The Uinta Basin’s history is steeped in names that have come and gone, often departing for oil prizes unconstrained by the Uinta’s takeaway issues of the past.

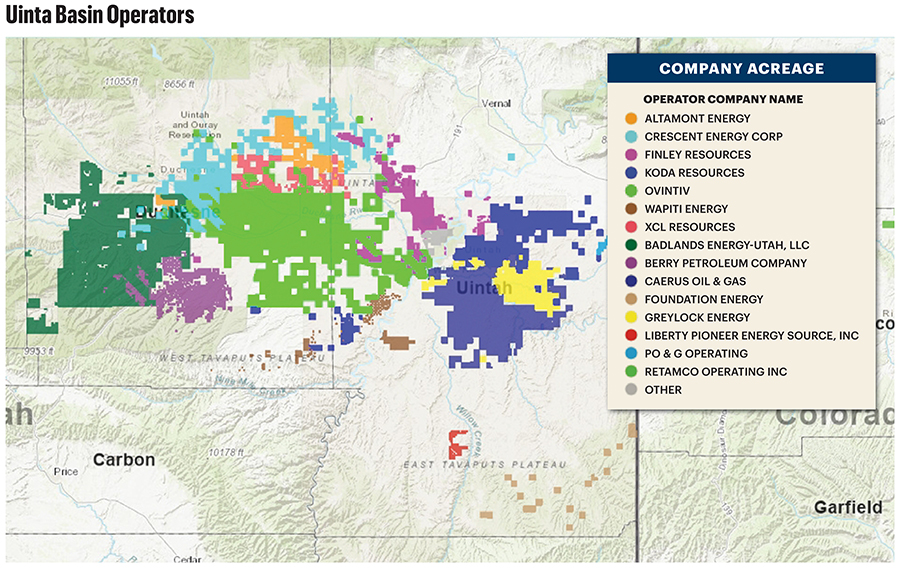

An A&D broker could run a standalone shop just on trading basin property and marketing farm-ins and farmouts, drill-to-earns, joint ventures and other deals.

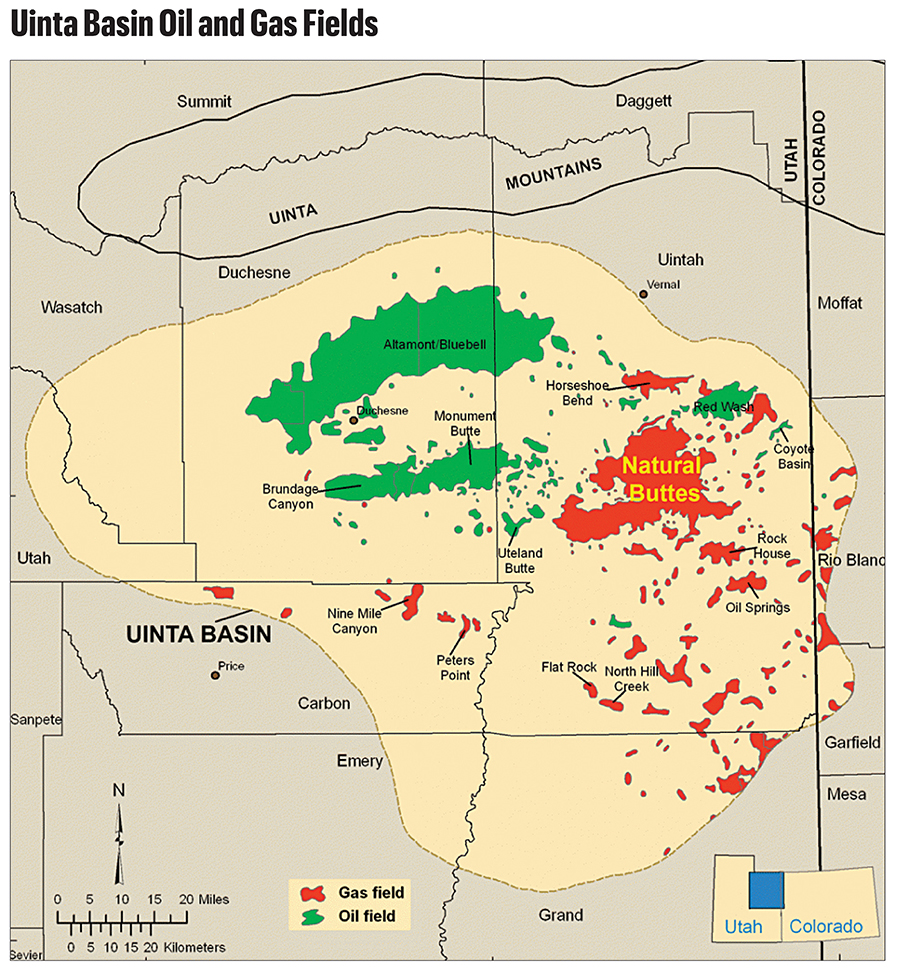

But today, the two-decade-old stimulated horizontal revolution has discovered this corner of Utah as market constraint has been unlocked for the basin’s valuable, but complicated, waxy crude. While 1.1 Bbbl of oil have already been produced, the Uinta was late to wildcatting from its start—drilling didn’t begin until the 1940s.

