Combined, the companies produce 277,000 bbl/d of oil with the Delaware Basin accounting for nearly 60% of the combined company’s total oil production. (Source: Hart Energy)

[Editor’s note: This story was updated from a previous version posted at 4:30 p.m. CT Sept. 27.]

Devon Energy Corp. and WPX Energy Inc. agreed on Sept. 28 to combine in an all-stock transaction the two U.S. shale producers called a “merger of equals.”

The combined company, which will be named Devon Energy, will create a leading unconventional oil producer in the U.S. with a dominant Delaware Basin acreage position totaling 400,000 net acres. Including the assumption of $3.2 billion in net debt, the all-stock transaction is valued at about $5.75 billion.

The announcement confirmed reports that Devon and WPX were considering a merger made by the Wall Street Journal on Sept. 26 citing people familiar with the matter.

WPX chairman and CEO Rick Muncrief will serve as president and CEO of the combined company. Meanwhile, Dave Hager, Devon’s current president and CEO, will serve as executive chairman of the combined’s company board.

The combined company’s executive team will also include Jeff Ritenour as executive vice president and CFO and Clay Gaspar as executive vice president and COO.

“This merger is a transformational event for Devon and WPX as we unite our complementary assets, operating capabilities and proven management teams to maximize our business in today’s environment, while positioning our combined company to create value for years to come,” Hager said in a statement.

Muncrief added that the “merger-of-equals” will help achieve the five-year targets WPX outlined in late 2019 alongside an agreement to acquire Felix Energy II, which boosted its position in the Delaware Basin.

“The combined company will be one of the largest unconventional energy producers in the U.S. and with our enhanced scale and strong financial position, we can now accomplish these objectives for shareholders more quickly and efficiently,” he said in the statement.

Check out the cover story from the September issue of Oil and Gas Investor featuring WPX Energy’s president and COO, Clay Gaspar.

The combined company will pursue a highly disciplined strategy with management committed to limiting reinvestment rates to approximately 70% to 80% of operating cash flow and restricting production growth to 5% or less annually. Targeting a cash-returns business model, free cash flow will be deployed by the combined company toward higher dividends, debt reduction and opportunistic share repurchases, the companies said in the joint release.

The companies expect capital activity plans of the combined company to focus on maintaining base production. Detailed forward-looking guidance for the full-year 2021 will be provided upon closing of the transaction, expected first-quarter 2021.

The maintenance capital requirements to keep oil production flat in 2021 versus 2020 fourth-quarter exit rates of greater than 280,000 bbl/d is estimated at approximately $1.7 billion. Pro forma for cost synergies, these maintenance capital requirements in 2021 are estimated to be funded at $33 WTI and $2.75 Henry Hub pricing, according to the joint release.

