Indonesia's national oil company, Pertamina. Indonesia is participating in several natural gas and carbon capture projects. (Source: Shutterstock.com)

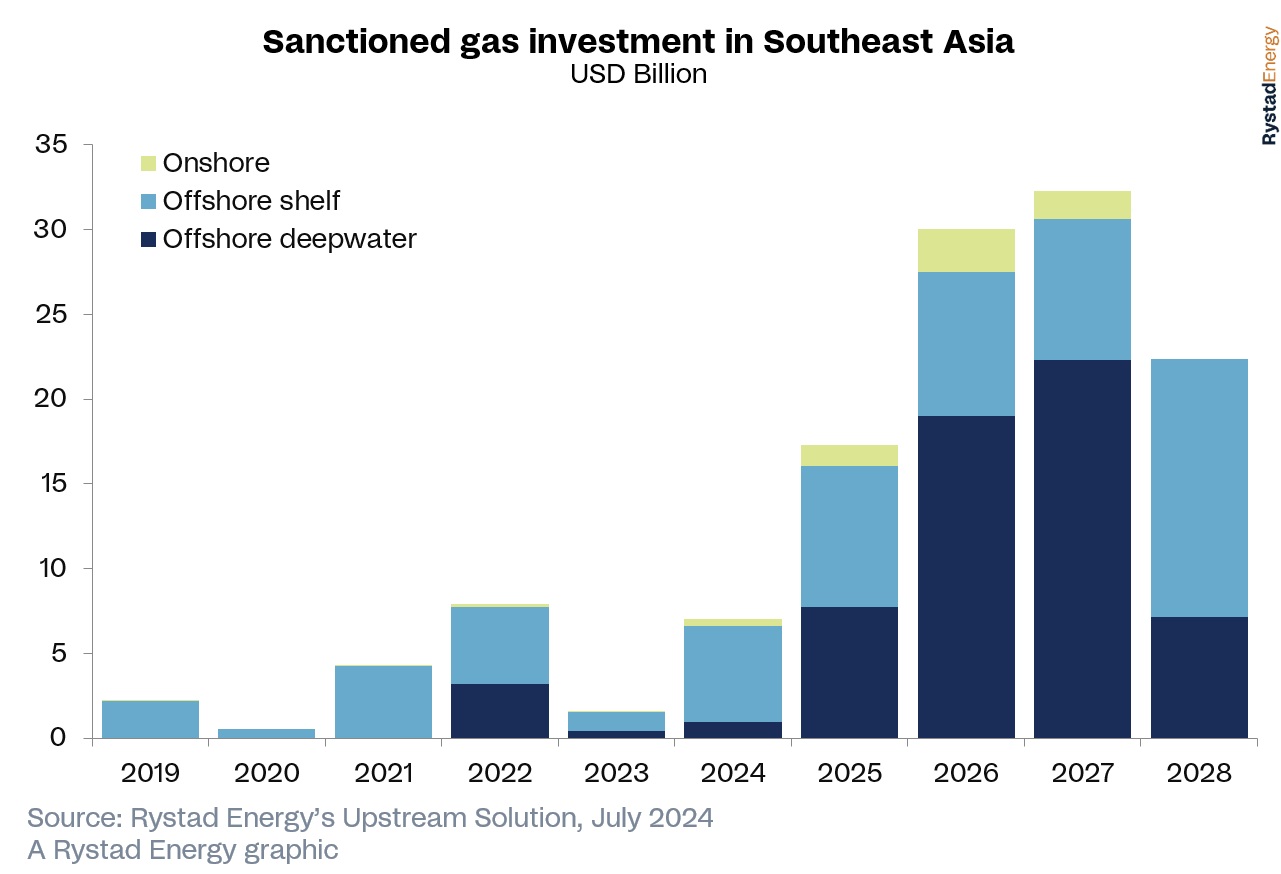

E&Ps are ramping up activity offshore Southeast Asia to increase natural gas output and meet long-term demand growth that could unlock a potential $100 billion in volumes, according to Rystad Energy.