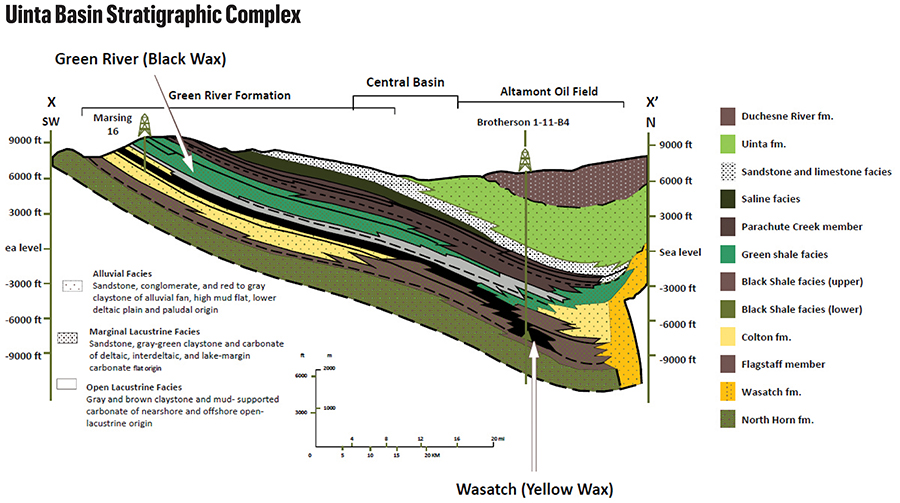

At first, operators were tapping deep Paleozoic Era deposits.

Quickly, though, they turned to the younger Cretaceous and Tertiary formations that were laid during the Laramide orogeny—particularly during the Tertiary’s Eocene and Paleocene epochs—that lifted the Uinta Mountains.

In the foreground during those millions of years, the land subsided and an ancient lake covered the structural depression, laying down thick, organic-rich lacustrine beds that the weight of more recent sedimentary deposits cooked into oil.

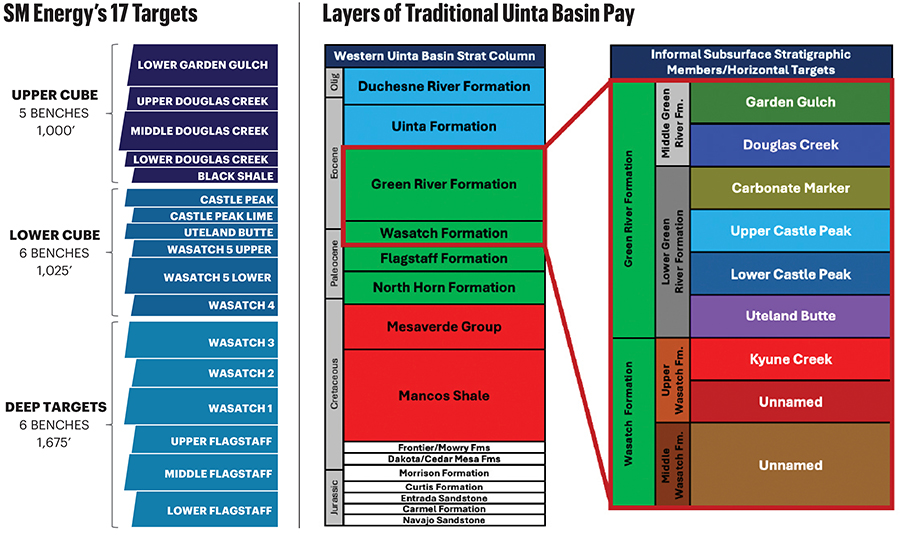

Drillers’ primary targets then and now are the Wasatch layer and, in particular, the Green River.

Among the latter’s members, the lowermost and most popular is the Uteland Butte, while perforations were also made in Castle Peak that is separated by a black shale source rock, Long Point, from the younger Douglas Creek and Garden Gulch.

