Forecasting groups and survivor bias ultimately result in skewed type curves because the dropped well rate equals the type well rate.

As the shale gale took off over the past few years, it generated a lot of excitement within the oil and gas industry and the denizens of Wall Street. One buzz word E&P executives used seemed to dominate their investor presentations, which touted ever-better well performance: the type curve.

Studies have shown that forecasting groups, the most common method for creating type wells, and a key technique used for forecasting unconventional wells’ performance, consistently leads to the overestimation of reserves. Some studies have shown these results to be off by as much as 25%. Other analysis work using hind casting studies shows those type wells are more likely to overstate EUR, and by an amount as high as 40%.

This becomes a problem. Obviously, these errors are used to guide important capital decisions within an organization, and they can lead to poor allocation of resources or decreased investor confidence. When times are good and commodity prices are higher, E&P companies can overcome such bad projections and still produce economic results. But in times like these, overspending on capital projects like plants or extra drilling could result in bankruptcy.

It’s time to look at these common errors inherent in the standard way of doing type wells and learn how to avoid them.

Forecasting groups vs. grouping forecasts

When only using well history, representative wells are averaged first, and then a forecast is derived from the average—in other words, this method is forecasting groups, which can affect forecast integrity.

Instead, engineers should first forecast all the wells individually, and then calculate the average—that is, grouping forecasts instead of forecasting groups.

By forecasting each well first, there is more opportunity to see trends develop. Forecasting from an averaged group tends to mask trends. Forecasting individual wells has the added advantage of having forecast differences in some wells offset the differences in other wells.

In the example in Figure 1, nine wells that produced for 27 continuous years were hind casted. The history was truncated to eight years to build a type well, with the remaining 19 years used to confirm the results. The white line shows the type well one would choose using the common method of forecasting from the grouped results. The blue line shows the actual data for the full 27 years. The yellow line shows the type well one would choose using the recommended grouped forecast method. This reveals the tremendous difference between the effectiveness of the two methods.

Survivor bias

When it comes to type wells, “survivor bias” describes the logical error of concentrating on the wells that “survived,” i.e., wells that do not deplete within the sample from which the type wells are created. Engineers focus on those survivors and drop the depleted wells from the calculation, post depletion.

However, there is an unintended consequence when the well count is reduced like this. The type well rate behaves as though the depleted well continues to produce at the average rate. Thus, the type well using the common method spikes upward—to suggest that more production is being added—when the opposite is true. That’s because a well that was previously trending toward zero is now being treated as though it is producing at the new average of the surviving wells.

Instead, every well must have a rate, which allows engineers to account for the depleted wells along with the survivors. To avoid this error, the correct treatment is to assume the depleted well continues to produce at a rate of zero. This keeps the depleted wells in the calculation for the average at a rate of zero, giving a more consistent type well that properly reflects the decline in the field.

Declining well count

The third error with the common method of creating type wells is similar to the second, failing to account for wells with no production in a declining well count. The difference is that in this scenario, the wells aren’t depleted.

Instead, in this case, there are wells in the forecast with varying years of production, so, to create the forecast, each well is normalized to start at the same time. Once a well reaches the end of its production time, it is dropped from the type well calculation due to lack of history. When this happens, there is a spike or drop in the type well due to the shrinking number of wells in the sample.

In the example in Figure 2, the lowest producing well has a shorter production history than the other two. So when it drops out, the common method for type wells would result in a type curve that jumps up, as the rate would be divided by only the top two producing wells, even though the trend for all three is in decline. If it was the top producing well that dropped out, you’d see a steep drop instead. Either way, the forecast will be overestimated or underestimated as a result.

Instead, engineers should forecast all the wells in the area first. That way, they won’t run into issues of comparing wells with seven years of history with wells with four years of history. In the example cited in Figure 2, the third well’s decline would be taken into account for the entire type well, leading to a more accurate curve.

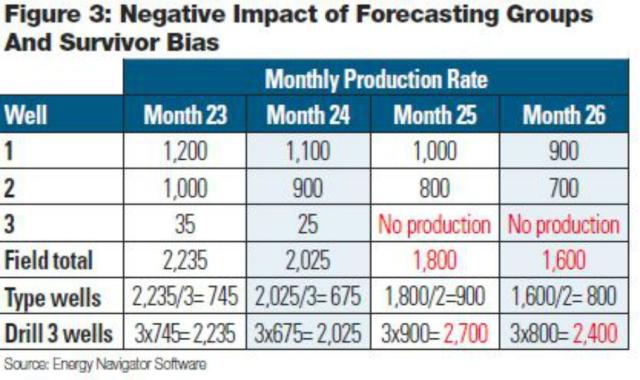

See the simple example in Figure 3 that illustrates survivor bias. Three wells are used to create a type well, which will in turn be used to predict the performance from three undrilled wells. Both should have the same total field rate. The type well rate is the field rate divided by the number of wells with data to average: three for two months, then two.

To use the type well, the type well rates are multiplied by the 3, which is the planned number of wells to drill. An engineer would not multiply by 3 until the end of month 24, then multiply by 2 because the number of wells in the type well decreased. Comparing red numbers in the “drill 3 wells” row to the “field total” row demonstrates that the common method of creating a type well inherently assumes that a well without production will produce at the type well rate. Clearly, that’s not logical and can result in an overstatement of EUR.

The answer: Forecast wells first

These are errors inherent in the common method of doing type wells, and are not mistakes made by bad engineering, but rather, flaws in the process itself. The solution for all of them is to change how to do type wells: forecast every well first, and then group those forecasts together to make a type well. Doing so will better identify trends in all wells in the sample and remove the errors associated with survivor bias.

In the past, it wasn’t feasible to forecast every well, which is why the common method became the standard method. Companies made concessions due to the labor-intensive methods for creating forecasts of the past. However, today, modern software solutions make forecasting wells much faster, with automated tools that assist engineers in the creation of forecasts on a per well basis. Work that previously would have taken days or weeks to complete can now be done by software in minutes, allowing engineers to test and validate rather than create. This in turn allows engineers to create better, more reliable type wells when they forecast first, then average the history and the forecast.

This simple change in how to do type wells could save organizations millions of dollars by avoiding the issues inherent in the common method of type well creation. Forecast first—then group the forecasts.

Randy Freeborn is a Distinguished Lecturer with The Society of Petroleum Engineers and serves as the chief research engineer for Energy Navigator Software. He has over four decades of experience in petroleum engineering, and is a recognized expert in decline curve analysis for conventional and unconventional resources.

Recommended Reading

Infinity Natural Resources’ IPO Nets Another $37MM

2025-02-07 - Underwriters of Infinity Natural Resources’ January IPO have fully exercised options to purchase additional Class A common stock at $20 per share.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Mach Prices Common Units, Closes Flycatcher Deal

2025-02-06 - Mach Natural Resources priced a public offering of common units following the close of $29.8 million of assets near its current holdings in the Ardmore Basin on Jan. 31.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Alliance Resource Partners Adds More Mineral Interests in 4Q

2025-02-05 - Alliance Resource Partners closed on $9.6 million in acquisitions in the fourth quarter, adding to a portfolio of nearly 70,000 net royalty acres that are majority centered in the Midland and Delaware basins.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.