The Williston Basin’s (pictured) middle Three Forks bench contains hundreds of millions of barrels of oil yet to be recovered, according to new reports. (Source: Shutterstock.com)

The Bakken Shale is the most popular target in North Dakota oil country—but experts caution not to count out the deeper Three Forks formation.

In fact, the middle Three Forks reservoir still contains hundreds of millions of barrels of undeveloped recoverable oil, according to two studies recently published by the North Dakota Department of Mineral Resources.

Oil and gas producers have primarily targeted the Middle Bakken formation with horizontal wells since the discovery of the Parshall Field in western North Dakota in 2006.

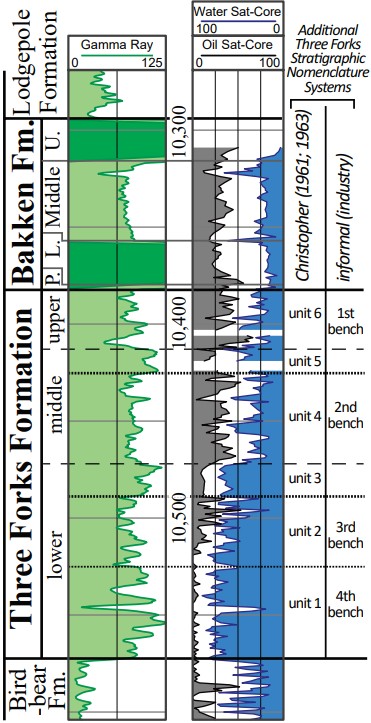

But operators started targeting the underlying Three Forks Formation as understanding and investment grew in the Williston Basin.

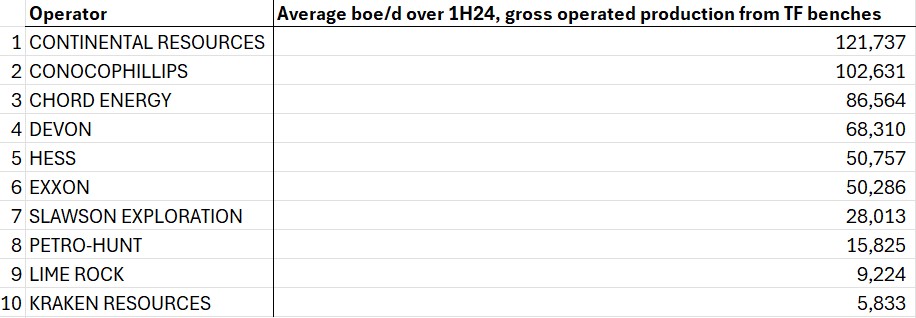

Continental Resources, ConocoPhillips and Chord Energy were the top three producers from the Three Forks during the first half of 2024, according to data from Enverus Intelligence Research.

Through August 2023, North Dakota producers have drilled and completed more than 400 horizontal wells in the middle (2nd) and lower (3rd) Three Forks intervals, producing more than 91 MMbbl of oil, 234 Bcf of natural gas and 106 MMbbl of water, according to the first study.

“These wells have amounted to ~2% of the drilling activity in the Bakken-Three Forks petroleum system, and ~1.7% of the total oil production to date,” authors Timothy Nesheim and Edward Starns wrote in the report.

Most of those projects (360+ wells) have landed in the shallower middle Three Forks bench.

Operators have only landed around 40 laterals in the deeper lower Three Forks. Just six lower Three Forks horizontals have come online since 2014—and none since 2017, “likely due to variable and overall low well production results,” per the report.

Lower Three Forks wells have produced approximately 6.7 MMbbl, 14 Bcf of gas and 11 MMbbl of water through August 2023.

Nesheim and Starns aimed to answer a key question in the first study: Does direct drilling and development of the middle Three Forks reservoir provide additional resource recovery? Or does middle Three Forks co-development only accelerate recovery rates of resources that would have otherwise been recovered by standalone upper Three Forks development?

“If middle Three Forks co-development simply accelerates oil and gas recovery rates, but does not add any long-term resource, then upper Three Forks wells should be less productive in the middle Three Forks co-development area versus upper Three Forks well performance where the middle Three Forks was not co-developed,” they wrote.

The report evaluated historical and future projected oil production from 593 North Dakota horizontal wells across 51 drilling spacing units (DSUs). North Dakota DSUs are typically 1,280 acres, or 2 square miles.