As some producers today are still making only vertical holes, the new Uinta is horizontal—also a bit late to the fractured lateral era. That’s because, until a few years ago, the Uinta’s waxy oil was virtually capped at about 100,000 bbl/d.

New rail capacities upended this. Oil production this past June averaged 176,000 bbl/d, according to state files. That’s up from 104,000 bbl/d in June 2019 and 114,000 bbl/d in June 2014. In June 2004, the basin’s operators produced only 39,000 bbl/d.

‘Pleasantly surprised’

A Permian and Eagle Ford operator, SM Energy surprised the market in June, announcing it planned to add the Uinta to its portfolio with a deal to buy XCL Resources.

Herb Vogel, SM president and CEO, said the Uinta was as surprising to SM as the news had been to peers and securities analysts.

“Pleasantly surprised,” he added.

Takeaway costs—hauling the oil to refineries in Salt Lake City or to rail south of the basin—do eat into the margin, he told investors in a post-announcement call.

But the high oil content per boe produced, along with the higher market price for the Uinta’s waxy crude, “winds up being better than the Permian,” he said.

SM had begun looking at the XCL property this spring and signed a deal within three months. He told investors that he was initially doubtful, as well.

“When I first looked at this, I thought ‘How can that be?’” he said. But “you look at the numbers and it’s really that the high oil percentage drives that really great per-boe number and lower costs.”

SM estimates the breakeven is between $43/bbl and $57/bbl.

There are five oil refineries in Salt Lake City and several rail options to ship crude to other markets. “We don’t see an issue on the takeaway side at all,” Vogel said.

In the latter option, XCL has a contract for a large portion of Energy Transfer’s 75,000 bbl/d Price River Terminal in Wellington, Utah, about 80 miles south of XCL’s property.

“So, there’s capacity,” Vogel said. Expanding the terminal doesn’t take much time, particularly when “compared to running a long-haul pipeline through Appalachia or something like that, right?”

Uinta?

Investors and onlookers were startled by SM’s news of expanding outside of Texas. Tim Rezvan, a securities analyst for KeyBanc Capital Markets, took a look at the basin, reporting his findings in early July.

“As the initial shock of learning SM Energy expanded back outside Texas subsides for investors, we believe it is important for them to realize that SM is not buying a science project or an exploratory acreage position,” he wrote.

“It is buying a high-quality asset in the early innings of full-field development with consistently strong and oily results across three intervals.”

In a quarterly earnings call with investors in August, SM didn’t receive any questions about the Uinta. Vogel took the mic back as the operator was closing the call.

“Is it sufficient in terms of takeaway and can we grow production?” he said investors have asked him. Out there, he said, are “perceptions about takeaway or complications related to rail that are actually quite outdated now.”

Capacity to market waxy crude “was limited in the 80,000 bbl/d range for the [Uinta] industry and was all delivered to Salt Lake City refineries.”

But since mid-2021, refineries south on the Gulf Coast and east in Oklahoma and Wyoming are able to add the oil to their refining slates, Vogel said.

It goes like this: As natural gas has overcome coal as the U.S.’ No. 1 power generation feedstock, western U.S. railways “are generally underutilized in the region because there’s less coal being moved,” Vogel said.

Now there is room for oil trains. “There are no rail constraints for current production or for expanding production,” Vogel said.

For the small amount of gas XCL’s northern Uinta property produces and gas from elsewhere in the basin, the MountainWest pipeline expansion this summer added 80 MMcf/d of capacity and Kinder Morgan has one underway to take 150 MMcf/d.

The deals

SM is paying $2.04 billion for XCL and separately selling 20% interest to nonoperator Northern Oil and Gas for $510 million.

Gabe Daoud, an analyst for TD Cowen, said the price is $35,000 per boe for XCL’s 44,000 boe/d and $1.25 million per each of 465 estimated net future-well locations.

In addition to EnCap Investments, XCL is backed by Rice Investment Group, the family office of the Marcellus-focused Rice Energy’s founders. (Rice Energy was sold to EQT Corp.)

XCL’s 46,500 net acres (37,000 net to SM) are in the overpressured oil window on the basin’s northwestern rim, 99% operated, producing 56,000 boe/d (43,000 boe/d net to SM), 88% oil with an API gravity of between 36 and 43 degrees.

The oil doesn’t contain sulfur and has a low metals content. Its waxy content sells in the higher-priced lubricants market.

Produced water is less than in SM’s and others’ operations in the Midland Basin, Vogel said. Drilling and completion (D&C) costs are the same as in West Texas and in SM’s Austin Chalk play at less than $850 per lateral foot.

The leasehold is less developed, Vogel said in June. “There’s quite a bit of acreage, but not much in production.”

