Bryan Sheffield first heard of an Australian shale opportunity in 2013.

He heard about it from his dad—Scott Sheffield, a more than 40-year wildcatter and the now-retired founding CEO of Pioneer Natural Resources, which was sold to Exxon Mobil in May.

The elder Sheffield had contacts in and out of Australia for years. Pioneer’s predecessor—Midland-based Parker & Parsley Petroleum, which was co-founded by the younger Sheffield’s late grandfather, Joe Parsley, who retired in 1984—bought Australia-based Bridge Oil in 1994 for some $330 million.

At the time, Parker & Parsley put Bridge’s U.S. property into its own operations and made the Bridge entity its international subsidiary. Bridge’s portfolio included production from conventional rock in the Timor Sea offshore Darwin.

When Bryan Sheffield’s dad bought Bridge, “my father brought us to Australia a couple of times when I was in high school while he was growing the asset there. We spent a lot of time in Sydney and the outer areas.”

He enjoyed it and was anxious to return. After graduating from Southern Methodist University in 2001, he found a Sydney-based energy-sector job with Credit Suisse First Boston.

Later returning to the U.S., he continued to work in finance until 2006 when starting school at Pioneer to learn how to make oil and gas wells. In 2008, he founded Parsley Energy, starting with Midland Basin wells his grandfather owned.

In 2013, his dad phoned. “He said, ‘Bryan, I saw some logs. I’ve never seen anything like this in all the fields in the world.’”

The elder Sheffield had built producing properties from West Texas to Tunisia, Argentina, South Africa and Canada before eventually refocusing Pioneer to its Permian Basin roots upon U.S. wildcatters’ success in extracting oil from tight rock.

He continued, “It’s stacked pay.” The reservoir is dry gas and looked like the Marcellus Shale, he added.

Bryan Sheffield was intrigued but said, “I’m about to IPO. I have to focus on the Midland Basin.”

Yet it was noteworthy—for more than the play’s description. “You could tell that he was excited. We always talked about the Permian Basin. For him to talk about something in Australia, I took a mental note.”

Enter Aubrey

In 2015, Aubrey McClendon was on the front page of the Wall Street Journal—for buying into Australian shale gas. The late co-founder of Chesapeake Energy had been at the front of land grabs in nascent U.S. shale plays, namely the Marcellus and the Haynesville.

With a new startup, American Energy Partners, McClendon signed a deal to farm into the Beetaloo Basin.

The basin’s 11,000 sq miles are the equivalent of a dozen Midland Counties.

“And I am so upset because Aubrey has money and he’s beating us on every Midland Basin deal [too] right now,” Bryan Sheffield said.

“I could have been ahead of Aubrey. I could have beaten him, gone in and picked up some acreage for cheap halfway around the world. My father told me about it two years before.”

McClendon died in 2016, “and the play kind of fizzled during a Northern Territory frac moratorium.” The pause was lifted in 2018, but momentum had been lost.

And Sheffield was still busy building his Parsley Energy, which he sold in January 2021 for $7.6 billion to Pioneer.

Again, the Beetaloo

Australia found Sheffield again in 2020, while the Parsley sale was signed but not yet closed. “Funny enough,” he said, “Tom Layman, one of the most conservative geologists I’ve ever met who I recruited from Chesapeake, told me at the end of 2020, ‘Bryan, I just saw logs.’”

Layman had retired from Parsley in 2019. “He’s very conservative. Everything he did was low-risk. He was very careful.”

Sheffield had signed a confidentiality agreement with Sydney-based Tamboran Resources when considering whether to invest in the E&P. That Layman was enthusiastic about what he saw in the logs “caught my attention because I know that when a conservative geologist says there’s something I should look at, then I should look at it.”

The logs were from the Beetaloo. It was stacked pay. “And that makes me feel better because, if one horizon doesn’t work, at least you have a chance to try to make another horizon work.”