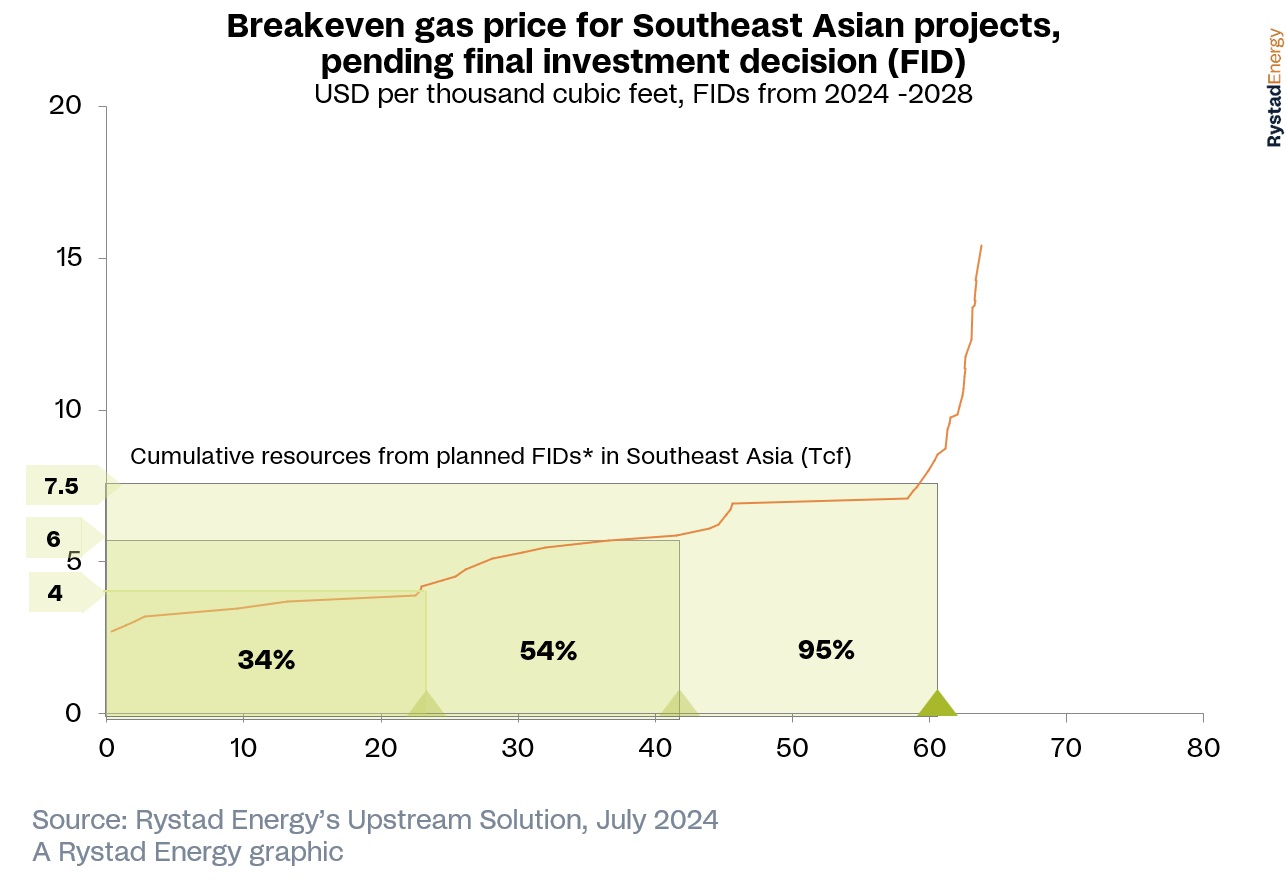

But development in the area will require high breakeven prices, Rystad said.

Asia is the U.S.’ second largest market for LNG exports, with an average 3.1 Bcf/d delivered last year — primarily to India, China, South Korea and Japan, according to the U.S. Energy Information Administration.

But regional projects in Southeast Asia stand to unleash by a “flurry” of final investment decisions (FID) by 2028, Rystad said.

