Operators can’t depend on traditional solutions to succeed on the Eastern Shelf, where drilling horizontal Strawn wells has been a decade-long iterative process. (Source: Shutterstock.com)

Industry veterans didn’t believe Bob Eagle when he told them about the horizontal Strawn wells his company was drilling on the Eastern Shelf of the Permian Basin.

“They’d say, ‘No you’re not,” Eagle told Hart Energy. “You’re not in the Strawn, you’re in the Cline or the Wolfcamp shale.’”

The Strawn Formation was already well-known to Eagle, president of Clear Fork Inc. of Abilene, Texas, and oilmen like him on the Eastern Shelf. Vertical oil production from the Strawn interval dates to 1920, according to state historical records.

“We’ve all drilled through it or for it our whole careers,” said Eagle, who has operated Clear Fork on the Eastern Shelf since 1981.

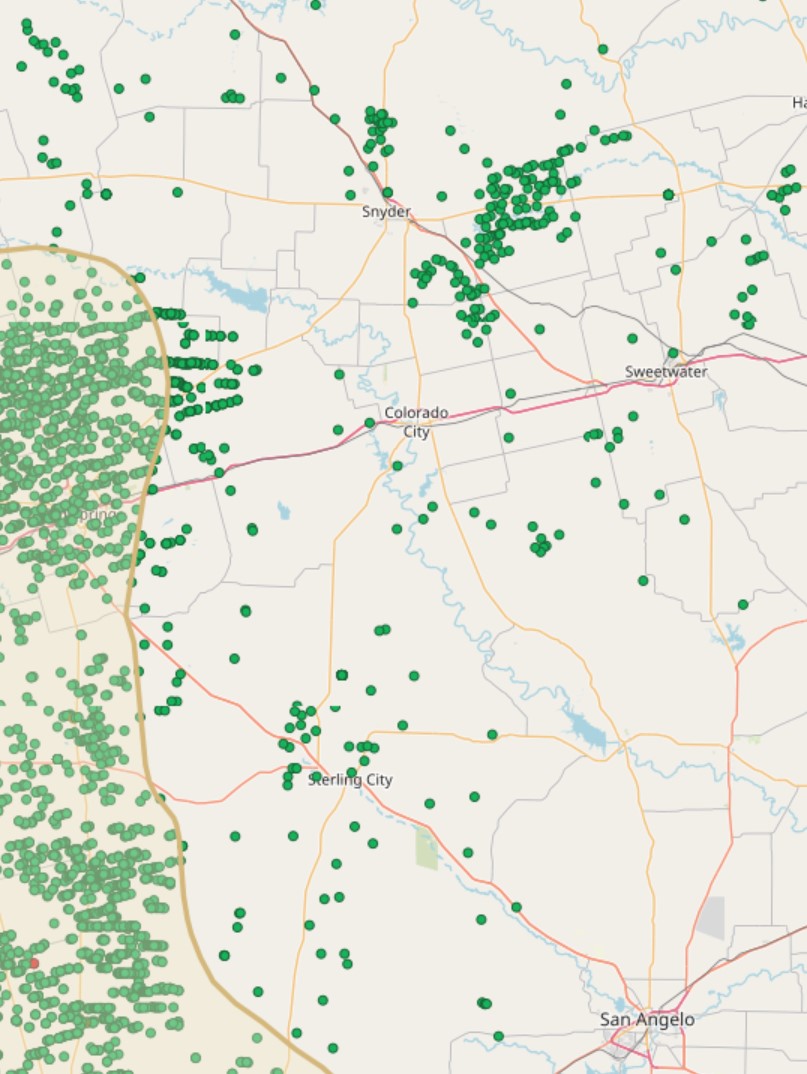

But it was the horizontal development of the Strawn sands starting in 2015 that kicked off a frenzy of new investment, leasing and drilling activity in the area.

“Part of that is a lot of the old timers in Midland just didn’t believe these results could be happening on the Eastern Shelf,” Eagle said.

Nearly a decade later, Clear Fork ranks among the top oil producers on the Shelf, after drilling or participating in about 60 horizontal wells.

Clear Fork and other operators have learned much about the Strawn sands—and the challenging variability drilling the interval across the play—over that period.

Operators leased up thousands of acres of country when the horizontal play was first taking off. But a near-decade of delineation has proven that the play isn’t as prospective as the independents first believed. Clear Fork has let “a lot of those acres expire” over time, Eagle said.

