SM and Vital each revealed in August that they were wildcatting for Woodford-Barnett pay in the Midland Basin. (Source: Shutterstock)

Vital Energy and SM Energy are reporting 150,000 boe to 250,000 boe in less than 12 months from the Woodford-Barnett in their initial deep tests in the southern Midland Basin.

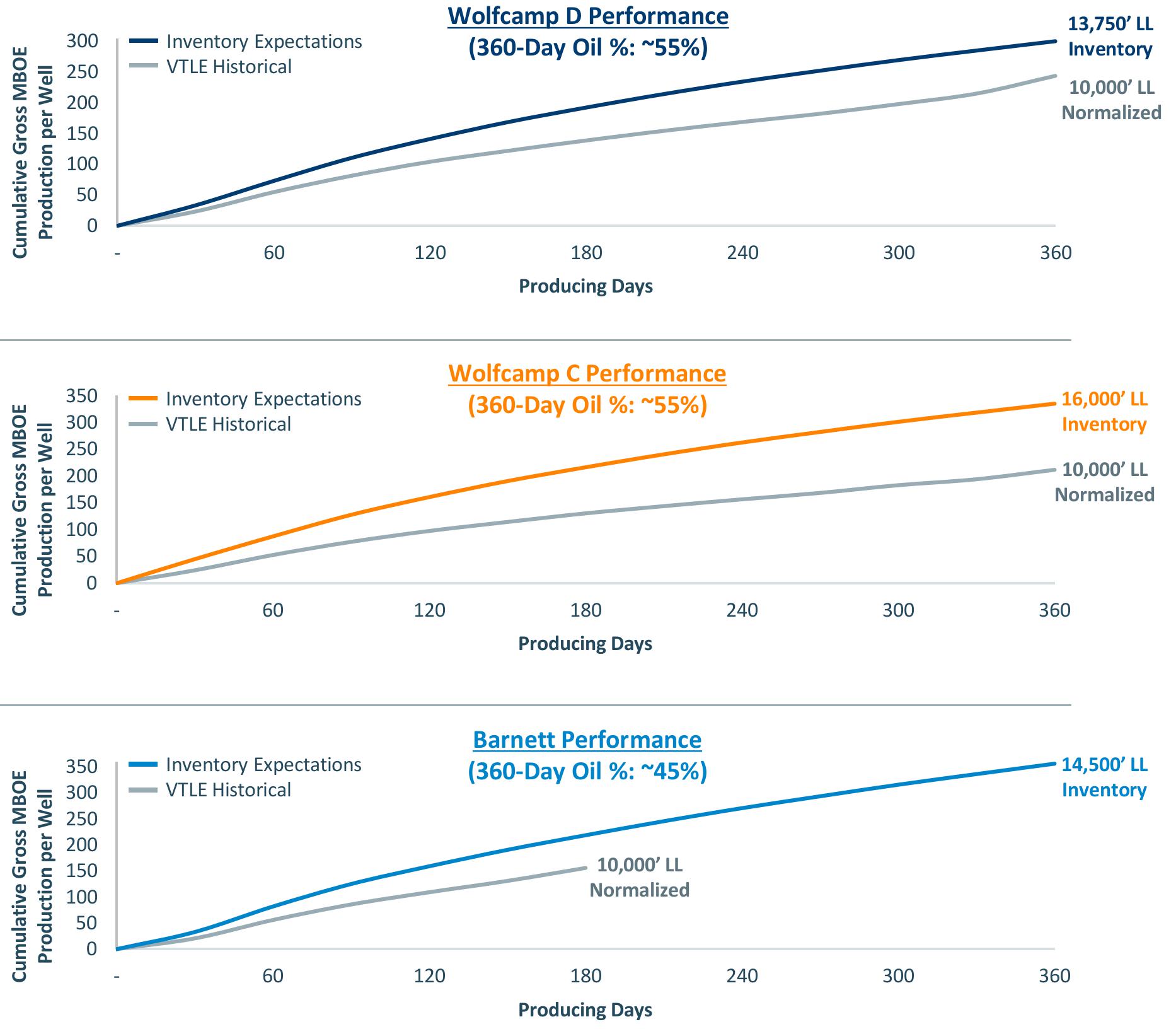

Vital has performance results for three Barnett tests in Texas, one each in Crane, Upton and Glasscock counties, with average lateral lengths of 14,500 ft and D&C costs that result in payback in one year at $55 oil, the E&P reported in a call with investors Feb. 20.

