(Source: Shutterstock, Matterhorn Express Pipeline LLC)

The Matterhorn Express pipeline, expected to help unclog the Permian Basin’s natural gas bottleneck for the next two years, has started flowing, according to one of the region’s E&P executives.

While a positive development for producers, the small amount of gas being moved has a ways to go before addressing the commodity’s regional price problems.

During a Sept. 3 presentation at the Barclays 38th Annual CEO Energy and Power Conference, Permian Resources co-CEO Will Hickey mentioned that a small amount of natural gas was flowing on the Matterhorn Express.

Hickey was discussing the negative natural gas prices at the regional Waha pricing point located near Pecos, Texas, when he dropped the news.

“[Waha price] been about as bad as it's ever been over the last few weeks,” he said. “But Matterhorn is online, moving little bits of gas and coming online in a real way over the next month or two.”

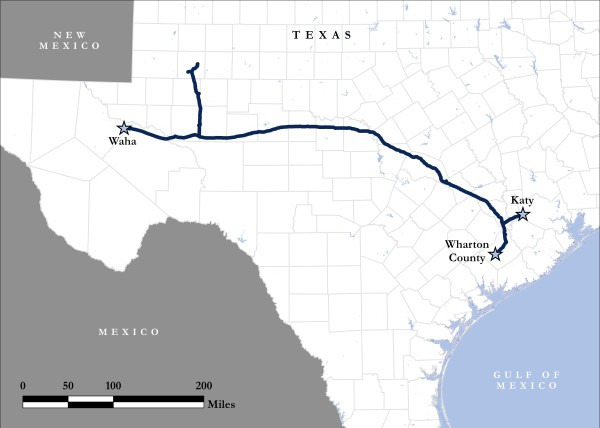

The Matterhorn Express is a joint venture between Whitewater Midstream, EnLink Midstream (recently acquired by ONEOK), Devon Energy and MPLX. At capacity, the line will be able to move 2.5 Bcf/d of natural gas from the Permian region to the Houston area.

The Permian is a crude-focused basin with associated gas produced as a byproduct of oil operations. In a shale play, the ratio of natural gas to oil increases as the well ages. Permian natural gas pipeline egress has been at capacity since the latter half of 2023.

That’s led to a lot of gas with nowhere to go.

As a result, the Waha Hub has set several records of dubious distinction over the past few months. Most recently, prices set a record daily average low of -$4.80/MMBtu on Aug. 30, about a week after hitting a record 26-day streak of negative prices.

For the past several weeks, analysts predicted the Matterhorn was nearing an in-service date. While gas may have started flowing on the line, it isn’t yet enough to make a dent in local prices.

“After trading back as far as -$8.60 last week, Waha cash basis improved to -$4.15 (on Sept. 4), while Katy and HSC (Houston Ship Channel) prices were relatively unchanged,” wrote TPH&Co. analyst Zack Van Everen in a commentary of the news. “This points to only a small amount of gas moving at this time.”

Once the line is fully in service, Everen said, the Waha price should move back into sustainably positive territory, while the prices at the Houston-area hubs should decline.

The new pipeline is expected to relieve congestion out of the area until 2026, when the recently announced 2.5 Bfc/d capacity Blackcomb Pipeline is expected to come online.

The line will be a real relief for Permian E&Ps. Hickey said natural gas rarely provides more than 5% of Permian Resources’ revenues “on a good day,” but even 5% is a decent contribution to his company’s bottom line.

“And, frankly, we’d like to sell gas for more than zero,” he said.

Recommended Reading

ADNOC Contracts Flowserve to Supply Tech for CCS, EOR Project

2025-01-14 - Abu Dhabi National Oil Co. has contracted Flowserve Corp. for the supply of dry gas seal systems for EOR and a carbon capture project at its Habshan facility in the Middle East.

Tamboran, Falcon JV Plan Beetaloo Development Area of Up to 4.5MM Acres

2025-01-24 - A joint venture in the Beetalo Basin between Tamboran Resources Corp. and Falcon Oil & Gas could expand a strategic development spanning 4.52 million acres, Falcon said.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

VoltaGrid to Supply Vantage Data Centers with 1 GW of Powergen Capacity

2025-02-12 - Vantage Data Centers has tapped VoltaGrid for 1 gigawatt of power generation capacity across its North American hyperscale data center portfolio.

Judgment Call: Ranking the Haynesville Shale’s Top E&P Producers

2025-03-03 - Companies such as Comstock Resources and Expand Energy topped rankings, based on the greatest productivity per lateral foot and other metrics— and depending on who did the scoring.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.