Look beyond the short-termism of shareholders and investment analysts, and the picture that begins to emerge for those seeking the fabled “green shoots of recovery” is one of an industry—like a well-oiled motorbike reassuringly kick-starting into life after several years of storage—reliably revving back up to running temperature.

The early fruit of its labor is already becoming evident, as operators emerge from the painful but necessary cuts made to personnel and expenditure and move on to the next phase of the recovery process.

It’s everyone’s favorite pastime, but no one can predict what the oil price might be—it’s an uncontrollable aspect that can and will again dramatically impact this business over time. But what can and is being implemented by most companies is the overriding imperative to take back control where it can, and that largely means reducing project costs.

That costs were too high, even when the price was more than $100/bbl, was already well-known (the costs of goods and services more than doubled in the last decade). The industry was in the early stages of attending to this but too slowly, despite years of warnings. The price collapse served to savagely expose that weakness. Now, of course, it has everyone’s full attention.

Energy demand driver

One key driver has not changed—the world’s thirst for energy, the majority of which will be satiated by oil and gas.

The challenge is to meet that demand, and it’s a very real one, with oil fields bound to decline by 10% to 15% per year without reinvestment. With spending on areas such as maintenance, workovers and infill drilling, that decline can be slowed to 3% to 6% annually (or up to 5 MMbbl/d globally each year of decline).

That brownfield work has to be supplemented by new supplies, which will come from more complex and remote sources with higher full-cycle development costs, such as the Arctic, deepwater, heavy oil, sour gas and the like.

It’s estimated that to make up for declining production and meet rising demand, this industry will need to develop 290 Bbbl of new oil resources by 2035. And despite the game-changing emergence of unconventional resources, much of that new output will come from offshore.

To do this, $12 trillion of investment will be needed from now until 2035 to meet all demand, the International Energy Agency said.

Buzz words

So what’s happening?

The industry’s new imperative to assume more control and synergies where it can means a number of standard “buzz words” have had a good airing since the start of 2015. Barely any conference could be attended without the words “collaboration,” “standardization,” “driving value” and “cooperation” making repeat guest appearances.

But rather than just rhetoric, what is increasingly apparent is that these phrases are being uttered by experienced hands, many of whom have been through three, four or even five of these industry cycles before and have worked their way up through the ranks. As a result, their words carry weight.

For instance, Karl Wetherell, project general manager for BP’s Eastern Region within its Global Subsea Hardware (GSH) organization, spoke at the recent MCE Deepwater Development event in London, where he outlined the operator’s efforts to multitask its subsea engineers and standardize subsea hardware.

The GSH division was formed in 2011 and covers everything from wellheads, trees and manifolds to controls, umbilicals and services. This cross-system approach tackles subsea concept development engineering for BP’s predefined projects, with less than 25% of the GSH employees dedicated to just one single site.

This, said Wetherell, provided about 30% efficiency over a “project dedicated” model and also issued a “single voice to the subsea suppliers.”

He represents some solid spending power—the GSH division’s stewarded capital in 2014 was $1.2 billion, and that figure will be higher in 2015.

He also went on to highlight some brief examples of standardization initiatives, such as post-FEED efforts on one of its Egyptian project christmas trees, which he said used the same tree core components, materials, engineering and quality requirements as one of its Trinidad trees.

Ichthys megaproject insight

Another proponent is the manager for one of the world’s biggest megaprojects currently underway, Inpex’s Ichthys LNG development in permit WA-285-P offshore Western Australia. According to Louis Bon, it has only been able to happen because of a top-to-bottom collaborative effort by all its participants.

Bon is a man who knows all about delivering world-class projects—on assignment from Ichthys partner Total, he was responsible for managing several of the operator’s biggest deepwater projects, including the Pazflor Field offshore Angola. According to Bon, it’s all about having an integrated team to overcome the major HSE and logistical challenges of a global project like Ichthys.

Illustrating the point, he highlighted that the development has yards constructing various aspects of the project’s FPSO vessel, central processing facility semisubmersible and huge subsea production system simultaneously in countries including South Korea, Thailand, China, the Philippines, Indonesia, Singapore and Malaysia. “We have a meeting in Perth every year of all the companies involved to foster that team approach,” he said. To give an insight into the global scale of Ichthys, more than 30,000 people worldwide have worked or are working on it.

