Formentera Partners is relying on bigger completions and longer laterals to crack the Pearsall code in Texas, following in EOG Resources' footsteps. (Source: Shutterstock, Formentera Partners)

Rumor had it more than a decade ago that the Pearsall Shale’s oil and condensate window underlying the Eagle Ford in south-central Texas was a new play.

Today, “the trial’s still out,” Bryan Sheffield, managing partner, Formentera Partners, told Hart Energy.

But he added, “We’re going to drill.”

Wildcatters IP’ed liquids from Pearsall horizontals in the early 2010s. But the EURs proved uneconomic.

Sheffield’s premise today is based on the fact that operators were using the best frac recipes of the time—and laterals were a mile or less.

For example, he said, one of those trials was a Marathon Oil well, Whitley-Dubose #1H, in Frio County in 2014. “This is in the middle of our block.”

Lateral length was 5,736 ft and proppant per lateral foot was 475 lb in a 20-stage frac, according to the completion report filed with the Texas Railroad Commission (RRC). Frac fluid was 16 bbl/ft.

In 10 years, the well, which is now owned by Formentera’s partner, Britanco LLC, made 97,429 bbl of oil through this past October and 348 MMcf.

In that time, shale producers’ frac recipes have advanced to 2,000 lb per foot and more. Sheffield’s thinking is more proppant and pressure-pumping intensity should make more liquids.

“If we go to 2,000 and 3,000 pounds per foot, you know that well is going to IP north of 400 bbl/d.”

And there is another point he considers promising, he said: “You have EOG [Resources] leasing everywhere.”

Joe Jaggers

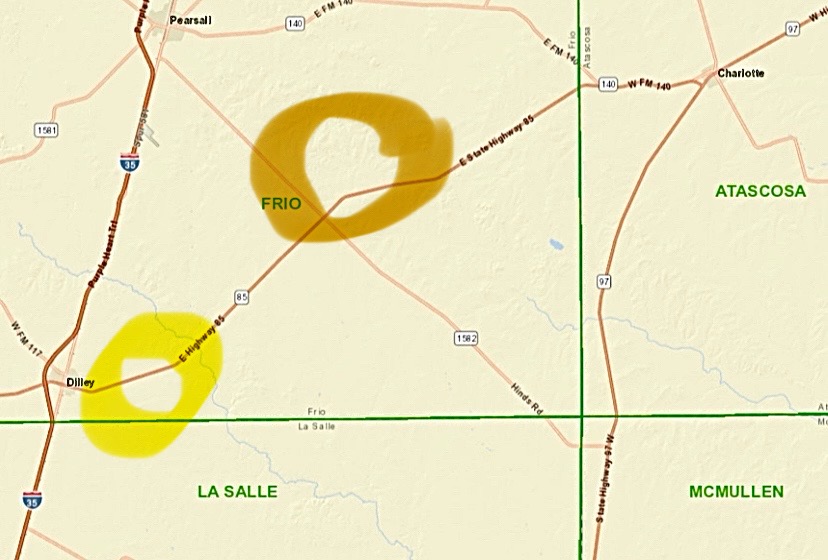

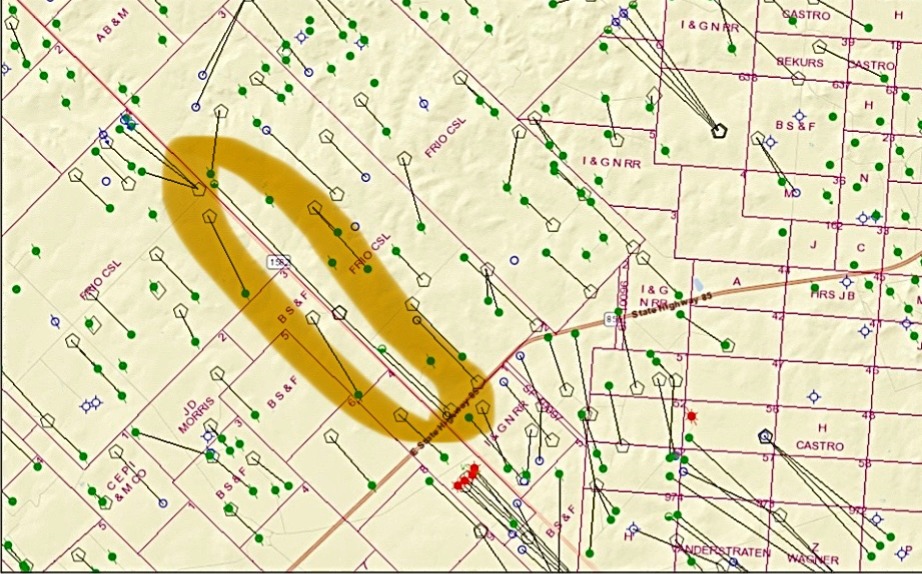

Formentera had two Pearsall laterals underway at press time near the Whitley-Dubose in southeastern Frio with explorer Joe Jaggers’ Britanco in a 35,000-Pearsall-acre deal signed in June.