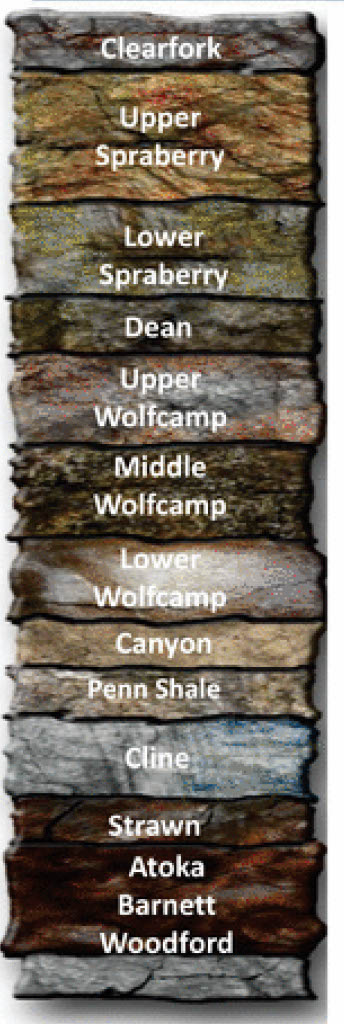

It also tested Wolfcamp D in Glasscock and Reagan counties with laterals averaging 13,750 ft and Wolfcamp C with laterals averaging 16,000 ft that pay off in one year at $45 oil, it added.

The Barnett wells are about 45% oil, while the Wolfcamp D and C wells make 55% oil, which is typical for the southern Midland Basin where deposition is deeper, thus more cooked, than in the northern Midland.

Over six months, Vital’s Barnett wells produced nearly 150,000 boe, gross, per 10,000 ft of lateral. In one year of production, Vital’s Wolfcamp D made about 200,000 boe; and Wolfcamp C, more than 150,000 boe.

Vital’s President and CEO Jason Pigott said in the call, “We de-risked significant inventory in deeper horizons.”

Combined, Vital brought online 16 wells in the Barnett and in Wolfcamp C and D during the year, “and our production was outperforming each quarter.”

“These tests gave us a robust understanding of productivity in the newer formations—the Wolfcamp C and the Barnett—allowing us to add inventory in those formations for the first time,” Pigott said.

Zach Parham, analyst with J.P. Morgan Securities, wrote after the call that Vital’s 925-well inventory, up from 885 in August, includes 140 in the Barnett and in Wolfcamp D and C across its southern Midland Basin leasehold.

“Vital also highlighted the potential to add 250 future locations through further delineation, though cited a multi-year process to bring these wells into inventory given a limited amount of delineation spending in 2025,” Parham added.