Logistically, the project will have up to 2,000 people offshore during peak construction activities, with about 500 offshore at present. Bon describes it as “a massive logistical operation,” using seven helicopters.

The Ichthys Field itself contains more than 340 Bcm (12 Tcf) of gas and 500 MMbbl of condensate, and the project is currently more than 64% complete. Latest activity includes the insertion of the 7,000-tonne turret into the field’s FPSO vessel and the seabed riser support structure recently being installed in place on site in 250 m (820 ft) of water. Deepwater pipelay activity got underway during the summer and is expected to be complete by the end of this year, he added. Two rigs— the Ensco 5006 and the Jack Bates—are currently drilling the development and injection wells.

Bon went on to describe Ichthys as “a very significant subsea installation,” with more than 30,000 tonnes of equipment to be installed on the seabed in total.

Giant facility

The central processing facility (CPF) itself is a massive facility. One conference delegate pointed out that, weighing in at around 70,000 tonnes, it will be approximately 70% heavier than the next biggest topsides facility—BP’s Thunder Horse platform, the topsides of which come in at a “mere” 40,000 tonnes.

Bon justified this large weight gain by outlining how Inpex and its partners learned from previous lessons and decided to opt for a robust design life for the CPF. The platform has to be able to withstand cyclones while staying on-station and last for the full 40-year planned life cycle. This was selected as opposed to options such as going for a 25-year period to be followed by various brownfield upgrades, revamps, heavier maintenance programs and so on, which was determined not to be desirable due to the lack of clarity over the future likely expense.

“We took the decision to design for a 40-year total life, and it had a huge impact on the design of the project. Virtually everything is a first, but we will have a facility that will last. It’s a good thing, but that also made it the biggest challenge,” he said.

Bon did also admit that the 70,000-tonne weight of the topsides had increased during detailed engineering by between 10% and 15%, but that it was a rise “in the right range that we normally see. It’s not uncommon.” Nevertheless, he added, at all times the weight was under strict control.

Efficiencies

Examples of efficiencies the project team is looking to employ going forward include options such as integrating the platform topsides modules in two-by-two batches and doing dual lifts.

The next challenge is going to be the integration of the topsides, he said, with one of the tasks the project team is aiming to tackle being to maximize pre-integration opportunities. Another challenge to overcome is the eventual hookup of the CPF and FPSO vessel on site. “But this kind of thing we know how to do,” Bon added.

Ronald Doherty, manager of field developments at Intecsea Consulting, also backed up this long-term approach to a development. He told delegates in a presentation that cutting costs in the engineering phase simply causes more expense later down the line and results in a lower net present value than would otherwise have been achieved. In one generic example he estimated the loss in earnings at around $2 billion over a project’s total life.

He warned that the engineering phase is often seen by operator project personnel “as an easy place to cut costs because, when the problems come back, they will not be there.”

Fabrication focus

In another operator perspective, Martijn Dekker, Shell’s vice president of appraisal and hydrocarbon maturation, said during a discussion at the same event on project efficiencies that a “big opportunity being missed is efficiency in fabrication.”

There is a big gain to be had there, he said, before also turning his gun on the installation contractors to say he thought there could be a “huge gain in efficiency in these areas.” However, he admitted with reassuring honesty that, in Shell’s case, “We do not involve any installation contractors up front. They come later.”

Dekker went on to recognize the need for operators and contractors to better understand each other in the current climate as to what is on offer. That includes better understanding by operators of what the contracting community can provide. “This means having a dialogue. What are we paying for, and what are we getting?”

EPC costs

The related issue of engineering, procurement and construction (EPC) costs also was touched on in a recent investor presentation by Chevron’s senior vice president upstream, Jay Johnson.