“This represents a twofold increase over the $45 billion in developments that reached FID from 2014 to 2023 and signals a surge for the region’s offshore gas industry,” Prateek Pandey, Rystad Energy vice president of upstream research said in the report. “New carbon capture and storage (CCS) advancements will help meet the region’s sanctioning agenda.”

The region's gas sector anticipates substantial growth, with projected gas resources from FIDs set to rise to 58 Tcf by 2028 — a threefold increase from the five years spanning 2019 to 2024.

Growth hinges on efficiently monetizing recent discoveries and advancing delayed developments.

Despite a favorable investment climate, operators face economic challenges, particularly in deepwater and sour gas ventures. Rystad Energy analysis indicates that many projects require gas prices above historical averages of $4/Mcf to achieve profitability. Optimally, prices need to be closer to $6/Mcf, Rystad said.

At prices of $7.50/Mcf, 95% ofof planned developments would be economically viable, especially LNG projects in Indonesia and domestic supply initiatives in Vietnam, Rystad found. As of July 17, natural gas prices Japan Korea Marker (JKM) traded at $11.95 for the week of July 5, according to Reuters.

First, the FIDs need to come, which will require buckets of capital.

Oil and gas majors are expected to play a sizeable role in development, accounting for 25% of planned investments. Their role could expand to 27% following TotalEnergies’ substantial acquisition efforts in Malaysia. That despite the Paris-based company agreeing to sell in June subsidiary TotalEnergies EP (Brunei) BV to Malaysian independent E&P Hibiscus Petroleum Berhard for $259 million.

Further investment would come from national oil companies (NOCs), which would account for a 31% share, Rystad said.

East Asia's own upstream companies are emerging with a 15% share and have the potential for growth through a focus M&A as well as exploration, Rystad.

Southeast Asian countries have lately focused on the future of domestic production while limiting dependence on gas imports. Energy security and the transition to gas as a fuel have become growing concerns for governments in the region.

As Nicke Widyawati, president and CEO of Indonesia’s Pertamina noted at the World Petroluem Congress last year, the NOC’s priority is to maintain Indonesian energy security, “whatever the price.”

Pertamina has also invested in electric vehicles, biofuels and carbon capture and sequestration.

Indonesia is a standout among countries in the region when it comes to investment. Major projects include the Inpex-operated Abadi LNG, Eni’s Indonesia Deepwater Development (IDD) and BP’s Tangguh Ubadari Carbon Capture (UCC).

Along with recent discoveries in the East Kalimantan and Andaman provinces, the country’s projects are estimated to account for 75% of Indonesia's total offshore gas investments slated for FID, Rystad said.

“This significant increase positions Indonesia as a formidable contender to Malaysia's established dominance, although Malaysia continues to maintain robust activity levels with recent FIDs, exploration success and planned exploration efforts,” Rystad said.

Indonesia anticipates increased FID activity starting in 2025, bolstered by major projects spearheaded by global players such as BP and Eni.

Malaysia's upcoming FID projects underscore significant discoveries made since 2020, primarily managed by Petronas, PTTEP and Shell.

Recommended Reading

MPLX Acquires Remaining Interest in BANGL for $715MM

2025-02-28 - MPLX LP has agreed to acquire the remaining 55% interest in BANGL LLC for $715 million from WhiteWater and Diamondback.

Western Midstream to Build Permian Produced Water Pipeline

2025-02-26 - Western Midstream is investing up to $450 million to expand its produced water infrastructure, including the Pathfinder pipeline to transport produced water to disposal facilities in the Delaware Basin.

Michigan Appeals Court Allows Enbridge’s Line 5 Permits to Stand

2025-02-21 - Enbridge’s Line 5 still faces a court battle against the state in a case brought by the government.

Polar LNG Express: North American NatGas Dynamics to Change with LNG Canada

2025-02-21 - The next major natural gas export project in North America has a location advantage with Asian markets. LNG Canada opens up a new pathway that will change the price dynamics for producers.

Cheniere’s Corpus Christi 3 Project Sends First Commissioned LNG Cargo

2025-02-20 - Cheniere Energy executives say the Corpus Christi Stage 3 project has been ahead of schedule in commissioning its first LNG cargo.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.