Woodside and Chevron have entered an agreement that shifts interests in Chevron’s North West Shelf Oil and carbon capture projects and Woodside’s Wheatstone LNG project with Chevron also paying Woodside $400 million. (Source: Shutterstock.com)

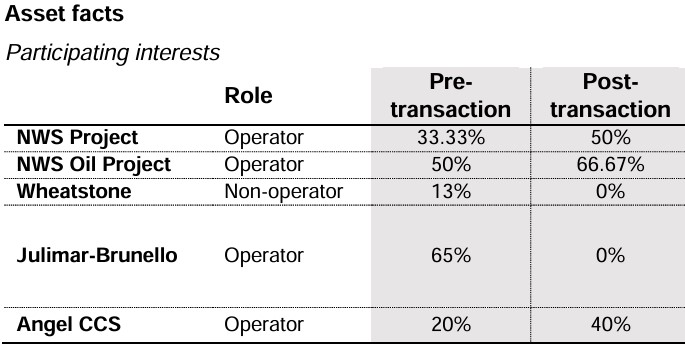

Woodside and Chevron have agreed to an asset swap under which Woodside will acquire Chevron’s interest in the North West Shelf (NWS) Project, the NWS Oil Project and the Angel Carbon Capture and Storage (CCS) Project.

Woodside will transfer all of its interest in the Wheatstone LNG and natural gas project, which Chevron operates in a joint venture with Woodside, and the Julimar-Brunello gas fields project to Chevron.

Chevron will also make a cash payment to Woodside of up to $400 million.

Under the terms of the swap, Woodside will transfer its 13% non-operated interest in the Wheatstone Project and 65% operated interest in the Julimar-Brunello Project to Chevron. Woodside will acquire Chevron’s 16.67% interests in the NWS Project and the NWS Oil Project and a 20% interest in the Angel CCS Project.

Through Sept. 30, Woodside’s interest in Wheatstone have averaged 34,000 boe/d. During the same time, Chevron’s NWS and NWS Oil Project have averaged 54,500 boe/d.

Woodside said the deal streamlines its Australian portfolio and consolidates focus on operated LNG assets. The swap also simplifies the company’s joint ventures and strengthens near-term cash flow to support shareholder distributions and ongoing investments.

“The strategic and commercial rationale for this asset swap is compelling for Woodside,” said Woodside CEO Meg O’Neill. “This transaction simplifies our portfolio, improving our focus and efficiency by consolidating our position in our operated LNG assets. It is immediately cash flow accretive and includes a cash payment upon both execution and completion.”

Andrew Harwood, vice president of research, upstream and carbon management at Wood Mackenzie said the deal positions Woodside to progress the extension of the North West Shelf LNG plant and unlock additional value for stakeholders.

“The Woodside-operated Browse resource has been identified as the preferred backfill candidate for the NWS, while the transfer of Chevron’s stake in the Angel Carbon Capture and Storage (CCS) project highlights Woodside's commitment to reducing emissions associated with any potential Browse development,” Harwood said.

Chevron’s operations in Australia remain one of its largest international holdings, he said. However, the U.S. company has streamlined its portfolio over the past year in preparation for its proposed $53 billion acquisition of Hess Corp. This year alone, Chevron has divested non-core positions in Alaska, Canada, and Congo, with “rumors suggesting that its UK portfolio could be the next divestment,” Harwood said.

RELATED

Chevron Sells Canadian Oil Sands, Duvernay Shale Assets for $6.5B

Wood Mackenzie anticipates a further wave of portfolio streamlining as U.S. Majors and Large-caps digest recent U.S.-focused mergers and acquisitions and trim their international portfolios.

The effective date of the Chevron-Woodside transaction is Jan. 1, 2024.

Recommended Reading

Kinder Morgan Reaches FID for $1.4B Mississippi NatGas Pipeline

2024-12-19 - Kinder Morgan plans to keep boosting its capacity to the Southeast and is moving forward with a 206-mile pipeline with an initial capacity of 1.5 Bcf/d.

Kinder Morgan to Build $1.7B Texas Pipeline to Serve LNG Sector

2025-01-22 - Kinder Morgan said the 216-mile project will originate in Katy, Texas, and move gas volumes to the Gulf Coast’s LNG and industrial corridor beginning in 2027.

Shale Outlook: Power Demand Drives Lower 48 Midstream Expansions

2025-01-10 - Rising electrical demand may finally push natural gas demand to catch up with production.

Glenfarne Signs on to Develop Alaska LNG Project

2025-01-09 - Glenfarne has signed a deal with a state-owned Alaskan corporation to develop a natural gas pipeline and facilities for export and utility purposes.

Energy Transfer Shows Confidence in NatGas Demand with Pipeline FID

2024-12-11 - Analyst: Energy Transfer’s recent decision to green light the $2.7 billion Hugh Brinson line to Dallas/Fort Worth suggests electric power customers are lining up for Permian Basin gas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.