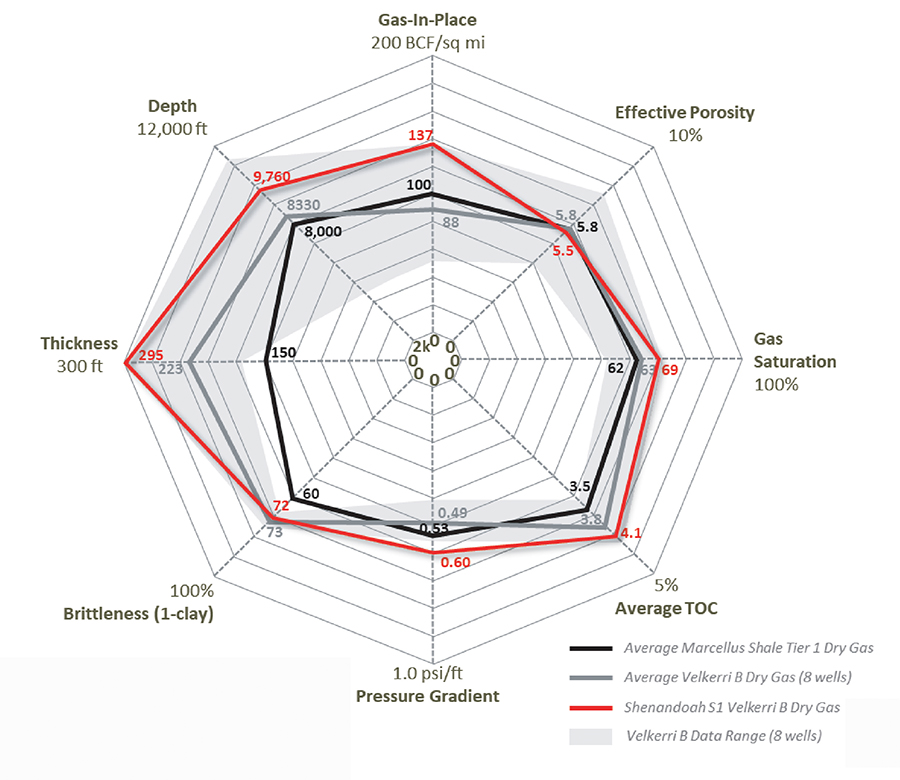

The rock of interest—the Velkerri—is similar to the Marcellus Shale. Total organic carbon (TOC) is up to 12%. Bottomhole pressure is 0.6 psi. Porosity is good.

Sheffield called Tamboran’s chairman, Dick Stoneburner. On the one hand, Australia was off Sheffield’s radar: He was building Formentera Partners, buying proved developed producing property onshore the U.S. with a model of paying out profits. He wasn’t wildcatting.

“So, I did a personal private placement with Tamboran.” The 7.4% stake closed in November 2021 for $20 million.

Now having equity in the Beetaloo, he bought into another interest-owner, Falcon Oil & Gas, which had a non-op in the same property with partner Origin Energy. The 8.66% stake cost $10 million. Sheffield gained an extra 2% overriding royalty interest for an additional $6 million. Falcon’s cash on hand at the time was $8.4 million.

“I bought into Empire [Energy Group] also. I’m trying to spread my chips with all the players,” Sheffield said.

Then, Origin, a top Australian utility, decided to divest its gas E&P business and focus on its power business.

In deals with Sheffield, Falcon and Origin, Tamboran became the largest Beetaloo acreage-holder, totaling 1.9 million net of the 4.7 million gross that are contiguous within the 7-million-acre basin.

And Sheffield became Tamboran’s largest shareholder with 16.7% of outstanding common. At press time, the E&P planned to list on the NYSE in a U.S. IPO.

Stoneburner’s entrance

Stoneburner got involved in the Beetaloo when approached to join the Tamboran board in 2014. He was scheduled to speak at Hart Energy’s DUG Australia conference in Brisbane that August.

He held renown Down Under as the geologist who was a lead developer of the Haynesville Shale with Petrohawk Energy beginning in early 2008, then making the Eagle Ford Shale discovery later in 2008.

He was already connected to Australia by way of BHP Billiton, which bought Petrohawk in 2012 for $15.1 billion. Stoneburner had stayed on for a year post-closing as president of BHP’s new North American shale division that consisted of the Petrohawk asset.

After the Hart Energy conference, Stoneburner dropped into Sydney to meet with Tamboran.

Joel Riddle, CEO, had joined the E&P in 2013. Prior, he had worked for offshore explorer Cobalt International Energy in the Gulf of Mexico and West Africa, and began his career in 1997 with Exxon Mobil, later joining Unocal and Murphy Oil.

Pat Elliott, Tamboran chairman, had formed the Beetaloo explorer in 2009 after having success in Australian coal-seam gas.

Stoneburner said of the visit, “I met Pat, Joel and a few of the other board members.” That was mostly the extent of the team. “It was a pretty bare-bones group.”

