SM plans to spend between 35% and 40% of its 150-well, $1.3 billion capex budget this year in the Uinta, with the balance going to its 111,000-net-acre Midland Basin and 155,000-net-acre South Texas property in the Austin Chalk and Eagle Ford. (Source: Shutterstock/ SM Energy)

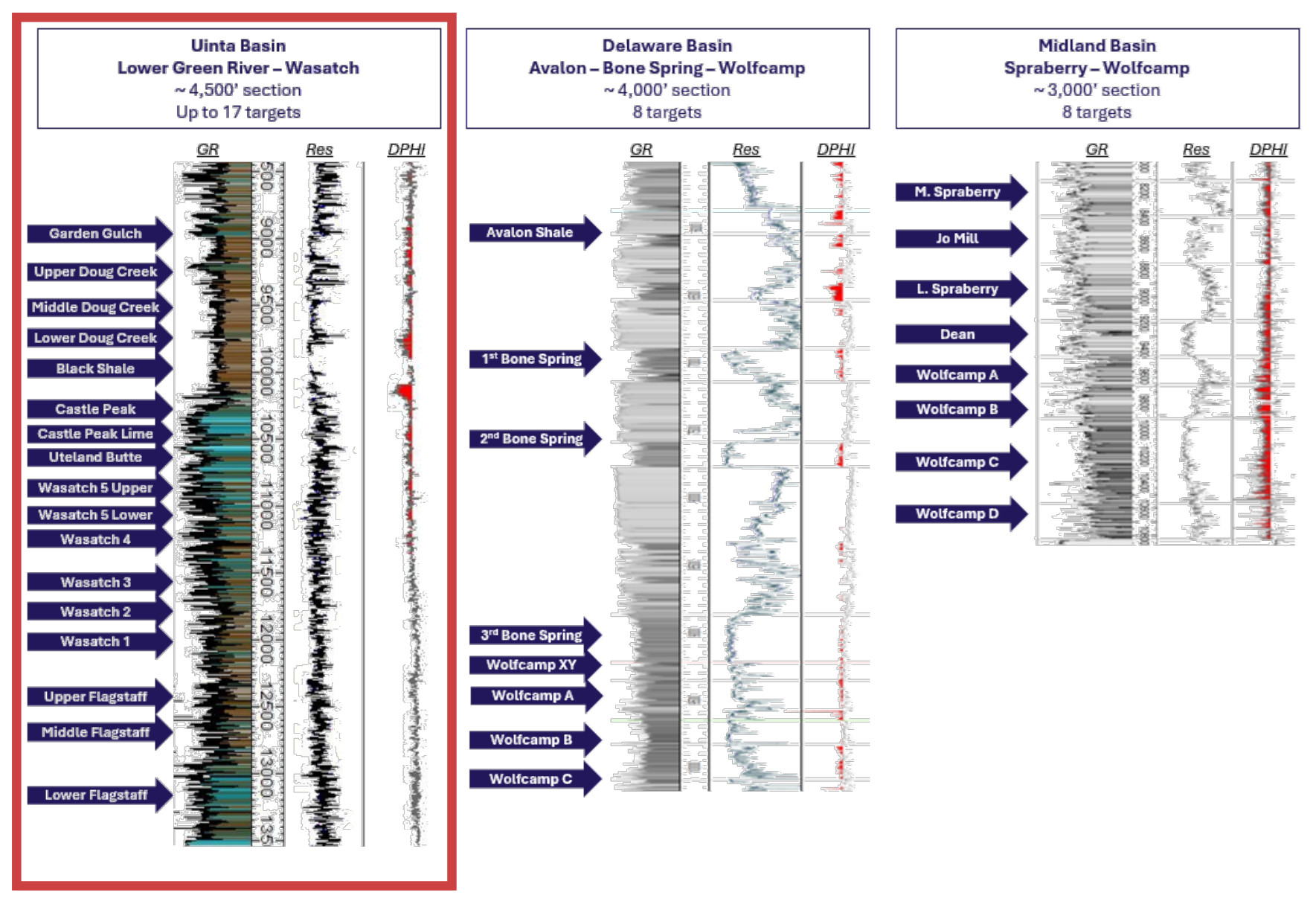

SM Energy brought on 30-day peak IPs averaging 685 boe/d from tests in the shallowest of its new 4,500-ft-thick, 17-payzone, stacked western Uinta Basin play in northeastern Utah, the E&P reported Feb. 20.

