With Montney Production Set to Grow, US E&Ps Seize Opportunities

Canada’s Montney Shale play has already attracted U.S. companies Ovintiv, Murphy and ConocoPhillips while others, including private equity firms, continue to weigh their options.

ARC Resources Divests Non-core, Non-Montney Assets

ARC Resources did not provide additional information on the divested assets, which the company said had results in proceeds of $59.2 million.

Tourmaline’s $950MM Crew Energy M&A Drills Deeper In Montney

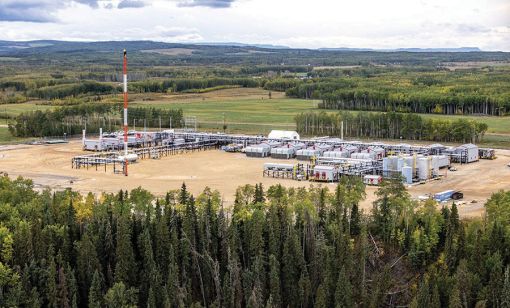

Tourmaline Oil is adding high-quality drilling locations in Canada’s Montney Shale with the CA$1.3 billion (US$950 million) acquisition of Crew Energy Inc.

ConocoPhillips’ Blowout: Permian, Eagle Ford, Bakken Output Rises

ConocoPhillips reported a notable uplift in Eagle Ford Shale production during the second quarter, while volumes in the Permian, Bakken and Canada’s Montney Shale also grew.

Ovintiv to Boost 2024 Free Cash Flow to Nearly $2B

Ovintiv management reported its on track to generate $1.9 billion in 2024 free cash flow but skirted a question about the company’s possible pursuit of Midland Basin E&P Double Eagle.

Whitecap Sells Stakes in Gas Processing Plants in Two Deals

In separate deals, WhiteCap Resources sold gas processing assets to Topaz Energy and Pembina Pipeline—a move that strengthens Pembina’s Western Alberta position, an analyst said.

Montney Pure-play Advantage Energy Makes $326MM Acquisition

Calgary-based Advantage Energy is acquiring undeveloped inventory and around 14,100 boe/d of production in a CAD$450 million (USD$326.77 million) deal with a private seller.

Crescent Point Divests Non-core Saskatchewan Assets to Saturn Oil & Gas

Crescent Point Energy is divesting non-core assets to boost its portfolio for long-term sustainability and repay debt.

Analyst: Chevron Duvernay Shale Assets May Sell in $900MM Range

E&Ps are turning north toward Canadian shale plays as Lower 48 M&A opportunities shrink, and Chevron aims to monetize its footprint in Alberta’s Duvernay play.

Chevron's Duvernay Sale Seen Attracting Mid-sized Canadian Shale Operators

As Chevron Corp. markets its Duvernay shale assets, the U.S. oil major is most likely to find a buyer among a handful of mid-sized Canadian firms looking to capitalize on the region.