Tanumbirini #1

When Riddle had joined a year earlier, Tamboran’s exploration licenses ranged from eastern Australia to Ireland, Northern Ireland and Botswana.

Riddle said, “We had a pretty colorful portfolio at the time. I spent the first six months in the job locked in a room with my technical team, which at the time consisted of a few consultants, and I had them explain or attempt to explain the technical rationale for all the assets we owned.”

Riddle proposed to the board that Tamboran fully focus on the Beetaloo. Its sole interest in the basin was 25% in a permit in which Santos was the operator.

By 2014, when Stoneburner visited, Santos had just drilled the Tanumbirini #1 vertical.

Stoneburner looked at the log. “While we didn’t have a full analysis,” he said, “it looked very attractive.

“That got me even more interested: It wasn’t just a speculative play, but a real play based upon the first contemporary log, really, being run in the basin.”

Stoneburner joined the board. Elliott and Riddle were also able to recruit another geologist, Fred Barrett, who had co-founded U.S. tight-gas developer Bill Barrett Corp.

In 2021, Stoneburner became chairman, prior to Tamboran’s Australian IPO.

“Pat had been chair since the beginning in 2009,” Stoneburner said. “The general rationale was, as we were going public, to have an American chairman with some name recognition within Australia.

“Not that Pat didn’t have it, but I kind of fit the bill. So, I became chairman.”

Precambrian

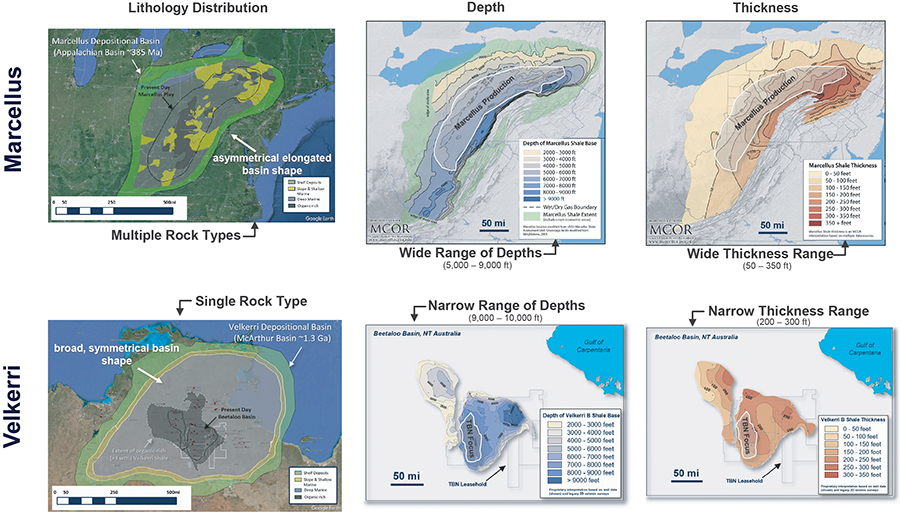

The story of the Beetaloo is nearly as old as Earth itself. The rock of interest—the 2,600-ft-thick Velkerri—was deposited some 1.4 billion years ago in the Proterozoic eon of the late Precambrian era.

At the time, the Velkerri was a sea of blue-green algae before Pangaea was formed. The eon spanned some 2 billion years, culminating with the Cambrian Explosion about a half-billion years ago.

“There aren’t near as many critters, if you will, living about 1.4 billion years ago,” Stoneburner explained. “Life didn’t really explode until about 600 million years ago. And since then is when most of the North American shale reservoirs were deposited.”

For its age, one would think the Velkerri would be over-mature, but “these rocks don’t know how old they are,” Stoneburner said.

Core pulled by past explorers contained “weird fossils,” geologists Matthew Silverman with Denver-based Robert L. Bayless Producer and Thomas Ahlbrandt with Australia’s Falcon told fellow geologists in 2011 in an American Association of Petroleum Geologists presentation.

They described the Beetaloo as an aborted rift basin rather than an intracratonic sag.

Stoneburner said, “This is the only 1.4-billion-year-old sedimentary rock that has been preserved in the world. There aren’t a lot of sedimentary basins around that are Precambrian.

“Before Cambrian, there’s just not a lot of sediment. You have granitic rock. But then, you have something like the Velkerri where you actually have preserved, 1.4-billion-year-old rock.”

