Tourmaline Oil is adding high-quality drilling locations in Canada’s Montney Shale with the CA$1.3 billion (US$950 million) acquisition of Crew Energy Inc. (Source: Shutterstock.com)

Canada’s Tourmaline Oil is acquiring fellow Calgary-based producer Crew Energy, deepening its footprint of British Columbia Montney shale assets.

Tourmaline Oil Corp. will pay $6.69 per share of Crew stock and assume $240 million of Crew’s net debt, valuing the transaction at approximately CA$1.3 billion (US$950 million), the companies said on Aug. 12.

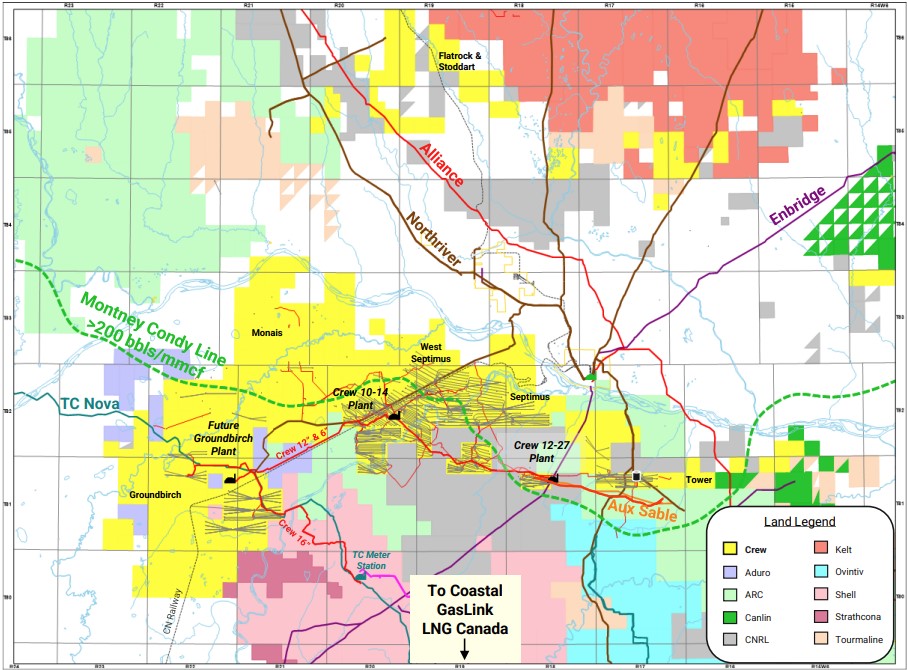

Crew’s assets are adjacent to Tourmaline’s existing South Montney-operated complex in northeast British Columbia. Crew’s portfolio brings low-decline average production of around 30,000 boe/d, including 129.6 MMcf/d of shale gas output.

Canada’s Montney and Duvernay Shale plays are primarily considered natural gas and NGL basins with relatively little oil production. Tourmaline bills itself as Canada’s largest natural gas producer.

“Tourmaline believes this is an opportune time for consolidating natural gas assets prior to imminent major growth in the North American LNG business and acceleration of natural gas-powered electrical generation requirements across the continent,” the company said.

Adding Crew’s assets will boost Tourmaline’s pro forma production to between 582,500 boe/d and 592,500 boe/d—up from a third-quarter forecast of between 550,000 boe/d and 560,000 boe/d.

The deal will also extend Tourmaline’s high-quality drilling inventory with an additional 700 net Tier 1 locations.

“As Canada’s leading natural gas producer and a well-capitalized, investment-grade organization, Tourmaline has a proven track record of developing large-scale and impactful resource projects which will now include Crew’s assets in Groundbirch and the Greater Septimus area, with the financial capacity to do so on an accelerated timeframe,” said Crew President and CEO Dale Shwed.

The Crew deal will also assist Tourmaline in its goal of growing production to 750,000 boe/d over the next five years.

The transaction is expected to close by Oct. 1. Both the Tourmaline and Crew boards have unanimously approved the acquisition. The deal remains subject to shareholder and regulatory approval.

RELATED

ConocoPhillips’ Blowout: Permian, Eagle Ford, Bakken Output Rises

Montney M&A

Top-tier North American drilling locations are growing increasingly scarce, fueling consolidation in resource-rich areas such as the Permian Basin.

But as prices for Permian locations creep up and M&A opportunities dwindle, E&Ps are taking harder looks at potential deals in other regions, like the Bakken, Eagle Ford, Uinta and Montney plays.

“Big picture, we believe consolidation will drive better valuations and greater investor interest in Canada over time,” said Jeoffrey Lambujon, an analyst with Tudor, Pickering, Holt & Co., in an Aug. 12 report.

Canadian producers have grown through M&A in the past year: Crescent Point Energy closed an acquisition of Alberta Montney E&P Hammerhead Energy for US$1.86 billion (CA$2.55 billion).

Montney pure-play Advantage Energy spent CAD$450 million (USD$326.77 million) on M&A with a private seller.

Chevron Corp. is marketing its 70% working interest in Duvernay Shale acreage, roughly 238,000 net acres.

Other major producers with holdings in the Montney include Shell Plc, ConocoPhillips and Ovintiv.

ConocoPhillips reported growing its Montney output to an average of 43,000 boe/d during the second quarter.

“That’s more than double relative to same quarter last year,” ConocoPhillips CFO Bill Bullock said on an Aug. 1 earnings call. “And then we’re up quarter-over-quarter as well, roughly 3,000 barrels a day.”

Ovintiv highlighted new drilling and completion efficiencies in the Montney in its second-quarter earnings. The Montney also boasts the lowest well costs across Ovintiv’s multi-basin portfolio.

RELATED

Recommended Reading

Analysis: Middle Three Forks Bench Holds Vast Untapped Oil Potential

2025-01-07 - Williston Basin operators have mostly landed laterals in the shallower upper Three Forks bench. But the deeper middle Three Forks contains hundreds of millions of barrels of oil yet to be recovered, North Dakota state researchers report.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

Sintana Reports Two Discoveries Offshore Namibia

2025-01-06 - Sintana Energy Inc. said the Mopane-2A well found gas condensate in one reservoir and light oil in a smaller one.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.