Perth-based Woodside has a diversified, large-scale, low-risk portfolio with operations in Australia, Canada, the U.S. Gulf of Mexico (projects including Shenzi, Mad Dog and Atlantis), Mexico, Senegal, Timor-Leste and Trinidad and Tobago. (Source: Shutterstock)

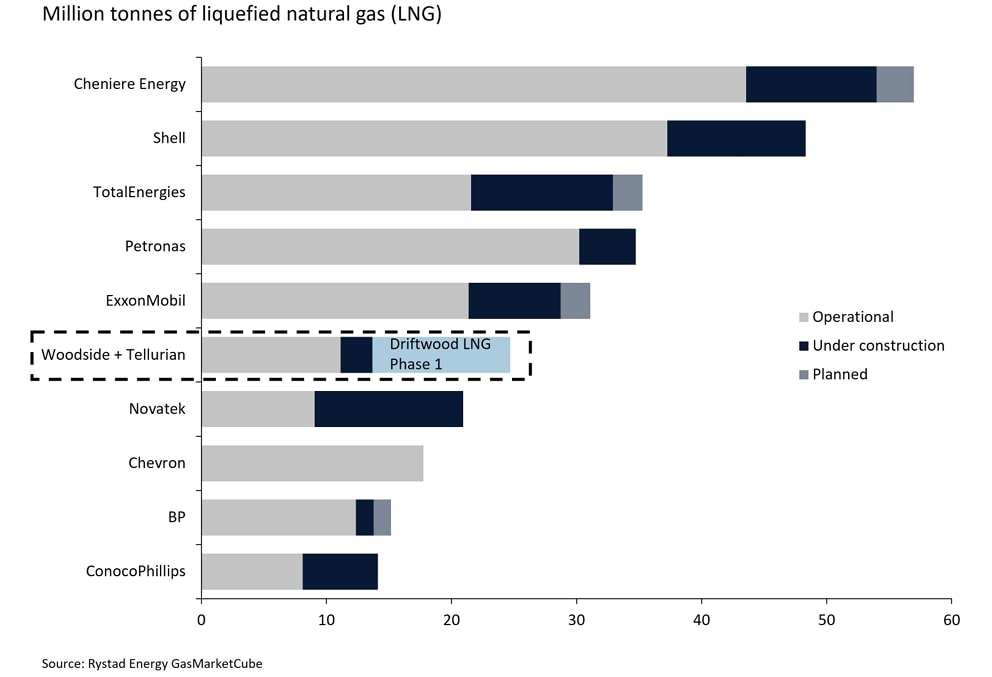

Woodside Energy Group Ltd.’s deal to acquire Tellurian Inc., which was struggling to develop its 27-million tonnes per annum (mtpa) Driftwood LNG project, not only boosts the presence of the Aussie company in the U.S. but creates a global liquefaction powerhouse to compete with the likes of Cheniere Energy, Shell Plc, TotalEnergies, Petronas and Exxon Mobil Corp.

The deal, revealed on July 21, consists of a total equity consideration of $900 million, or a cash offer of $1 per share, with an implied enterprise value of $1.2 billion, Woodside and Tellurian said in separate statements.

“By incorporating the first phase of the Driftwood LNG project, which consists of an 11 mtpa liquefaction capacity into Woodside’s existing 20-mtpa portfolio, Woodside will emerge as one of the largest global LNG suppliers by volume,” Daniel Toleman, research director for global LNG at Wood Mackenzie, said July 24 in a research note.

What differentiates this deal from others is that it’s the first time a major portfolio player has assumed full strategic control of a U.S. project, Toleman said.

“We have seen companies take strategic, non-operated positions in the past, but this move indicates that Woodside wants to determine its own future by taking control of one of the best remaining LNG development sites on the Gulf Coast,” Toleman added.

Located in Louisiana, Driftwood LNG is fully permitted with both a valid non-Free Trade Agreement (FTA) LNG export authorization from the Department of Energy (DOE), and a Federal Energy Regulatory Commission (FERC) authorization, which was recently approved for an extension.

Importantly, Biden’s LNG pause doesn’t impact the project.

