Both of the tests are in SM’s “Sweetie Peck” development area at the intersection of Midland, Upton and Crane counties, Texas. (Source: Shutterstock)

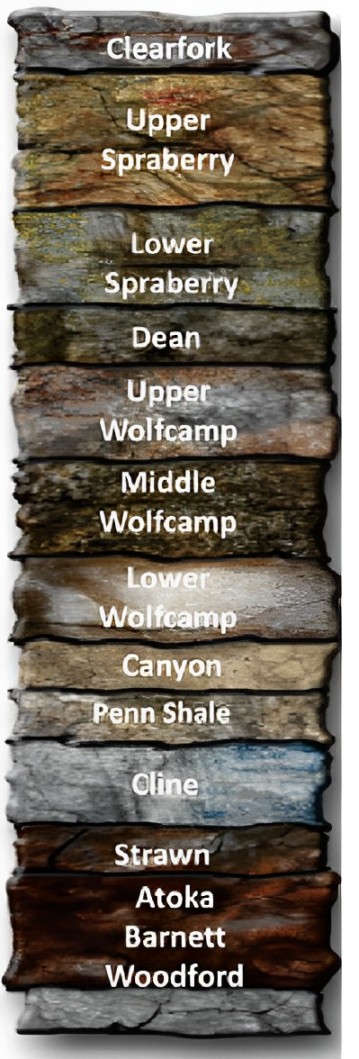

SM Energy’s two new Permian Barnett and Woodford wildcats in the Midland Basin suggest it may have more than 20,000 net acres prospective for these deeper oil reservoirs, executives told investors Aug. 8.

A 10,200-ft lateral test had a 30-day peak IP of 1,622 boe/d. The other, a 5,900-ft lateral, had a 30-day peak IP of 830 boe/d, SM reported.

Both of the tests are in SM’s “Sweetie Peck” development area at the intersection of Midland, Upton and Crane counties, Texas. Both were brought online in the second quarter.

The liquids cut was not included in the investor material, but it is roughly 57% oil, Herb Vogel, president and CEO, said during an earnings call.

“It's an over-pressured play, which is great,” he said.

The oil’s API gravity is about 50. The Btu content of the gas isn’t determined yet, but “I imagine the gas will be quite rich,” he said.

SM doesn’t have more Barnett-Woodford tests planned for this year.

The 20,000-plus-net-acre figure is roughly all of its Sweetie Peck area, Vogel added.

“We did quite a bit of land work to secure the deep rights under our … position and then we added that 9,100 acres to the west.”

The estimate is based on other operators’ well control—past and present findings in the Barnett and Woodford that are in Texas Railroad Commission and other data files.

“We are surrounded by good Woodford-Barnett wells there,” Vogel said.

The area’s vertical well control “enhances our ability to map the play and that's why we have the confidence [in the net-acre estimate] and, obviously, we'll be working overtime to figure out the optimal spacing for the play.”

The over-pressured nature of the reservoir and the high oil cut “really help on getting the economics improved over time too,” he added.

Is there more?

Outside of its Sweetie Peck area, SM isn’t looking currently at Woodford or Barnett potential, but Vogel added, “I would say I'm never going to speak for our geoscience team because what they come up with is pretty amazing sometimes, and we'll see.”

“I have no doubt that we have Woodford-Barnett maps and ... if they come up with good opportunities, we'd pursue them. … I'm sure I'll be seeing stuff in the future that I don't know about yet.”

As for variability in the Woodford-Barnett area, Vogel said it’s gassier toward the east in the Midland Basin.

“The east side is deeper, so that will be gassier. The west side of our acreage is shallower and will be oilier,” Vogel said.

“… That's simply [a function of] depth and the thermal maturity.”

SM has four rigs drilling in the Midland Basin and two completion crews.

Vital’s Barnett tests

Vital Energy bought 17,000 net acres prospective for the Barnett in the Midland Basin but is limiting details for now, it told investors Aug. 8.

“We're really excited about it,” said Jason Pigott, president and CEO.

The acreage add is not simply leasing rights underneath Vital’s existing footprint, he added.

Vital has drilled four Barnett wildcats and, “as we speak, are starting flowback,” Pigott said.

The location of the acres is “beyond what we would show on a map because it's competitive [intelligence]. We don't have it out there for you today.”

Vital’s leasehold in the Midland is in both the northern basin and southern, primarily in Howard, Glasscock and Reagan counties, Texas, according to its current, public map.

But Occidental Petroleum is drilling for Barnett in the southern Midland Basin—"two wells now just west of our western Glasscock position—so there's additional potential underneath areas like that.

“But because it's so competitive right now, we're kind of keeping our information tight,” Pigott said.

He noted that SM had reported testing the Barnett.

“There's some good excitement. These are … oily wells with low water yields, so it can be a great opportunity for us in the future to add low-cost inventory.”

While the tests are more expensive than development-program wells in the overlying Wolfcamp and Spraberry, success would add to Vital’s wells-in-inventory count, Vital reported.

“We're coming in and [completing] one well at a time so it's a less efficient process than our traditional zipper frac [on multi-well pads],” Pigott said.

The wells’ ultimate cost is unknown currently.

“It’s the first tries,” Pigott said. “… We’ll have more guidance when we've got these wells done and we get to a program that is kind of more predictable and steady versus the one-off wells that are higher cost just because they're drilled in isolation.”

Recommended Reading

Murphy’s Vietnam Find May Change Investor Views, KeyBanc Analysts Say

2025-01-09 - The discovery by a subsidiary of Murphy Oil Corp. is a reminder of the company’s exploration prowess, KeyBanc Capital Markets analysts said.

CNOOC Makes Oil, Gas Discovery in Beibu Gulf Basin

2025-03-06 - CNOOC Ltd. said test results showed the well produces 13.2 MMcf/d and 800 bbl/d.

Equinor’s Norwegian Troll Gas Field Breaks Production Record

2025-01-06 - Equinor says its 2024 North Sea production hit a new high thanks to equipment upgrades and little downtime.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.