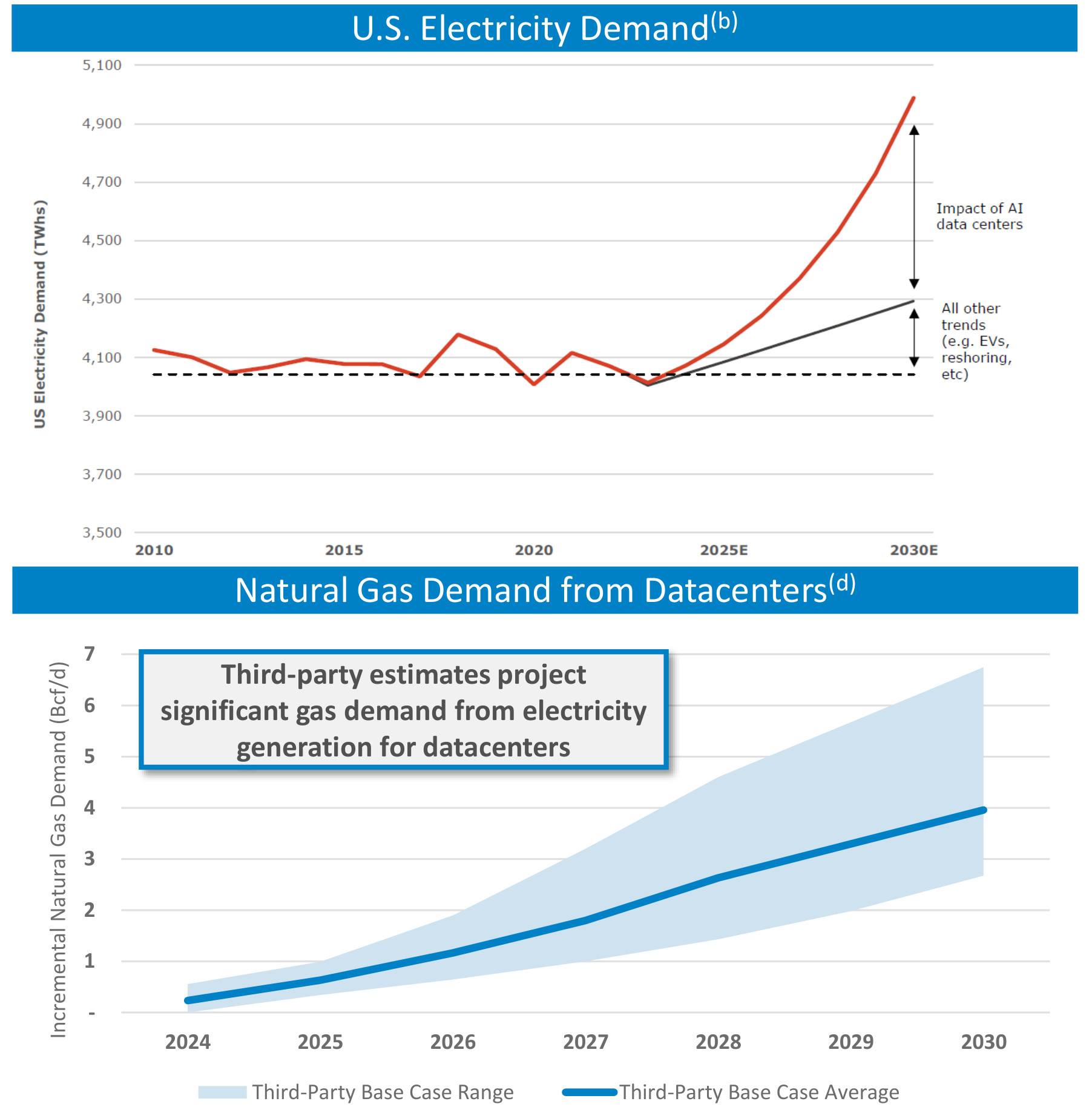

As much as 8 Bcf/d in U.S. natural gas demand growth for gas-fueled power generation is estimated to be needed to serve additional data center load. (Source: Shutterstock/ Range Resources)

Positioning for Marcellus gas-fired power generation is heatedly underway in the Appalachian Basin to power growing AI-enhanced data center demand, Range Resources executives confirmed.

