A natural gas pipeline. (Source: Shutterstock)

The Matterhorn Express Pipeline, which ramped up transmission of Permian Basin natural gas on Oct. 1, eclipsed 1.2 Bcf on Oct. 18, surpassing expectations of analysts at East Daley Analytics.

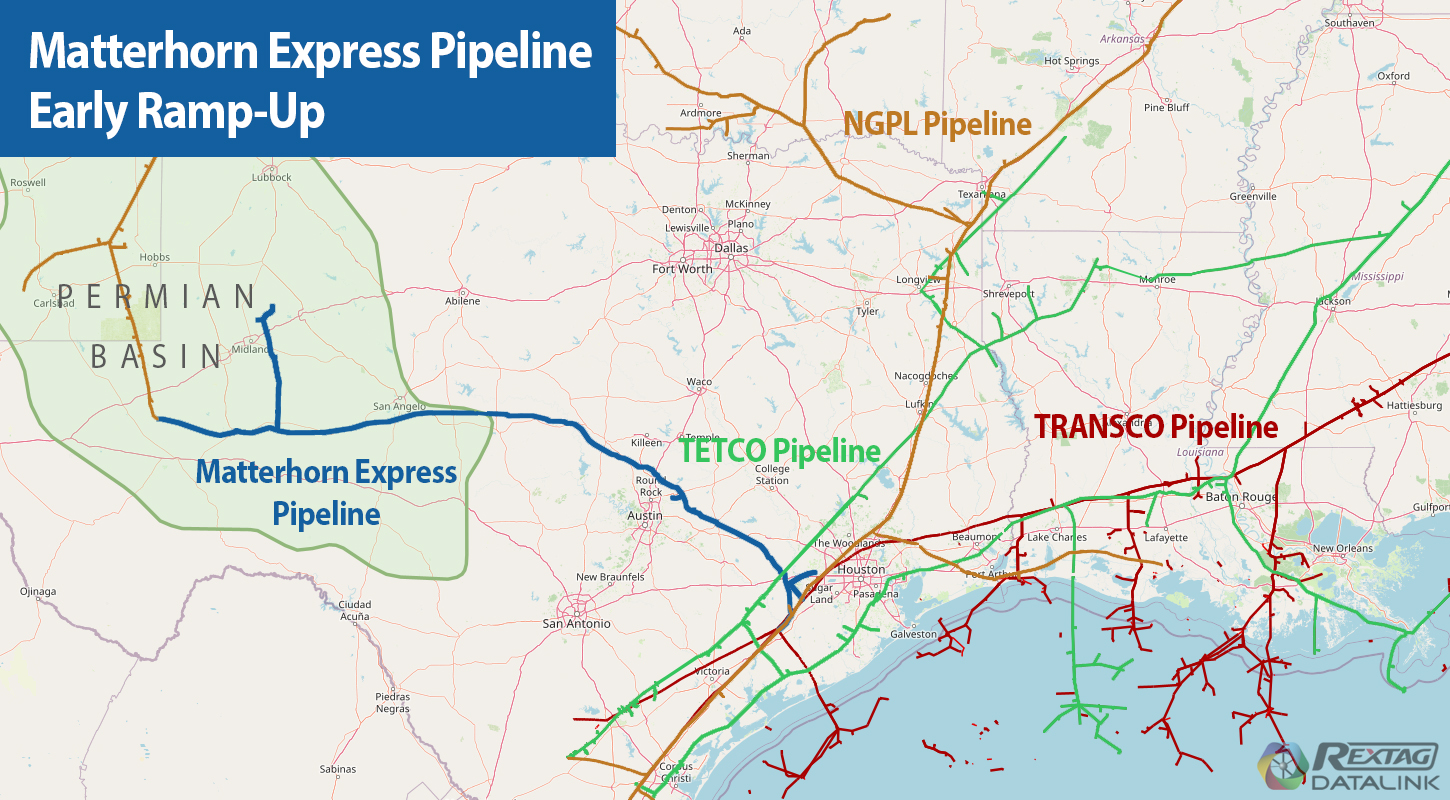

Matterhorn, a joint venture (JV) of Whitewater Midstream, EnLink Midstream (recently acquired by ONEOK), Devon Energy and MPLX, began deliveries to its third interstate pipeline on Oct. 15, East Daley said. Kinder Morgan’s NGPL joined Williams Cos.’ Transco and Enbridge’s Texas Eastern (TETCO) pipelines in receiving gas.

“The ramp on Matterhorn is happening at a faster clip than [East Daley] modeled in the ‘Permian Supply & Demand Forecast,’” research analyst Ian Heming wrote in a research note. “Notably, northbound flows from the Permian have only decreased 200 MMcf/d since Matterhorn began delivering gas on Oct. 1, based on pipeline electronic bulletin boards we monitor.

NGPL posted initial flows of 165 MMcf/d, Heming wrote. The three interconnecting pipelines have a total capacity of more than 1.4 Bcf/d, or about 57% of 42-inch Matterhorn’s nameplate capacity of 2.5 Bcf/d, he said.

However, Heming raised the possibility that Matterhorn may be ramping even faster. He noted that the Gulf South pipeline’s Coastal Bend interconnect saw its flows jump 70% to average 462 MMcf/d through mid-October, compared to its September average of 271 MMcf/d. The interconnect set its own record of 567 MMcf/d on Oct. 18.

While the quick ramp is welcome news for owners of the three interstate systems, “it’s also good for the Permian industry at large, lending confidence in our forecast for oil and gas growth,” Heming wrote.

East Daley expects Matterhorn’s presence in the Permian to boost fourth-quarter crude production by 150,000 bbl/d to 200,000 bbl/d. Its 2025 growth forecast is 350,000 bbl/d.

Recommended Reading

US Crude Oil Stocks, Excluding SPR, Fall to 2-Year Low, EIA Says

2025-01-15 - Crude inventories fell by 2 MMbbl to 412.7 MMbbl in the week ending Jan. 10, the EIA said, compared with analysts' expectations in a Reuters poll for a 992,000-bbl draw.

What's Affecting Oil Prices This Week? (Feb. 18, 2025)

2025-02-18 - The price of Brent crude oil did reach $77 on Feb. 18 before falling back with news that members of the Trump Administration were holding talks with their Russian counterparts.

What's Affecting Oil Prices This Week? (Jan. 6, 2025)

2025-01-06 - Recent geopolitical news also provided some support for oil prices with the rhetoric heating up between Iran and Israel.

What's Affecting Oil Prices This Week? (Jan. 13, 2025)

2025-01-13 - Stratas Advisors expect that there is some room for oil prices to move higher this week, but the price of Brent crude oil will struggle to breakthrough $82.50.

What's Affecting Oil Prices This Week? (Feb. 10, 2025)

2025-02-10 - President Trump calls for members of OPEC+ and U.S. shale producers to supply more oil to push down oil prices to the neighborhood of $45/bbl.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.