Middle Velkerri B

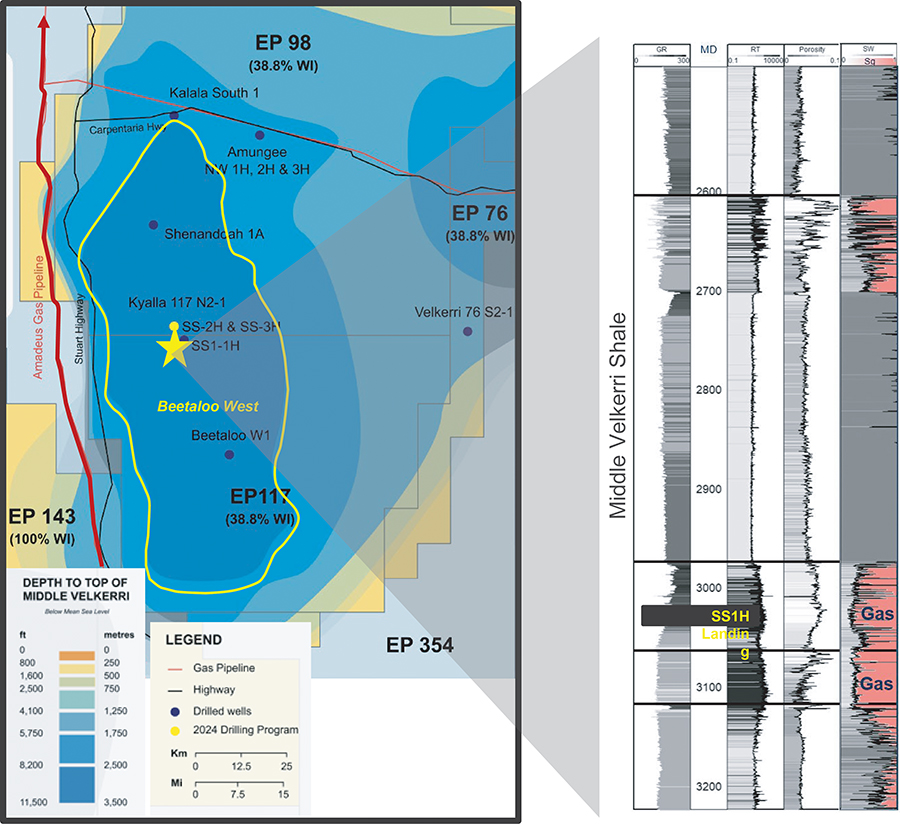

The lateral target is primarily the Middle Velkerri B at between 8,000 ft and 11,000 ft. “It’s probably three to four times older than the oldest shale reservoir in North America,” Stoneburner said.

“I wasn’t concerned about the generation of what we call thermal gas as opposed to biogenic gas. What I was concerned about was that it would be over-mature—that you would have a basin that’s that old, that you’re either going to have the gas diminished or potentially a lot of inerts.

“You could have a lot of CO2; you could have a lot of nitrogen, which is common in Australia to begin with.”

Instead, vertical and horizontal tests showed the gas to be 92% methane with between 2% and 4% CO2. “So, you have very high-quality gas that we don’t have to process any liquids out of. We basically just have to strip the CO2.”

The Velkerri C member also tested well. “It’s very comparable,” Stoneburner said.

Unchanging facies

The Beetaloo’s core of 5 million acres became concentrated through uplifts, erosion and other geological events. So, facies are unchanging in the acres.

“You just have a core area that you can kind of depend on being pretty consistent,” Stoneburner said. “In this case, you have 5 million acres. It’s the core of the basin; everything else is gone. This is just one solid blue-green algae in three different [Velkerri A, B and C] blankets.”

For horizontal development, “this is as good as it gets. There’s very little faulting. It’s a very quiet basin.”

It’s not your typical sweet spot. Riddle said, “The whole basin is sweet.” In holes made in the Velkerri north, south, east and west, “there it was, right where it was supposed to be.”

Pressure rather than rock quality will define the basin’s tiers in the case of the Beetaloo, Stoneburner said. At the core’s northernmost end, it’s 0.43 psi per foot, while other wells show 0.6 psi.

The lower-pressure area will work, “but it’s just not going to work as well as a rock that’s got 0.6. You pack more gas in 0.6 than you can in 0.43,” Stoneburner said.

“So, you’re going to get higher flow rates and higher EUR. They’ll both work, but pressure always creates a better volume, a better resource.”