Jaggers founded Perman-focused Jagged Peak Energy, which Sheffield’s Parsley Energy bought in 2020 before selling Parsley to Pioneer Natural Resources a year later. Prior to Jagged, Jaggers was CEO of Ute Energy until its 2012 sale; president of Bill Barrett Corp. until 2010; and president of Barrett Resources until its sale to Williams Cos. in 2001.

The Pearsall could be a great play for small independents like Formentera, Sheffield said.

“I don't know if it's big enough for guys like EOG. Maybe EOG has leased up enough acreage [with Pearsall rights] where it does move the needle.”

Formentera was drilling the Hurrikain Cat I-STX #S731H at press time and planned the Darlene 1-STX #N731HP next.

Each is from one pad, with one traveling southeast; the other, northwest. They are about 20 miles northeast of an EOG Pearsall wildcat.

“We are in the volatile oil window and our payzone is right around 10,000 to 11,000 feet,” Sheffield said. “We are a little shallower and updip and less mature than EOG's position, which is contiguous to our block on the south.”

Deposited in the early Cretaceous, the Pearsall sits under and north of the Eagle Ford (Late Cretaceous) trend as the ancient shoreline was receding, forming the Gulf of Mexico.

“We think our position points to more oil,” Sheffield said. “EOG is deeper, around 12,000 feet on payzone, so probably a little more condensate.

“But I think their area is going to be just as good.”

EOG’s Burns Ranch #1H

Into early 2014, there was a slew of Pearsall news articles, Sheffield noted. “And then nothing. Nothing!”

That’s until this past July when Hart Energy reported “EOG Resources Wildcatting Pearsall in Western Eagle Ford Stepout.’”

EOG moved a Nabors Industries rig some 30 miles west of its next-nearest South Texas drilling—which is for Eagle Ford—to southern Frio, spudding Burns Ranch #1H in late June to land in Pearsall.

The well is about 6 miles east of Dilley, Texas, and has a permitted depth of up to 12,000 ft.

The completion report and production had not been released at press time by the RRC.

Evan Kochelek, Formentera senior geologist, told Hart Energy, though, “We were told [by sources] the well has good pressure, between 3 and 4 MMcf/d and 400 bbl/d with low water.”

EOG’s Moonlight #22H

The Burns Ranch wildcat follows a 2-mile Pearsall test EOG made in northwestern McMullen County, Texas, in 2023 in its 30-Eagle Ford-well Moonlight development.

The Pearsall test, Moonlight #22H, IP’ed 1,115 bbl and 7.3 MMcf from a 10,627-ft lateral.

API gravity was more than 50°.

“So definitely condensate,” Kochelek said. “Rumor is that only part of the well is producing, not the entire 10,000-ft lateral.”

EOG did not include proppant load in its completion report to the RRC.

Through October, the well produced 44,738 bbl and 750 MMcf in 19 months online.

It’s “a bit too gassy, but great liquids,” Sheffield said. “So I think [the Pearsall] is going to be highly economic when we bring down capex.”

Indio Tanks (Pearsall) Field

Frio County hasn’t made much historically in comparison with its neighbors. Except for Eagle Ford wells along its southern end, holes in the county consist of legacy verticals and short Austin Chalk laterals.

Eagle Ford production represented nearly all of Frio’s 383,000 bbl of oil and 30,000 bbl of condensate in August. As for the Pearsall in Frio, Indio Tanks (Pearsall) Field made 600 bbl of condensate, no oil.

In La Salle County, the field’s August production was 351 bbl of condensate, no oil.

Across South Texas, the field made 2,000 bbl of condensate, plus 14 bbl of oil.

In Indio Tanks’ 17-year history, its output totaled 699,038 bbl of oil and 654,156 bbl of condensate through this past October. Gas was some 30 Bcf.

Early 2010s

The horizontal Pearsall play was lit in mid-2012 when Coterra Energy predecessor Cabot Oil & Gas signed Osaka Gas up to invest $250 million for a 35% stake in exploring the shale.

TPH & Co. reported the deal was the equivalent of $14,000 an acre. “This mark of value caught industry by surprise, given limited well control,” TPH analysts wrote.

The focus was on the intersection of Atascosa, McMullen, Frio and La Salle counties.

Soon, four wells were online with 30-day rates averaging 630 boe/d, 56% oil.

“Assuming a 550 MMboe EUR and $9.5 million well cost, these assets appear to be slightly less competitive than Cabot’s Eagle Ford position,” the analysts wrote.

In Frio, Cabot’s RH Pickens A #103H tested 559 bbl from a 5,489-ft lateral. It made 49,213 bbl its first 10 months online and a total of 89,391 bbl before it was shut-in in 2022 by its new owner, Crescent Energy, according to RRC data.