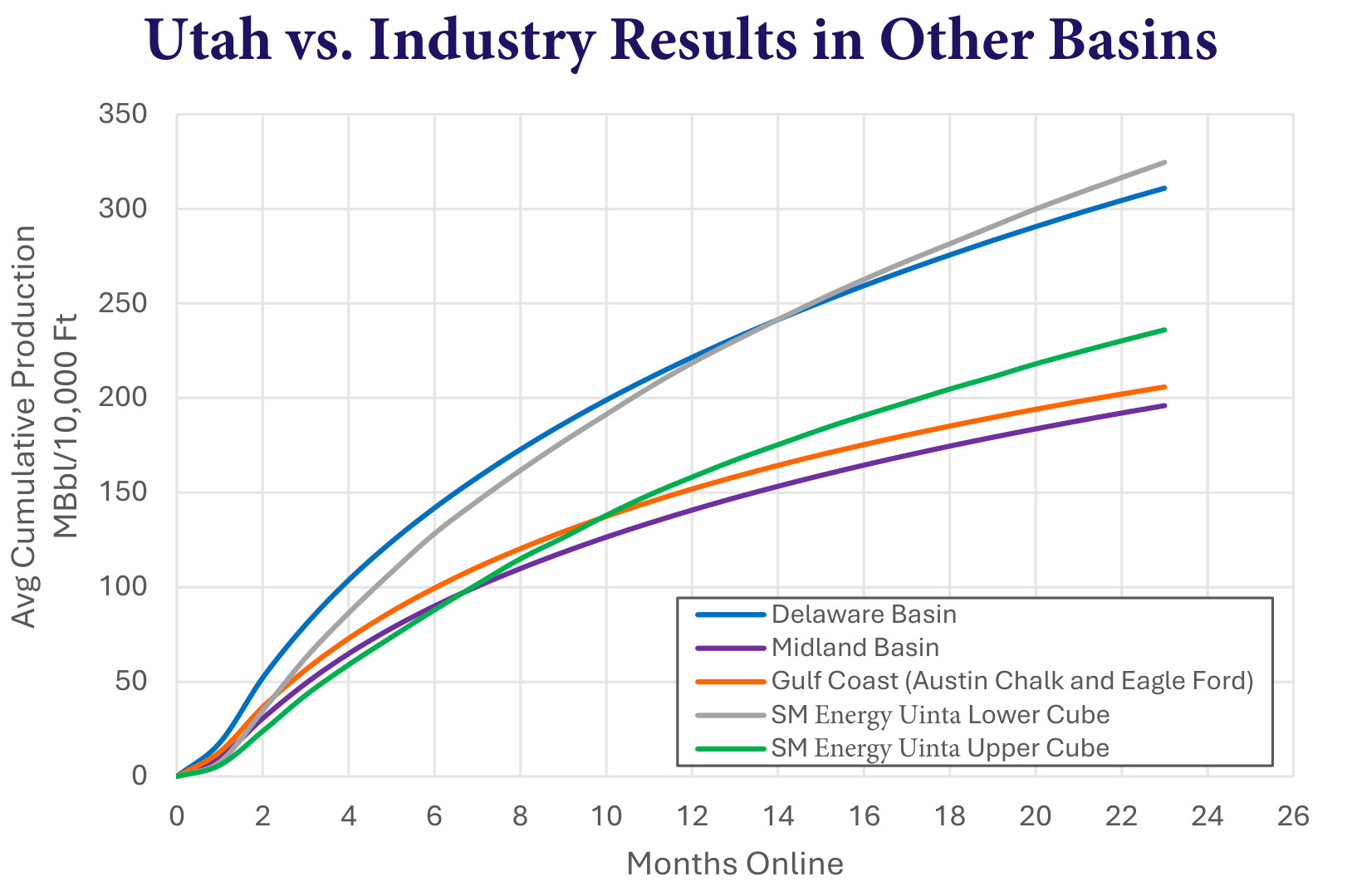

To date, the shallowest tests are producing rates similar to its Midland and South Texas property, while outperforming industry-wide results, SM added.

