companies with equity commitments. The companies are working to assemble positions in some of those same lucrative (and expensive) plays as private equity firms begin to rebuild after the running of the M&A bulls.

During the latter part of 2024, Oil and Gas Investor caught up with three of the new companies: the Haynesville Shale’s Quantent Energy Partners; Delaware Basin-focused Ichthys Energy Partners; and the Utica Shale’s Tiburon Oil & Gas Partners.

Building a profitable footprint in any of those plays will be no easy task. Quantent, Ichthys and Tiburon are banking on a network of connections, a feel for their respective plays and a willingness to lock down every profitable piece of acreage still available. All while facing off in the oil and gas version of Squid Game: A&D.

In the Haynesville, most of the best and biggest blocks of acreage are locked down by major producers waiting to cash in on increased LNG exports. Operators range from privately held Aethon Energy to public E&P Expand Energy, the country’s largest natural gas producer. Expand holds 650,000 net acres in the play and averaged 2,452 MMcfe/d in the third quarter.

But Quantent has already locked down one acquisition and sees more opportunities ahead.

In the Utica, the liquids-rich areas have been swarmed by new entrants chasing EOG Resources and jockeying with top producers Encino Energy, Ascent Resources and Infinity Natural Resources. Finding a viable large contiguous position will be increasingly difficult there.

Scott Hudson, president and CEO of Tiburon, sees a lot more grassroots leasing that can be done in what he calls “pockets” or “donut holes” in which an operator can pick up three-or five-well units.

“Those definitely do exist,” he said. “I mean, you’re not going to go up into the Utica and pick up 10,000 acres in the windows that we’re talking about today, but there are definitely opportunities out there.”

Pieces of the Permian

Then there’s the picked-over Permian, which lacks any convenient edges or an inviting lid depicting the sweep of counties stretching from arid Texas to arid New Mexico. With its horizontal wells jutting every which way, the Permian is vast and competitive. And, again, large independent E&Ps and majors hoard the best pieces.

The consolidation in the basin, including large-scale deals by Occidental Petroleum, Diamondback Energy and Exxon Mobil, creates a space for Ichthys “to come in and hopefully do some cleanup work on the smaller side, building those assets that way,” Ichthys CEO Michael Poynter said.

The other benefit of all the Permian M&A is that, as larger companies get even larger, “their appetite and focus on the much smaller interests that take time and some dirty work to piece together into something more valuable is maybe just less meaningful and doesn’t move the needle as much for them.”

Post Oak’s teams are largely made up of new blood, unlike the tried-and-true portfolio companies EnCap Investments and Quantum Capital Group that are re-upping with more funding. (NGP Energy Capital has said it’s unlikely to fund more than a couple of new teams.)

Frost Cochran, managing director and founding partner of Post Oak, told Hart Energy in October that Ichthys, based in Dallas, is a group of “young guys who are just getting started with their first company, but they’re focusing in the area that they know best, which is the Permian and specifically more, the northern Delaware.”

The company’s leadership was spun off of Permian Resources.

Cochran said private equity has to source new, younger teams that “have the skill sets and capabilities … with some support from us from the capital side. And whatever we can do to try to match assets with teams, we do as well.”

Some of the Post Oak teams had made initial acquisitions and held acreage out of the gate when the private equity firm committed equity to their ventures. Other teams were still looking.

What unites Post Oak’s teams is a shared entrepreneurial drive and that special trait common in startups: confidence in their strategies, experience and expertise.

Haynesville 9,000

Quantent CEO Kevin DeLay views the Haynesville’s opportunity set, essentially, as a math equation.

The Haynesville comprises 9,000 sq miles—an area larger than the nation of Israel. And within that expanse are a lot of tracts that aren’t getting the attention, or capex, they need.

“They’re underdeveloped either due to lack of capitalization or operational expertise to develop those positions,” DeLay said. “We really feel like, with our operational background and track record, plus with our ability to be creative on deal structures, there’s a lot of opportunities still left in the Haynesville to get into those parts of play.”

DeLay is well-versed on the Haynesville.

DeLay served in engineering and management roles at Devon Energy, including operations and portfolio management. He also served as general manager at McClendon Energy Partners and led engineering efforts for several new ventures at Chesapeake Energy founder Aubrey McClendon’s American Energy Partners.

“Aubrey loved the play,” DeLay said. “He was always very excited about it. I will admit he was excited when I came to him in 2014 saying I thought the play had bigger potential.”

DeLay had observed a set of about 12 wells that had used larger completions—more sand and fluid.

“And one-for-one, every one of those wells outperformed their direct offsets and gave me a feeling that the Haynesville had a step change of performance in front of it with new completion techniques,” he said.

