Editor’s note: This is part of an ongoing series of Oil and Gas Investor articles examining major shale play trends— from electrification to M&A to infrastructure needs— as E&Ps enter 2025.

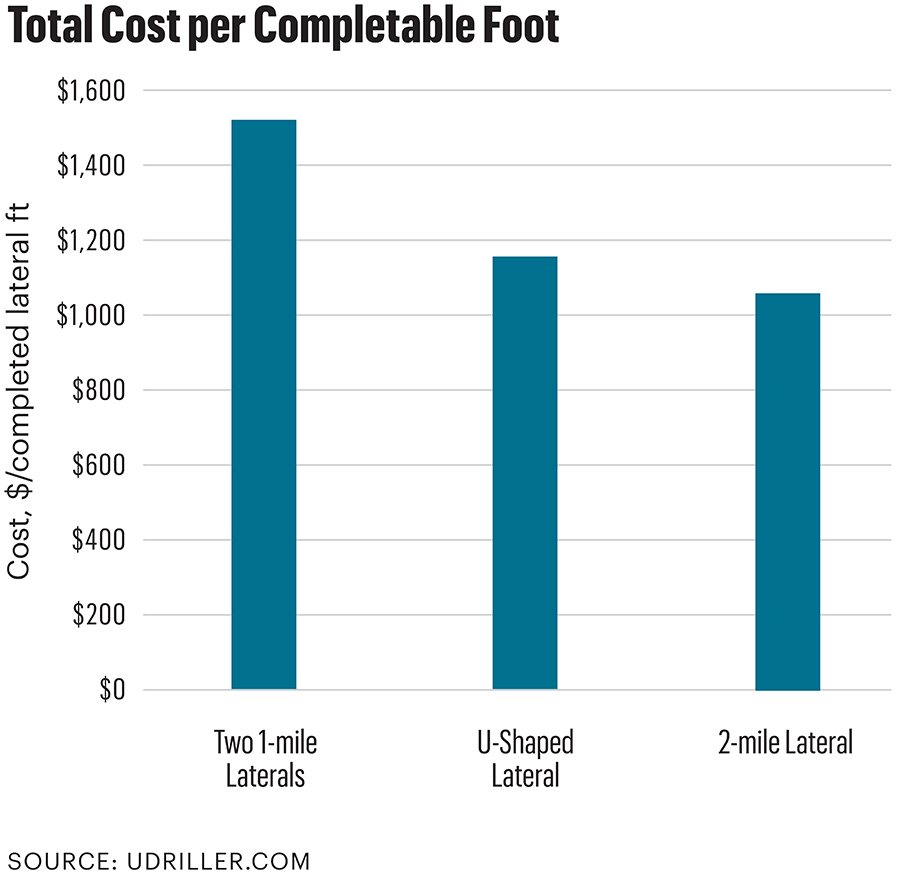

Operators across the Lower 48 are drilling U-shaped double-long laterals, finding lower-cost new-well inventory in acreage they already hold.

And they’re doing it problem-free.

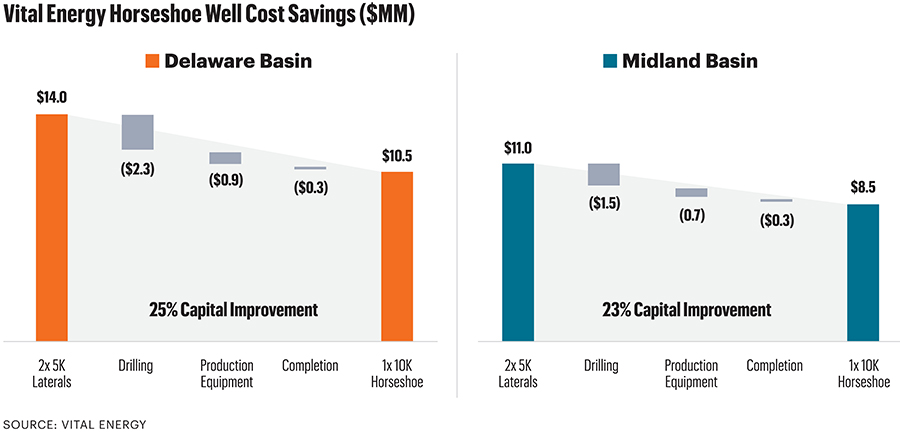

“When we look at the M&A landscape, there are fewer and fewer opportunities out there that will have inventory that will jump ahead of the low breakeven inventory that we’ve added today,” Jason Pigott, Vital Energy president and CEO, told investors in a 2024 call.