Its slightly deeper wells are outperforming industry-wide results in the Delaware Basin and widely outperforming South Texas and Midland Basin wells.

The E&P, which had been focused exclusively in Texas’ Permian Basin and Eagle Ford Shale, picked up 63,300 net Uinta acres, 93% oil, from XCL Resources and Altamont Energy for $2.1 billion Oct. 1.

SM plans to spend between 35% and 40% of its 150-well, $1.3 billion capex budget this year in the Uinta, with the balance going to its 111,000-net-acre Midland Basin and 155,000-net-acre South Texas property in the Austin Chalk and Eagle Ford.

The 150-well-count includes completing 128 gross DUCs, including 48 it held in the Uinta at year-end, it reported in fourth-quarter 2024 results.

“It’s just timing,” Beth McDonald, COO, said of the DUC accumulation in the E&P’s earnings call.

Herb Vogel, president and CEO, added, “DUCs are not something we manage to [have]. They're just an outcome.

“And with the acquisition from XCL, where they were running three rigs, obviously the DUC count went up high.”

Pad size plays into it as well.

“If you're doing, say, three-well pads in South Texas, then you'll have a lower DUC count. If you're doing eight-well pads in Utah, you'll have a higher DUC count,” Vogel said.

18 new wells

The four new tests in the uppermost section of pay averaged 685 boe/d each, 95% oil, from laterals averaging 9,867 ft, SM reported.