Also in Frio, Cabot’s Chilipitin Ltd. #101H tested 670 bbl from a 4,387-ft lateral. It made 34,905 bbl until 2020, when it was shut-in. It is also owned by Crescent Energy now.

In Atascosa County, Cabot tested its Hindes-Live Oak Unit #101H for 534 bbl from a 5,958-ft lateral. It made 32,346 bbl through January 2023 and has been offline since, according to the RRC. Crescent Energy now owns this well, too.

Cabot quickly shelved its Pearsall program. In 2014, Osaka took a one-time impairment, deeming Pearsall “economically unfeasible.”

The Japanese gas utility’s general manager said at the time, “We learned investment risks through the Pearsall experience. We want to target projects and fields with good production track records in our next acquisition.”

In 2019, it turned to the Haynesville Shale instead, buying Sabine Oil & Gas, which has grown into a Top 10 Haynesville producer.

‘Heartbreak shale’

The vertical Pearsall discovery was in the early 1960s west of Frio in the Maverick Basin. Elsewhere, “the Pearsall was known as a heartbreak shale,” Richard Mason, retired technical editor for Hart Energy, wrote in 2012.

The horizontal Indio Tanks opener was TXCO Resources’ Glass Ranch B #177 that came on in November of 2007 and made 194 MMcf with no liquids before being shut-in 11 months later, according to the RRC.

TXCO made four more Pearsall wells before filing for Chapter 11 bankruptcy: FOGMT #2SP for 1.9 Bcf and 210 bbl of condensate through this past September; Myers #2683H for 267 MMcf and 188 bbl of condensate; Myers #1683D for no MMcf or liquids; and O’Meara-Webb 687 Unit #1H for 446 MMcf and 553 bbl of condensate.

The property came to be owned by Newfield Exploration (now part of Ovintiv Inc.) in 2010 when TXCO was dissolved.

Crescent Energy is now the owner of FOGMT #2SP. El Toro Resources owns the O’Meara-Webb well, which was still producing gas in October and had last produced condensate in 2015.

Other early Pearsall wells

Two other early Frio wells in Pearsall are still online. Blackbrush Oil & Gas’ Pals Ranch #12H tested 568 bbl from a 3,815-ft lateral. It made 26,946 bbl through this past September.

Separately, Pals Ranch #11H tested 706 bbl from a 2,670-ft lateral. It made 14,164 bbl through this past September.

In 2013 in La Salle, Carrizo Oil & Gas' Crawford Ranch B #12H was completed with 14 stages and IP’ed 105 bbl of condensate and 1.7 MMcf. Carrizo reported at the time that it planned “to monitor the performance of the well before deciding whether to drill additional Pearsall tests.”

Carrizo didn’t make any more Pearsall wells, according to the RRC. Eventually, the Crawford well made 39,992 bbl condensate and 819 MMcf from its 1,700-ft lateral. It continued to produce in October. The well is now owned by Texas American Resources.

In Atascosa County, Marathon’s McCarty A Unit #1H IP’ed 440 bbl. The well produced 33,245 bbl through May 2021 and was shut-in upon SilverBow Resources’ acquisition of the property. The lateral was 5,668 ft. The well is now owned by Crescent Energy, which acquired SilverBow in July.

Another Pearsall attempt in Atascosa was EOG’s Alonzo Peeler A #1H, which tested 368 bbl from the 3,510-ft lateral. The well produced 4,359 bbl until shut-in in 2018.

Far northeast in Gonzales County, Penn Virginia Oil & Gas put Cannonade Ranch South #50H in Pearsall for 140 bbl from a 4,210-ft lateral. It made 4,481 bbl before put offline in September 2014.

Recommended Reading

On The Market This Week (April 7, 2025)

2025-04-11 - Here is a roundup of marketed oil and gas leaseholds in the Permian, Uinta, Haynesville and Niobrara from select E&Ps for the week of April 7, 2025.

M&A Competition Off to the Races as Mesa Minerals Kicks Off Fourth Iteration

2025-04-16 - The Mesa Minerals IV launch comes as M&A competition grapples for mineral and royalty interests, no matter the basin, says Mesa Minerals CEO Darin Zanovich.

Devon, BPX to End Legacy Eagle Ford JV After 15 Years

2025-02-18 - The move to dissolve the Devon-BPX joint venture ends a 15-year drilling partnership originally structured by Petrohawk and GeoSouthern, early trailblazers in the Eagle Ford Shale.

Sabine Oil & Gas to Add 4th Haynesville Rig as Gas Prices Rise

2025-03-19 - Sabine, owned by Japanese firm Osaka Oil & Gas, will add a fourth rig on its East Texas leasehold next month, President and CEO Carl Isaac said.

Chevron Completes Farm-In Offshore Namibia

2025-02-11 - Chevron now has operatorship and 80% participating interest in Petroleum Exploration License 82 offshore Namibia.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.