SM reported Nov. 1 it has an eight-well Dawson completion underway. (Source: Shutterstock/ SM Energy)

SM Energy’s first Dean sandstone wildcats in southern Dawson County have come in averaging 918 boe/d, 93% oil, each in choked 30-day IPs from 11,510-ft laterals, the E&P told investors in a Nov. 1 call.

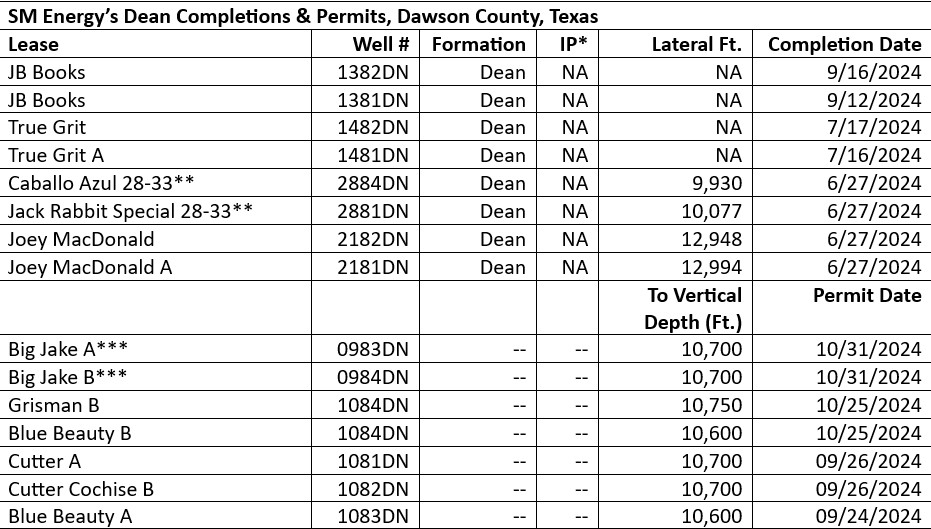

The wells were not identified. Texas Railroad Commission (RRC) files show two SM wells in Dawson came online in July, each with a roughly 13,000-ft lateral as per the completion reports.

One of them, Joey MacDonald #2182DN, made 21,684 bbl in its first days online through Aug. 31. Casinghead gas was 13.8 MMcf.

An adjacent well, Joey MacDonald A #2181DN, produced 35,199 bbl. Casinghead gas was 18 MMcf.

“The wells [with 918 boe/d IPs] are confirming our geologic model that there's oil saturation in an area that's more a conventional play,” Herb Vogel, president and CEO, told investors in the call.

Another new well, True Grit A #1481DN, was put online in August, making 11,675 bbl in its first days, according to RRC files. Casinghead gas was 3.5 MMcf.

‘Six more’

The holes are SM’s first wells since it bought the 20,750 contiguous net acres, 90% average working interest, in mid-2023 for $93.5 million from Midland-based private E&P Reliance Energy.

The property came with eight horizontals—six landed in Dean—producing roughly 1,300 boe/d, along with 30 legacy vertical wells.

Neighbors include EOG Resources and privately held operators Birch Resources, Ike Operating and Hibernia Resources IV.

SM reported Nov. 1 it has an eight-well Dawson completion underway.

“With what we saw in the first two wells—and really the first eight wells—we said, ‘Let's put the rig back up there and drill six more,” Vogel said.

“So we're back up there now drilling those.”

Gabe Daoud, analyst with TD Cowen, called the initial Dean results “attractive.”

“Expect a favorable reaction. Buy,” he concluded.

Produced water

Produced water volume varies within the leasehold, SM reported, Vogel added. “But overall the water/oil ratios are coming in as what we thought.”

Having vertical-well control, SM has defined “where the high water [volume] will be versus lower water. So that allows us to map and steer where we put the wells.”

New wells are being brought online as initial water volumes decline, he added. “It is not efficient to build water-handling facilities to peak rates.”

While initial output is constrained, the wells will have lower IPs but a “slower decline rate afterwards.”

“Value-wise, it's the right way to go because you spend less capital.”

‘Oil-cut perspective’

At about 9,000 ft overlying Wolfcamp, Dean has attracted new-well interest in Dawson County, which had only 90 permits pulled for horizontals prior to 2021, according to RRC files. The first was issued in 1990; the second, 1996.

Of the 207 permits since 2020, 75 were pulled by wildcatters this year alone through Oct. 31.

SM has pulled 16, all of them this year.

The two SM wells’ IPs in Dawson County—as well as IPs for its new wells in the Uinta Basin—are not “eye-popping from a boe perspective,” KeyBanc Capital Markets analyst Tim Rezvan reported upon the SM news.

But “they are eye-popping from an oil-cut perspective,” Rezvan said.

“These are very economic wells for us. So we're happy with the results,” Vogel said in the call.

He added that the new wells are indicating “there's less interaction with offset wells. So that's a positive as long as you space correctly and we believe we spaced correctly.”

Recommended Reading

Aris CEO Brock Foresees Consolidation as Need for Water Management Grows

2025-02-14 - As E&Ps get more efficient and operators drill longer laterals, the sheer amount of produced water continues to grow. Aris Water Solutions CEO Amanda Brock says consolidation is likely to handle the needed infrastructure expansions.

How DeepSeek Made Jevons Trend Again

2025-03-25 - As tech and energy investors began scrambling to revise stock valuations after the news broke, Microsoft Corp.’s CEO called it before markets open: “Jevons paradox strikes again!”

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

Pair of Large Quakes Rattle Texas Oil Patch, Putting Spotlight on Water Disposal

2025-02-19 - Two large earthquakes that hit the Permian Basin, the top U.S. oilfield, this week have rattled the Texas oil industry and put a fresh spotlight on the water disposal practices that can lead to increases in seismic activity, industry consultants said on Feb. 18.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.