In another deal, SM is buying 80% of XCL neighbor Altamont Energy for $70 million; Northern is buying 20%.

All in the Altamont-Bluebell Field, the Altamont property was bought from Linn Energy for $132 million in 2018. The property was 36,000 net acres, 27,000 net undeveloped, at the time, producing 1,500 boe/d from 116 wells.

J.P. Morgan Securities analyst Arun Jayaram wrote in July that Altamont brought only eight wells online in 2023. Its production in 2023 was 3,200 bbl/d versus 84 bbl/d in 2022.

Its volume this year through May averaged 2,200 bbl/d, Jayaram reported.

17 benches

From XCL’s and other data, SM sees 17 layers of pay in the property in a 4,000-ft hydrocarbon column, “which ranks among the largest overpressured hydrocarbon columns in U.S. producing basins,” Vogel said.

Nearly 1 Bbbl of oil has been produced from just the Wasatch and Green River formations in the basin to date in nearly 9,000 wells.

“What stands out immediately is simply how much oil is in place relative to other top basins,” Vogel said.

Of the acres SM is buying, 10 benches have at least one test well and six of those have more than 10 tests each, Vogel said.

“It is quite de-risked when you look at it,” Vogel said. “And that’s only on the XCL acreage. If you go off to neighboring acreage, there’s even more.

“So, the amount of de-risking that’s been done and the continuity of the play with the rock that we’re talking about here really shows what a high-quality basin this is.”

J.P. Morgan’s Jayaram wrote, “SM believes that its technical expertise at stacked-pay development is applicable to other basins across U.S. shale, which the company will now get the chance to prove to the market with the Uinta asset.”

About that wax

Uinta wax ranges from yellow (north) to black (south), depending on deposition. Both are valuable, but the paraffin content makes Uinta oil more costly to get to market, said Juan Nevarez, executive vice president of Uinta operator Scout Energy Partners.

“You’re having to truck it and, in some cases, [both] truck and rail it because it has to remain heated,” he told Hart Energy in August.

The wax will solidify otherwise. “That’s what makes Uinta oil a little more challenged than in the Delaware Basin.”

The new rail option for the basin’s oil has allowed Uinta production to grow. But to continue to grow, “you’re going to have to have more rail capacity,” he added.

The oil is heated in the tank battery at the pad. The truck trailers and rail cars are insulated.

In-field heating is low-cost, though, he said: Operators use some of the associated gas they produce.

And there is relatively little associated gas to process and ship. In Scout’s operations, “you’re typically getting about one Mcf for every barrel of oil.

“It’s far less gassy than anything that you’re dealing with in the Permian.”

What gas is leftover—and what’s produced from the gassy eastern side of the basin—flows to California on the Kern River pipeline.

The basin is producing some 180,000 bbl/d now. Nevarez said, “I think 300,000 is possible. But you have to continue to have a good price environment.”

Scout’s position

Dallas-headquartered Scout entered the Uinta in mid-2022 when it saw an opportunity to pick up a property from Ovintiv.

Formed in 2011, the institutional fund manager buys mature assets—“property that still has opportunity to be optimized and to put some capital in them to either grow production or maintain flat production,” Nevarez said.

The entry asset was a waterflood in the basin’s oily southside in Monument Butte Field, southeast of Duchesne. “Ovintiv wanted to focus north where they saw more opportunity to develop horizontally.”

The property came with some 3,000 gross vertical wells, virtually all in the Green River formation, and 90,000 net acres.

Scout’s position today is 110,000 gross acres, 85,000 net, all HBP and all on federal, state and private, non-tribe land.

While it continues to work the vertical waterflood, “we knew there was opportunity to exploit the horizontal portion of the field,” he said.

In 2023, it brought in Wasatch Energy Management (WEM) in a horizontal drill-to-earn deal. Upon a well’s completion, Scout takes over as operator, while WEM retains a significant working interest.

“They de-risk the area, putting their own capital to work,” Nevarez said. “It allows us to prove up that acreage and, after an assessment period, say, ‘OK, this is a good area’ and have the ability to put some of our own capital to work.”

WEM partner

Provo, Utah-headquartered WEM got its break in the Uinta in 2018. The team had been looking for where it could build an E&P company—but at a five-figures-per-acre entry cost rather than the tens of thousands the Permian and other high-profile oil plays command.

Its drill-to-earn and other deals now number five, spanning the Uinta’s oily western side, with XCL Resources, Uinta Wax, Ovintiv, Scout and Altamont, said Danny Gunnell, WEM’s CEO.

The E&P plans to double its current net production of 15,500 boe/d from some 28,000-plus net acres in nonop positions and joint ventures, along with an operated position in the southwestern corner of the basin.