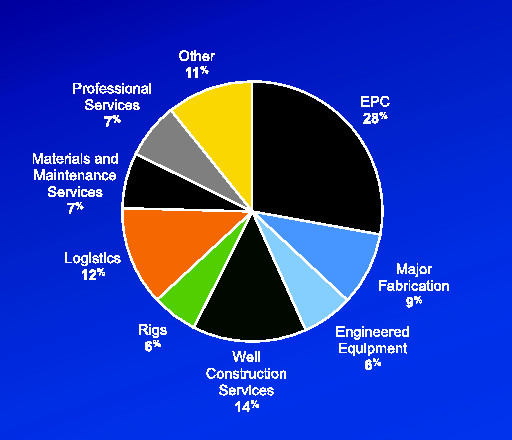

He was responding to a question from an analyst on why the operator had flagged the construction-related part of deepwater projects and equipment as a cost issue rather than the more usual talking point of drilling rigs. In a Chevron pie chart EPC activities make up 28% of the company’s upstream gross operated spend, with “major fabrication” making up a further 9%. This is compared to the oft-discussed industry “cost indicator” of drilling rigs, which in the same chart represented just a 6% slice of the pie.

The reason for focusing on costs: The biggest slice of Chevron's upstream gross operated spend this year is the 28% designated for EPC, with major fabrication making up another 9%. (Source: Chevron)

Johnson said that fabrication yards “are a big part of your capital costs with these [projects]—particularly a new hub where you are putting a new facility out. Subsea costs are moving to higher levels of standardization on subsea equipment, so there’s more interchangeability, both between vendors and within our own system. It’s another area where we are also working hard to bring those costs down. Even things like logistics and having a logistics support center help so that we make the most efficient use of our boats and aircraft. That can represent a very large part of the operating cost. So it’s really across the board in terms of how we go after these things.”

Maximizing value

Paul Hillegeist, president of Quest Offshore Resources, commented at the MCE Deepwater Development event that the key industry challenge is to “maximize the value of every boe.” Flagging the challenged economics of deepwater projects, he pointed out areas of concern such as the ever-increasing cost and weight of topsides on floating production systems, which have been driving up the expense of such systems and adding to increased project delays. “And complex projects drive demand for high-spec construction,” he said.

Hillegeist also pointed out the current drop-off in offshore exploration activity, which if sustained would mean a potentially reduced backlog of discoveries to develop post-2021. Exploration activity will need to pick up over the next five years to drive development demand to 2021 and beyond.

This was also touched upon separately by another analyst, Wood Mackenzie, which adopted a more positive view with global exploration drilling activity to possibly bounce back in 2016.

Wood Mackenzie said that as the industry responds to the low oil price environment with exploration budget cuts of around 30%, it is at the same time addressing the long-standing cost inflation issue with average costs set to fall by a third. Although overall well numbers will dip this year, it said drilling activity in 2016 is set to recover as many explorers seize their chance to drill at lower costs.

Cost deflation

The report, titled “Upstream cost deflation: How much could costs of exploration fall?” concluded that exploration deflation will average 33% by 2016, comprising global elements that are locally compounded by favorable exchange rate moves: Like-for-like costs will decline by 19%, simplification of activities could save 5%, efficiency improvements will save another 5% and U.S. dollar strength will save 4% overall.

Wood Mackenzie’s Dr. Andrew Latham said, “Only about half of these gains will be enjoyed during 2015 as contracts unwind and operators take time to adopt new practices. We expect the full benefit during 2016 unless oil prices recover quickly.”

He added that deflation could allow companies that hold spending flat into 2016 to fund 50% more exploration vs. 2014. Even those with average cuts of around 30% may see their 2016 activity bounce back to 2014 levels.

The report also highlights that prior to the oil price plunge, some of the strongest service sector margins had been among drilling and seismic contractors. “Exploration-focused contractors should ... be able to reduce their prices further and quicker than relatively less profitable general oilfield service providers,” he said. “Cost deflation will ... exceed equivalent falls in costs of development. Lower costs of exploration will help reduce breakeven prices and improve full-cycle economics, with some of the best improvements in deepwater plays.”

Latham went on to warn, however, that exploration savings alone are only a small part of the story, shaving perhaps $5 or less from typical breakeven prices. “Reductions are also needed from the much larger development and operating costs.”

Long-term measures

Latham will have been heartened to hear a succession of speakers at the annual SPE/IADC Drilling Conference in London line up to outline some of the long-term measures their companies have undertaken to raise their game. Many also took the time to stress that most of these measures were being implemented before the price downturn.