The surface- and minerals-rights situation is also quiet. The Northern Territory owns the land and minerals. “It’s similar to what you might see in the Gulf of Mexico,” Riddle said. “There’s no private land out here.”

The terrain is quiet, too. Across the 5 million acres, there’s no remarkable difference in elevation or vegetation. The 5 million acres are “flat scrub. It’s development-ready,” Riddle said.

As for the surface lease-holders, four ranches hold 99-year leases on most of the land.

The wells

Tamboran’s data points come from 21 wells that have been drilled through the Middle Velkerri by it and others. Tamboran participated in seven; it’s the operator of four.

Its newest well, Shenandoah South #1H, was drilled in August by a Helmerich & Payne shale-level super-spec FlexRig3, flowing 3.2 MMcf/d its first 30 days from a 1,644-ft lateral in a 295-foot section of Middle Velkerri B. It underwent a 10-stage frac.

The 60-day rate was 3.0 MMcf/d; the 90-day rate, 2.9 MMcf/d.

Normalized for a 10,000-ft lateral, the 30-day rate would have been 19.5 MMcf/d.

The pressure gradient was approximately 0.6 psi per foot; the initial wellhead pressure, 4,611 psi.

Tamboran has a 38.75% working interest; its partners are Sheffield’s Daly Waters Energy and Falcon.

The rig reached total depth in 21.5 days, averaging 500 ft per day.

Another new well, Amungee NW #3H, was drilled by H&P in September but it’s been DUC’ed, awaiting arrival of a Liberty Energy frac spread later this quarter.

The #3H hole was made from the same pad as the year-old Amungee NW #2H that was drilled by another rig operator in 38 days. The H&P rig did the newer job in fewer than 18 days—the fastest rate yet in the Beetaloo, according to Tamboran.

The Tanumbirini #1V, drilled in 2014, was completed in 2019 and flowed 1.2 MMcf/d, settling to 0.4 MMcf/d. After a COVID-related shelter-in-place order was lifted, the well was reopened, flowing 10 MMcf/d initially and averaging 2.9 MMcf/d in its first 90 hours.

Two Santos-operated horizontals that were made in 2021—Tanumbirini #2H and #3H—flowed 2.1 MMcf/d and 3.1 MMcf/d, respectively, in their first 30 days from between 2,000 ft and 2,200 ft of lateral in each. The #2 had been on test longer without tubing yet, resulting in reduced reservoir pressure when formal testing began.

The 10,000-ft rate would have been 9.5 MMcf/d and 15.5 MMcf/d for the two wells. Tamboran was non-op in these with 25% working interest in each.

“The Tanumbirini #3H ended up being the best flow rate the basin had seen up until that point in time,” Riddle said.

A U.S. shale job

The laterals weren’t very long, but it was clear that the early wells’ design wasn’t correct for a true U.S.-style shale completion, Stoneburner said.

“There are two things any horizontal shale well needs: 5.5-inch casing and, in a reservoir of this depth and this pressure, 15,000-pound wellhead equipment.”

Combined, up to 100 bbl can be pumped into the lateral per minute in that treatment. Santos had the 15,000-lb equipment but the casing was 4.5 inches.

“They would only get 60 barrels a minute,” Stoneburner said.

Tamboran also made a hole in the Beetaloo with 5.5-inch casing but had 10,000-lb equipment. “So, it was also hamstrung, if you will, in pumping the rate that’s necessary to effectively stimulate the rock.”

Tamboran’s recent Shenandoah South #1H is the first well to have been made with both 5.5-inch casing and 15,000 lb. Riddle said, “So, the performance is a 65% greater flow rate than Tanumbirini #3H.”

Stoneburner added, “And a much flatter decline.”

H&P, Liberty Energy

The trouble with getting both the hole and the frac to U.S. shale standards was behind Tamboran’s push to enlist U.S. shale driller H&P and pressure-pumper Liberty Energy into the Beetaloo.

Riddle said, “Our mindset was that we have to import the technology that had been developed for the last 20 years.”

In addition to making a $14.1 million investment in Tamboran in 2022, H&P sent a FlexRig3 last year. It’s operated by both the crew onsite and remotely from H&P’s Tulsa, Okla., headquarters.

While the short-lateral Shenandoah South #1H and the Amungee NW #3H were each drilled in about 18 days, the vertical Tanumbirini #1 had been drilled in 2014 in 100 days.

The H&P contract is for one FlexRig until August 2025 with a 10-year option for up to five additional rigs.