Its primary target is Uteland Butte with four wells in a drilling spacing unit with secondary targets in the underlying Wasatch (two) and the overlying Black Shale/Long Point (four) and Douglas Creek (four).

“The Uinta Basin has some of the best wells in America,” Gunnell said. “Well results are predictable, consistent and compete toe-to-toe with Permian Basin wells.”

Tight reservoir

The Green River Formation is at about 5,000 ft in Monument Butte Field.

Vertical drillers wouldn’t perforate the Uteland Butte in the past because the carbonate was too tight to give up much oil, Nevarez said. Putting a frac on it will create flow, but a vertical hole doesn’t expose the well to enough rock beyond just what’s near the hole.

“Most of the horizontal wells that are being drilled in the Uinta Basin are going into the Uteland Butte now,” Nevarez said.

Operators are also testing Castle Peak that overlies Uteland Butte and the underlying Wasatch with stimulated laterals. At times, drillers are landing in the yet shallower Douglas Creek.

While Scout thought in 2022 the Uinta would lend itself to horizontal development, what operators have proven in just two years has exceeded its expectations.

“Two years ago, there was no indication that it would compete, on a rock-quality basis, with some of the best basins in the United States,” Nevarez said. “But it does.”

SM is entering the basin and Nevarez sees other companies showing interest. “I think the basin has proven that it can provide a good return for your capital.”

But the growth isn’t just because the oil is there, he added—Utah is a pro-business state. In addition, residents support the industry and many work in the business.

“There’s some farming in the basin, but there aren’t many other jobs there. They really appreciate the oil and gas industry.”

(Source: SEC filing, former Uinta Basin operator Veren Inc., FKA Crescent Point Energy)

9-gallon bucket

Before that Monument Butte Field waterflood came eventually into Scout’s hands, it was in the hands, so to speak, of Dave Donegan.

Park City, Utah-based Donegan retired in 2023 from Sinclair Oil & Gas Co., where he was president, and this summer from a six-year term on Utah’s Trust Lands Administration (TLA) board, lastly as chairman.

The TLA is similar to Texas’ University Lands in that it manages state land with proceeds benefiting the state’s public schools and select institutions. Created in 1994, the Permanent School Fund has grown from $50 million to more than $3.2 billion.

Its portfolio consists of 3.3 million acres of surface and mineral acres and 1.2 million acres of minerals-only property.

In the late 1990s, Donegan was operations manager and director of business development for Uinta-focused Inland Resources, which owned the waterflood program in the Green River Formation that Ovintiv bought and Scout now owns.

At the time, Uinta operators produced deep oil from Wasatch on the northern rim of the basin and shallow oil from the Green River on the southern rim.

“Historically, all of the crude went to Salt Lake City,” Donegan said. “Refining capacity is roughly 150,000 bbl/d, but they’re short of cracking capacity. The cracking capacity is about 90,000 bbl/d.”

Uinta oil is almost all waxy. “Those are long hydrocarbon chains that have to be cracked,” Donegan said. “As long as you have cracking capacity, waxy crude is the perfect crude. It’s worth WTI-Cushing.”

When the basin exceeded that 90,000 bbl/d cap in the past, the extra oil’s economics collapsed.

“It’s worth a significant discount to WTI,” Donegan said. “So historically, that always provided a cap to how much production came out of the basin.”

Extra oil is like pouring 10 gallons into a nine-gallon bucket. The tenth gallon “has no value at all.”

Fort Worth-based Uinta operator Jim Finley changed this, though. “He put a lot of money into building rail-takeaway capacity.”

To rail a Uinta barrel out of Utah costs more. Uinta operators who don’t have all of their capacity contracted to Salt Lake City refiners will need a higher breakeven on the extra oil.

For this reason, the Uinta “has historically been a sort of Tier 2 basin—not for its geology but for its commercial aspects.”

‘Goldilocks area’

The northern rim of the Uinta, including the Altamont-Bluebell Field, is deep at between 8,000 and 12,000 ft, Donegan said. It originally produced from the Wasatch.

“The target reservoir is overpressured, steeply dipping with a lot of porosity,” he said.

The south side is a less steeply dipping flank that primarily produces from the Green River Formation at between 4,000 and 6,000 ft with many thin sand lenses at a normal pressure and little fracture porosity.

Meanwhile, the central part of the basin is the “Goldilocks area.” There, the target reservoirs range from moderately deep to deep and overpressured in a gently dipping structure.

“You have the ability to drill long laterals within multiple individual benches and recover substantial reserves per lateral,” Donegan said. “This is the part of the basin that SM [is buying] and is the play that has dramatically grown the production from the basin.”