Perth-based Woodside has a diversified, large-scale, low-risk portfolio with operations in Australia, Canada, the U.S. Gulf of Mexico (projects including Shenzi, Mad Dog and Atlantis), Mexico, Senegal, Timor-Leste and Trinidad and Tobago. In the piped-gas and LNG spaces, Woodside is focused on leveraging infrastructure to monetize undeveloped gas, including optionality for hydrogen.

Woodside CEO and Managing Director Meg O'Neill said the Tellurian acquisition was an attractive entry into a fully permitted pre-final investment decision (FID) development option with expansion potential. Pre-FID activities have incurred over $1 billion in expenditures to date, O’Neill said July 22 during a press conference with analysts and the media to talk about the transaction.

“Starting with our portfolio, this acquisition improves our already strong asset base, adding depth and optionality to our growth pipeline for the 2030s,” she said. “It positions Woodside to be a global LNG powerhouse, differentiated with significant exposure across both the Pacific and Atlantic Basins.”

“The Driftwood LNG development offers a pathway to complement our existing Australian LNG position, with an increase in material presence in the Atlantic Basin,” O’Neill continued. “This creates opportunity for value optimization and arbitrage between the basins, underpinned by multiple competitive cost of supply LNG sources.”

O'Neill said Woodside would also leverage its LNG development, operations and marketing expertise. “We will bring our multidecade track record as a world class LNG player and our strong relationships with key suppliers and customers,” she said.

RELATED

Exclusive Q&A with Woodside Energy CEO Meg O’Neill

Woodside’s offer came at a perfect time for Tellurian, which had seemingly fallen on hard times in recent years, to say the least.

Tellurian, under former executive chairman Charif Souki until he was ousted in December 2023, struggled financially to move forward Driftwood. Tellurian lacked both offtake agreements and equity backing. However, in May 2024, under the new leadership of Executive Chairman of the Board Martin Houston, Tellurian relaunched itself as a pure-play LNG company with the divestment of its Haynesville Shale upstream assets to Aethon Energy for $260 million. The Woodside deal followed in around two months.

With Tellurian’s liquefaction project not likely to be developed anytime soon, its decision earlier this year to sell its upstream assets extended its financial runway and also made the company a more straightforward acquisition target, Rystad Energy said July 23 in a research report.

Regarding Tellurian’s deal with Woodside, Houston told Hart Energy it was “the right deal for everyone.”

“We found a great buyer. Woodside is a great company, a great LNG operator, and I think they’ll be a great custodian of the assets going forward,” Houston said July 22 during an interview.

“With their very significant and well-established, well-regarded and well-run position in Australia, I think they are a global LNG force to be reckoned with,” said Houston, who was part of team that created Cheniere, which today boasts 45 mtpa of capacity with expansion plans slated to add to those volumes.

Driftwood LNG development plan

Wood Mackenzie’s base case scenario forecasts global LNG demand growing 53% by 2033, supported by China, emerging Asian markets and growth in Europe. The Tellurian acquisition significantly improves Woodside’s already well-positioned standing in the LNG space.

Under Woodside’s view, Driftwood LNG will consist of five trains in a phased development. Phase 1 will consist of two trains with processing capacity of 5.5 mtpa each. Phase 2, Phase 3 and Phase 4 will each consist of a single train with a processing capacity of 5.5 mtpa each.

Woodside aims to further debottleneck the first three trains from Phases 1 and 2 to increase capacity. Under the phased approach, Woodside plans to manage the pace of investment in subsequent phases, Daniel Kalms, Woodside’s International COO, said during the July 22 press conference. He said it also provides the ability to incorporate the latest technology in future phases.

The Driftwood LNG project also includes a 37-mile pipeline, which provides multiple options for sourcing low-cost feedgas from the Haynesville and other regions, such as the Eagle Ford.

Additionally, there is a second 780-acre expansion site further south that offers future development optionality. A second Driftwood LNG site could allow for an additional 30 mtpa in the future, subject to obtaining necessary permits and export authorization.