250k boe in 8 months

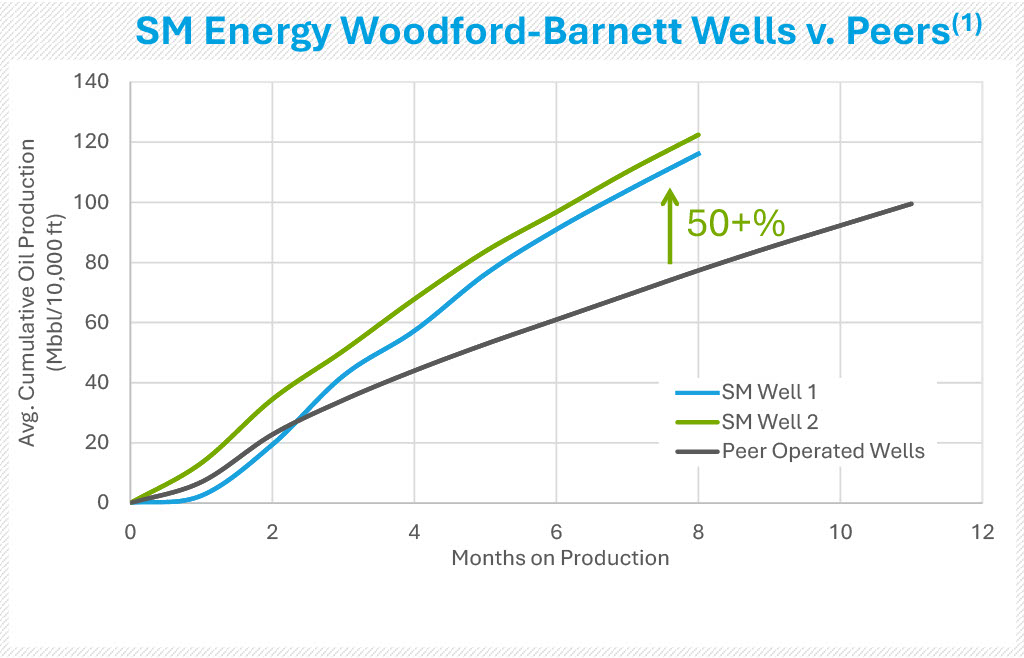

Separately, SM Energy reported its two Woodford-Barnett laterals each made about 120,000 bbl of oil in the eight months they have been online.

On a boe basis, “for the Woodford-Barnett, we had a well produce about 250,000 boe in the first eight months,” Beth McDonald, SM COO, said in the call Feb. 20.

“So significantly outperforming our peers and definitely competitive for capital going forward.”

Two large-cap peers’ eight Woodford-Barnett wells have averaged 100,000 bbl through 11 months, SM reported in a slide deck.

The comparison data via Enverus files through Jan. 23 involves Barnett wells in Crane, Ector, Upton and Midland counties through this past August.

SM estimates it has 20,000 prospective net acres for economic Woodford-Barnett laterals within its 27,500-net-acre Sweetie Peck asset area in the southern Midland Basin.

It plans four more Woodford-Barnett net wells this year and to bring two online among the 40 new-drills and 50 completions it plans throughout its total 111,000 net Midland Basin acres, it added.

An analyst asked in the call if it was “too early for you guys to put a stake in the ground and say it's as good as your legacy stuff.”

Herb Vogel, SM president and CEO, said, “On the Woodford-Barnett, we're real pleased with that one.

“But we're two wells into it. We're drilling some more now.”

Over-pressured

SM and Vital each revealed in August that they were wildcatting for Woodford-Barnett pay in the Midland Basin.

SM reported an initial 10,200-ft-lateral test had a 30-day peak IP of 1,622 boe/d. The other test had a 30-day peak IP of 830 boe/d from a 5,900-ft lateral.

Both were brought online in the second quarter.

The liquids cut is roughly 57% oil; gravity, about 50.

And “it's an over-pressured play, which is great,” Vogel said in August.

Vital reported in August that it had four Barnett wildcats and, “as we speak, are starting flowback,” Pigott said at the time.

Occidental Petroleum is also drilling for Barnett in the southern Midland Basin, including two wells west of Vital’s western Glasscock position.

Neighbors’ test results have been helpful, Pigott said in August.

“There's some good excitement. These are … oily wells with low water yields, so it can be a great opportunity for us in the future to add low-cost inventory.”

Recommended Reading

Woodside Divests Greater Angostura Assets to Perenco for $206MM

2025-03-28 - The Greater Angostura field produces approximately 12% of Trinidad and Tobago’s gas supply, said Woodside CEO Meg O’Neill in a press release.

Phillips 66 Director Criticizes Activist Investor Elliott Amid Proxy Battle

2025-03-28 - A boardroom battle between U.S. refiner Phillips 66 and activist investor Elliott Investment Management has intensified with a Phillips 66 independent director leveling criticisms at Elliott in an open letter to shareholders.

Glenfarne Deal Makes Company Lead Developer of Alaska LNG Project

2025-03-28 - Glenfarne Group LLC is taking over as the lead developer of the Alaska LNG project with the acquisition of a majority interest in the project from Alaska Gasline Development Corp.

Mentor Buys Diamondback-Operated Royalty Acres in Permian

2025-03-28 - Mentor Capital Inc. has purchased a 25.127 net royalty acre stake in West Texas’ Permian Basin.

Energy Transition in Motion (Week of March 28, 2025)

2025-03-28 - Here is a look at some of this week’s renewable energy news, including another record for renewables power capacity growth.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.