Before co-founding Quantent, DeLay served and directed upstream development projects as COO at Nadel and Gussman New Ventures, which was backed by Post Oak. He largely worked in the Haynesville, drilling out more than 40 wells, often at 20% lower costs than an offset operator.

In 2023, the Haynesville was still top of mind.

DeLay’s thesis: a lot of potential remains in the play. In September, Post Oak announced the closing of an equity commitment to Quantent and its initial acquisition of 7,000 net acres in North Louisiana.

Quantent captured an asset in the play “offsetting an existing asset we had in the Haynesville,” Cochran said. The management team “was the execution team with that prior asset we worked with. So, it’s really a second iteration with that team on a similar asset.”

The company’s strategy is to find untapped inventory and maximize its operational expertise. Following its September acquisition, DeLay said Quantent had a solid proved developed producing (PDP) base.

Ultimately, however, the company is looking for places to put the drill bit into the ground while searching for more upside locations through acquisitions.

“Obviously, if the deal has PDP involved and it works into our economics and we will go after it. But I would say, right now, we are focused on trying to find undeveloped locations,” DeLay said.

And the company is in the play for the long haul.

“Strategically, anything we buy, we’re going to be willing to fully develop and produce. That has to be the strategy at this point in the cycle of our industry.”

And that plays to the strengths of Quantent’s team.

DeLay said an important lesson McClendon taught him was the value of expertise.

“Your people are the most important part of your company. [You can] have the best rock in the world, but if you don’t have people to execute it, then you’re not going to be a top performer,” he said. “I think we bring in some of, what I consider, the best experts in the field to come drill these wells with us and complete them.”

Tiburon set for 2Q Utica drilling

Scott Hudson worked in nine shale basins during his career at Carrizo Oil & Gas before the company was sold to Callon Petroleum.

About two years ago, Hudson started to think back on one play in particular: the Utica.

While digging into the Utica at Carrizo, there’d been no modern day frac techniques brought to bear, he said. Right-sizing well spacing hadn’t been implemented. Around 2013, Hudson was also working without the benefits of fully built out midstream infrastructure, which was a challenge and expense for the company at the time.

Hudson’s conclusion: All the lessons that had been applied to the Delaware and Midland basins and the Eagle Ford Shale ought to be brought to the Utica.

“I kind of felt like, ‘Hey, there was a big opportunity.’” And Tiburon was born.

Considering the various basins, his expertise and his team’s expertise, the Utica seemed ripe for the picking. And so, Tiburon was built from a team forged at Carrizo, largely with experience in the Appalachian Basin.

In mid-October, Tiburon, backed by an investment from Post Oak, closed on an initial acquisition of leasehold in the liquids-rich portion of the Utica.

Hudson said Tiburon had been working for a year on grassroots leasing. The acquisition, with some other funding, allowed the startup to coalesce a sizeable acreage position with enough running room to get started.

“We’re really excited about how many acres that we have out there,” he said. “We have the ability to drill about 30 wells. So, it’s a sizable footprint that we’ve been able to put together.”

But, in November 2022, EOG Resources announced what it called the “Utica Combo” play in Ohio, including the acquisition of about 395,000 net acres in Ohio’s volatile oil window and black oil windows. EOG’s publicly disclosed successes in the play quickly overshadowed the play’s gassy reputation. A&D efforts began to focus on liquids. In October, Infinity Natural Resources filed paperwork to launch an IPO.

“It’s definitely gotten a lot more competitive in the last 12 months since EOG announced their presence in the basin, whereas when we started, there were [few] people looking in the basin,” Hudson said. “Now, there’s a ton of competition.”

Hudson said the company has built a solid position while actively grabbing additional units where “we can find additional sticks to drill,” Hudson said.

The company has no set parameters on its eventual size. It will likely be a 10-person shop in the near term. For now, the plan is to scout out good opportunities and acquire while setting up rigs, drilling and turning wells to production. The company plans to start production in the second quarter.

For now, the team is enthusiastic as it begins to apply advanced completions to the Utica.

“We’re excited to work with Post Oak. They’ve been incredibly supportive,” he said. “And we’re ready to get that rig up in the air.”

But that’s been the team’s path since their Carrizo days.

“We had this lease and drill strategy where we wanted to go in and we wanted to take our expertise that we’ve had for the last decade, decade and a half, and we wanted to go in and get this opportunity to get this acreage that we had put together and develop … not drill one or two wells,” he said. “We wanted to drill the whole well set, and so they believed in that methodology.”

Hudson said he’s been in the industry about a quarter of the century—on the young side for oil and gas veterans.

“But yeah, we’re still hungry,” he said. “What my team loves to do is lease and drill, lease and drill. That’s what we did at Carrizo together. That’s what we want to do now. And so, we’re just really excited about it.”