“We see really similar cycle times with this design as we do with a more conventional straight-lateral steering strategy,” Vital COO Katie Hill added.

Vital has converted 84 1-mile wells in its inventory to 42 2-mile horseshoe wells and added 77 horseshoe wells in locations that were not initially planned because they were considered sub-economic as short laterals, Pigott said.

Udriller.com, a website that keeps track of U-turn wells dating back to the initial horseshoe well in 2019, counted 76 of these through early October, with 35 spud in the first nine months of 2024 alone.

Among operators drilling U-turn laterals in 2024 were Matador Resources, Occidental Petroleum and EOG Resources, in addition to Vital, SilverBow Resources, Comstock Resources and GeoSouthern’s GEP Haynesville.

77 more locations

A Permian Basin pure-play E&P, Vital gained two horseshoe wells in the Delaware in its 2023 acquisition of Forge Energy and is targeting U-shaped wells for special-sized leaseholds in both the Midland and Delaware basins.

Since one 10,000-ft U-lateral costs less than two 5,000-ft straight laterals, or “sticks,” Vital was able earlier this year to add 77 new long-lateral U wells out of 154 1-mile locations that Pigott said were “previously excluded due to the economics.”

When Vital was drilling its first horseshoe wells in 2023 at its Allison pad in Upton County in the Midland Basin, “every single well was getting faster,” Pigott told investors.

“So, the more we do it, we’ll continue to get costs down and improve our breakevens.”

Vital also added Delaware acres in the $1.1 billion cash acquisition in September of Point Energy Partners, which had leasehold that includes locations suitable for horseshoes.

“We’re really excited about Point because it’s in our backyard, it had low-breakeven wells and we’re using horseshoe technology to improve economics out of that asset,” Pigott said in November.

Spacing and completion recipes are the same in U laterals as two single-well laterals, he added.

“We targeted this technique anywhere we have short laterals.… When you come back [after the turn, toward the pad], you come back on that same spacing that you would traditionally have.

“So, whether you develop on six wells per section or four wells per section, we designed the return lateral on that spacing.”

Matador U-turns

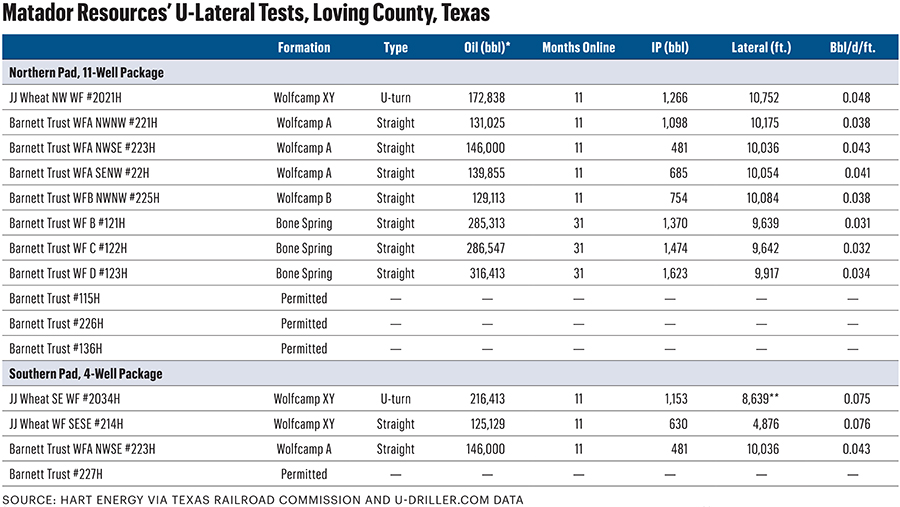

Matador’s first two 2-mile U-lateral tests in the Delaware are outperforming adjacent 2-mile straight laterals in 11 months online now, according to Railroad Commission of Texas (RRC) data.

Both U-laterals are in a development of 11 wells to date about 4 miles north of Mentone, Texas, in Loving County.

The U-shaped JJ Wheat NW WF #2021H produced an average of 0.048 bbl/d per lateral ft through August, higher than the 0.038 bbl/d to 0.043 bbl/d per ft averaged through August from four adjacent straight-lateral sticks.

