Despite the Biden administration’s pause on LNG export facilities, the U.S. took the spot as global LNG exporter in 2023, overtaking Australia, Qatar and Russia, according to the International Gas Union. (Source: Shutterstock.com)

The U.S. assumed the top spot as the world’s largest LNG producer in 2023, according to the International Gas Union (IGU), surpassing Australia and Qatar.

The U.S.’ climb to the top spot was not without its obstacles, including Biden’s pause on new LNG export facilities and environmental concerns.

The North American country reported an annual increase of 8.9 MMmt in LNG exports in 2023 to overtake Australia and Qatar, boosted by Freeport LNG’s return to service in 2022 after unplanned maintenance and new exports from Calcasieu Pass LNG.

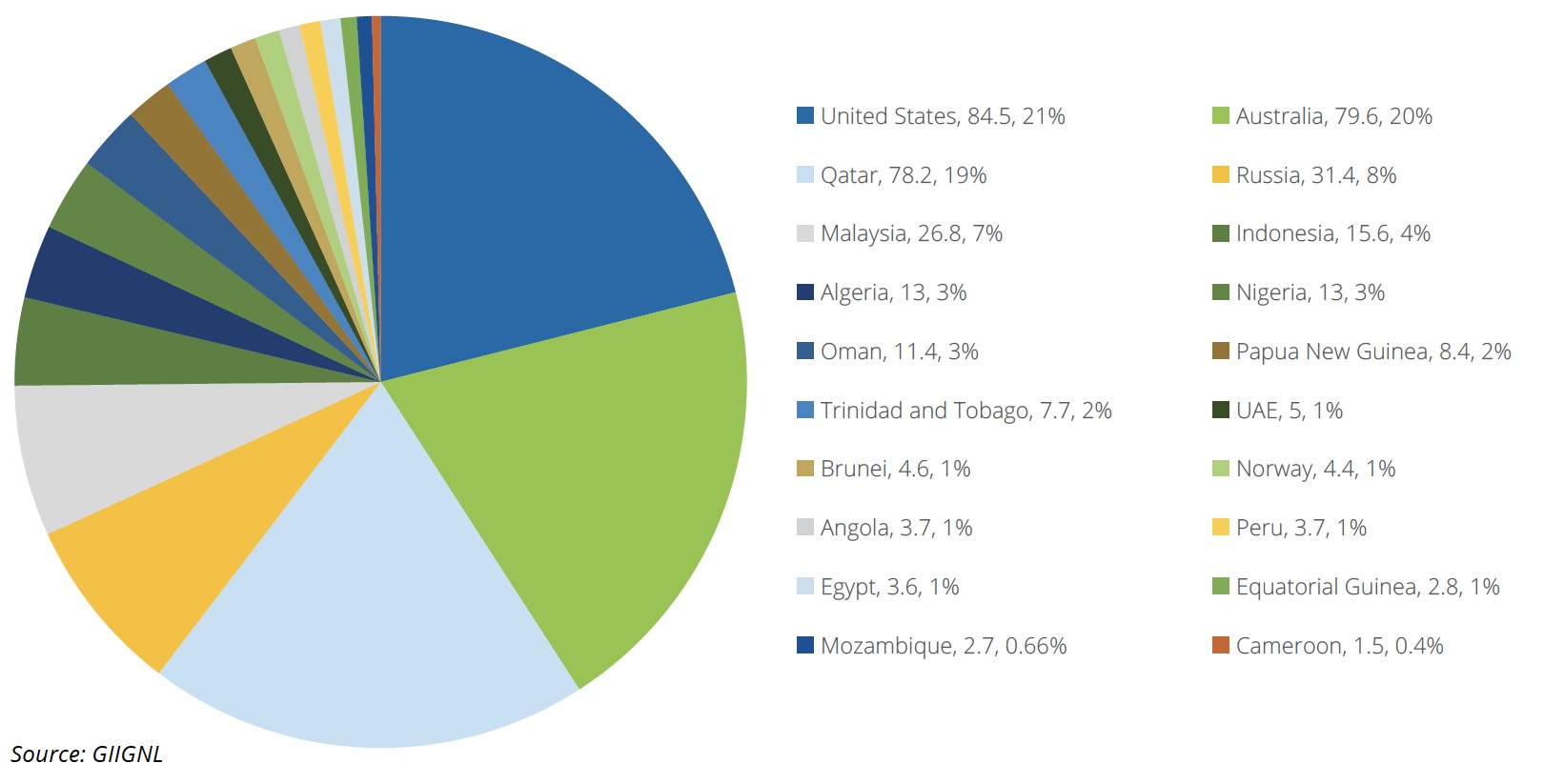

The U.S. exported 84.5 million tonnes (MMmt) in 2023 compared to 75.6 MMmt in 2022. Australia, the second-largest LNG exporter, retained its position with exports of 79.6 MMmt in 2023 compared to 79.3 MMmt in 2022. Qatar was the third largest LNG exporter with exports of 78.2 MMmt in 2023 compared to 79.6 MMmt in 2022, the IGU said in its 2024 report published on Aug. 27.

Collectively, the top three LNG exporters—the U.S., Australia and Qatar—accounted for 60.4% of global LNG output in 2023.

Vladimir Putin’s Russia remained the fourth-largest LNG exporter with exports of 31.4 MMmt in 2023 compared to 32.5 MMmt in 2022, despite sanctions on Russian energy exports after the country’s invasion of Ukraine in early 2022. Malaysia retained its status as the fifth-largest LNG exporter with exports of 26.8 MMmt in 2023 compared to 27.6 MMmt in 2022.

Over the next 5 years to 6 years, the IGU said it was likely that the world’s LNG export capacity could grow to around 700 million tonnes per annum (mtpa) from 401 mtpa in 2023.

“This potential massive increase is an emphatic demonstration that the world still needs more LNG and is driven [primarily] by demand in Asian developing economies and China. Peak LNG demand is not likely to be reached until the 2040s,” the IGU said.

