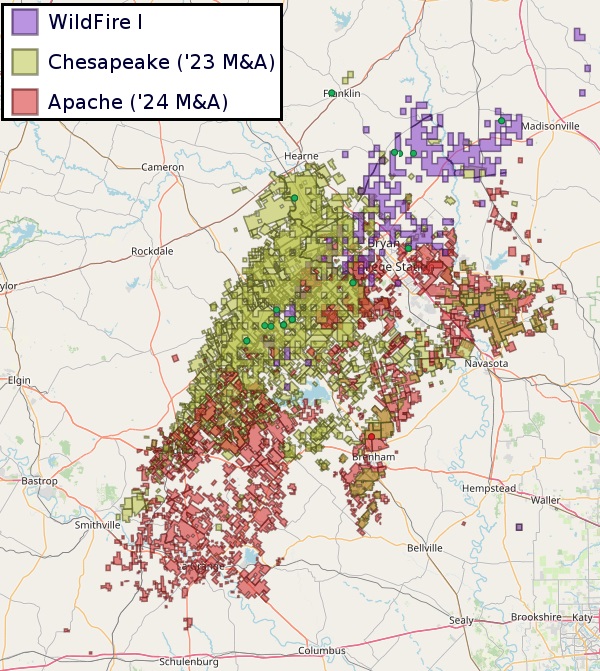

After closing the acquisition from Apache, WildFire will operate over 2,000 wells on around 850,000 net acres in the eastern Eagle Ford. (Source: Shutterstock/ WildFire Energy I)

Private equity-backed WildFire Energy I continues to grow in the Eagle Ford Shale through M&A.

WildFire acquired around 237,000 net acres in the East Texas Eagle Ford play from APA Corp. and subsidiary Apache, the company announced after markets closed May 20. The transaction included interests in 465 wells.

The assets acquired from Apache averaged net daily production of around 11,000 boe/d (67% liquids) during first-quarter 2024.

After closing the acquisition from Apache, WildFire will operate over 2,000 wells on around 850,000 net acres in the eastern Eagle Ford, including Fayette, Bastrop, Lee, Austin, Washington, Burleson, Brazos, Milam, Robertson, Madison and Grimes counties, Texas.

“This acquisition of adjacent assets presented us with a strategic opportunity to continue consolidating the basin,” said WildFire President and COO Steve Habachy. “With a total of more than 850,000 net acres, we have built a premier contiguous asset base, making WildFire the largest operator in the entire Eagle Ford trend.”

WildFire has amassed a huge Eagle Ford position since launching in 2019 with backing from Warburg Pincus, Kayne Anderson and company management.

The company acquired Hawkwood Energy LLC in August 2021 and MD America Energy LLC in March 2022, kicking off WildFire’s consolidation of the eastern Eagle Ford.

Last year, WildFire completed a $1.425 billion acquisition of Chesapeake Energy’s assets in the Brazos Valley.

The Chesapeake deal included around 377,000 net acres and interests in 1,350 wells.

WildFire’s total position includes around 550,000 net acres in the Austin Chalk play, as well as acreage in the Woodbine, Buda and Georgetown formations.

APA separately announced raising over $700 million across two transactions: the Eagle Ford asset sale and a divestiture of mineral and royalty interests in the Permian’s Midland Basin. The deals are expected to close in the third quarter.

RELATED

APA Corp. Sells $700MM in Non-core Permian, Eagle Ford Assets

Apache sheds non-core assets

APA is focused on reducing debt after closing a $4.5 billion acquisition of Callon Petroleum in April.

The Callon acquisition gave Apache a much deeper portfolio of drilling locations in the Permian Basin, particularly in the Permian’s western Delaware Basin.

One of the ways Apache is raising money to pay down debt is selling non-core assets.

Speaking during Hart Energy’s SUPER DUG Conference & Expo in Fort Worth, Texas, APA Corp. CEO John Christmann said there are parts of Apache’s portfolio that aren’t attracting capital—but that might fit better into the portfolio of another nearby operator.

“It would be things like that that you could see us do something with,” Christmann said. “We’ve said we would move fairly quickly.”