It was landed in Wolfcamp XY, while the four sticks are in Wolfcamp A and B, according to RRC files.

Including the #2021H, the five laterals range from 10,036 ft to 10,752 ft.

Next door, Matador varied the project in three tests.

A 2-mile U-turn, JJ Wheat SE WF #2024H, averaged 0.075 bbl/d per lateral ft in its first 11 months online from a total 8,659 ft of hole in Wolfcamp XY, according to the RRC.

An adjacent 1-mile stick, JJ Wheat WF SESE #214H, averaged 0.076 bbl/d per lateral ft through August. It is also landed in Wolfcamp XY. The lateral is 4,876 ft.

In another look from the same pad, Matador made a 2-mile straight lateral, Barnett Trust WFA NWSE #223H, in Wolfcamp A. Production through August from the 10,036-ft hole averaged 0.043 bbl/d per lateral ft, according to the well file.

Five more tests

Since turning these into sales in October 2023, Matador has made five more New Mexico U-laterals—the Janie Conner #120H in Eddy County, in the Lower Avalon and four Burke State wells, all in Bone Spring, in Lea County—according to Udriller.com.

Data was not yet available on these.

Joe Foran, Matador chairman and CEO, told investors in fall 2024 that the five new U-laterals were drilled 30% faster than the first two.

Also, it used remote, simul-frac completions on the four Burke State wells.

The four 2-mile U-lateral Burke State wells are in a 1-mile section where Matador would have needed to make eight laterals to tap the equivalent length of rock.

“The team estimated $3 million in cost savings per U-turn well when compared to the alternative of drilling eight 1-mile … wells,” Foran said, by eliminating the vertical sections of four of the eight 1-mile holes.

U-turn IPs

The initial JJ Wheat U-turn tests’ first-24-hour IPs were also higher than their straight lateral Wolfcamp counterparts, coming in with 1,266 bbl and 1,153 bbl, according to RRC data.

One of the 2-mile straight laterals IP’ed 1,098 bbl; the other four, fewer than 800 bbl.

“Even though they’re U-turn wells, they performed just like a straight 2-mile-long lateral—very high pressures and IP rates of between 2,100 and 2,400 boe/d [including gas],” said Tom Elsener, Matador executive vice president of reservoir engineering.

At the time, the U-shaped JJ Wheat wells were online more than four months. In addition to oil, they made between 1 Bcf and 1.3 Bcf of casinghead gas in their first 11 months.

“You wouldn’t know the difference if it was a U-turn or 2-mile lateral from the production results,” Elsener said.

At the time, Matador estimated making up to 20 U-turn wells in the next two years.

“We’re ready to do a few more of those.” But, at first, “we still are kind of in the learning phase,” Elsener said.

“We’re going to learn about some different targets in different areas.… I still think we’re kind of in the walking mode. We’re not quite in the running mode yet.

“But I think we’re very optimistic about it.”

Haynesville, Marcellus, Utica

Through early October, operators had spud 76 U-turn wells across the Lower 48 since a Shell Oil pilot in 2019 in Loving County, according to a running tally at Udriller.com.

All but four have been in oil plays: Permian, Denver-Julesburg and Anadarko basins, and Bakken and Eagle Ford shales.

Chesapeake Energy was second to test U-turn laterals, landing one in La Salle County in 2020. Chesapeake merged with Southwestern Energy to form Expand Energy in 2024.

That well, Jea Unit L Las L #3H, had been producing since mid-2012, according to the RRC file, and had declined to 31 bbl/d for a total of 266,000 bbl in its first 98 months online.

It was brought back online in September 2020 with the U lateral and produced 809 bbl/d. Production in May was 103 bbl/d. The well produced 310,000 more barrels over the 45 months since it converted to a horseshoe.

Including that well, Expand made eight U laterals, all in the Eagle Ford—six full U-turn holes, a W-turn and a J-turn—before exiting South Texas in 2023.

“We’ve done it successfully,” Tim Beard, Expand vice president, drilling, told Oil and Gas Investor. “And you do that because of offsetting wells, lease requirements” and other reasons.

There is potential for U-turns in Expand’s Haynesville leasehold as well, Beard said.

Beard said, “Now, you have to worry about the stresses downhole to make sure that these wellbores aren't going to fall apart.”

But they’re doable.

