Citgo has long served as the natural market for Venezuelan oil, and its gasoline stations are scattered throughout the U.S. (Source: Shutterstock)

Venezuela has officially lost its most prized international asset: Citgo Petroleum, the 807,000-bbl/d U.S. refining arm of state-owned Petróleos de Venezuela (PDVSA).

The final auction price went for $7.3 billion to winning bidder Amber Energy Inc., which boasts the backing of a group of strategic U.S. energy investors, including Florida-based Elliott Investment Management LP.

A steal, according to Venezuela’s energy and political analysts that expected a much higher price.

Venezuelan officials from the ruling party and opposition can’t agree on anything, except maybe Citgo’s minimum valuation and that the disputed Essequibo region belongs to Venezuela.

Citgo’s valuation should be at least $12 billion, they argue. And, considering Citgo’s reported EBITDA of $3.3 billion in 2023 and a 5 times EBITDA multiple, the potential value is higher still at around $16.5 billion, according to Hart Energy calculations.

Therein lay some of the initial discussions, at least around value.

Beyond its three state-of-the-art refineries in the Gulf Coast and Midwest, Houston-based Citgo operates a network of pipelines and terminals, as well as lubricants-blending plants across the U.S.

Citgo has long served as the natural market for Venezuelan oil, and its gasoline stations are scattered throughout the U.S.

But Citgo’s importance as an outlet for Venezuela oil has changed in recent years due to political uncertainties in Venezuela and broken U.S.-Venezuela political relations. U.S. sanctions imposed in 2019 under the Trump administration’s “maximum pressure” campaign were aimed at toppling the government of Venezuelan leader Nicolás Maduro.

Citgo—Venezuela’s largest remaining foreign asset—has been entangled in the legal spat for years.

Lawsuits from numerous international investors and companies have targeted Citgo as a way to recoup capital lost from asset expropriations in Venezuela under the South American country’s late leader Hugo Rafael Chávez Frías.

A PDVSA 2020 bond issuance, this time under Maduro, was backed by a majority stake in Citgo. Venezuela has since defaulted on those bonds. Bondholders are also lining up to seek compensation. And at least 21 creditors, including Canada’s Crystallex and the U.S.’ ConocoPhillips, continue to seek compensation for asset expropriations in Venezuela.

Summed up, the claims are worth around $21 billion, according to Reuters.

Amos Global Energy CEO and President Ali Moshiri, who led Chevron Venezuela during the OPEC country’s oil sector opening in the 1990s, told Hart that the Venezuelan people were the real losers in the Amber deal because all of the claims from creditors and bondholders remain unaddressed.

Moshiri—who also ran Chevron Africa-Latin America until March 2017—said Citgo’s replacement cost was over $20 billion. A different option, like a bankruptcy reorganization, would have allowed Citgo to continue to operate on its own while diverting certain capital to pay creditors, he said.

RELATED

Wirth: Chevron Won’t Put ‘New Capital into Venezuela’

ConocoPhillips Looks to Scale Portfolio, But Citgo Auction Not a Factor

Energy pundits in Venezuela fear that the Citgo assets will be broken off and sold in the future if the deal moves forward.

For its part, Amber said it was committed to enhancing Citgo’s assets and continuing to deliver Citgo products to market, according to a press release posted on Amber’s website on Sept. 27.

Amber’s plan for Citgo includes a focus on the future and prioritizing the refiner’s operational excellence, an Amber spokesperson reiterated to Hart on Oct. 1.

Citgo auction next steps

According to U.S. court documents, the Citgo sale was to involve as many shares of Citgo owner PDV Holding as necessary to satisfy financial judgments. As a result, the Citgo auction process hasn’t been without its critics.

Citgo’s three U.S.-based refineries have a processing capacity of 807,000 bbl/d. They are based in Corpus Christi, Texas (167,000 bbl/d); Lemont, Illinois (177,000 bbl/d); and Lake Charles, Louisiana (463,000 bbl/d).

Additionally, Citgo wholly and/or jointly owns 34 active refined product terminals with a total storage capacity of 18.1 MMbbl. Citgo also has pipelines as well as lubricants-blending and packaging plants. Citgo marketers sell gasoline and other motor fuels through more than 4,000 independently owned, branded retail outlets, all located east of the Rocky Mountains, according to deals on its website. Citgo has had a presence in the U.S. for over 100 years.

Creditors seeking compensation from the Citgo auction criticized terms of a conditional offer, according to Reuters. The offer was revealed by Robert Pincus, special master for the District of Delaware U.S. District Court, which selected Amber.