Kalms said Woodside currently estimates a development cost of $900 per tonne to $960 per tonne of capacity for Phases 1 and 2. This includes engineering, procurement and construction (EPC), owner's costs and contingency, but excludes the pipeline. That said, a fully developed Driftwood LNG, excluding the pipeline, could require a minimal investment of $24.8 billion to $26.4 billion.

Woodside expects to complete the Tellurian deal in the fourth quarter 2024. The company is targeting FID readiness for Phase 1 in the first quarter 2025, Kalms said, “with a pathway to achieving the return targets of our capital allocation framework.”

Kalms said Driftwood had FERC approval until the second quarter of 2029.

“While several U.S. LNG projects are currently navigating challenges in light of the Biden administration's pause, the Driftwood LNG project's favorable position may propel it ahead in the pre-FID queue, reinforcing Woodside's strategic foresight in navigating the evolving dynamics of the LNG market,” said Wood Mackenzie’s Toleman.

O’Neill said that despite all the potential new LNG coming into the market, Woodside was well positioned to be competitive with other projects to capture the market.

Funding Driftwood

In the aftermath of Woodside’s transformational merger with Melbourne-based miner BHP in 2022, and now Tellurian, the company already had three near-term growth opportunities in the pipeline, O’Neill told Hart Energy in April 2024.

The projects include a massive liquefaction project at Pluto Train 2 in Australia, a deepwater project in Mexico at Trion and another deepwater project in Senegal at Sangomar. Of the three, the latter is already online and the two in Australia and Mexico will come online within the next five years.

Woodside’s purchase of Tellurian could re-prioritize the Australian company’s project pipeline, potentially sidelining Browse, Australia’s largest untapped conventional gas resource, according to Rystad. Rystad expects Woodside to invest around $21 billion between 2024 to 2030. If Driftwood LNG Phase 1 is developed with 100% equity, total investment could exceed $30 billion.

“It would make Woodside the sixth biggest public player in the world by net liquefaction capacity by 2030 and the fourth largest when excluding national oil companies and infrastructure players,” Rystad said.

Woodside has a strong underlying business generating significant cashflows, a robust investment grade credit rating and a strong balance sheet.

O’Neill said Woodside’s balance sheet was “in great shape with approximately 13% gearing at the end of June, which is at the lower end of our target range, and liquidity of approximately $8.5 billion.”

Woodside doesn’t intend to use any project financing, according to O’Neill. The company expects to bring in high-quality partners to Driftwood LNG and is targeting an equity sell-down of around 50%.

“We have multiple pathways to funding, including bringing in strategic partners to reduce our equity exposure in this project. We have already received multiple inbounds from companies interested in working with us in the U.S. LNG market,” O’Neill said.

According to Rystad, citing media speculation, potential suitors could include Saudi Aramco and ADNOC, as well as Japanese LNG buyers.

But Rystad warned that Woodside’s ability to reach FID by first quarter 2025 was ambitious. Woodside must first complete the acquisition and finalize the EPC contract with Bechtel, while it simultaneously works to sell down its equity, the consultancy said.

“While Woodside's involvement improves the prospects of achieving Driftwood's FID, challenges remain,” Rystad said.

Recommended Reading

Tech Gains Show Up in Emissions Reductions, Midstream Efficiency

2025-04-23 - Midstream giants Williams and Enbridge have deployed better equipment and AI to ensure more fuel gets to where it’s supposed to go.

Stonepeak Launches Data Center Company Montera Infrastructure

2025-04-23 - Stonepeak has committed $1.5 billion to Montera Infrastructure to develop and operate data centers in metro areas.

Drones Proving to be More than Just a Toy in Chevron Operations

2025-04-22 - Chevron Corp. has partnered with drone maker and operator Percepto to get a better look at its operations in two U.S. basins.

Aris Takes on the Permian’s ‘Wall of Water’

2025-04-21 - Aris Water Solutions CEO Amanda Brock rings the alarm bell on the Permian’s water takeaway and recycling challenges and how they can be solved.

Halliburton, Nabors Collab to Deploy Drilling Automation in Oman

2025-04-15 - The companies integrated Halliburton’s Logix automation with Nabors Industries’ SmartROS rig operating system.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.