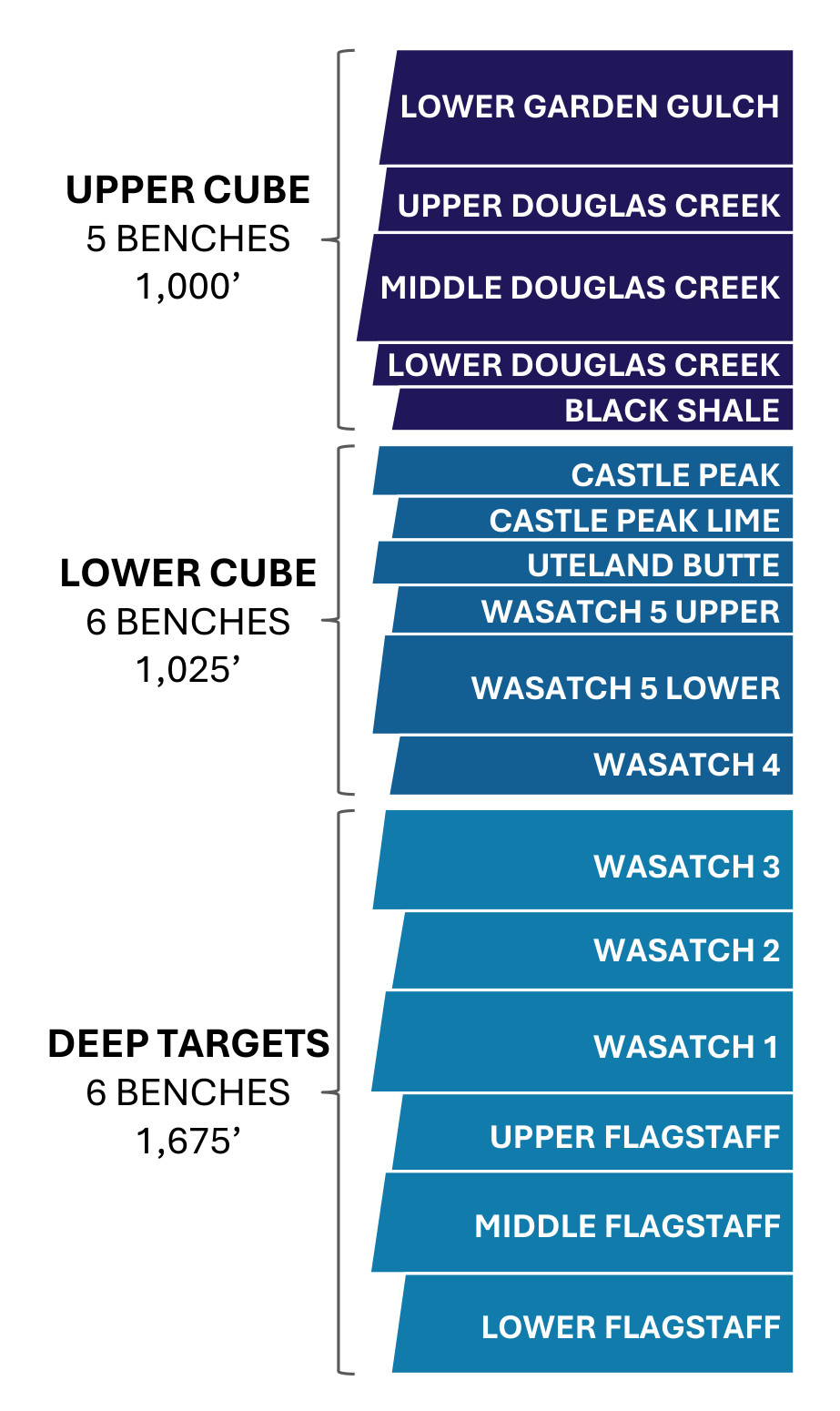

Named the “upper cube” by SM in the 17-zone play, it consists of the lower Garden Gulch, three Douglas Creek benches and an underlying, unnamed black shale, ranging from 9,000 ft to 10,000 ft in depth.

SM brought the other 14 wells online in the “lower cube,” which is where operators have traditionally landed in the western Uinta.

The wells averaged 1,366 boe/d each, 92% oil, from laterals averaging 10,186 ft.

The six formations and benches in the lower cube consist of Castle Peak and an underlying limestone, Uteland Butte, the Wasatch 5 upper and lower, and Wasatch 4 between 10,000 ft and 11,500 ft.

It also has a test online in the “deep cube,” McDonald reported, that contains three more Wasatch benches and three benches of Flagstaff at between 11,500 ft and 13,500 ft.

“So we'll continue to enhance our understanding in the other zones, while maintaining most of our value creation within the lower cube,” McDonald said.

The shallowest wells were made on the western flank of the property, while the deeper, traditional, lower-cube wells were placed in the middle of its leasehold at the Duchesne County border with Uintah County.

The uppermost wells have a lower IP as “it takes a while to clean up and then to get to that peak oil rate, but it has much shallower decline,” McDonald said.

Recommended Reading

Canadian Province Gives Environmental Warning to Pipeline Project

2025-03-19 - The Prince Rupert Gas Transmission Project is a 497-mile project that would ship up to 3.6 Bcf/d of natural gas to an LNG facility on the Canadian west coast.

Entergy, KMI Agree to Supply Golden Pass LNG with NatGas

2025-02-12 - Gas utility company Entergy will tie into Kinder Morgan’s Trident pipeline project to supply LNG terminal Golden Pass LNG.

Glenfarne Signs on to Develop Alaska LNG Project

2025-01-09 - Glenfarne has signed a deal with a state-owned Alaskan corporation to develop a natural gas pipeline and facilities for export and utility purposes.

Intensity Infrastructure Partners Pitches Open Season for Bakken NatGas Egress

2025-02-04 - Analysts note the Bakken Shale’s need for more takeaway capacity as Intensity Infrastructure Partners launches an open season for a potential 126-mile natural gas transport line out of the basin.

Shale Outlook: Power Demand Drives Lower 48 Midstream Expansions

2025-01-10 - Rising electrical demand may finally push natural gas demand to catch up with production.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.