Sitio has made 195 acquisitions since its inception, amassing more than 265,000 net royalty acres. (Source: Shutterstock/ Sitio Royalties)

Denver-based Sitio Royalties Corp. has wrapped up its acquisition of Denver-Julesburg (D-J) Basin interests on 13,062 net royalty acres, the company said in its May 8 earnings report.

The $126.6 million deal, announced in February, includes assets that produce an average 2,621 boe/d (36% oil). The assets generated 8.5 million in asset level cash flow in the first quarter.

Sitio previously said 77% of the interests were located within the Wattenberg Field in Weld County, Colorado. Sitio did not disclose the seller.

Top operators by production volumes on the acquired assets are Chevron Corp., Civitas Resources and Occidental Petroleum.

Sitio CEO Chris Conoscenti said that first-quarter production—pro forma for the D-J Basin acquisition— reached an all-time company high of 37,970 boe/d, up by 3.7% compared for fourth-quarter 2023.

The increase was primarily due to Delaware Basin and Eagle Ford Shale activity, Conoscenti said in the earnings release.

“As expected, we closed the D-J Basin acquisition on April 4th and we continue to have a strong pipeline of minerals acquisition opportunities to evaluate," he said.

Tim Rezvan, a KeyBanc Capital Markets analyst, said Sitio provided summary details on the recently acquired D-J Basin effect on base production and EBITDA in the first quarter.

“These assets had [2,600 boe/d] of production in 1Q24 and would have generated $8.5 [million] of incremental EBITDA,” Rezvan said in a May 8 report. “There are 7.4 net line-of-sight D-J Basin wells, equal to 14% of total line-of-sight wells for Sitio, suggesting stronger D-J Basin contribution throughout 2024.”

Sitio’s overall M&A prospects look “as good as ever for the remainder of the year given one of its key peers appetites will likely be full and mineral sector remains highly fragmented,” Truist Securities analyst Neal Dingmann, wrote on May 5.

Dingmann said the company looks to continue its disciplined acquisition strategy, which has resulted in a number of accretive deals.

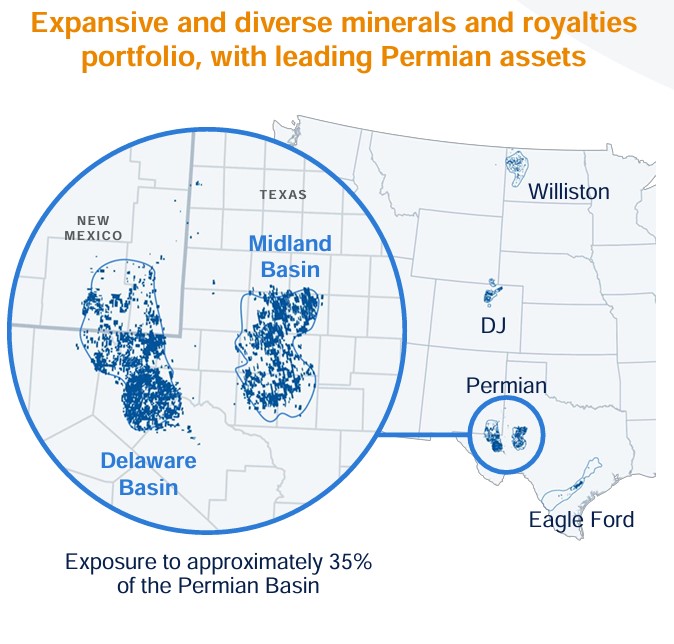

Sitio has made 195 acquisitions since its inception, amassing more than 265,000 net royalty acres. The company’s M&A strategy sees minerals consolidation in “early innings,” with $73 billion in royalty payments paid in the last 12 months—just 3% of which generated public mineral company revenue.

Earnings, outlook

Sitio said that pro forma first-quarter average daily production was 37,970 boe/d, 51% oil. The company has line-of-sight on 52.9 wells as of March 31—77% of which are in the Permian Basin and 14% in the D-J Basin.

Dingmann said in a May 8 report that Sitio reported higher first-quarter earnings and free cash flow than Truist expectations and consensus, driven by better quarterly oil production and prices.

The company reported first-quarter net income of $18.7 million, compared to a net loss of $91.7 million in the previous quarter. The reversal was due to no loss on sale of assets, no loss on extinguishment of debt and other factors.

Sitio returned $0.49 per share of Class A common stock, including a $0.41 per share dividend and $0.08 per share in stock repurchases. The company repurchased $13 million worth of shares in the quarter.

Recommended Reading

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Chevron Makes Leadership, Organizational Changes in Bid to Simplify

2025-02-24 - Chevron Corp. is consolidating its oil, products and gas organization into two segments: upstream and downstream, midstream and chemicals.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.