Production from Canada’s Montney, Duvernay Gains Momentum

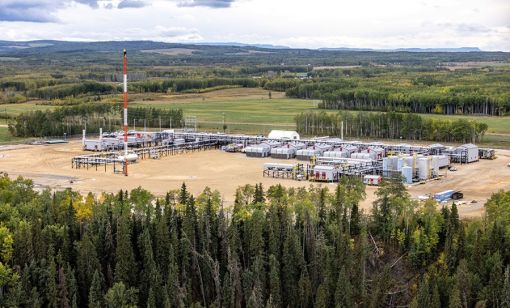

The dust has settled on acquisitions, and the leading players have publicized five-year plans that demonstrate a commitment to increasing production from Canada’s premier shale plays.

Flurry of Deals from Canada to the Permian Basin Close Out 2023

Several Canadian E&Ps are adding scale and undrilled inventory in prolific resource plays in Alberta, while in the Permian Basin, Ring Energy finalized an acquisition in the Central Basin Platform.

Crescent Point Buying Alberta Montney E&P in $1.86 Billion Deal

Crescent Point is extending its premium drilling inventory in the Alberta, Canada, Montney Shale with a roughly US$1.86 billion (CA$2.55 billion) acquisition of Hammerhead Energy.

Cheaper Canadian Oil, Gas Valuations Lure Potential US Buyers North

The largely untapped potential of Canadian shale is a draw for investors.

Ovintiv CEO McCracken: Magnifying Margins

Ovintiv President and CEO Brendan McCracken has beefed up the E&P’s portfolio with a major acquisition in the Permian and added exposure to the lucrative Canadian LNG market.

The OGInterview: Ovintiv Magnifies Margins [WATCH]

Ovintiv President and CEO Brendan McCracken has beefed up the E&P’s portfolio with a major acquisition in the Permian and added exposure to the lucrative Canadian LNG market.

Analysts: Top-Tier Drilling Inventory Shrinking as Well Costs Rise

The cost of supply for North American shale producers is expected to continue rising, according to a recent analysis by Enverus Intelligence Research.

Murphy Oil Closes $104MM Divestiture of Non-Core Canada Assets

Murphy Oil sold non-core assets in western Canada for $104 million in cash, with proceeds earmarked for new development in Africa and Asia.

Baytex Energy Declares Quarterly Dividend

Baytex Energy Corp.’s board of directors has declared a quarterly cash dividend amounting to CA$0.0225 per share, payable on Oct. 2.

Energy A&D Transactions from the Week of April 19, 2023

Here’s a snapshot of recent energy deals, including Matador Resources' $1.6 billion acquisition of Midland Basin E&P Advance Energy Partners and Kimbell Royalty Partners deal to bolt-on more Northern Midland Basin acreage.