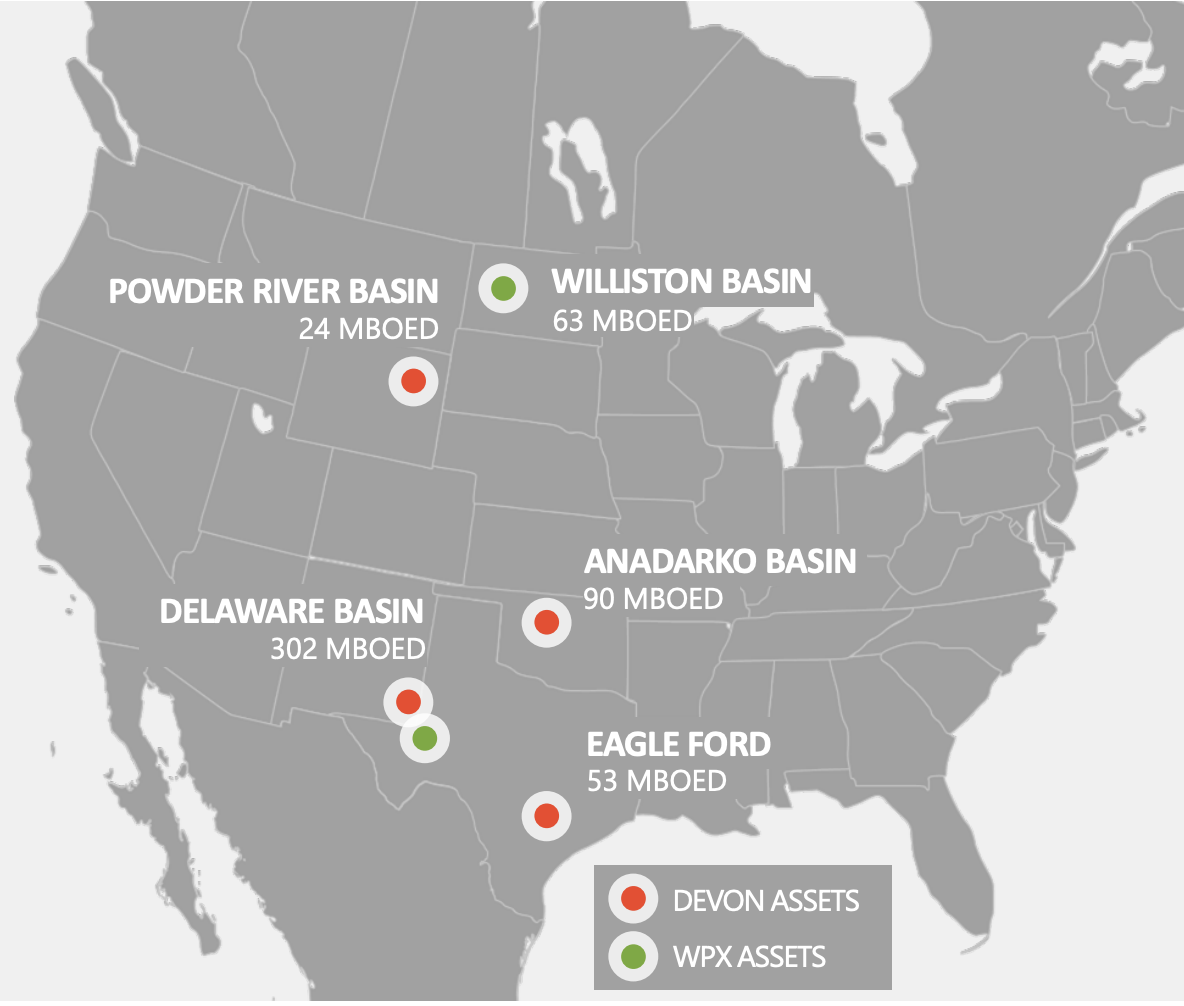

Combined, the companies produce 277,000 bbl/d of oil with the Delaware Basin accounting for nearly 60% of the combined company’s total oil production.

In addition to its position in the Permian’s Delaware sub-basin, Devon’s operations are focused in the Eagle Ford, Anadarko Basin and Powder River Basin. WPX also holds a large position in the Bakken and Three Forks plays within the Williston Basin.

“In our view, the merger would address DVN’s risk to federal acreage into the election and creates a larger entity better able to navigate the current landscape,” Gabriele Sorbara, equity research analyst with Siebert Williams Shank & Co. LLC, wrote in a Sept. 27 research note.

WPX holds roughly 30,000 net acres exposed to federal lands out of a total about 160,000 net acres in the Delaware Basin. Meanwhile, about 55% of Devon’s Delaware Basin acreage and 60% of its Powder River Basin acreage is exposed to federal lands, according to Sorbara.

He expects the merger would be slightly dilutive to Devon’s free cash flow profile while also increasing the company’s oil mix with WPX’s oilier asset base enhancing margins.

“While all the metrics are not directionally favorable, DVN is trading at a cheaper valuation and with the recent M&A chatter and deal speculation in the market, we believe a negative potential outcome was likely reflected in current depressed valuation,” he wrote. “Specifically, DVN trades at half turn discount to peers on 2021 EV/EBITDA and is down 69.5% YTD (vs. peers which are down 62.8% YTD).”

WPX Energy entered the Permian Basin in 2015 with the $2.75 billion acquisition of RKI Exploration & Production. The company also added onto its Permian position in 2017 with the closing of a $775 million deal for Panther Energy.

Earlier this year, WPX grew its Delaware position with the $2.5 billion acquisition of Felix Energy II. In 2016, Devon closed the purchase of Felix Energy I’s positition in the STACK play within the Anadarko Basin. Both Felix Energy I and II were backed by EnCap Investment LP.

Upon completion of Devon and WPX’s combination, Devon shareholders will own approximately 57% of the combined company and WPX shareholders will own about 43%. Funds managed by EnCap Investments own approximately 27% of the outstanding shares of WPX and have entered into a support agreement to vote in favor of the transaction.

Under the terms of the agreement, WPX shareholders will receive a fixed exchange ratio of 0.5165 shares of Devon common stock for each share of WPX common stock owned. The exchange ratio, together with closing prices for Devon and WPX on Sept. 25, results in an enterprise value for the combined entity of approximately $12 billion, the companies said in the joint release.

J.P. Morgan Securities LLC is financial adviser to Devon for the transaction. Skadden, Arps, Slate, Meagher & Flom LLP is serving as its legal adviser. Citi is serving as WPX’s financial adviser. Kirkland & Ellis LLP is its legal adviser. Vinson & Elkins LLP is legal adviser to EnCap Investments.

Recommended Reading

On The Market This Week (Jan. 27, 2025)

2025-02-02 - Here's a roundup of marketed oil and gas leaseholds in Appalachian and the Central basins from select sellers.

CNX’s $505MM Bolt-On Adds Marcellus, Deep Utica in Pennsylvania

2024-12-05 - CNX Resources CEO Nick Deluliis said the deal to buy Apex Energy underscores CNX’s confidence in the stacked pay development opportunities unlocked in the deep Utica.

CNX Expands in Appalachia with Closing of $505MM Apex Deal

2025-01-27 - The bolt-on of Apex Energy II's upstream and midstream assets expands CNX’s stacked Marcellus and Utica undeveloped leaseholds.

Coterra Energy Closes Pair of Permian Basin Deals for $3.9B

2025-01-28 - Coterra Energy Inc. purchased Delaware Basin assets from Franklin Mountain Energy and Avant Natural Resources for $3.9 billion.

NOG Spends $67MM on Midland Bolt-On, Ground Game M&A

2025-02-13 - Non-operated specialist Northern Oil & Gas (NOG) is growing in the Midland Basin with a $40 million bolt-on acquisition.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.