The primary fuel for M&A: U.S. shale consolidation. For the remainder of the year, Rystad said the industry could see another $150 billion in M&A. (Source: Shutterstock)

M&A chatter lately has it that inventory is scarce, the pool of potential U.S. shale targets are drying up and consolidation is slowing. But deal making may be poised to shift from the recent epicenter of M&A—the Permian Basin—to the Bakken, Marcellus and elsewhere.

Research firm Rystad Energy said $80 billion worth of North American assets remains on the market, with the U.S. shale sector expected to be the engine driving activity. Shale assets account for 66%, slightly more than $52 billion, of total assets on the market.

Some potential deals up for grabs include Bakken-focused Grayson Mill Energy, Uinta-focused XcL Resources, Exxon Mobil's Bakken portfolio, EQT's remaining non-operated Marcellus portfolio and certain Haynesville assets from Shell and BP, Rystad said in an April 28 report.

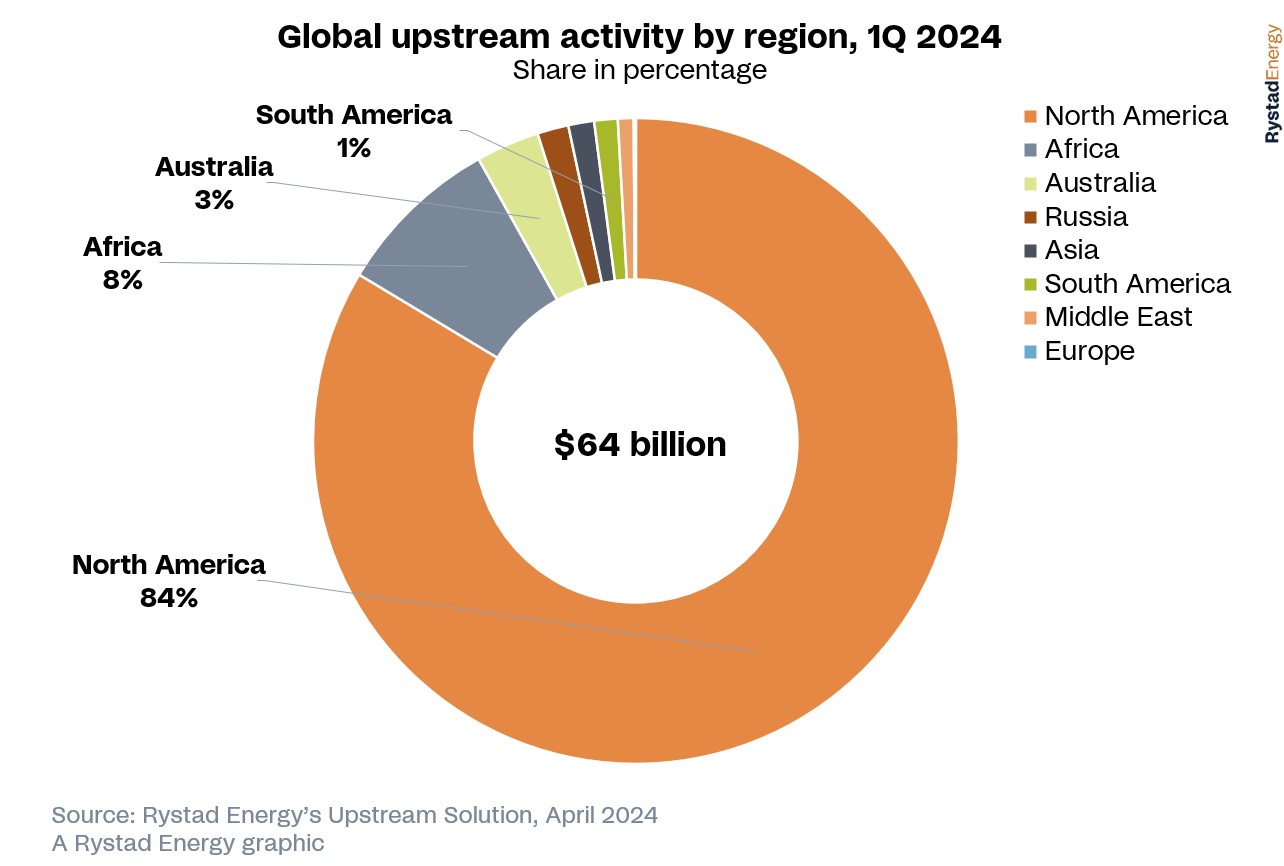

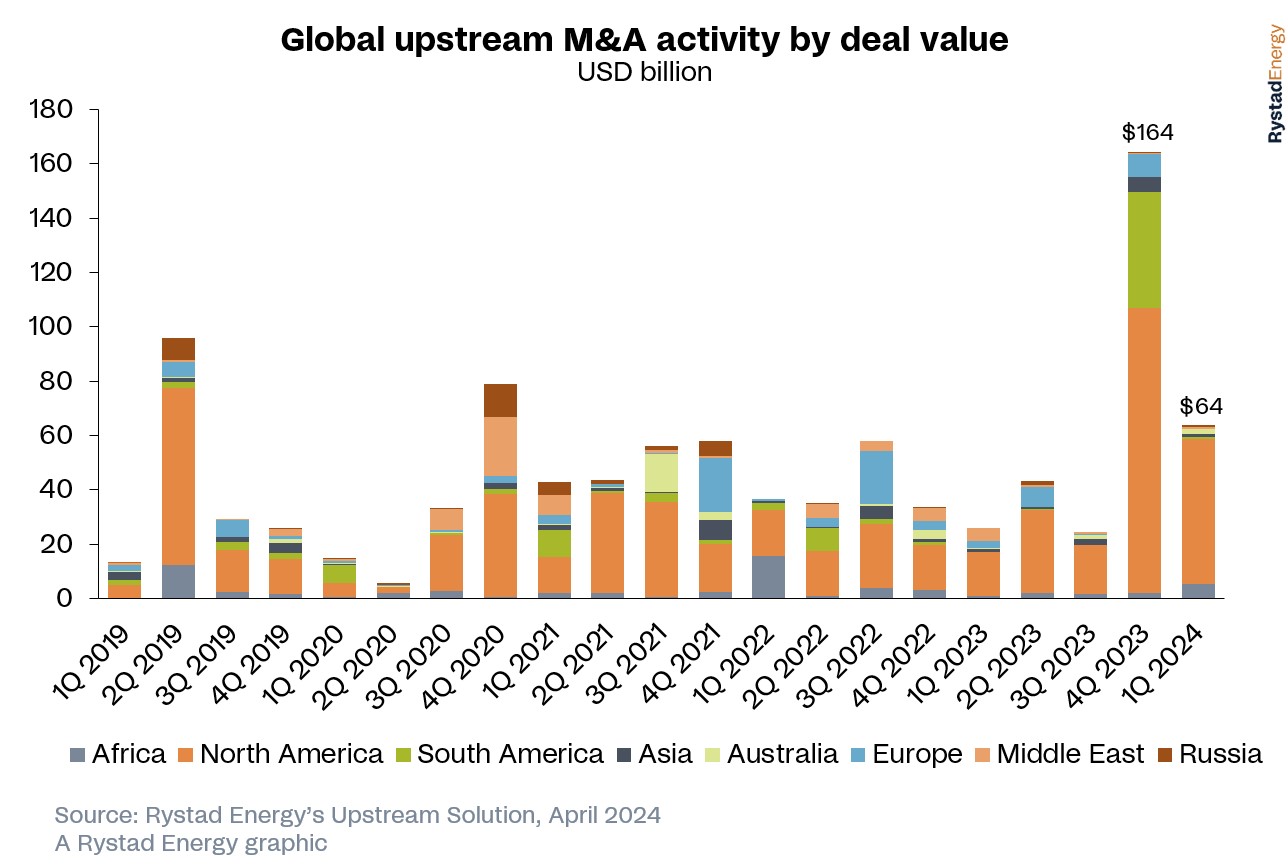

Globally, the first quarter saw the biggest dealmaking tab in five years as deal M&A value crossed the $64 billion threshold. By value, deals were up 145% compared to first-quarter 2023.