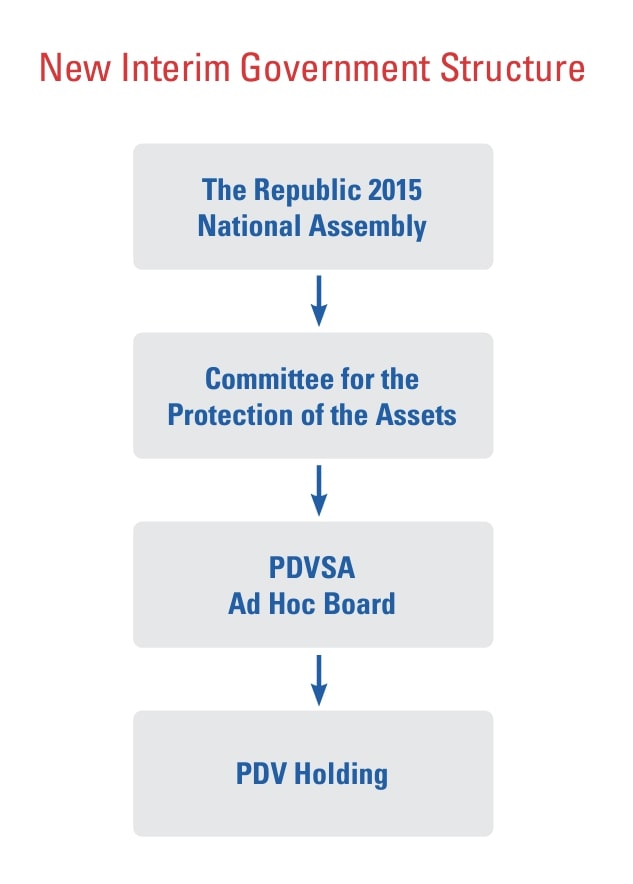

For its part, PDVSA Ad Hoc reiterated its unwavering commitment to defend Citgo.

“Although the road has been challenging, there is still much we can and will do to protect Citgo and ensure the best possible outcome in safeguarding PDVSA’s assets,” PDVSA Ad Hoc said Sept. 27 in a statement on its website.

PDVSA Ad Hoc was established in 2019 as an administrative board parallel to the one controlled by the Venezuelan ruling party. It aims to manage “PDVSA’s assets abroad, transparently and by law,” according to statements on its website.

PDVSA still has an opportunity to exercise its appeal rights before or at the Amber deal’s court hearing on Nov. 19.

“It is also important to highlight that if the process does not satisfy most creditors—who may see this recommendation [of Amber as the acquirer of Citgo] as insufficient and unfair—they, too, will have the opportunity to present objections to the process,” PDVSA Ad Hoc said.

Citgo drama and Amber’s vision

Citgo has been shielded by Washington since 2019. The plan was to relinquish the refiner to a U.S. friendly Venezuelan government in the future. Despite the recent Amber announcement and Citgo’s importance to Venezuela and PDVSA, the company confronts an ongoing Venezuelan feedstock headwind.

Citgo is currently restricted from processing PDVSA’s oil exports since Maduro’s government continues to control PDVSA’s operations in Venezuela, forcing the refiner to source oil from other providers.

Venezuelan presidential elections on July 28 saw Maduro, again, claim victory and this time without releasing the final voting data. Opposition leaders both in Venezuela and in exile continue to argue the election was won by opposition candidate Edmundo González Urrutia, citing voting data collected on election day.

Enter Elliott via Amber.

Elliott is reported to be a bondholder of the PDVSA 2020 bonds, according to Reuters, and Amber doesn’t have experience operating a refinery.

Amber is committed to enhancing Citgo’s assets and continuing to deliver the refiner’s products to market. Amber, confident in Citgo’s fundamental strength and long-term potential, believes the refiner is well positioned and aims to enhance its strong market position, the company said in its Sept. 27 press release.

Amber’s leadership team—led by CEO Gregory Goff and President Jeff Stevens—has decades of experience, according to details on Amber’s website.

For his part, Goff is a member of Exxon Mobil Corp.’s board of directors as well as the board of Avient (formerly PolyOne Corp.), and XEnergy. Goff was previously Chairman, President, and CEO of Andeavor (formerly known as Tesoro) from 2010 until its acquisition by Marathon Petroleum in 2018. Goff spent nearly 30 years at ConocoPhillips and serves as CEO of the technology company Claire Technologies Inc.

Stevens serves as president of Denver-based Franklin Mountain Energy, Stevens is also a principal at the investment firm Franklin Mountain Capital. Stevens was also a founding partner of Western Refining Inc. and served as CEO from 2010-2017.

Whether this is the end for Citgo as we know it, only time will tell.

RELATED

US Companies Ponder Future in Venezuela as Washington Pressures Maduro on Elections

Wirth: Chevron Won’t Put ‘New Capital into Venezuela’

ConocoPhillips Looks to Scale Portfolio, But Citgo Auction Not a Factor

Fitch Warns of Citgo Credit Risks but Affirms Stable Outlook

Recommended Reading

Mentor Buys Diamondback-Operated Royalty Acres in Permian

2025-03-28 - Mentor Capital Inc. has purchased a 25.127 net royalty acre stake in West Texas’ Permian Basin.

PE Firm Bluewater to Sell Apex International Energy

2025-02-10 - Since Bluewater first invested in Apex International Energy in 2018, the company has grown to be one of the top 10 upstream producers in Egypt.

Encino's Owner Mulls $7B Sale, IPO of Utica E&P, Sources Say

2025-02-04 - CPP Investments is considering a sale or IPO of Encino Acquisition Partners following January’s IPO of fellow Utica Shale E&P Infinity Natural Resources.

After Big, Oily M&A Year, Upstream E&Ps, Majors May Chase Gas Deals

2025-01-29 - Upstream M&A hit a high of $105 billion in 2024 even as deal values declined in the fourth quarter with just $9.6 billion in announced transactions.

Continental Resources Signs JV to Explore Shale Oil, Gas in Turkey

2025-03-12 - Early evaluations from the joint venture between Continental Resources, Türkiye Petroleum and TransAtlantic Petroleum suggest ultimate recoverable reserves could reach 6 Bbbl of oil and 32 Tcf to 65 Tcf of gas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.