There, recovery per well “is comparable to be the best horizontal crude plays in the Lower 48 today, including the Bakken, Eagle Ford and Midland Basin’s Wolfcamp/Spraberry.”

The learning curve

KeyBanc’s Rezvan’s look at the Uinta this summer was similar to many others’ Uinta experience in 2024: “Quickly climbing the Uinta Basin learning curve,” he wrote.

While much of the basin is geologically quiet, so was news attention to drilling and dealmaking over the years.

Rezvan found that, of the 530 horizontals 11 operators put in the basin since 2016, the layers targeted most often are the Uteland Butte, Wasatch and Castle Peak.

He called it “a prolific, stacked-pay oil play” and was “impressed by the overall rock quality.”

Of those 11 operators that landed laterals, six are still active in the basin, he added.

Among the Uteland Butte wells, first-12-month production averaged 227,000 boe, 85% oil. From the Wasatch, it was 202,000 boe, also 85% oil. From Castle Peak, production was less, coming in with 141,000 boe, but 87% oil.

XCL had 121 horizontals in the three formations by this summer with at least six months of production history. Among these, 58 were landed in Wasatch, 35 in Uteland Butte and 28 in Castle Peak.

It also put five horizontals in other formations. The average lateral length of all 126 was 2 miles.

The first-six-month performance from Uteland Butte horizontals was 18,937 boe per 1,000 ft; from Wasatch, 15,165 boe per 1,000; and Castle Peak, 12,015. The five laterals in other formations averaged 9,252 per 1,000 lateral ft.

Meanwhile, 110 laterals landed by Ovintiv made between 15,000 boe and 27,000 boe per 1,000 ft in their first six months.

Crescent Energy’s 104 horizontals averaged between 12,000 boe and 17,000 boe per 1,000 ft. The wells also brought more solution gas, averaging 78% oil while the XCL and Ovintiv wells averaged 87% oil.

And the 131 made by Uinta Wax averaged between 10,000 boe and 17,000 boe per 1,000 ft, 89% oil.

New neighbor

The increased M&A interest in the Uinta—and the potential entry now of a third public operator, SM, adding to public comment on the results in addition to Ovintiv’s—is helpful to the basin, said David Rockecharlie, Crescent CEO.

“We’re very pleased to have another—what I’ll call resource-oriented public company—in the basin helping develop it,” he told Oil and Gas Investor in September.

Publicly traded Crescent began sharing results earlier this year of testing larger proppant loads in its horizontal Uinta wells.

The operator was formed in 2021 from the merger of publicly traded Contango Oil & Gas and privately held Independence Energy under the management of investment firm KKR’s real estate team.

Crescent picked up its Uinta property in early 2022 from EP Energy for $690 million after the Federal Trade Commission (FTC) refused XCL’s attempt to bolt the EP property onto its own.

In the deal, Crescent acquired 30,000 boe/d, 65% oil, from more than 400 active vertical and horizontal wells with 145,000 contiguous net acres and 83% average working interest.

Before rail capacity was added in the past few years, “a lot of the challenges came from companies trying to grow too fast” in the basin, Rockecharlie said. “I think this latest stage of growth has been more methodical.”

Bigger fracs

Crescent’s new Uinta Basin completions are showing 60% greater production from new-design wells, based on first-150-day results, it reported in May.

And the extra oil has been with only minimal increases in D&C cost, Rockecharlie told investors in an August call.

“When we acquired this position [in 2022], the only horizontal development on the assets utilized a legacy, smaller completion design with roughly 1,500 pounds of proppant per foot,” Rockecharlie said in a May call.

The new completions are with twice the proppant—3,000 pounds per foot (lb/ft).

Crescent operates as Javelin Energy Partners and was Utah’s No. 3 oil producer in January, putting some 21,000 bbl/d into trucks and trains, according to state data.

One of its laterals, Robinson 5-19-20-C4-6H in Altamont-Bluebell Field, came on in November with 21,000 bbl of oil in 31 days in its first full month of production, according to state data.

The adjacent Robinson #4H made 21,000 bbl and the neighboring Robinson 4-19-20-C4-2H produced 46,000 bbl.

“There’s more production and longer reserve life in that basin than there’s ever been,” he said. “And it looks like that’s going to continue.”

Neighbors are more active than Crescent right now, he added, and “others’ growth will outpace ours because of a different business philosophy and strategy.”

The FTC problem

Scout’s Nevarez expects the FTC will become untroubled by Uinta dealmaking going forward as production and rail capacity grow and while Salt Lake City refineries continue to be supplied.

