Endeavor was the largest, privately held pure-play operator in the Midland Basin, while Diamondback is a Permian pure-play focused on both the Southern Delaware and Midland basins. (Source: Shutterstock/ Endeavor Energy Resources/ Diamondback Energy)

Diamondback Energy’s $26 billion merger with Permian E&P Endeavor Energy Resources—bogged down for months under extensive review by the Federal Trade Commission (FTC)—has closed, creating what an analyst called “the last and best oil sandbox” in basin.

“We see a combined FANG/Endeavor as a unique ‘sandbox’ of large contiguous high quality Permian acreage,” Bernstein Research’s Bob Brackett said. A sandbox, in Bernstein Research’s vernacular, is a large single-basin resource with massive running room and the opportunity for focused technology to be applied in one place.

To get to this point, Diamondback endured two extensive reviews by the FTC. Along the way, there were reports by Bloomberg that the company, Hess Corp. and Occidental Petroleum, among others, were being probed by FTC investigators over their communications with OPEC.

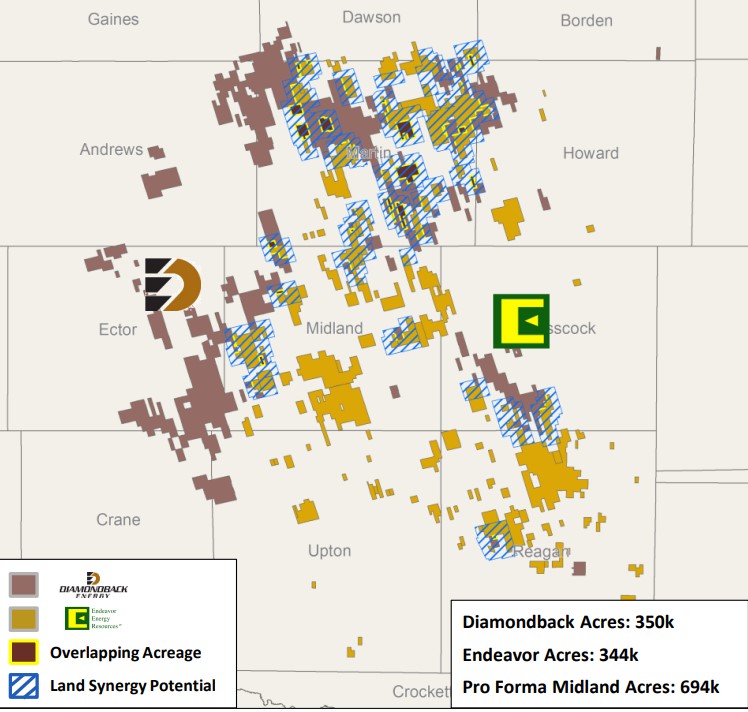

Based on Endeavor’s 344,000 net Midland acres and roughly 2,300 core drilling locations, Diamondback’s purchase price works out to about $31,200 per acre and $4.7 million per location, TD Cowen managing director David Deckelbaum has said.

Pro forma, Diamondback’s oil production will grow to 468,000 bbl/d (816,000 boe/d) from 273,000 bbl/d (463,000 boe/d). The company’s total Permian acreage will grow to around 838,000 net acres.

Diamondback’s cash-and-stock agreement creates a Permian juggernaut with a combined value of more than $52 billion in a merger of near equals. The transaction consideration, when initially announced in February, consisted of approximately 117.3 million shares of Diamondback common stock and $8 billion of cash, subject to customary adjustments.

Endeavor was the largest, privately held pure-play operator in the Midland Basin, while Diamondback is a Permian pure-play focused on both the Southern Delaware and Midland basins.

Diamondback said it sees annual synergies of $550 million, representing $3 billion in net present value over the decade. That includes capital and operating cost synergies of approximately $325 million; capital allocation and land synergies of $150 million; and financial and corporate cost synergies of approximately $75 million.

Endeavor was founded by wildcatter Autry C. Stephens, who died at 86, in August.

RELATED

Wildcatter at Heart: Autry Stephens (1938-2024)

Travis Stice, Diamondback chairman and CEO, said the transformative merger creates a “most own” North American independent oil company.

“Today, Diamondback is not only bigger, but better,” Stice said. “Our high-quality inventory located in the heart of the Permian Basin gives us the running room to do what we do best: turn rock into cash flow."

Stice thanked his employees for getting this deal across the finish line, and he welcomed Endeavor’s employees to Diamondback.

“Together, I am confident we can continue to build off of Diamondback's impressive operational track record of low-cost operations and position the new Diamondback for long-term success."

Bernstein initiated coverage on Diamondback following the deal’s close, saying that “during this critical M&A juncture for the shale sector” in which 4.6 MMboe/d have traded hands in the past two quarters, the Midland-focused Permian pure-play “was able to negotiate its own stock+cash transaction with the largest privately-held Midland shaleco, Endeavor Energy Resources (EER).”

“There is simply no other public oil company with such focused scale in the most prolific shale basin on Earth,” Brackett wrote.

Bernstein’s price target for Diamondback is $243 per share, 8% above consensus. The target was derived from applying a 6.5x enterprise value multiple to estimated 2025 EBITDA of $12.1 billion, incorporated $2 billion in dividends to reflect total shareholder return.

“Our bottoms-up NAV model places the value of combined FANG+EER Midland position at north of $65B. Scale deserves a premium in Midland (operational, drilling, completions efficiencies, and modest scarcity/takeout premium), so we apply a 6.5x multiple (in line with our previous favorite sandboxes).”

Recommended Reading

Belcher: Trump’s Policies Could Impact Global Energy Markets

2025-01-24 - At their worst, Trump’s new energy policies could restrict the movement of global commerce and at their best increase interest rates and costs.

CEO: TotalEnergies to Expand US LNG Investment Over Next Decade

2025-02-06 - TotalEnergies' investments could include expansion projects at its Cameron LNG and Rio Grande LNG facilities on the Gulf of Mexico, CEO Patrick Pouyanne said.

Belcher: Tariff Growing Pains Will Help US Achieve Energy Dominance

2025-04-03 - Tariffs may bring short-term pain, but Trump is aggressively pursuing goals that benefit the U.S., says Cornerstone Government Affairs’ Jack Belcher.

Burgum: Yes to US Power Supply, Reliability; No on Sage Grouse

2025-01-16 - Interior Secretary nominee Doug Burgum said the sage grouse is neither endangered nor threatened; he'll hold federal leases as scheduled; and worries the U.S. is short of electric power and at risk of losing the “AI arms race” to China and other adversaries.

Pickering Prognosticates 2025 Political Winds and Shale M&A

2025-01-14 - For oil and gas, big M&A deals will probably encounter less resistance, tariffs could be a threat and the industry will likely shrug off “drill, baby, drill” entreaties.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.