Horizontal development of the Eastern Shelf is too big a job for the smallest family-owned operators, and it’s too small a play to pique the interest of the publics and majors.

A few publics, including Devon Energy, were active in the area in the mid-2010s when the Cline shale was a hot topic. But most publics have focused their investment on the Permian’s Wolfcamp, Spraberry and Bone Spring formations in recent years.

Independents like the Eastern Shelf Strawn play because of the competitive well economics. The Strawn wells are drilled to shallower depths than the deeper Midland Basin wells. Producers also don’t need to frac the Strawn sands as hard as Midland producers do with the tight shale rock.

So, the Eastern Shelf emerged as a sort of “independent paradise in that regard,” Eagle said.

“But I would say there’s a fine line between paradise and a graveyard,” he added. “Most people would say it’s a graveyard, but that’s what makes it interesting.”

RELATED

Small Play, Big Wells: Permian Basin’s Horizontal Eastern Shelf

Dreaming of Dessie

Chris Graham, president and CEO of Verado Energy, remembers well the Eastern Shelf’s leasing frenzy last decade. He helped kick it off.

Graham joined Allen, Texas-based Verado in 2013. Before that point, the company had primarily developed gassy conventional assets in the East Texas Oak Hill Field.

Verado was looking for opportunity outside of East Texas when Graham was introduced to King Operating at an industry conference. King Operating had acreage and vertical Strawn wells on the Eastern Shelf—but the company was looking to boost production, Graham recalled.

The two producers discussed Verado’s experience fracking legacy vertical wells at Oak Hill and pondered how similar techniques could be applied to Eastern Shelf wells.

“We decided it’s not a good idea to frac the whole wellbore and try to get as many zones comingled at once,” Graham said. “But since you know the Strawn’s producing, it looks like it’s got some characteristics where we said, ‘Let’s go horizontal on this.’”

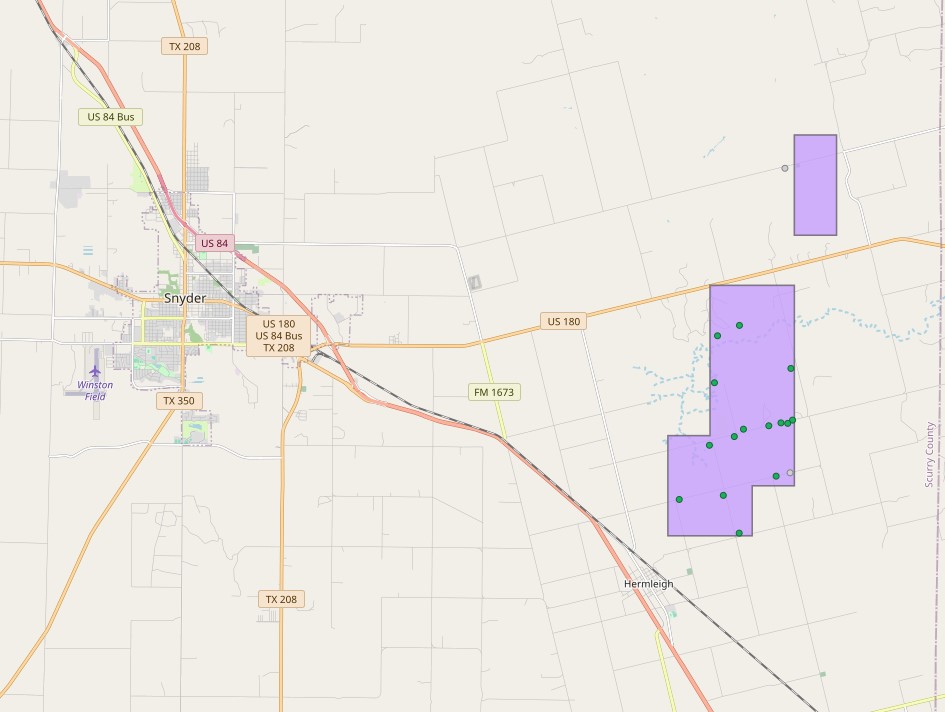

With King as operator and Verado as a non-operated interest holder, the companies completed the Dessie 91 #1H well in Scurry County—near the town of Hermleigh, Texas—in August 2015, Texas Railroad Commission (RRC) filings show.

“It came in phenomenally, especially for a half-length horizontal well,” Graham said. “After seeing the results on that, we said, ‘Let’s drill a full-length one.’”

