Sintana confirmed from Custos Energy that the Mopane 2X exploration well in PEL 83 has been spud. (Source: Shutterstock)

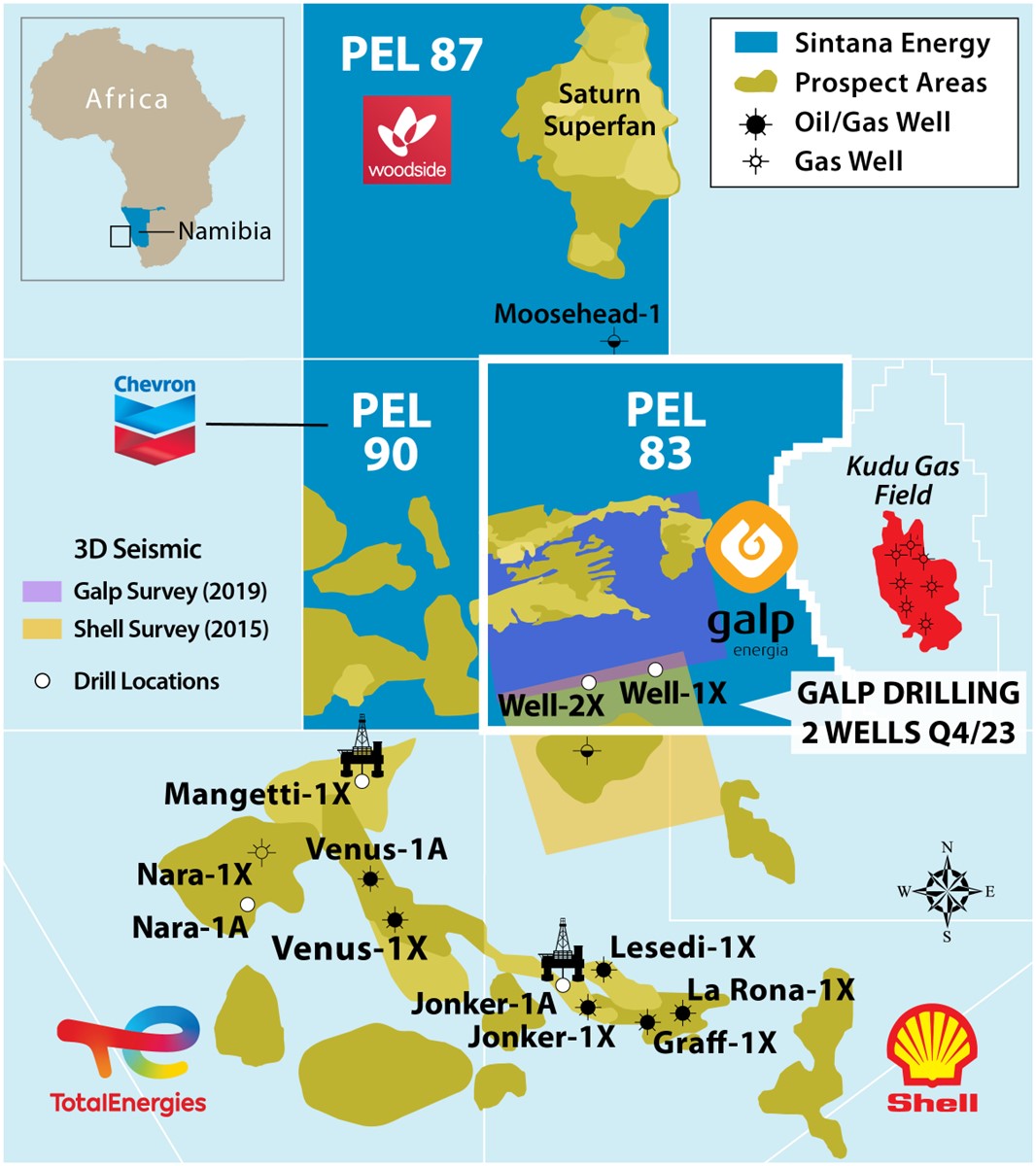

Sintana Energy provided updates on its petroleum exploration licenses 83 (PEL 83) and 90 (PEL 90) in Namibia’s Orange Basin, the company announced in an Nov. 27 press release.

Sintana confirmed from Custos Energy that the Mopane 2X exploration well in PEL 83 has been spud. The Mopane well is the first of two wells scheduled to be drilled by the semisubmersible Hercules.

Each of Custos and NAMCOR, Namibia’s national petroleum company, own 10% working interests in PEL 83 and are carried by Galp Energia through the exploration phase, according to the release. Sintana maintains a 49% indirect interest in Custos.

An affiliate of Chevron filed for an Environmental Clearance Certificate with the Ministry of Environment, Forestry and Tourism for the Republic of Namibia. This would provide for the drilling of up to five exploration and five appraisal wells on Block 2813B, governed by PEL 90, beginning Q4 of 2024.

Sintana, through its investment in InterOil, maintains a 49% indirect interest in Trago Energy Ltd, a 10% working interest owner in PEL 90.

Recommended Reading

Elk Range Acquires Permian, Eagle Ford Minerals and Royalties

2025-01-29 - Elk Range Royalties is purchasing the mineral and royalty interests of Newton Financial Corp., Concord Oil Co. and Mission Oil Co.

NatGas Rising: WhiteHawk Inks $118MM Marcellus Royalties Deal

2025-03-31 - WhiteHawk Energy is getting deeper in Pennsylvania’s Marcellus Shale with a $118 million deal as demand for natural gas grows.

Ring Energy Bolts On Lime Rock’s Central Basin Assets for $100MM

2025-02-26 - Ring Energy Inc. is bolting on Lime Rock Resources IV LP’s Central Basin Platform assets for $100 million.

Uncoiled: Viper Energy Rides Investor, M&A Wave to New Heights in ‘24

2025-03-25 - With its units coming off an all-time high, Viper Energy made a $4.45 billion Permian acquisition. VNOM units are gaining favor among Wall Street investors. It took more than a decade and several economic downturns to get there.

After Big, Oily M&A Year, Upstream E&Ps, Majors May Chase Gas Deals

2025-01-29 - Upstream M&A hit a high of $105 billion in 2024 even as deal values declined in the fourth quarter with just $9.6 billion in announced transactions.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.