Indonesia's national oil company, Pertamina. Indonesia is participating in several natural gas and carbon capture projects. (Source: Shutterstock.com)

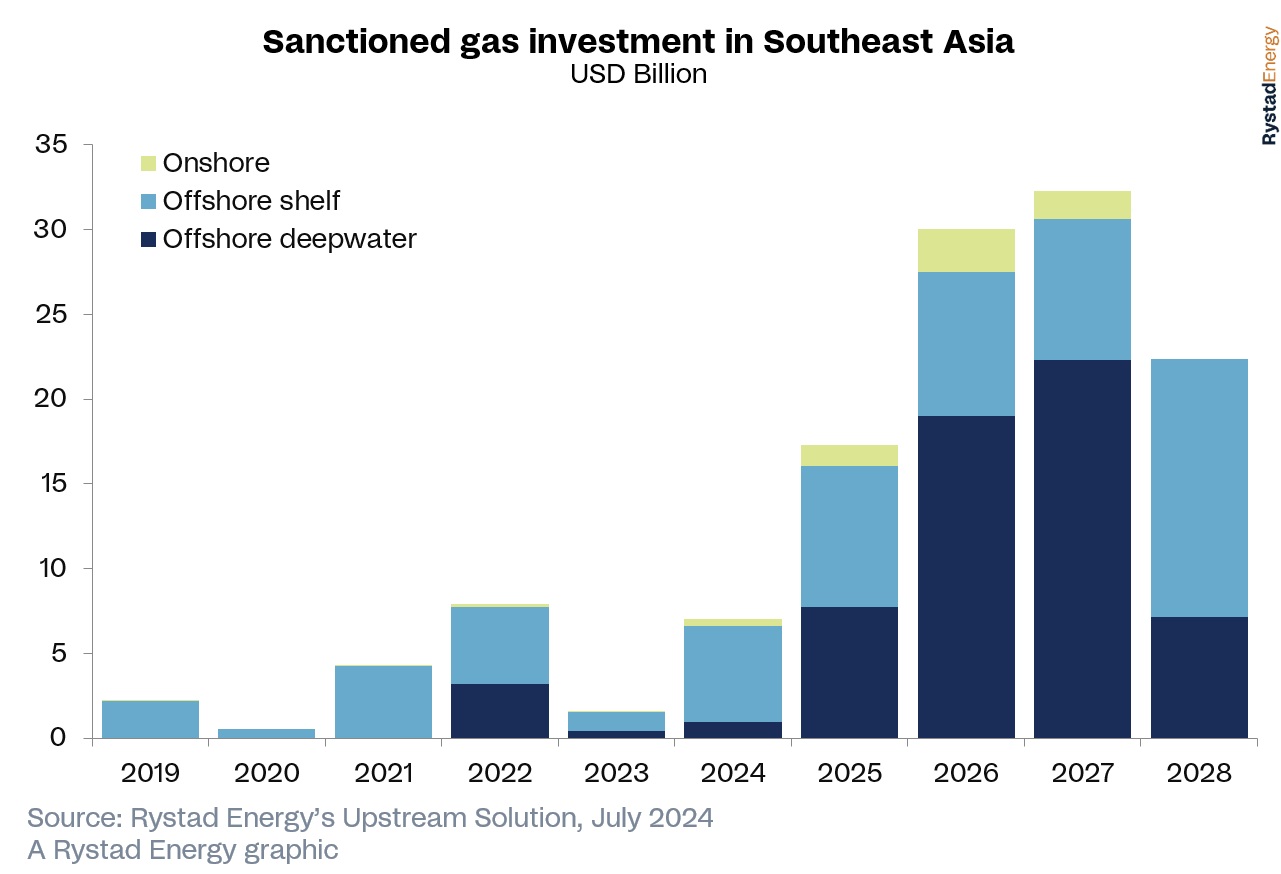

E&Ps are ramping up activity offshore Southeast Asia to increase natural gas output and meet long-term demand growth that could unlock a potential $100 billion in volumes, according to Rystad Energy.