Verado and King teamed up on a second well, the Kate 143 Unit #1H, which went to sales in 2016. Impressed by its performance, too, Verado bought out King’s interest and took operatorship of the Hermleigh assets.

“We finished up that third well and we just kept going from there,” Graham said.

Verado has produced nearly 3.8 MMbbl from Scurry County since the start of 2015, per RRC data. The company has drilled 16 horizontal wells since entering the Eastern Shelf, Graham said.

But growth hasn’t come without challenges. Verado and every other operator of substance on the Eastern Shelf have described subsurface complexity and variability across the play.

“As you expand out, there’s variability,” Graham said. “There’s different segments and benches—the Strawn B or Strawn C or Strawn A, depending on how you define them.”

Wells tend to be deeper to the eastern side of the play. Water cuts will change from location to location. There’s heightened risk and uncertainty on the outskirts of the play, where reservoir characteristics are less defined.

“Sometimes it works out really well, and sometimes you get some surprises as you’re drilling,” Graham said.

Verado still has room left in Scurry County to drill a handful of additional locations, he said. Some of those locations are to the west of its acreage, where the shelf will dip down, or prograde, into the deeper Midland Basin.

A few future locations are to the north of Verado’s acreage, where Graham said reservoir characteristics can be a bit different. Verado’s latest project—Xray #1H, completed in early 2023—is sited to the north of its acreage block.

Two years ago, Graham formed Corvus Resources, the next iteration of the Verado team, to hunt for acquisitions in areas with greater future upside.

RELATED

DUG Permian/Eagle Ford: Horizontal Conventional; Eastern Shelf Sand

Clear Fork

Clear Fork has drilled conventional, shallow sands and limestones on the Eastern Shelf for decades. In late 2012, the company was producing around 1,000 bbl/d, watching as Permian shale players started to apply unconventional drilling techniques to the conventional reservoirs on the Shelf.

But it was the company’s horizontal Strawn wells—the largest drilling projects in Clear Fork’s history, Eagle said—that took production to the next level.

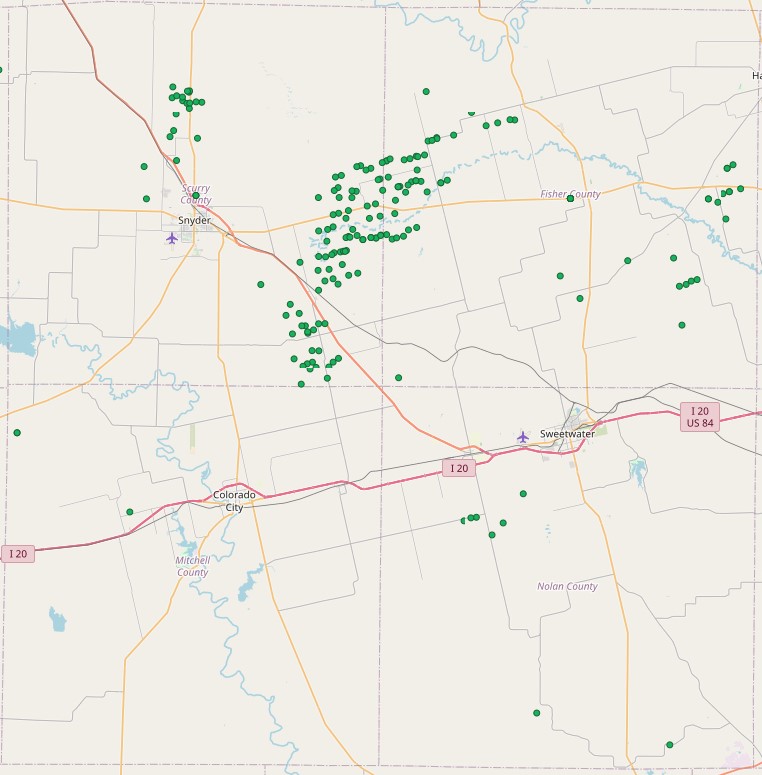

Clear Fork completed its first Strawn horizontal in Fisher County in July 2018, RRC filings show. The well was drilled just a few miles over the county line from Dessie 91 #1H, Verado’s half-lateral horizontal that kicked off the play in 2015.

The company was pumping about 1,400 bbl/d by the end of 2018. Oil production had grown to over 3,600 bbl/d by year-end 2019.