“We added a new slide to the deck this [earnings] cycle to try and put some color around that,” said Dennis Degner, Range president and CEO, in an earnings call Oct. 23.

“There are a lot of conversations that are starting to materialize around data centers’ future power demand,” he said.

A PJM auction in July “probably shed some light on the critical movement … around power in the future.”

PJM is the grid independent system operator in the Appalachian region, serving Pennsylvania and 12 other states, plus the District of Columbia.

In the grid-capacity auction, bids reached $270 per megawatt per day (MW/d) from a year-before high of $29, according to PJM. In the Baltimore area, capacity went for $466 per MW/d.

In Dominion Energy’s delivery area—a region known as “Data Center Valley” that includes Washington, D.C., and Loudoun County, Virginia—capacity sold for $444 per MW/d.

“So there’s some early indication that movement [on securing power supply] has taken shape,” Degner said.

‘How do you add power?’

Power-demand growth due to AI data center development is estimated at 75 GW.

Currently, Virginia’s Loudoun County area holds the world’s largest concentration of data capacity, due in part to available trunkline broadband.

PJM reported after the July auction that it “remains concerned with the slow pace of new generation construction.”

Some 38 GW have been approved “but have not been built due to external challenges, including financing, supply chain and siting/permitting issues,” it reported.

A PJM executive said in the auction-results summary, “Interconnection process reform is proceeding, but hurdles remain…. We are considering ways to accelerate those who can successfully overcome those challenges and build.”

Degner said the auction indicates power costs are “going up and ultimately conversations will accelerate to quickly figure out how you have an expansion of the grid.

“How do you add power?”

‘A lot of conversations’

As much as 8 Bcf/d in U.S. natural gas demand growth for gas-fueled power generation is estimated to be needed to serve additional data center load.

Range produced 1.5 Bcf/d in the third quarter—entirely from the Appalachian Basin.

A securities analyst asked in the call if Range and others are talking to counterparties about fixed-price gas-supply agreements or other deals.

Mark Scucci, Range CFO, said, “I think the conversations are being had rapidly. A lot of conversations [and] a lot of different counterparties on different ways of servicing that need.

“… So all those conversations are being had.”

But deals will take some time, he added.

“Keep in mind that these investments by those companies are multi-decade type investments…. So these are not discussions that are going to be had and [decisions] arrived at in a series of months,” Scucci said.

He expects deals will begin to come about as 2025 progresses. “The nature of those conversations will develop the tenor and pricing structures.”

Among deals, some will be directly with power producers, some will be off-grid “behind the meter” and one already is for the restart of a fallow power plant: Three Mile Island’s unit one reactor.

Scucci noted that, while nuclear is a power-supply option, the Three Mile Island reactor generates just under 1 GW. And the restart is “assuming it gets regulatory approval and meets all the required clearances to recommission.”

But that deal shows “the creativity and the recognition by data centers and industrial demand that they need reliable 24/7, clean power.

“And that's something that we, the natural gas industry, can do reliably 24/7.”

Recommended Reading

Trump Ambiguous Whether Canadian-Mexico Tariffs to Include Oil

2025-01-31 - At a news conference, President Trump said that he would exclude oil from tariffs before backtracking to say that he “may or may not” impose duties on crude.

Analysts: How Trump's Tariffs Might Affect Commodity, Energy Sectors

2025-02-03 - Trump's move has sparked volatility in the commodities market. Oil prices rose, with WTI up 2.4% at $74.27 a barrel and Brent crude futures adding 1% to $76.40 a barrel.

Cushing Crude Storage Levels Near All-Time Lows

2025-01-16 - Near-empty tanks can cause technical and price problems with oil, an East Daley Analytics analyst says.

Trump Stirs Confusion with Support, Spurning of Canadian Oil

2025-01-24 - President Trump signed an order that could boost Canadian crude imports — and then said the U.S. doesn’t need Canadian crude.

What's Affecting Oil Prices This Week? (Feb. 10, 2025)

2025-02-10 - President Trump calls for members of OPEC+ and U.S. shale producers to supply more oil to push down oil prices to the neighborhood of $45/bbl.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.