Oil and Gas Investor Magazine - January 2017

Cover Story

CONVENTIONAL REVIVAL

While the downturn throttled most conventional drilling last year, Gulf Coast explorationists are finding new traction for idled prospects with the anticipation of moving economic projects to drillbit sooner rather than later.

Feature

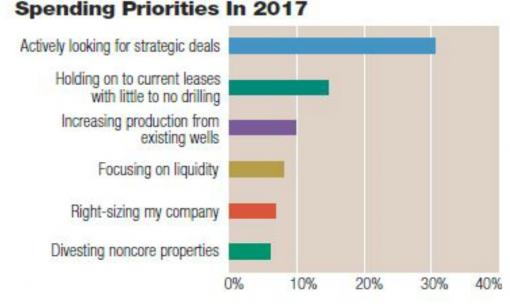

2017 OUTLOOK: POSITIONING FOR A RECOVERY

With U.S. production cuts in the works and oil prices doubled since early 2016, this year could be the start of a slow but certain rebound for the industry, says a Grant Thornton LLP survey.

CROSSCURRENTS IN ENERGY LENDING

While access to bank capital may be loosening for E&Ps in favored basins, others are subject to greater selectivity in their search for funding.

EXECUTIVE Q&A: EXTRACTION PLANS TO EXTRACT VALUE

Positive tailwinds pushed Extraction Oil & Gas Inc. over the line as the first upstream IPO in two years. It was oversubscribed by more than 11 times. Here’s a peek at the company’s strategy.

EXPLORATION AND PRODUCTION: PERMIAN FRINGE BENEFITS

Three private operators pursuing the Central Basin Platform talk about taking risks in transition zones.

GULF OF MEXICO: SHELF LIFE

New decommissioning regulations threaten the survival of offshore operators in the name of protecting U.S. taxpayers. But how great is the actual risk?

INSIGHTS FROM STRATAS ADVISORS: BAKKEN SHALE

The prolific oil play in the Bakken Shale has experienced one of the larger falls from grace in the industry over the course of the now two-year slump in commodity prices, where oil fell to below $30 per barrel (bbl) in early 2016.

LOWER 48 EXPLORATION: ALPINE HIGH

Questions about this new discovery abound—as do the barrels of oil equivalent in place. Here is an introduction to the Lower 48’s newest resource play.

MANAGEMENT STRATEGIES: MAKING EVERY DOLLAR COUNT

Watch out for these five factors behind operational inefficiencies.

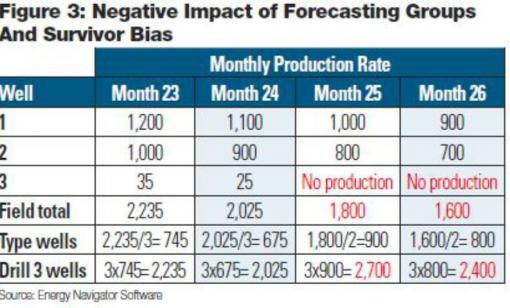

WELL PERFORMANCE: FORECAST FIRST

This SPE Distinguished Lecturer explains how to overcome the most common errors companies make when creating type wells.

A&D Trends

LONGPOINT’S SECRET IDENTITY

Tucked into the history of the Santa Rita No. 1, the famed 1923 Texas well that first tapped the bounty of Permian crude, is a $516.23 royalty payment.

At Closing

DON’T GET OUT OF WHACK

By now, you’ve read a lot of commentary about the deal between OPEC and other producers such as Russia to cut oil output beginning this January. This should be what it takes to balance the global supply-demand equation—but it could backfire if high oil prices encourage U.S. producers to drill too much too soon, warns Harold Hamm, CEO of Continental Resources Inc.

Bright Spots

MEET SHANNA KEAVENY

Shanna Keaveny has good chemistry with her team at Texakoma.

E&P Momentum

THE PRICE IS RIGHT

Just when E&Ps thought it was safe to get back in the water comes the first news of rising prices for oilfield services. Leading edge well stimulation prices increased in the fourth quarter of 2016 with additional momentum expected in 2017.

From the Editor-in-Chief

OFF TO THE RACES? STAY CALM, AND GROW STEADY

The week after OPEC relented on its two-year effort to flood the world markets with crude and agreed in late November to cut back on production, the U.S. land rig count lurched forward by a whopping 27 rigs, the largest week-over-week jump in rig count since April 2014.

On the Money

OPEC’S GRAND BARGAIN—AT LAST

OPEC proved naysayers wrong by delivering a well-orchestrated production cut that, on the surface, involved not only its members, but also non-OPEC producing countries.