Clearfork Midstream Bags First Deal after $400 Million Equity Commitment

Clearfork Midstream agreed to acquire Azure Midstream Energy, which has a natural gas gathering and treating platform spanning the core areas of the Haynesville Shale formation.

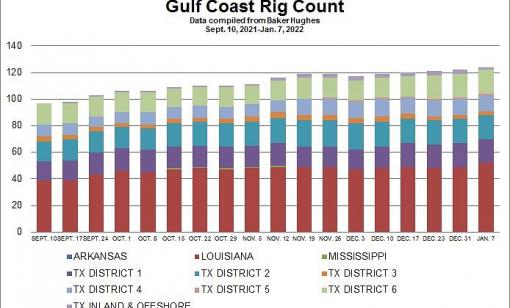

Chart: Gulf Coast Rig Count as of January 7, 2022

Arkansas, Louisiana, Mississippi and Texas RRC Dist. 1, 2, 3, 4., 5, 6, inland, offshore

Energy A&D Transactions from the Week of Nov. 17, 2021

Here’s a snapshot of recent energy deals including the acquisition of Veritas Energy’s nonop position by Northern Oil and Gas in a transaction worth over $500 million in the Permian Basin plus a $2.5 billion Freeport LNG deal.

Energy A&D Transactions from the Week of Nov. 10, 2021

Here’s a snapshot of recent energy deals including Continental’s entry into the Permian through the $3.25 billion acquisition of Pioneer’s Delaware Basin position plus Southwestern acquires another private Haynesville producer.

Energy A&D Transactions from the Week of Nov. 3, 2021

Here’s a snapshot of recent energy deals including the $1.8 billion sale of Oasis Petroleum’s midstream affiliate and the closing of Chesapeake’s Vine Energy acquisition.

Chesapeake Completes $2.2 Billion Acquisition of Haynesville Producer Vine Energy

Chesapeake had previously announced the acquisition of Vine Energy in August in what the Oklahoma City-based company called a “zero premium” transaction valued at approximately $2.2 billion.

Vine Energy Drills Longest Horizontal Well in State of Louisiana

The well was recently drilled by Vine Energy in Sabine Parish to the Mid-Bossier formation with an estimated lateral of 15,240 ft and total measured depth of 27,520 ft.

Energy A&D Transactions from the Week of Sept. 8, 2021

Here’s a snapshot of recent energy deals including Enbridge’s $3 billion purchase of the largest crude export terminal in North America located along the Texas Gulf Coast.

Southwestern Energy Completes $2.7 Billion Haynesville Shale Expansion

Southwestern Energy previously announced the acquisition in early June with eyes of taking advantage of the direct access to the Gulf Coast LNG corridor provided by Indigo Natural Resources’ position in the Haynesville.

Energy A&D Transactions from the Week of Sept. 1, 2021

Here’s a snapshot of recent energy deals including the closing of Hess’ Denmark asset sale, a $150 million Permian Basin JV and another multimillion-dollar deal by Enerplus in the Williston Basin.