By August 2022, and after drilling over 40 horizontals in the Hermleigh play, Clear Fork’s oil production peaked at nearly 10,000 bbl/d, records show; gas output averaged 20.5 MMcf/d that month.

Since the play started in 2015, Clear Fork has been the top oil producer in Fisher County and the fifth-largest producer in Scurry County (behind Occidental Petroleum and Kinder Morgan Production Co., operators of legacy conventional assets in the area).

Clear Fork, like most of the Eastern Shelf’s top producers, focused its efforts in and around the core of the Hermleigh Field spanning the Scurry-Fisher county line.

Since delineating the Hermleigh Field, Clear Fork and a smattering of other operators have pushed further east into Fisher County, near the town of Sylvester, Texas.

“You have the Hermleigh proper and then the Sylvester area, which is where the activity is right now,” Eagle said.

Nearby operators include Cholla Petroleum, Browning Oil Co. and Walsh & Watts Inc.

Clear Fork went forward with a handful of horizontals in the Sylvester development area, but they “have not been good performers.”

“Although it had the same characteristics, it just wasn’t the same as the Hermleigh proper,” he said. “The geology was a little bit more complicated.”

RELATED

Exxon Explores Sale of Conventional Permian Basin Assets

M&A challenges

The Midland Basin to the west is awash in M&A. The Eastern Shelf has seen relatively little dealmaking.

In 2019, Mid-Con Energy Partners LP sold most of its Eastern Shelf property to Scout Energy Group IV for $60 million, in counties north, east and south of Scurry.

Last year, Clear Fork sold its flagship asset in the Hermleigh Field to Austin-based Legacy Star Capital Partners for an undisclosed price.

Legacy Star acquired 100% of the Hermleigh asset through a newly launched platform company, Peak 10 Hermleigh LP. Peak 10 operates the Scurry County asset jointly with Browning Oil Co.

Clear Fork continues to operate acreage and Strawn wells in the Sylvester area of Fisher County, Eagle said.

By and large, well variability and a lack of multizone upside has made dealmaking challenging on the Eastern Shelf.

“We can’t sell anything,” said Gideon Powell, CEO of Dallas-based Cholla Petroleum—another top Eastern Shelf producer. “No one’s going to give any value to the upside because we can’t even internally explain why it works sometimes.”

The Permian is popular with big shale producers because of its lower risk profile. It’s almost a guarantee you’ll strike oil in the Midland Basin because there are so many zones to attack: the Spraberry and Wolfcamp intervals, the Dean, the San Andres and more.

An Eastern Shelf producer might be able to land a lateral in a single zone. At most, you might find two producing benches, Eagle said.

And even when subsurface characteristics look promising, well results have varied rather inexplicably across the shelf.

“It’s a prograding shelf edge, so trying to draw a correlation from a well one mile away is sometimes impossible,” Powell said.

“We’ve got two horizontal dry holes—that is not something that a lot of companies can stomach,” he said.

Moriah Energy Investments, through its operating arm Moriah Operating LLC, has been one of the Eastern Shelf’s top producers over the past nine years.

Moriah has been active on the shelf since 2015 but started a new leasing effort the next year, spudding its first horizontal in 2018, Moriah President Tyler Harris said.

He also agreed: Subsurface variability is a real thing and does make it difficult to replicate results across the shelf.

“Operators need to take a statistical view to well results,” he said. “Individual wells may vary significantly from the field mean and I would expect that smaller development programs will experience a significant deviation from the mean, in either direction.”

Eastern Shelf operators also stress the importance of geology.

“We had a miscalculation that what we were doing in the core Hermleigh was going to work all across Fisher County, that all we had to do is just find a thick sand,” Eagle said.

“We proved that to be not totally correct—that geology really mattered,” he said, “and that you better do your homework to understand deposition, structure and all kinds of elements.”

RELATED

Peak 10 Energy Launches with Permian Basin Acquisition

Shelf moves south

Moriah still has a few locations left to drill in the Scurry-Fisher part of the Eastern Shelf. Late last year, Moriah completed a 10,500-ft lateral in Scurry County, Hannah #1H; Verado contributed some of its acreage to Moriah for the 2-mile well, Graham said.

But Moriah is hunting for the next play, too.