In 2023, Asia Pacific was the largest exporting region with 134.80 MMmt, followed by the Middle East (94.7 MMmt) and then North America (84.5 MMmt). Conversely in 2023, Asia Pacific was also the largest importing region with 155.3 MMmt, followed by Europe (121.3 MMmt) and then Asia (105.5 MMmt).

LNG headwinds remain

U.S. President Joe Biden implemented his LNG pause on non-Free Trade Agreement (non-FTA) and FTA export authorizations in early 2024 to allow the U.S. Department of Energy (DOE) to update economic and environmental analyses to determine if such applications are in the public interest.

The decision—applauded by environmentalists—caused concern in the global LNG market over the role U.S. LNG will play to support the energy transition and energy security of customers in Europe and Asia. A federal judge overturned the pause in July.

“LNG has become a critical component of the global energy mix, with its role as a flexible and highly efficient and reliable resource continuing to grow, and as such, decarbonizing along the LNG value chain is a priority for many stakeholders in the industry,” the IGU said.

But near-term global LNG balances will likely remain unaffected despite the pause delaying over 70 mtpa of new U.S. LNG capacity, the IGU said, citing the projects already with non-FTA approval and the pre-FID projects outside of the U.S. as supplements.

Amid the uncertainties the IGU cited around the Biden pause, the U.S. Office of Foreign Assets Control (OFAC) ramped up sanctions on the 19.6-mtpa Arctic LNG 2 Russian project by complicating the delivery of icebreaker class vessels, without which the project is unable to export.

The Arctic project “counts Japanese and Chinese companies among its foundation customers, as well as portfolio volumes to [France’s] TotalEnergies and operator [Russia’s] Novatek,” the IGU said. “All foreign shareholders have suspended participation in the project, and TotalEnergies and Novatek have issued Force Majeure notices.”

Recommended Reading

Exclusive: Mesa Minerals IV to Reload in Haynesville, Permian, Other Basins

2025-03-19 - Mesa Minerals IV, backed by NGP funds, is launching to acquire mineral and royalty interests in the Permian and Haynesville, said Mesa President and CEO Darin Zanovich at DUG Gas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.