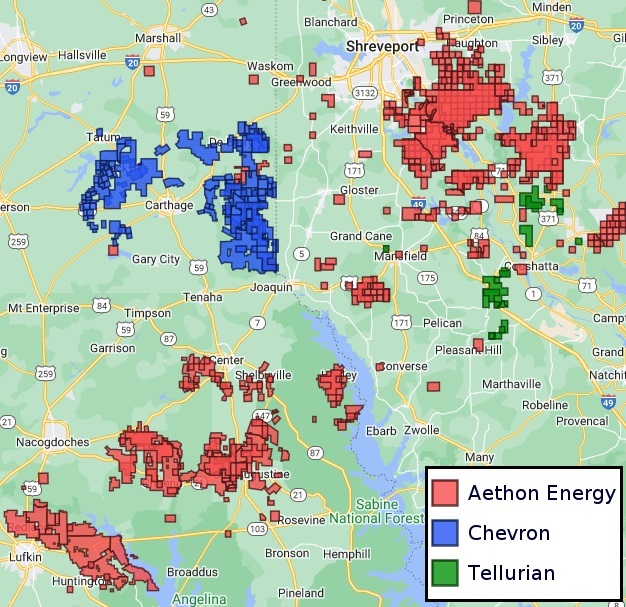

Appetites have been whetted by 72,000 net, mostly contiguous, undeveloped Haynesville acres that sit in the center of the shale play.

Chevron Corp. owns them and is putting them on the market, according to sources at Hart Energy’s DUG GAS+ Conference and Expo in Shreveport, Louisiana.

“That is a position that all Haynesville operators are interested in,” Mike Winsor, CEO and COO of Paloma Natural Gas, said in an on-stage interview.

“[And] mainly because it's undeveloped: You don't have parent-child [well] concerns.”

Chevron had five horizontal Haynesville wells online in 2023 on the property, which is in Panola County just across the Texas border from De Soto Parish, Louisiana, south of Shreveport, according to Texas Railroad Commission (RRC) files.

Though in December, only four of those wells were online with production reaching 159 MMcf, gross, or an average 1.28 MMcf/d per well.

The company reported in a March 28 Securities and Exchange Commission filing that it is “evaluating strategic opportunities for these assets.” Chevron did not respond to a request for comment from Hart Energy.

The company added in the filing that it cut spending in East Texas in 2023. According to the RRC, Chevron’s latest request for a new-drill horizontal permit in Panola County was submitted in June 2023.

The neighbors

Meanwhile, Chevron’s neighbors in the field, Carthage-Haynesville, produced more than 42 Bcf in December, including 18.5 Bcf by Rockcliff Energy II, which was bought at year-end by TG Natural Resources (TGNR).

TGNR itself produced 1.6 Bcf from Carthage-Haynesville in December.

Craig Jarchow, TGNR’s CEO, said onstage in Shreveport that he was aware that the property may be sold. But, he added, “we're very busy with the [Rockcliff] acquisition, onboarding those assets, making sure that the transition goes smoothly.”

TGNR will still likely look at the property, he said. “We really have our hands full, but generally we look at everything just as a matter of discipline. Right now we're pretty busy.”

Another neighbor, Sabine Oil & Gas, produced 9 Bcf in December from Carthage-Haynesville. Carl Isaac, Sabine’s president and CEO, didn’t comment on the property while speaking in the Shreveport conference.

Comstock Resources is also a large operator in Carthage-Haynesville, producing 3.5 Bcf in December. However, it has not reported an interest in Chevron’s Haynesville acreage. Instead, it has been investing in its greenfield play, the far western Haynesville north of Houston.

Private-equity-backed Silver Hill Energy Partners produced 2.4 Bcf from Carthage-Haynesville in December, according to the RRC. It recently added property in the Williston Basin.

Pipe deal

Another operator told Hart Energy in Shreveport, though, that the Chevron asset includes a long-term firm-volume contract with Williams Cos. that Chevron signed in 2023.

In the deal, Williams will install gas-gathering on 26,000 acres Chevron dedicated, connecting it to Williams’ Louisiana Energy Gateway (LEG) pipeline across the border.

That 1.8 Bcf/d long-haul pipe was to come online this year but was delayed to second-half 2025 in February. Another delay is expected as a result of a pipeline dispute with Energy Transfer that surfaced in March.

‘Blank slate’

Besides Panola County, all of Chevron’s E&P operations in Texas are in the Permian Basin, according to the RRC.

Its gross production from Panola was 1.1 Bcf in December, primarily from hundreds of legacy, shallower vertical wells it gained from the 2000 acquisition of Texaco Inc. and that Chevron drilled post-acquisition before the horizontal Haynesville play developed in 2008.

Most of Chevron’s production from Panola in December was from Carthage-Cotton Valley Field with 748 MMcf gross.

“It's not very often you can come into an acreage position that is consolidated. You can come in with a blank slate,” Winsor said.

“And whatever your well-spacing, whatever your design, there’s a huge amount of running room there.”

EnCap-backed Paloma will look at the package, he said. “We like to say there’s not any Haynesville or Bossier acreage that we don’t like. [But] it’s just a matter of which ones we want to acquire.”

As a PE portfolio E&P, “we would look pretty closely at the ratio of PUD value to PDP [proved developed producing]. We look to acquire property with a fair amount of running room,” Winsor said.

Overall “it's definitely a package that many people would be interested in,” he said.

Recommended Reading

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Expand Appoints Dan Turco to EVP of Marketing, Commercial

2025-02-13 - Expand Energy Corp. has appointed industry veteran Dan Turco as executive vice president of marketing and commercial.

Japan’s JAPEX Backs Former TreadStone Execs’ New E&P Peoria

2025-03-26 - Japanese firm JAPEX U.S. Corp. made an equity investment in Peoria Resources, led by former executives from TreadStone Energy Partners.

Michael Hillebrand Appointed Chairman of IPAA

2025-01-28 - Oil and gas executive Michael Hillebrand has been appointed chairman of the Independent Petroleum Association of America’s board of directors for a two-year term.

Chevron to Lay Off 15% to 20% of Global Workforce

2025-02-12 - At the end of 2023, Chevron employed 40,212 people across its operations. A layoff of 20% of total employees would be about 8,000 people.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.