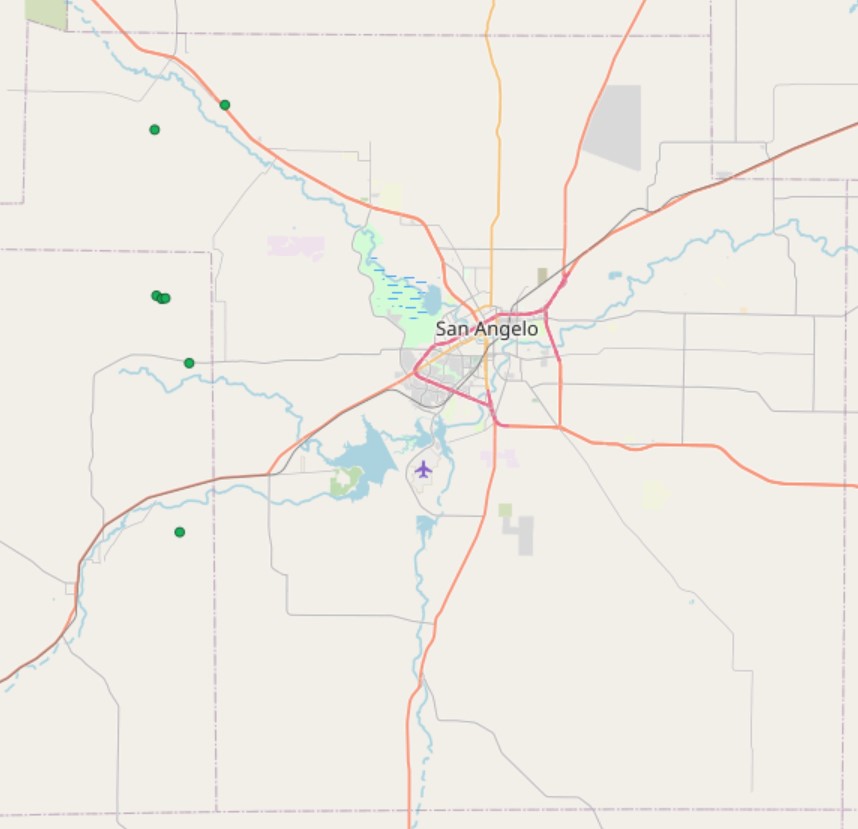

The company has more recently focused its drilling efforts on Tom Green and Irion counties, Texas, northwest of San Angelo.

Moriah’s first horizontal in Irion County was completed in November 2023. The Tullos Unit #1H (~8,000-ft lateral) was drilled targeting the Canyon reservoir.

RRC records show production from Tullos Unit #1H peaked at approximately 712 bbl/d in January. The well produced more than 116,000 bbl through July, according to the most recent available data.

A Strawn well completed in Tom Green County last December—Mozelle Unit #1H (~10,500-ft lateral)—produced over 600 bbl/d in April.

Harris was tight-lipped on the recent activity in the southern Eastern Shelf.

“That play is very early on its life cycle and we’re still evaluating results to assess the return profile and attractiveness of that area,” he said.

Moriah is delineating the play along with Rising Star Energy Partners LLC, which has submitted data on five wells drilled in Irion County.

Clear Fork Inc. isn’t in that part of the Eastern Shelf yet, but Eagle acknowledges that “they’re making really, really nice wells there.”

“It’s two-tiered—it’s a Strawn and Canyon sand,” he said.

Spurned or simply ignored by the publics, the Eastern Shelf remains a playground for independents.

Clear Fork, Moriah, Verado and Cholla each say the Eastern Shelf Strawn play—and other conventional or semi-conventional “hybrid” reservoirs as Powell calls them—will have long shelf lives going forward.

“I truly believe the independents and the small, family-owned companies are going to play the biggest role going forward on unlocking new reserves,” Powell said. “Exploration of these hybrid reservoirs, I think, is in its infancy.”

RELATED

SM, Vital Reveal Wildcatting for Permian Barnett and Woodford Oil

Recommended Reading

US Oil Rig Count Falls by Most in a Week Since June 2023

2025-04-11 - The oil and gas rig count fell by seven to 583 in the week to April 11. Baker Hughes said this week's decline puts the total rig count down 34 rigs, or 6% below this time last year.

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Judgment Call: Ranking the Haynesville Shale’s Top E&P Producers

2025-03-03 - Companies such as Comstock Resources and Expand Energy topped rankings, based on the greatest productivity per lateral foot and other metrics— and depending on who did the scoring.

SM Energy Marries Wildcatting and Analytics in the Oil Patch

2025-04-01 - As E&P SM Energy explores in Texas and Utah, Herb Vogel’s approach is far from a Hail Mary.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.