Pressure-pumper Liberty Energy followed H&P with a $10 million investment last year and had a frac spread on a ship to Australia in mid-June. Liberty has a two-year preferred-supplier deal.

Tamboran’s Shenandoah South #1H last year had a D&C cost of $19 million. The next wells are expected to D&C for $26 million with 10,000-ft laterals and bigger frac jobs, including more stages.

Later wells, upon moving into manufacturing mode, are expected to cost $16 million each at 9,800-ft depth and 60 stages.

Next plans

Having the H&P rig now, Tamboran’s laterals going forward will be 2-milers, Riddle said. At some point, it expects to make 3-mile laterals.

Two new-drills are expected by year-end, resulting in two drilling spacing units (DSUs) totaling 51,200 gross acres around one of the new wells, Shenandoah South #2H.

The 23 pads and six wells per pad will result in 138 wells, Tamboran reported.

For proppant, it hopes to have a local sand mine in place in 2025. Prospective locations are numerous in the field, it reported.

Baker Hughes is also providing services for the wells planned for this year and next. Also having a presence in Australia are Halliburton and Schlumberger, “so we’re not going to be short of potential options for oilfield services,” Riddle said.

All of Tamboran’s wells are shut in for now. It plans to put in a 40 MMcf/d gas compression and dehydration plant and lay a 20-mile pipe to the nearby Amadeus pipeline. The 40 MMcf/d is expected to be online in the first half of 2026.

The pipe runs along the western side of Tamboran’s acreage, traveling north to Darwin and beginning some 600 miles south near Alice Springs. It also provides access to Australia’s East Coast gas market, which is expected to be short gas later this decade.

Stoneburner said, “Think how fortuitous it is that we found the best part of the field and it’s only 20 miles away from 12-inch pipe.”

Up to 2 Bcf/d

With takeaway in place, Tamboran expects to drill up to 200 wells. Eventually, capacity is to total up to 2 Bcf/d.

Amadeus’ owner, APA Group (not related to Apache Corp. owner APA Corp.), plans to lay a new, northbound, 42-inch pipe alongside the existing pipe and a new 30-inch pipe to the southeastern Australian market.

A gas field at Alice Springs, Mereenie, had supplied the Northern Territory gas market, beginning some 30 years ago.

“But over time, that field has reached legacy status with limited upside,” Riddle said.

An offshore field, Blacktip, operated by Italy-based ENI SpA, was supplying the Northern Territory with gas, but it’s drying up. The Northern Territory’s power producer, Power & Water Corp., has been taking gas instead from a Darwin LNG plant under a pre-existing emergency-services agreement.

Once Tamboran’s volume to satisfy indigenous demand is assured, its excess production will be sold as LNG.

‘Something new’

In April, the awaited Liberty frac spread was being refurbished to make it remote-operations-ready. As of mid-June, it was expected to arrive in Australia later this summer.

Liberty had been asked for frac spreads abroad before, “but we’ve always had all of our fleets busy,” said Chris Wright, chairman and CEO.

“We’ve never had any spare equipment and I’m never willing to go to a customer and say, ‘Hey, sorry, we got better work overseas. We’re taking your fleet away.’”

But Liberty is building new digiFrac fleets now. “We have some older equipment coming off the back end that’s going to be idle.”

So it agreed to send one to Australia. The other reason Wright was convinced, “really, is Bryan Sheffield,” he added. Parsley Energy had been a good customer.

Sheffield got in touch with Wright about needing a modern frac spread in Australia. “Hey, look, I want to make this Beetaloo Basin work,” he told Wright.

The opportunity reminded Wright of the mid-1990s. At the time, his Pinnacle Technologies was part of an East Texas Cotton Valley breakthrough: a water frac on tight gas.

Prior best practice had held that a gel frac was necessary in the Cotton Valley. An operator, Union Pacific Resources Group, did a mostly water frac on a well. The cost fell from $4 million to $1 million. The gas flow was the same or more after 14 months online.

The idea was taken to George Mitchell, whose Mitchell Energy & Development Corp. had been trying for more than a decade to make economic amounts of gas from the Barnett Shale.

Mitchell gave the water frac a try. It worked. From there, the U.S. shale-gas revolution began.

“It was something new, getting economic gas out of shale,” Wright said.

‘Go’ boxes

Taking the American shale revolution on the road the past two decades, though, has been impeded in various countries by myriad facts. Most of the time, it’s the lack of economic amounts of hydrocarbon resource or the resource is stranded.