Permian itch

Ichthys’ approach to building a position in the Permian Basin—specifically the northern Delaware— is to do it any way it can. So far, the company hasn’t made an acquisition. But the company has multiple strategies, including picking up smaller assets that are not meaningful enough for the larger E&Ps to spend time on.

Poynter said the initial pitch to Post Oak was focused on the networking, relations and experience his team, with roots in Permian Resources and Colgate Energy, had in Midland, Texas, and in the basin.

The more nuts-and-bolts strategy of the company is to create an operated E&P with a focus on a land-first ground game, building up from smaller acquisitions into one or two drillable units at a time.

“I think that strategy really resonated with the Post Oak team. It’s reflected in a lot of my past experience of teams that I’ve been on from the private equity company building side where we have done things from sort of the ground up,” he said. “I think, given our backgrounds and the companies, the successful companies that we’ve been at, [we] really fit with that strategy.”

However, Poynter said the company’s business development pipeline could range from grassroots leasing to acquiring smaller non-operated interests “where we see a strategic angle to trade with other parties or participate in forced pooling, for instance, to maybe the third being farm-in opportunities and strategic partnerships with others in that way.”

Another avenue is the post-consolidation rationalization acquirers are likely to engage in. Poynter said the company may look at larger packages or marketed processes.

Ichthys CFO Will Weidig said the consolidation-driven asset rationalization deals can be divided into two buckets.

“There’s what I would call the macro bucket and a micro bucket. And the macro would be what Michael mentioned around large marketed assets, where an investment bank is sending out teasers and it’s a $500 million plus [to] $2 billion type of transaction,” he said. “And then there’s the micro-scale deal, which is kind of what Michael mentioned secondarily, which is the smaller transaction, the DSU that was originally on the drill schedule that now isn’t and therefore creates some kind of optionality for us.

I think we’ll be more focused on the latter. And that’s not to say we’ll be fully cut off from the macro bucket, but I think it’ll be more opportunistic to see us engage in something like that.”

Poynter added that the company would participate in large deals if a “real strategic edge” emerges “as opposed to us just outbidding other parties.”

Poynter said he recognizes the Permian is a highly competitive market, but “that’s a big part of why we want to be there.”

“We go back to the strategy and the partnership with Post Oak and how that fits and think that this is the right time … on the consolidation side to be pursuing a strategy like this. I think we also have the right backgrounds from our prior experiences with both private and public companies in the Permian. We’re both intimately familiar with the Permian Basin, but then also our networks within Midland and the Permian, as well.”

Weidig said the company’s willingness to be nimble and creative to get deals done is key, “whether that’s from a structuring perspective, a partnership perspective or just being willing to do a series of smaller transactions versus maybe one splashy larger deal.”

“I think all of those will accrue to our benefit as we go out and execute the strategy,” Weidig said.

In the next three to five years, Poynter sees Ichthys focused on building units from the ground up and maintaining an ongoing series of operated drilling units that are staggered so that, by the time the first wells are generating cash flow, new wells are being drilled or coming online.

“I think my vision a few years from now would be that we’ve made this strategy repeatable enough to have multiple projects going” with varying “maturation points” and cycles of “developing, partnering, potentially even buying and selling various pieces all simultaneously by that point and continuing to build the business organically.…”

Ichthys started with what Poynter called a “sort of entrepreneurial itch.”

“For me it was just kind of time,” Poynter said. “We had accomplished what we set out to accomplish with the Colgate investment and then had seen Permian Resources stabilized and headed in the right direction.”

Weidig said he has the same entrepreneurial streak.

“For me, it was identifying timing, a partner to work with and a partner from the private equity perspective, just that really rounded out the picture and made it make sense and look really compelling,” he said. “We really found that, in terms of what we think is a really attractive market opportunity right now.”

All of that added up to, “Hey, this is the right time with the right people,” he said, “and, we think, the right strategy to go and execute.”

Recommended Reading

BKV Applies Refrac Playbook to Potential M&A Targets

2025-04-03 - BKV Corp. applies its refrac playbook—tried and true in the Barnett Shale—to potential M&A targets as it looks to gain contiguous acreage, Upstream President Eric Jacobson told Hart Energy at DUG Gas.

Exclusive: India’s Cairn to Deliver First Shale Well in Summer

2025-03-23 - India's Cairn Oil & Gas, part of Vedanta Group, plans to deliver its first shale well using U.S. shale techniques honed by oilfield service companies, in June or July.

IBAT CEO: Lithium Extraction in Smackover ‘Almost Child's Play’

2025-03-24 - Iris Jancik, the CEO of International Battery Metals, said the company aims to work with oil and gas companies to explore lithium extraction projects.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.