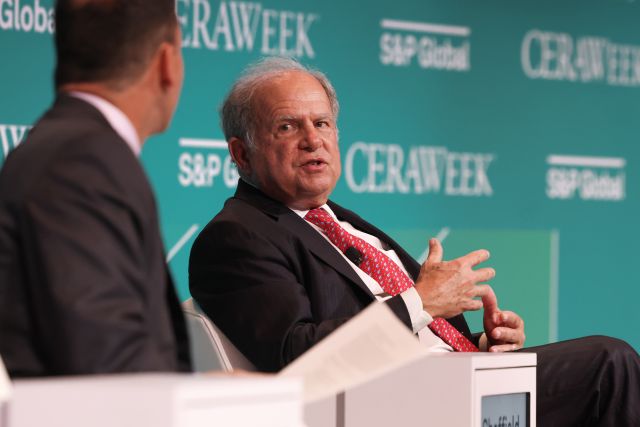

Scott Sheffield, founding CEO of Pioneer Natural Resources. (Source: CERAWeek by S&P Global)

Former Pioneer Natural Resources CEO Scott Sheffield is firing back at the U.S. Federal Trade Commission’s (FTC) complaint against him that alleged an organized anticompetitive stunt and prohibited him from taking a seat on Exxon Mobil’s board.

The complaint was filed in tandem with the agency’s proposed consent in early May to Exxon’s $60 billion merger with Pioneer. The message was clear: cut Sheffield from the board or face continued scrutiny, certainly delaying and perhaps squashing the deal.

Exxon accepted the government’s terms. Sheffield was out and the biggest shale oil transaction ever signed closed on May 3.

Sheffield exercised respectful silence at the time. In a statement to the press, he and others at Pioneer refrained from taking steps to prevent closing. Sheffield opted to put the interests of investors, employees and the competitive health of the U.S. energy industry first, the company said.

Still, known throughout the U.S. and international business circles as a straight-shooter unafraid of the limelight, Sheffield was expected to clap back at some point.

On May 28, he issued the following from a 23-page comment to the FTC:

“The ordered restriction on Mr. Sheffield’s right to be appointed to Exxon’s board is arbitrary, capricious, an abuse of discretion, beyond the FTC’s lawful authority, and not in the public interest,” Sheffield said in the comment.

From there, he addressed the accusations listed in the agency’s complaint against him as “a false narrative about these statements and a farfetched interpretation of the applicable statues.”

Sheffield said that despite the FTC’s litany of assertions, including that he had allegedly colluded with others – including U.S. producers and members of OPEC – via text and email to manipulate oil prices, the agency didn’t ask about those communications during a four-hour examination under oath on April 9.

Sheffield said the U.S. producers were two in number: his son and an executive at a small producer simply wishing him well when he returned to lead Pioneer in 2019.

Sheffield said other communications cited by the FTC were also few and limited to a text he sent during the pandemic to connect Secretary General Mohammed Barkindo with the Texas Railroad Commission.

The FTC allegation that Sheffield “exchanged hundreds of text messages with OPEC representatives and officials discussing crude oil market dynamics, pricing and output” is another point of contention.

“This is dead wrong,” he said.

The FTC’s complaint also asserted that Sheffield was “signaling” that producers should collude in restricting production as far back as 2017. At the time, shareholders and investors were bolting from the industry in response to poor returns and growth-for-growth’s sake. Sheffield was among the first to call for capital discipline — a trend that has resulted in historic free cash flow, much of which has been returned to shareholders.

“Contrary to the FTC’s allegation, this was not an attempt to signal about output in the oil market. Mr. Sheffield’s statements were made in public interviews and speeches involving matters of investor and public interest,” Sheffield said in the comment. “These statements were perfectly legitimate and also protected by the First Amendment.”

The net effect of the FTC’s actions — vilifying him and barring him from serving on Exxon’s board — is a violation of administrative law, Sheffield said.

“No American citizen should be subjected to this kind of relentless and baseless personal attack by a government agency in a proceeding where nothing is proven and the individual has no opportunity to be heard,” he said.

Nevertheless, the FTC remained firm.

“The FTC stands by our allegations,” FTC spokesman Douglas Farrar told Hart Energy. “There is no question that Mr. Sheffield publicly urged Texas oil producers to limit production, while having regular, private back-and-forth communications with senior OPEC representatives over a period of years.”

Beginning in the fall with its “Second Request” notification it would be seeking additional information into the Exxon-Pioneer merger, the FTC has since launched a slew of similar notices to E&P dealmakers. A historic round of oil and gas industry M&A has taken shape during the last nine months, with many of the largest deals met by heightened FTC scrutiny.

Chesapeake Energy has reported the FTC’s notice has delayed its acquisition of Southwestern Energy, and others including Diamondback Energy’s $26 billion deal with Endeavor Energy Resources is also pending the agency’s review.

Recommended Reading

Exclusive: Mesa Minerals IV to Reload in Haynesville, Permian, Other Basins

2025-03-19 - Mesa Minerals IV, backed by NGP funds, is launching to acquire mineral and royalty interests in the Permian and Haynesville, said Mesa President and CEO Darin Zanovich at DUG Gas.

Queen’s Chess: Changing the Rules

2025-02-28 - There’s a popular response to the inexplicable: “I don’t know. I don’t make the rules.” But what is known with certainty, as shown throughout history, is that we can change them.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.