But in some areas, there is a ban on hydraulic fracturing or a political regime known for ignoring contracts and property rights.

Australia is different, though. It checked Wright’s “go” boxes.

“And this is a giant basin,” he said. “This is gas-in-place similar to the Marcellus.”

While Australia’s offshore production puts it among the top three LNG exporters, its population center in the southeast is increasingly gas-short. “They need new gas or they’re going to be importing gas from their own northern and western [LNG] coasts.”

Liberty President Ron Gusek told Hart Energy in April, “H&P was out in front of us by a year. They shipped the rig [to Australia] last year and we will ship the frac fleet this year.”

The North American frac fleet is unparalleled, he added. “The amount of work that gets done on a daily basis in North America is unrivaled.”

The Australian opportunity “is intriguing to us. The potential scale of the Beetaloo Basin is really quite something … I don’t know how that will play out. We shall see. It’s very early days … with only a handful of wells there.

“But it’s geographically well-located [near] the Asian [LNG] market. So, we view that as quite an exciting possibility.”

‘That exact room’

The Beetaloo’s depo-center is flanked on the west by the town of Daly Waters. In time, Riddle said, “that’s going to be ‘The Town.’”

Visiting Daly Waters virtually via Google’s street view is remarkable for the odd appearance of structures and an intersection—and both of the roads are paved.

Otherwise, the 1,900-mile highway from Adelaide to Darwin features hypnotic sameness—red soil and brush—awakened at times by three-trailer-plus road trains.

The basin’s population is about 1,500 people—about one person per 7 sq miles.

The town is “on the map,” though: the Australian hikers’ pub map, that is.

Daly Waters Pub, established in 1930, is somewhat legendary in the outback. Anyone who’s traveled through will have at least a handful of images from the watering hole on their iPhone.

“We focus on the important things in life, such as cold beer and filling [the] wine glass up past the line,” the pub advertises. The beer is very good and “no one is entirely sure why,” but “between you and me, it’s probably more because it’s bloody hot outside and you’re in the middle of the outback.”

There’s beef ’n barra on the barbecue, “the loin of kangaroo will get you hopping and the crocodile slider might make you a bit snappy.”

Tim Carter, the owner, expanded the pub to include a motel, cabins, bunkhouses and campgrounds. “Unattended children will be given an energy drink and taught to swear,” a sign warns.

Visitors leave a flag from their home country and a bra.

When at the Shenandoah South #1H drill job last year, Sheffield spent a night at Carter’s camp. The place is other-worldly. “It’s a movie,” Sheffield said.

Carter has cattle horns affixed to his electric wheelchair’s steering wheel. His riding companions include Kevin, a chocolate lab; Black, a goat; and Polly, a horse. Kevin often rides; Polly eats from a bucket Carter hooked onto one of the horns.

Sheffield said of his visit, “I came out of my room and [Carter’s] looking at me, sitting there waiting for me. He said, ‘Did you know that a man named Aubrey McClendon was here a few years ago, staying in that exact room?’”

Full stop.

Sheffield began talking to Carter. “He said, ‘When is this play going to happen? Aubrey came and now you’re here in the middle of the outback.’”

Sheffield told him, “It’s going to happen. It just takes time. I’m working on it.”

[sidebar]

Decades in the making

When Bryan Sheffield looked at logs in 2020 of Beetaloo wells, it meant that other operators had looked at it before.

So why was the basin still open for new entry?

Sheffield, who was in the midst of selling his Permian-focused Parsley Energy at the time, said, “That’s what I wanted to know: Why hasn’t someone else picked it up?”

Altogether, operators and non-op partners have spent more than $600 million exploring the Beetaloo, according to a Tamboran Resources Corp. estimate.

Denver-based Robert L. Bayless Producer identified the Beetaloo as a shale basin in the mid-1990s, said Dick Stoneburner, Tamboran chairman.

“This is before the Barnett,” Stoneburner noted. “This was very pioneering on [the late] Rob Bayless’ part to identify a shale reservoir in Australia before much had been done in the United States, certainly from a horizontal standpoint. These guys were ahead of their time.”

Pacific Oil and Gas had looked at the Beetaloo in 1984 and drilled 12 verticals into the Velkerri through 1993. But it tapped the basin’s conventional rock and results weren’t good enough. Pacific Oil left.