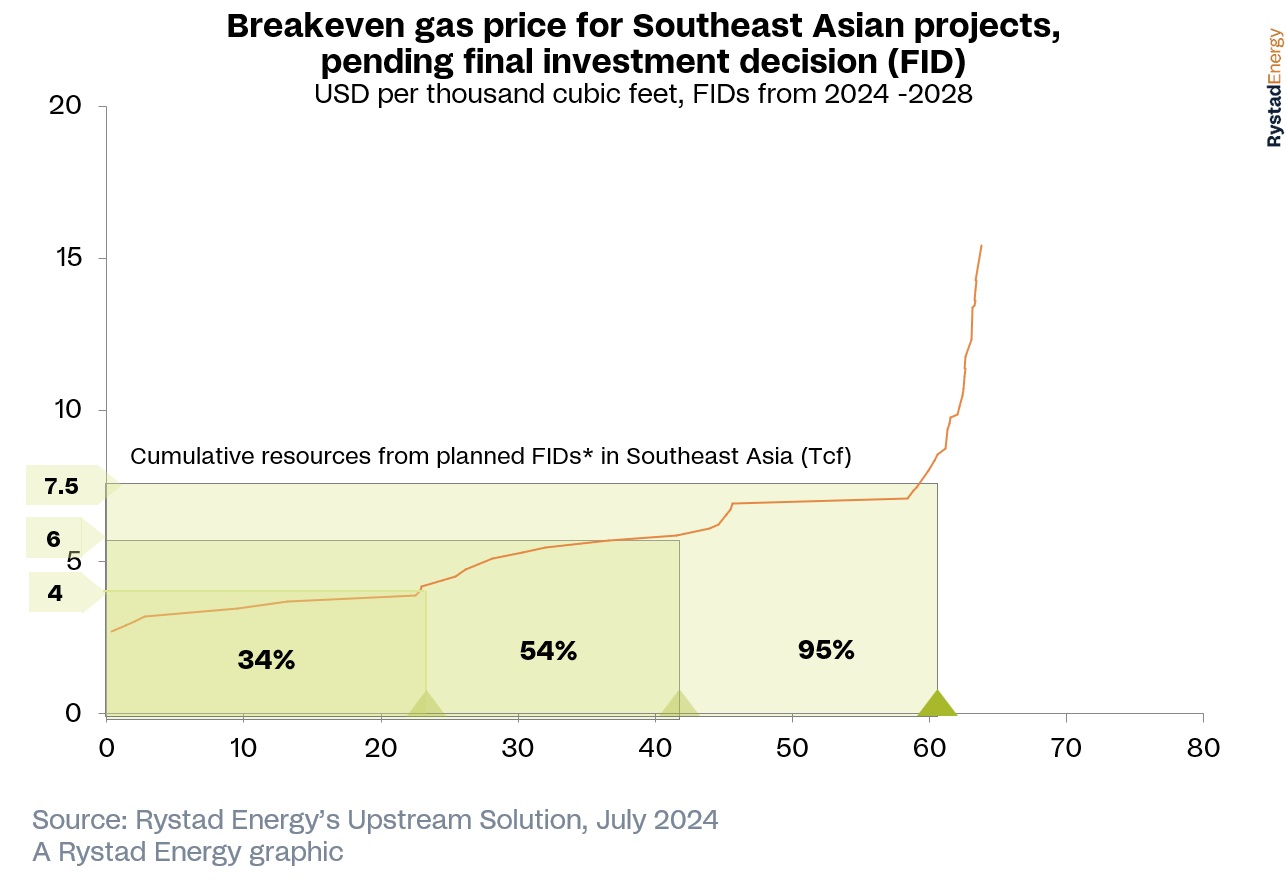

But development in the area will require high breakeven prices, Rystad said.

Asia is the U.S.’ second largest market for LNG exports, with an average 3.1 Bcf/d delivered last year — primarily to India, China, South Korea and Japan, according to the U.S. Energy Information Administration.

But regional projects in Southeast Asia stand to unleash by a “flurry” of final investment decisions (FID) by 2028, Rystad said.