The balance of Expand’s portfolio is in the Marcellus. Is it interested in making U-laterals there? “Absolutely,” Beard said.

Where there is stranded acreage, “it’s going to enhance your economics. We’re not doing it for any reason other than that.”

Ascent Resources landed one, Echo S ATH HR #3H, in the Utica’s gas-weighted fairway in eastern Ohio in April 2023. Through June 2024, it produced 5.9 Bcf and 10,739 bbl of oil, according to Ohio Department of Natural Resources data.

Coterra Energy spud one in the Marcellus in Susquehanna County, Pennsylvania., in September 2023, according to Udriller.com.

Beard said, “I think the Ohio and West Virginia area—being more benign from a subsurface-feature perspective—is probably where they make the most sense in [Appalachia].

“But that doesn’t mean we won’t do those in Northeast Pennsylvania as well.”

Torque and drag

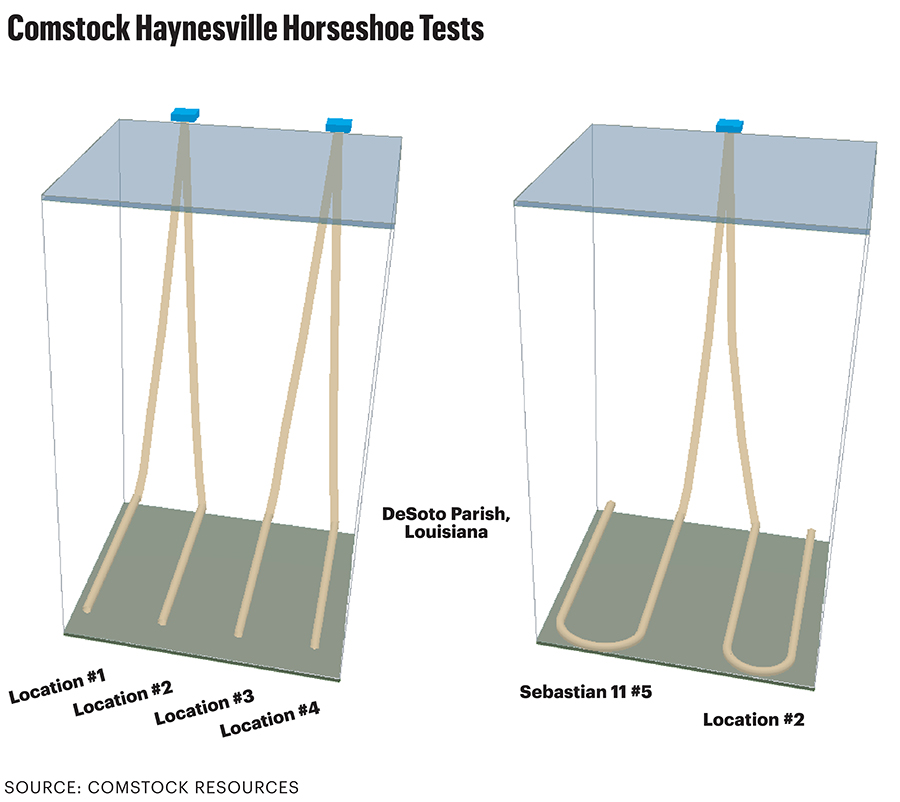

In the Haynesville, GeoSouthern Energy’s GEP Haynesville spud a U-turn in DeSoto Parish, Louisiana, in early 2024.

The results prompted Comstock Resources to put one, Sebastian 11 #5, nearby. Turned into sales in October, it had an IP of 31 MMcf/d from 9,300 ft of completed lateral.

The single-section lease had meant four 1-mile sticks that would have involved two pads and cost $40 million, Dan Harrison, Comstock COO, said in an investor call.

Making two U-turn wells instead will result in a single pad at a cost of $32 million.

If successful, “the majority of all the short wells in our inventory will convert to long laterals,” Harrison said.

Making these wells is a matter of necessity, he added.

“Until you kind of ‘have’ to do it—you’re looking at your inventory improvement—a lot of people probably just don’t push to go there.”

In the drilling process, “it’s the same tools, the same motors that we run,” Harrison said. “You just make another turn and you just stay with it until it goes all the way around 180 degrees.”

There is some risk in drilling a horseshoe well, though. “You have to get casing around the curve,” Harrison explained. “When you’re completing and pumping your perforating guns down and plugs for all your frac stages, all of these have to get pumped around the curve.”