Of the 10 rigs drilling in the basin in August, three were making hole for XCL.

Built and soon to be flipped to SM in just a half-dozen years, Denver-based XCL was producing 53,000 bbl/d of oil, gross, this spring from the Uinta.

Quickly, it overtook Ovintiv, which was pushed to the No. 2 position at 34,000 bbl/d.

When XCL’s deal to add the Altamont property in 2022 was blocked by the FTC and went to Crescent instead, “we just went full in focus on our asset only,” Blake McKenna, XCL president and COO, told Hart Energy in a May interview.

XCL didn’t get quiet; instead, it got bigger—entirely from the property it already held.

What it already had was producing less than 10,000 bbl/d. “We just focused all of our efforts on that asset,” McKenna said.

It was comfortable with the risk because it had planned ahead, he added. The team went to work to “make sure we have the refineries to sell to in Oklahoma, Wyoming, the Gulf Coast and all of our takeaway points.”

On the D&C side, it tested small and went big and bigger.

“We’re big believers in bookends,” McKenna said. “Let’s test it small; let’s test it huge. And we’ll go to both sides [of the leasehold] and see where we should end up.”

Frac sizes ranged from 1,800 lb/ft to 3,000 lb/ft, finding the volume at which “a frac is so big it’s not worth the extra money,” he said.

“That helped us settle more in the middle—2,200 to 2,500.”

Neighbors have done completions of 1,000 lb/ft to 1,500 lb/ft. They’re moving into the 2,000-lb/ft and 2,500-lb/ft range now as well, McKenna said.

Spacing

Lateral length is typically 2 miles, but XCL has been landing 3-milers in some of its northernmost leasehold—depending on the formation—for spacing reasons.

While it has two years of data now on its bigger wells, XCL gained a clear look just six months in at what the modern frac jobs will get out of Uinta rock—and what is the appropriate spacing.

It came quickly because of the highly overpressured nature of XCL’s end of the basin.

“When we operated in the Bakken in a previous life, it would take you 12 to 18 months to really understand how those wells were interacting,” McKenna said. “But in the Uinta, because the pressure profile is so great, you understand where you are in six to nine months.

“It’s helped us make that evolution faster here in the Uinta because we can update spacing and change frac design quickly.”

Berry looking lateral

Operating in the Uinta since 2003, Berry Corp. has 100,000 net acres in the basin, producing from roughly 1,200 verticals primarily perforated in Uteland Butte.

By its count, roughly half of all Uinta operators’ new wells in the past seven years were drilled in just the past two.

And it’s excited about what neighbors’ work has brought to its already-paid-for, nearly 100% HBP leasehold, it told investors.

Berry’s business model is onshore, low geologic risk, low decline, long-lived—entirely focused in California and Utah.

The company was bought in 2013 for $4.3 billion by Linn Energy, a PDP-focused MLP. But Linn succumbed to bankruptcy in 2016, imploding under the weight of its M&A-heavy model that had deals priced at when oil prices were on their way up.

Berry spun out in 2017 as a standalone company and carried on.

Earlier this year, having watched neighbors’ horizontal results for some time and as lateral development was moving toward its leasehold, it wanted to take a look.

In April, it bought a 21% interest for $10 million in a neighbor’s plan to make four 10,000- to 15,000-foot laterals in the Uteland Butte on Berry’s property, which is tucked into the Uinta’s southwestern corner.

By August, the initial results indicated better wells than Berry’s pre-drill estimate, CEO Fernando Araujo told investors in a call.

The wells IP’ed 1,100 boe/d each, 90% oil. “But also remember that we are at the shallow end of the basin with lower reservoir pressures,” Araujo said.

“So, our IPs are slightly lower compared to some of the IPs in the northern end in the deep basin. We have to be mindful of that.”

Berry’s current Uinta profile isn’t much different than at year-end 2012 when it reported 7,600 boe/d from the property, all from verticals in the Green River and Wasatch.

Its leasehold at the time was 122,000 net, excluding 49,000 undeveloped net acres that were part of a drill-to-earn deal. Proved reserves were 36.8 MMboe with 20.6 MMboe of these PUD.

Ovintiv’s Uinta for sale?

Ovintiv entered the Uinta in 2004 with a $575 million acquisition of Inland by a predecessor, Newfield Exploration, gaining 110,000 acres in Monument Butte Field with an 80% average working interest.

The deal came with 326 Bcfe of proved reserves, 85% oil, and 70% proved undeveloped. Net production at the time was approximately 7,000 boe/d and Newfield expected to increase that to 14,000 boe/d in 2006 with three rigs.