“This represents a twofold increase over the $45 billion in developments that reached FID from 2014 to 2023 and signals a surge for the region’s offshore gas industry,” Prateek Pandey, Rystad Energy vice president of upstream research said in the report. “New carbon capture and storage (CCS) advancements will help meet the region’s sanctioning agenda.”

The region's gas sector anticipates substantial growth, with projected gas resources from FIDs set to rise to 58 Tcf by 2028 — a threefold increase from the five years spanning 2019 to 2024.

Growth hinges on efficiently monetizing recent discoveries and advancing delayed developments.

Despite a favorable investment climate, operators face economic challenges, particularly in deepwater and sour gas ventures. Rystad Energy analysis indicates that many projects require gas prices above historical averages of $4/Mcf to achieve profitability. Optimally, prices need to be closer to $6/Mcf, Rystad said.

At prices of $7.50/Mcf, 95% ofof planned developments would be economically viable, especially LNG projects in Indonesia and domestic supply initiatives in Vietnam, Rystad found. As of July 17, natural gas prices Japan Korea Marker (JKM) traded at $11.95 for the week of July 5, according to Reuters.

First, the FIDs need to come, which will require buckets of capital.

Oil and gas majors are expected to play a sizeable role in development, accounting for 25% of planned investments. Their role could expand to 27% following TotalEnergies’ substantial acquisition efforts in Malaysia. That despite the Paris-based company agreeing to sell in June subsidiary TotalEnergies EP (Brunei) BV to Malaysian independent E&P Hibiscus Petroleum Berhard for $259 million.

Further investment would come from national oil companies (NOCs), which would account for a 31% share, Rystad said.

East Asia's own upstream companies are emerging with a 15% share and have the potential for growth through a focus M&A as well as exploration, Rystad.

Southeast Asian countries have lately focused on the future of domestic production while limiting dependence on gas imports. Energy security and the transition to gas as a fuel have become growing concerns for governments in the region.

As Nicke Widyawati, president and CEO of Indonesia’s Pertamina noted at the World Petroluem Congress last year, the NOC’s priority is to maintain Indonesian energy security, “whatever the price.”

Pertamina has also invested in electric vehicles, biofuels and carbon capture and sequestration.

Indonesia is a standout among countries in the region when it comes to investment. Major projects include the Inpex-operated Abadi LNG, Eni’s Indonesia Deepwater Development (IDD) and BP’s Tangguh Ubadari Carbon Capture (UCC).

Along with recent discoveries in the East Kalimantan and Andaman provinces, the country’s projects are estimated to account for 75% of Indonesia's total offshore gas investments slated for FID, Rystad said.

“This significant increase positions Indonesia as a formidable contender to Malaysia's established dominance, although Malaysia continues to maintain robust activity levels with recent FIDs, exploration success and planned exploration efforts,” Rystad said.

Indonesia anticipates increased FID activity starting in 2025, bolstered by major projects spearheaded by global players such as BP and Eni.

Malaysia's upcoming FID projects underscore significant discoveries made since 2020, primarily managed by Petronas, PTTEP and Shell.

Recommended Reading

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Transocean President, COO to Assume CEO Position in 2Q25

2025-02-19 - Transocean Ltd. announced a CEO succession plan on Feb. 18 in which President and COO Keelan Adamson will take the reins of the company as its chief executive in the second quarter of 2025.

BlackRock CEO: US Headed for More Inflation in Short Term

2025-03-11 - AI is likely to cause a period of deflation, Larry Fink, founder and CEO of the investment giant BlackRock, said at CERAWeek.

Stonepeak Backs Longview for Electric Transmission Projects

2025-03-24 - Newly formed Longview Infrastructure will partner with Stonepeak as electric demand increases from data centers and U.S. electrification efforts.

Michael Hillebrand Appointed Chairman of IPAA

2025-01-28 - Oil and gas executive Michael Hillebrand has been appointed chairman of the Independent Petroleum Association of America’s board of directors for a two-year term.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.