SM said it continues to work on the geologic model of the formation’s potential in its 20,750 contiguous net acres in Dawson County. (Source: Shutterstock)

Six more wells in, early indications are the 90%-plus oil Dean formation in the northern Midland Basin is “stellar,” wildcatter SM Energy told investors Feb. 20.

“One of our best Klondike [asset-area] Dean producers produced over 150,000 boe in the first six months,” Beth McDonald, COO, noted in an earnings call Feb. 20.

“So we've had really stellar results there.”

SM made the six new wells in the southern Dawson County, Texas, formation, which sits at about 9,000 ft between Spraberry and Wolfcamp since its November investor call.

The new ones averaged peak 30-day IPs of 829 boe/d, 95% oil, from lateral lengths averaging 12,904 ft.

Leo Mariani, E&P analyst for Roth Capital, noted the newer wells’ results underperformed two initial SM wells in the Dean that were disclosed in November.

Those averaged 30-day peak IPs of 918 boe/d, 93% oil, from laterals averaging 11,510 ft.

Mariani added, however, “SM said that it has seen quite a bit of variability in the play and its last two wells had average IP-30's of 1,312 boe/d, though these were in a different area with different completions.”

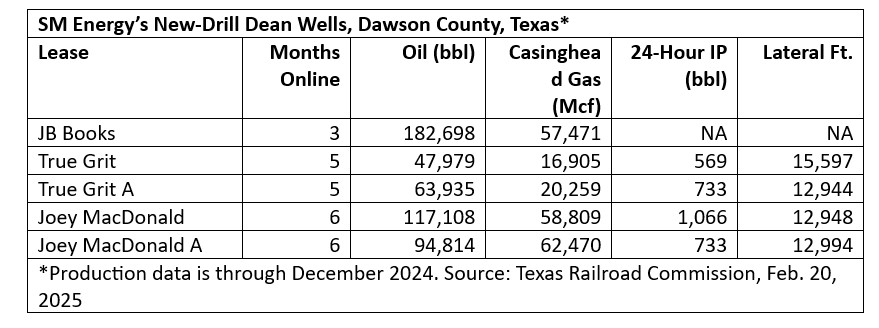

Production data was available through December by mid-February in Texas Railroad Commission (RRC) files for five of SM’s eight Dean wildcats.

Herb Vogel, president and CEO, said in the recent call that SM expected some variability from the Dean “and we're seeing that variability.”

“It’s going to be pad-dependent,” Vogel said.

But the Dean has shown that, “because of the productivity, it's really competitive,” he added.

That is, “as long as you select the right locations for it.”

Geologic model

SM’s neighbors in wildcatting the Dean include EOG Resources and privately held operators Birch Resources, Ike Operating and Hibernia Resources IV.

SM plans to complete six more Dean wells, gross, this year, it reported.

McDonald said SM continues to work on the geologic model of the formation’s potential in its 20,750 contiguous net acres in Dawson County.

The E&P had picked up the property in July 2023 from Midland-based operator Reliance Energy for $93.5 million.

One of Reliance’s wells, Arod 2-11-14, produced 602,506 bbl in 30 months through December since it came online in July 2022, according to RRC files.

Blue Beauty 15-22 made 544,393 bbl in its first 42 months. Jack Rabbit Special 28-33 made 509,313 bbl in its first 33 months.

All three are now owned by SM.

As for the early findings on SM’s new-drills on the property beginning in mid-2024, McDonald said when the “wells’ performance and results come in, it's just verifying that [geologic] model.

“And so we'll continue our delineation program in Klondike with six more wells this year [that will] come on around the summer timeframe.

“So we're really encouraged with what we see there.”

Working around water

Vogel said in November that produced water volume varies within the leasehold. “But overall the water/oil ratios are coming in as what we thought.”

Having vertical-well control, SM has defined “where the high water [volume] will be versus lower water. So that allows us to map and steer where we put the wells.”

New wells are being brought online as initial water volumes decline, he added. “It is not efficient to build water-handling facilities to peak rates.”

While initial output is constrained, the wells will have lower IPs but a “slower decline rate afterwards.”

“Value-wise, it's the right way to go because you spend less capital.”

Recommended Reading

Argent LNG, Baker Hughes Sign Agreement for Louisiana Project

2025-02-03 - Baker Hughes will provide infrastructure for Argent LNG’s 24 mtpa Louisiana project, which is slated to start construction in 2026.

Expand Appoints Dan Turco to EVP of Marketing, Commercial

2025-02-13 - Expand Energy Corp. has appointed industry veteran Dan Turco as executive vice president of marketing and commercial.

Expand Energy Picked to Join S&P 500

2025-03-10 - Gas pureplay Expand Energy will be elevated on March 24 from its position in the S&P MidCap 400 index.

Baker Hughes to Supply Equipment for NextDecade’s Rio Grande LNG

2025-03-11 - Baker Hughes will provide turbine and compression for NextDecade’s trains at Rio Grande LNG.

Enbridge Appoints Steven Williams to Chair of the Board

2025-03-12 - Enbridge has appointed Steven Williams to lead the board of directors following Pamela Carter’s retirement as chair.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.