Christmann said Apache’s U.S. assets outside the Permian were near the top of the list for potential non-core asset sales. But the company also wasn’t ruling out a Permian sale.

“There are areas in the Permian where we’ve got some non-op interests or things that might make sense where others are investing capital, or that others might value,” Christmann said.

APA “received a reasonable price” for the over $700 million in non-core asset sales that the company “was not likely getting any credit for in analyst valuations,” Capital One Securities analysts wrote in a May 21 report.

The bank ascribed a proved developed producing value of around $480 million, or roughly $44,000 per flowing oil-equivalent barrel, on the 11,000 boe/d of Eagle Ford production that WildFire picked up through the acquisition.

Capital One did not attribute value to Apache’s Eagle Ford acreage or undeveloped inventory.

The remaining $220 million of deal value was attributed to the 2,000 boe/d of mineral and royalty interest production in the Midland Basin.

“The sale price suggests a valuation of roughly $110K per flowing boe per day,” Capital One wrote. “That may seem high, but the lack of associated capex spending in minerals deals always commands a higher price relative to more typical E&P deals.”

RELATED

Minerals Market Growing But Needs More Scale, Consolidation

Eagle Ford, Western Haynesville M&A

A record-setting amount of corporate consolidation in 2023 centered on the Permian Basin, the nation’s top oil-producing basin. But the Eagle Ford Shale has seen a flurry of dealmaking, too.

Last week, Crescent Energy announced a $2.1 billion bid to acquire SilverBow Resources—a combination that would yield one of the largest producers and leaseholders in the western Eagle Ford.

Crescent has around 231,000 net acres in the Eagle Ford; SilverBow has around 220,000 net acres.

The transaction will create the second largest Eagle Ford operator with pro forma production of roughly 250,000 boe/d, 56% oil and liquids, the companies said.

Closer to WildFire’s position, Magnolia Oil & Gas has continued to be a consolidator in the Giddings Field and Austin Chalk.

Magnolia, in its first-quarter earnings earlier this month, reported adding another 27,000 net acres in the Giddings Field from a private operator for $125 million.

Last summer, Canadian operator Baytex Energy closed a $2.2 billion acquisition of Ranger Oil, adding acreage in the crude oil window of the Eagle Ford.

The Ranger acquisition complemented Baytex’s existing non-operated position in the Karnes Trough.

French energy giant TotalEnergies acquired Lewis Energy Group’s 20% interest in the Dorado gas field in the far-western Eagle Ford. The Dorado gas play is operated by EOG Resources (80% interest).

Further north from WildFire’s acreage, natural gas producers Comstock Resources and Aethon Energy are delineating the emerging western Haynesville Shale play.

Comstock Resources recently reported adding 198,000 net acres in the area, bringing the company’s total western Haynesville position up to 450,000 net acres.

Private producer Aethon Energy Operating also wants to add leasehold in the western Haynesville, Aethon COO Andrea Wescott Passman said at Hart Energy’s DUG GAS+ Conference & Expo in late March.

RELATED

Comstock Adds Four Whopper Wildcats; Takes Western Haynesville to 450K

Recommended Reading

Norwegian Energy Data Companies PGS, TGS Complete Merger

2024-07-02 - Norwegian companies PGS and TGS have completed their merger to create a full-service energy data company.

BPX’s Koontz: The Rise of a Shale Man

2024-07-02 - CEO Kyle Koontz takes the reins of BPX Energy’s rapid onshore growth amid big changes at BP.

LandBridge Chair: In-basin Data Centers Coming for Permian NatGas

2024-06-28 - Newly public Delaware Basin surface-owner LandBridge Co. has a 100-year lease agreement with one developer that could result in ground-breaking in two years and 1 GW in demand.

Permian’s LandBridge Prices IPO Below Range at $17/Share, Raising $247MM

2024-06-30 - Houston-based LandBridge, which manages some 220,000 surface acres in the Permian Basin, kicked off trading at $19 per share, more than 10% above its listing price.

Pembina Pipeline to Offer $690MM in Public Debt

2024-06-27 - Pembina Pipeline Corp. is offering senior unsecured debt to extend maturity dates for near-term debt that matures between 2026 and 2029.