But Ovintiv hasn’t aimed to increase its Uinta output since then. More than 80% of its 137,000 net acres are undeveloped. Most recently, it was making 28,000 bbl/d of oil.

Its capex is in output-maintenance mode.

“We have the ability to grow [the Uinta] if we choose,” Brendan McCracken, president and CEO, told investors in July. The property is “competitive with the Permian” in market access, well productivity and cost.

“But if we’re not growing the total company production, there’s not a motive to be growing the Uinta at the expense of any of [our] other assets. So, I would expect it to stay pretty stable as we head through the back of this year and into 2025.”

Reports circulating in late August citing unidentified sources had Ovintiv putting its Uinta property for sale for $2 billion.

TD Cowen’s Daoud wrote after the news, “While we’ve liked the well productivity and improved margin profile of the Uinta, it’ll likely never amount to a material play for Ovintiv.”

Ovintiv improving its debt profile by selling the Uinta property and focusing on its Permian property instead “likely makes the most sense and would be most preferred amongst investors,” Daoud added.

Using the SM deal metrics for the XCL property, he assessed the PDP value of the Ovintiv property at $1.1 billion and the undeveloped property at $1.6 billion, based on 1,248 potential additional well locations.

“Thus, all-in, we believe Ovintiv could attract greater than the [news article’s stated] $2 billion,” Daoud wrote.

But, he noted, “our inventory estimate could be overstated and a buyer may be unwilling to pay up entirely for undeveloped value.”

While the FTC remains on the loose, identifying the buyer could be difficult to guess.

“Crescent would be an obvious candidate,” he wrote. But it had just bought Eagle Ford operator SilverBow Resources. Since the Ovintiv rumor, Crescent made a second Eagle Ford deal.

SM “would logically make sense as well,” Daoud wrote, but since SM just arrived in the basin with some $2.1 billion for 80% of XCL and Altamont, “that also feels unlikely.”

RELATED

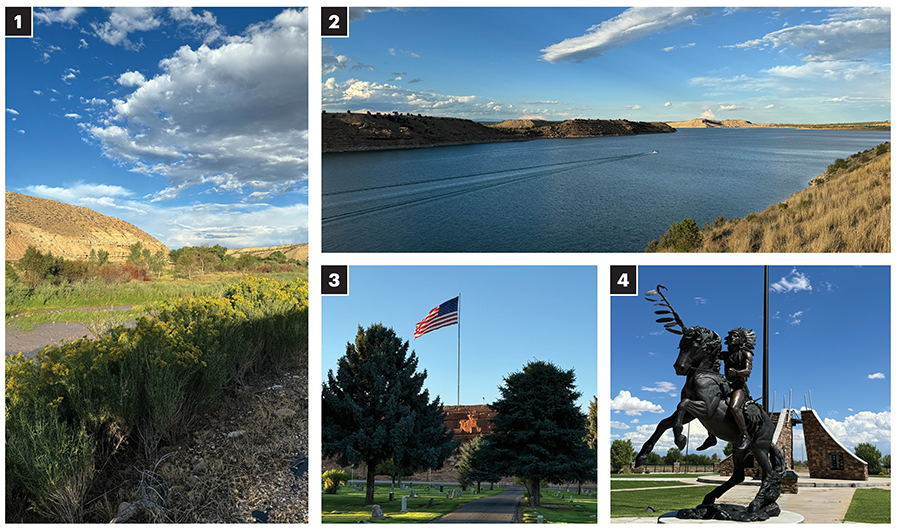

Darbonne: The Geologic, the Man-made and the Political of Uinta Basin Outcrops

Recommended Reading

Scott Sheffield Sues FTC for Abuse of Power Over Exxon-Pioneer Deal

2025-01-21 - A Federal Trade Commission majority opinion in May barred former Pioneer Natural Resources CEO Scott Sheffield from serving in any capacity with Exxon Mobil Corp. following its acquisition of the Permian Basin E&P.

Enterprise Products Considering Moving On from SPOT

2025-02-05 - Permitting delays and challenges finding customers have put the future of Enterprise Product Partners’ Seaport Oil Terminal Project in doubt.

Oil Industry Veteran Beyer Appointed to Key Interior Department Post

2025-02-05 - Energy industry veteran Leslie Beyer has been appointed to assistant secretary of land and minerals management at the U.S. Interior Department, where she will oversee key agencies including the Bureau of Land Management and Bureau of Ocean Energy Management.

VanLoh: US Energy Security Needs ‘Manhattan Project’ Intensity

2025-02-06 - Quantum Capital Group Founder and CEO Wil VanLoh says oil and gas investment, a modernized electric grid and critical minerals are needed to meet an all of the above energy strategy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.