‘Oversupplied’ NatGas Market Aiding Williams’ Storage Business

Midstream company Williams saw overall demand growth as heavy gas volumes passed through its network.

U.S. Shale-catters to IPO Australian Shale Explorer on NYSE

Tamboran Resources Corp. is majority owned by Permian wildcatter Bryan Sheffield and chaired by Haynesville and Eagle Ford discovery co-leader Dick Stoneburner.

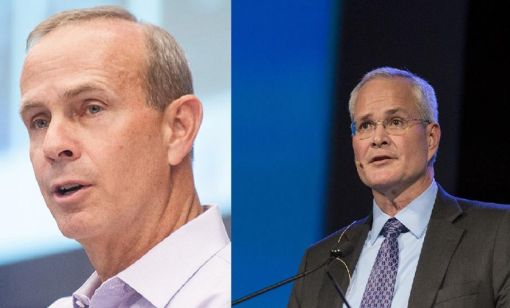

Exxon Shale Exec Details Plans for Pioneer’s Acreage, 4-mile Laterals

Exxon Mobil plans to drill longer, more capital efficient wells in the Midland Basin after a major boost from the $60 billion Pioneer Natural Resources acquisition. Data shows that Exxon is a leading operator drilling 4-mile laterals in the Permian’s Delaware Basin.

Chesapeake Stockpiles DUCs as Doubts Creep in Over Southwestern Deal

Chesapeake Energy is stockpiling DUCs until demand returns through growth from LNG exports, power generation and industrial activity.

Tellurian Reports Driftwood LNG Progress Amid Low NatGas Production

Tellurian’s Driftwood LNG received an extension through 2029 with authorization from the Federal Energy Regulatory Commission and the U.S. Army Corps of Engineers.

SilverBow Makes Horseshoe Lateral in Austin Chalk

SilverBow Resources’ 8,900-foot lateral was drilled in Live Oak County at the intersection of South Texas’ oil and condensate phases. It's a first in the Chalk.

Comstock Adds Four Whopper Wildcats; Takes Western Haynesville to 450K

Comstock Resources' four newest wells, which IP’ed at more than 35 MMcf/d, were landed at up to 19,400 feet total vertical depth.

M&A Spotlight Shifts from Permian to Bakken, Marcellus

Potential deals-in-waiting include the Bakken’s Grayson Mill Energy, EQT's remaining non-operated Marcellus portfolio and some Shell and BP assets in the Haynesville, Rystad said.

Chevron CEO: Permian, D-J Basin Production Fuels US Output Growth

Chevron continues to prioritize Permian Basin investment for new production and is seeing D-J Basin growth after closing its $6.3 billion acquisition of PDC Energy last year, CEO Mike Wirth said.

Barnett & Beyond: Marathon, Oxy, Peers Testing Deeper Permian Zones

Marathon Oil, Occidental, Continental Resources and others are reaching under the Permian’s popular benches for new drilling locations. Analysts think there are areas of the basin where the Permian’s deeper zones can compete for capital.