Next, Sweetpea Corp. picked up permits in the early 2000s and drilled the vertical Shenandoah #1 in 2007 but to only 5,000 feet and stopped.

Falcon Oil & Gas took over four permits in 2009. It re-entered and deepened Shenandoah #1, renaming it the #1A, to 8,900 ft. In 2011, it did the first hydraulic frac job in an Australian shale.

In 2011, Hess Corp. farmed into Falcon permits. Hess had to leave a few years later, though, when activist investor Elliott Management persuaded it to sell down to only the Bakken and Guyana.

South Africa’s Sasol partnered with Falcon, drilling three verticals and one horizontal in 2015 and 2016.

Around that time, Pangaea Resources drilled some wells in the westernmost Beetaloo. And Tamboran farmed out 75% of one of its permits to Santos.

Then the Northern Territory put a pause on completions. Very little was done in the Beetaloo for the next four years.

[sidebar]

Building the team, board

Faron Thibodeaux joined Tamboran Resources as COO in 2021. Joel Riddle, Tamboran CEO, had worked with him when they were both at Unocal, then Chevron in Indonesia.

From Indonesia, Thibodeaux had joined Apache Corp., working on the E&P’s assets in Egypt, Suriname and Australia. In 2014, just prior to Apache selling its Australian unit in 2015, Thibodeaux was put in charge of Apache’s Permian operations, thus he became well familiar with the rock, rig and frac spread needed to do a U.S. shale job.

For Tamboran’s COO job, “there was one call I made and it was to Faron,” Riddle said. “I consider Faron to be one of the best in the business.”

After enlisting Thibodeaux, Tamboran hired a team in 2021 out of Pioneer Natural Resources, keeping the group based in the Irving, Texas, area. Among them was Jaime Lopez, a Pioneer completion engineer who trained Bryan Sheffield in the aughts while Sheffield worked at Pioneer.

Sheffield’s grandfather Joe Parsley said in a 2014 interview with his University of Texas alma mater’s Cockrell School of Engineering that, before he wanted Bryan to take over his Permian Basin wells in 2008, he “didn’t know much about the oil business.

“So [Bryan’s dad] Scott [Sheffield] hired him at Pioneer and let him work with the engineers for a few months, with the geologists for a few months, out in the field for a few months, in accounting—he worked in all the departments that make up an oil company.”

Tamboran’s board filled out over the years, too. Joining Riddle were Tamboran founder Pat Elliott, U.S. shale developer Dick Stoneburner and Fred Barrett, co-founder of U.S. tight-gas operator Bill Barrett Corp.

Joining since 2014 are John Bell, Helmerich & Payne’s senior vice president of international and offshore operations; Ryan Dalton, who was CFO at Bryan Sheffield’s Parsley Energy; Stephanie Reed, a partner in Sheffield’s Formentera Partners and who had been a Parsley senior vice president; Andrew Robb, a former Australian trade minister; and David Siegel, a senior adviser to Apollo Global Management.

While Bryan Sheffield owns 16.7% of Tamboran, investment manager CREF holds 10.6%. Additional shareholders include Morgan Stanley Australia Securities, 6.4%; an affiliate of The Baupost Group, 5.7%; H&P, 5.1%; Liberty, 4.6%; Siegel, 3.1%; Pat Elliot, 1.4%; and Riddle, 1.2%.

Recommended Reading

Woodside Awards SLB Drilling Contract for Project Offshore Mexico

2025-03-31 - SLB will deliver 18 ultra-deepwater wells for Woodside Energy’s Trion ultra-deepwater project starting in early 2026.

Energy Technology Startups Save Methane to Save Money

2025-03-28 - Startups are finding ways to curb methane emissions while increasing efficiency—and profits.

Kelvin.ai the 'R2-D2' Bridging the Gap Between Humans, Machines

2025-03-26 - Kelvin.ai offers an ‘R2-D2’ solution that bridges the gap between humans and machines, says the company’s founder and CEO Peter Harding.

NatGas Positioned in a ‘Goldilocks’ Zone to Power Data Centers

2025-03-26 - On-site power generation near natural gas production is the tech sector's ‘just right’ Goldilocks solution for immediate power needs.

AI Moves into Next Phase of E&P Adoption as Tech Shows Full Potential

2025-03-25 - AI adoption is helping with operations design and improving understanding of the subsurface for big companies. Smaller companies are beginning to follow in their footsteps, panelists said at Hart Energy’s DUG Gas Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.