This introduces more torque and drag. “Obviously, when you’re pushing and pulling pipe around the 180-degree bend, it adds more drag, tripping in and out of the hole.

“So, a 10,000-ft horseshoe [is] maybe more like the equivalent of a 15,000-ft straight lateral when you look at the drag going in and out of the hole.”

Reduced footprint

Despite this, Harrison said the risk is small. “The industry kind of already has shown it in the Permian and I think the Eagle Ford [and] other areas.…

“You just have to prove it out and … after you do more of them, it becomes a little bit more routine and the risk is greatly diminished,” he said.

Fewer wellheads are more environmentally beneficial as well, he said, as the surface footprint and emissions are reduced.

If successful, Harrison said, “the majority of all the short wells in our inventory will convert to long laterals.”

The exception will be in sections where spacing allows only one more lateral. “We won’t be able to convert all of them to 10,000-ft horseshoe wells, but I think a good chunk of the inventory we will be able to convert,” he added.

As Comstock’s new U lateral was landed problem-free, “I think this is the first of many to come,” he said.

“I think the public wants to see more of them drilled. They want to see it become routine. They want to see it de-risked.”

A 15k-ft horseshoe?

A securities analyst asked Comstock if there are 7,500-ft stick locations that can be made into 15,000-ft horseshoes.

“We’ve already kind of had some internal discussions about that,” Harrison said. “We’re not ready to kind of jump out there and do that yet.”

It is, however, a possibility in the future.

“The industry gets better with time,” he said. “Tools get better. If you have the demand for tools and the demand for certain services, in time they show up. They get developed and they get refined.”

There are economic considerations to take into account, however, and today a 7,500-ft lateral has better economics—a better breakeven—than a 1-mile lateral when factoring for all-in cost to drill versus production and reserves, Harrison said.

For that reason, there would be less incentive to convert 1.5-mile sticks into 3-mile U wells.

“If you have two sections or three sections, typically we’ll just drill a 15,000-ft straight lateral,” Harrison said. “We’re not going to do a bunch of [15,000-ft] horseshoe laterals.”

While Comstock is not likely to drill longer U-shaped wells at present, “there will probably be some people that will try to push the horseshoe lengths a little bit farther,” Harrison said.

The Shell well, 2019

The first known horseshoe lateral was the Neelie #4H well drilled by Shell Oil in the Delaware Basin in 2019.

According to Udriller.com, the 2-mile lateral, now owned by ConocoPhillips, was landed in the Wolfcamp in Loving County with 1,300-ft spacing. It was brought online in June 2019 and produced 727 bbl/d of condensate its first full month.

According to RRC data published in mid-August, production totaled 273,791 bbl of condensate through May 2024. Solution gas through May totaled 1.6 Bcf.

A look at Shell’s request for an RRC permit to drill the U-shaped lateral demonstrates the Texas oil and gas reviewer’s own surprise.

The file includes a pre-emptive note by Shell in the request, explaining that the plan is for a horseshoe well. The motivation was a workaround on a subsurface issue rather than a surface, acreage-related issue, it added.

“Due to loss-circulation issues in the Neelie 1-85 LOV #2H well, this permit is being amended to drill the original #4H lateral and the previously permitted #2H lateral,” Shell reported to the RRC.

The #2H would now include the #3H well. The exception required a waiver by the offset operator, but since Shell operated both wells, it told the RRC that it “grants itself a waiver.”

Recommended Reading

Enchanted Rock’s Microgrids Pull Double Duty with Both Backup, Grid Support

2025-02-21 - Enchanted Rock’s natural gas-fired generators can start up with just a few seconds of notice to easily provide support for a stressed ERCOT grid.

E&P Highlights: April 7, 2025

2025-04-07 - Here’s a roundup of the latest E&P headlines, from BP’s startup of gas production in Trinidad and Tobago to a report on methane intensity in the Permian Basin.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

McDermott Completes Project for Shell Offshore in Gulf of Mexico

2025-03-05 - McDermott installed about 40 miles of pipelines and connections to Shell’s Whale platform.

M&A Competition Off to the Races as Mesa Minerals Kicks Off Fourth Iteration

2025-04-16 - The Mesa Minerals IV launch comes as M&A competition grapples for mineral and royalty interests, no matter the basin, says Mesa Minerals CEO Darin Zanovich.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.