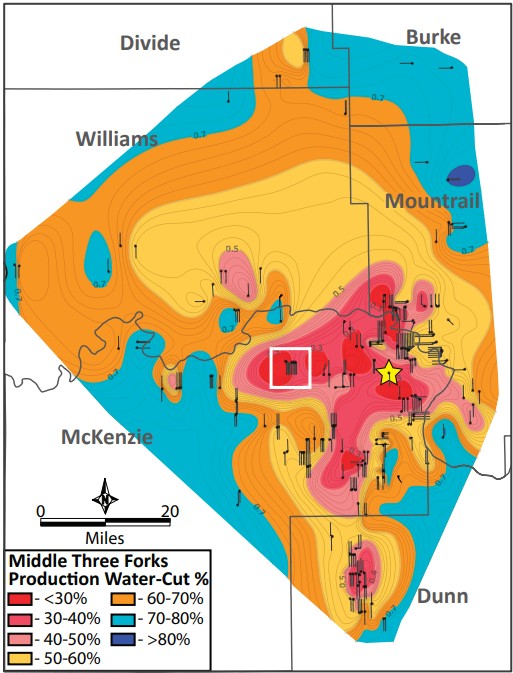

The study focused on northeastern McKenzie County, North Dakota—near the deepest portions of the Williston—where most of the middle Three Forks development has been sited.

Of the 25 DSUs evaluated that contained middle Three Forks horizontals, 17 “exhibited a clear volumetric addition of oil” from the reservoir, according to the study; six did not, and the contributions were unclear for two of the units.

Those 17 DSUs with middle Three Forks development showed an approximate 1 MMbbl to 2 MMbbl uplift in EURs compared to adjacent units without middle Three Forks development.

RELATED

Devon Energy Completes Grayson Mill Acquisition

Future upside

The first study aimed to demonstrate the incremental productivity of co-developing the middle Three Forks alongside the middle Bakken and upper Three Forks. A second study aimed to define a contiguous area of potential new development for middle Three Forks projects.

Assuming middle Three Forks wells can be drilled in each 1,280-acre DSU, researchers outlined approximately 275,000 acres in northeast McKenzie County where new horizontal wells are most viable.

Not counting existing wells, 604 middle Three Forks horizontals could still be drilled with that immediate prospective area, according to the study. Ultimate EURs for the new projects could range between 165 MMbbl and 410 MMbbl of oil.

“The results of these studies indicate that developing the middle Three Forks in addition to the Middle Bakken and upper Three Forks can increase long-term recovery,” Nesheim and Starns wrote.

Longtime North Dakota producers like Continental Resources and Petro-Hunt have explored the Three Forks’ potential since the mid-2000s.

With the Bakken shale in a later stage of maturity today, some North Dakota producers are touting their future upside in the deeper Three Forks intervals.

Devon Energy Corp. deepened its Williston footprint with a $5 billion acquisition of EnCap portfolio company Grayson Mill Energy last year.

The Grayson Mill acquisition deal added 500 gross undrilled locations and around 300 candidates for refrac projects. Around 80% of the new locations are in the Bakken and 20% were underwritten in the Three Forks.

Last fall, private equity firm Carnelian Energy Capital made an investment in Zavanna LLC, which has around 150 drilling locations across the Bakken and Three Forks.

RELATED

Recommended Reading

ADNOC Contracts Flowserve to Supply Tech for CCS, EOR Project

2025-01-14 - Abu Dhabi National Oil Co. has contracted Flowserve Corp. for the supply of dry gas seal systems for EOR and a carbon capture project at its Habshan facility in the Middle East.

Enchanted Rock’s Microgrids Pull Double Duty with Both Backup, Grid Support

2025-02-21 - Enchanted Rock’s natural gas-fired generators can start up with just a few seconds of notice to easily provide support for a stressed ERCOT grid.

McDermott Completes Project for Shell Offshore in Gulf of Mexico

2025-03-05 - McDermott installed about 40 miles of pipelines and connections to Shell’s Whale platform.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

Baker Hughes: US Drillers Add Oil, Gas Rigs for Third Week in a Row

2025-02-14 - U.S. energy firms added oil and natural gas rigs for a third week in a row for the first time since December 2023.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.