The primary fuel for M&A: U.S. shale consolidation. For the remainder of the year, Rystad said the industry could see another $150 billion in M&A.

“The Permian Basin has dominated recent dealmaking, but other shale plays look set to attract significant investments in the near future, with about $41 billion of non-Permian opportunities on the market,” Rystad said in an April 28 report.

In some cases, deals already announced will spawn other deals. Exxon Mobil, Chevron, Occidental Petroleum and Diamondback Energy are set to make divestitures that could “invigorate short-term M&A activity,” Rystad said.

With significant recent acquisitions, the companies are planning to divest non-core assets, “paving the way for growth among regional upstream players,” Rystad said. Chevron, for instance, has plans to divest approximately $10 billion to $15 billion worth of assets by 2028. Occidental’s divestiture target ranges between $4.5 billion and $6 billion.

“The Permian has been the focal point for M&A activity in recent times, but that focus is waning as available assets in the basin become scarce,” said Atul Raina, vice president of upstream research at Rystad. “But with appetite still strong, deal-hungry players are looking outside the basin for acquisitions. A power shift could be on the cards, with non-Permian assets taking center stage in the future North American deals pipeline.”

International upstream M&A

Outside of the U.S., deal activity has remained strong in the first quarter of 2024, with $10.5 billion changing hands at a 5% year-on-year increase, Rystad reported.

Upstream majors BP, Chevron, Shell and TotalEnergies collectively accounted for $5.2 billion in deals. Rystad said demand for gas-producing resources has been high, representing about 66% of total resources bought and sold in first quarter 2024.

Africa also saw “notable activity,” with transactions surpassing $5.3 billion fueled by oil and gas upstream majors. The largest deal was Shell’s divestment of its 30% stake in the SPDC joint venture in Nigeria to the Renaissance consortium. The $2.4 billion deal included about 520 MMboe of gas resources.

Majors’ appetite for exploration opportunities was also on display. In March, TotalEnergies said it had agreed to acquire a 33% operated stake in Block 3B/4B offshore South Africa and additional interest in two blocks offshore Namibia.

South American M&A ticked up in the first quarter with assets valued at $752 million changing hands—a significant increase from 2023 when the full year tally for deals came to $790 million.

Gas, gas, gas

In the Middle East, national oil companies including ADNOC, Saudi Aramco and QatarEnergy added to their gas and LNG portfolios, “allowing them to cut emissions and diversify their domestic economies away from a reliance on oil revenues,” Rystad said. ADNOC and Aramco are actively exploring further expansion opportunities in the LNG sector, including potential investments in the west, the firm said.

QatarEnergy announced the North Field West (NFW) development earlier this year, aimed at boosting Qatar’s LNG capacity to 142 million tonnes per annum (mtpa) and surpassing the previous target of 126 mtpa. QatarEnergy has taken a similar approach with previous expansion projects such as its North Field East and North Field South. ADNOC is expected to seek international operators' participation in the NFW project. Simultaneously, ADNOC and QatarEnergy are pursuing international expansion alongside their longstanding partners, BP and TotalEnergies, Rystad said.

Recommended Reading

Water Management Called ‘Massive Headwind’ for Permian Operators

2024-11-21 - Amanda Brock, CEO of Aris Water Solutions, says multiple answers will be needed to solve the growing amounts of produced water generated by fracking.

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

Coterra Takes Harkey Sand ‘Row’ Show on the Road

2024-11-20 - With success to date in Harkey sandstone overlying the Wolfcamp, the company aims to make mega-DSUs in New Mexico with the 49,000-net-acre bolt-on of adjacent sections.

E&P Highlights: Dec. 30, 2024

2024-12-30 - Here’s a roundup of the latest E&P headlines, including a substantial decline in methane emissions from the Permian Basin and progress toward a final investment decision on Energy Transfer’s Lake Charles LNG project.

Aris Water Solutions’ Answers to Permian’s Produced Water Problem

2024-12-04 - Aris Water Solutions has some answers to one of the Permian’s biggest headwinds—produced water management—but there’s still a ways to go, said CEO Amanda Brock at the DUG Executive Oil Conference & Expo.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.