Gary Jones, head of BP’s global wells organization, told delegates that at his company “collaboration has been ongoing already, long before the downturn. We understand collaboration, and of course during the current environment it is even more important.”

Jones pointed out that with oil companies having lost “50% to 60% of their revenues,” they have two essential choices—cutting capital and stopping activity or doing what they do but at a reduced cost.

“We work long-term, and we need to keep going with what we are doing, so for us the best option is to do things for less money, to do things more effectively. But it’s not in our interest to cut the margins of suppliers. So we are working with contractors and looking at where we can bring the cost of drilling wells down,” he said.

Shell International’s Ivan Tan, vice president of wells and HSE, said the oil price landscape requires it to be more capital-efficient. He highlighted the importance of risk management and that “the consequences of something going wrong are quite significant, so there is some level of conservatism that will come into various aspects of the wells, and then the scope grows.”

Standard well design initiative

Statoil’s drilling technology chief engineer, Arne Lyngholm, outlined some examples of the Norwegian operator’s initiatives to improve efficiency, underway for more than a year.

They included a revamp of its engineering process, with an estimated 25,000 hours spent so far reworking the system to be more efficient. Another example is its well designs. According to Lyngholm, 60% of its wells (between 95 and 100 this year) are going to be delivered with a standard well design.

He also stressed the continued importance of developing and implementing new technologies: “We need to develop and implement the technology and put it to work,” he said. But he added that the industry also needed to work harder at better collaboration, especially between operators, and also to improve industry standards in a number of different areas.

Industry engagement

Schlumberger’s Steve Kaufmann, president of drilling and measurements (drilling group), highlighted at the SPE/IADC event how the take-up of technology generally has been very good over the past couple of years, driving down the lifting costs per barrel significantly in the unconventional arena and also seeing major benefits in terms of drilling performance and efficiencies in the deepwater Gulf of Mexico (GoM).

“But today we do need to collaborate more and understand better the requirements that operators want,” he said.

He also pointed out that there were clear areas where there could be “better efficiencies,” with Schlumberger currently providing 24 different sizes of rotary steerable systems in the deepwater GoM. “There’s a huge opportunity to collaborate. We can streamline that better.”

He added that in the current downturn, “the industry engagement over the last four or five months has been very good.”

Technology driving efficiency

Technology is clearly able to drive better efficiency. Johnson went on to highlight some examples: In the deepwater GoM, enhanced seismic via ocean bottom nodes is helping to optimize both the placement and the number of wells, lowering costs and increasing recovery.

“In deepwater drilling we’ve delivered a 25% reduction in drilling days for 10,000 feet [3,048 m] over the last two years,” he said. “And on the completion side, our development and implementation of the single-trip multizone frack pack increases completion efficiency and reduces rig time. It has already delivered nearly $200 million in savings, and the savings grow with each additional well we drill and complete.

“Seafloor pumps reduce backpressure on deep reservoirs and deliver increased recovery. In the case of the Jack/St. Malo project, this is expected to yield an improvement of 10% to 30%, which equates to 50 MMbbl to 150 MMbbl of additional oil recovery.

“Successful application of technology is lowering costs, increasing recovery and improving the economic outcomes from our deepwater projects,” he emphasized.

Recommended Reading

The Wall: Uinta, Green River Gas Fills West Coast Supply Gaps

2025-03-05 - Gas demand is rising in the western U.S., and Uinta and Green River producers have ample supply and takeaway capacity.

Shale Outlook: Power Demand Drives Lower 48 Midstream Expansions

2025-01-10 - Rising electrical demand may finally push natural gas demand to catch up with production.

Plains’ $725MM in Deals Add Eagle Ford, Permian Infrastructure

2025-01-08 - Plains All American Pipeline’s executed transactions with EnCap Flatrock Midstream in the Eagle Ford and Medallion Midstream in the Delaware Basin, among other moves.

Tallgrass, Bridger Call Open Season on Pony Express

2025-02-14 - Tallgrass and Bridger’s Pony Express 30-day open season is for existing capacity on the line out of the Williston Basin.

Kinder Morgan Completes Bakken G&P Acquisition from Outrigger Energy II

2025-02-18 - Kinder Morgan closed on a $640 million deal for a Bakken natural gas gathering and processing network in the Williston Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.