The price of Brent crude ended the week at $73.11 after closing the previous week at $73.84. (Source: Shutterstock)

The price of Brent crude ended the week at $73.11 after closing the previous week at $73.84. The price of WTI ended the week at $70.04 after closing the previous week at $70.22. The price of DME Oman crude ended the week at $73.70.

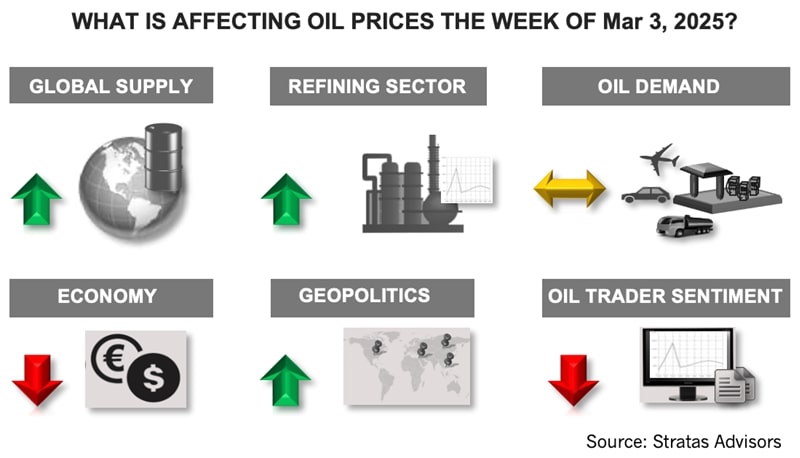

At the beginning of last week, we expressed the view that the price of Brent crude would have difficulty breaking through $76 – and that certainly proved to be true with oil prices moving downward during much of the week before rebounding in the latter half of the week.

Macro-level factors created uncertainty and price volatility last week– and are expected to do so during the upcoming week – especially with the market reacting (and over-reacting) to news headlines.

- At the end of last week, President Trump revoked the license given to Chevron by the prior administration to operate in Venezuela stating that President Maduro had not made sufficient progress on electoral reforms and migrant returns. Chevron has been exporting about 240,000 b/d of crude from Venezuela, which is around 25% of Venezuela’s total oil production and about 33% of Venezuela’s crude oil exports. Additionally, U.S. refiners will not be allowed to buy Venezuelan crude oil. Imports of Venezuelan crude oil represent around 10-15% of crude oil imported by USGC refiners.

- President Trump also stated that a 10% tariff will be placed on crude oil from Canada starting on March 4. Also, last week, in somewhat contradictory terms, President Trump mentioned an interest in reviving the Keystone XL pipeline, which would facilitate bringing more crude oil from Canada into the U.S. The tariff on Canadian crude and banning of Venezuela’s exports to the U.S. will likely narrow the light-heavy oil differential.

- On Feb. 27, President Trump signed an executive order that keeps a wide range of sanctions on Russia until at least March 6, 2026 – including those related to Russia’s energy sector – and the sanctions that the Biden Administration imposed on Jan. 10 of this year. Additionally, the meeting in the Oval Office between President Trump and President Zelensky broke down, resulting in the proposed mineral agreement not being signed. The fallout was viewed as positive for oil prices because it made a peace deal with Russia less likely. Regardless, it is our view that a negotiated peace deal with Russia will not have much of a lasting impact on oil prices, even if sanctions are removed on Russia because Russian oil volumes are expected to continue to be driven mainly by the OPEC+ agreement. Members of OPEC+, including Russia, understand that maintaining adherence to agreed quotas is essential to prevent a sharp downturn in oil prices.

Within the context of uncertainty, the sentiment of oil traders remains bearish. Last week traders of WTI crude, for the fifth consecutive week, reduced their net long positions by decreasing their long positions while increasing their short positions. Net long positions of WTI have decreased by 73% since Jan. 21 of this year and are 74% below the level seen on July 16, 2024, when the price of WTI was $80.76. Traders of Brent crude also reduced their net long positions by decreasing their long positions while increasing their short positions. Sentiment continues to be weighed down by disappointing news about the economy and concerns about oil demand and the supply overhang. The latest news about tariffs is not helping. Last week, President Trump pledged that more tariffs will be implemented on March 4. While the tariffs on Mexico and Canada were delayed, the additional 10% tariffs on China have already gone into effect. The new tariffs will include 25% tariffs on Canada and Mexico and another 10% tariff on imports from China. Trump has also indicated that on March 12, 25% tariffs will be placed on steel and aluminum imports. Besides these tariffs, Trump is planning to place reciprocal tariffs on other trade partners, including India, Brazil, and Turkey. Lastly, Trump is hinting at placing a 25% tariff on imports from the EU.

For the upcoming week, we are expecting that oil prices will continue to bounce around but overall will trend upward.

For a complete forecast of crude oil and refined products and other energy-related fundamentals and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

IOG, Elevation Resources to Jointly Develop Permian Wells

2025-04-10 - IOG Resources and Elevation Resources’ partnership will focus on drilling 10 horizontal Barnett wells in the Permian’s Andrews County, Texas.

Saudi Aramco Discovers 14 Minor Oil, Gas Reservoirs

2025-04-10 - Saudi Aramco’s discoveries in the eastern region and Empty Quarter totaled about 8,200 bbl/d.

Burleson: Rockcliff Energy III Builds on Past Successes

2025-04-09 - Rockcliff Energy III is building on past experiences as it explores deeper in the Haynesville, CEO Sheldon Burleson told Hart Energy at DUG Gas.

Liberty, Imperial, Range Partner to Support Pennsylvania Power Plant

2025-04-08 - Liberty Energy Inc., Imperial Land Corp. and Range Resources are focusing on a plant to meet energy demands from data centers and industrial facilities.

E&P Highlights: April 7, 2025

2025-04-07 - Here’s a roundup of the latest E&P headlines, from BP’s startup of gas production in Trinidad and Tobago to a report on methane intensity in the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.