A Patterson-UTI rig drills Mac 10H, the second of six wells on EQT's Greene County, Pennsylvania, site on Tuesday, September 14, 2021. Patterson-UTI was a leader in U.S. onshore feet drilled during the first quarter, according to Enverus Intelligence Research data. (Source: Tom Fox/Hart Energy)

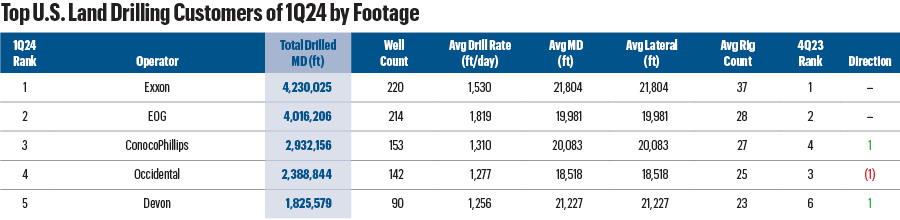

No other operators are going longer in U.S. shale than Exxon Mobil and EOG Resources.

Exxon and EOG led the nation in U.S. land footage drilled during the first quarter, with more than a combined 8.23 million feet drilled onshore between the two producers, according to an analysis by Enverus Intelligence Research.

At roughly 1,562 miles drilled, that’s the equivalent of drilling twice across the entire state of Texas from east to west—or drilling over half the distance between Los Angeles and New York City.

Exxon Mobil led the nation in onshore footage drilled during the first quarter at approximately 4.23 million feet. EOG drilled approximately 4.02 million feet.

ConocoPhillips, Occidental Petroleum and Devon Energy, which each boast deep multi-basin U.S. onshore portfolios, rounded out the top five.

Exxon drilled average lateral lengths of around 12,000 ft in the first quarter, per Enverus figures. The Texas-based supermajor is pushing lateral lengths further and further in the Delaware Basin, where Exxon has brought online a handful of 4-mile wells at its operating site near Poker Lake, New Mexico.

EOG, which is deep in the Delaware Basin, the Eagle Ford trend in South Texas and the emerging Ohio Utica shale oil play, drilled average laterals of about 9,200 ft.

EOG is seeing the benefits of drilling longer laterals across its shale portfolio, COO Jeff Leitzell said during the company’s second-quarter earnings call.

Last year in the Delaware Basin, EOG brought on four 3-mile lateral wells. This year, more than 50 Delaware wells, or 15% of its 2024 capital program, will go toward drilling 3-mile wells, Leitzell said.

In EOG’s Eagle Ford position, the company is on track to extend laterals by an average of 20%. Year-to-date, EOG has seen a 7% boost in drilled feet per day in the Eagle Ford.

“Longer laterals allow for more time being spent drilling downhole and less time moving equipment on the surface,” Leitzell said. “In addition, the more we extend laterals, the more benefit we derive from our in-house drilling motor program. EOG motors drill faster and are more reliable, which becomes more impactful on our drilling performance as lateral length increases.”

RELATED

Beyond the Horizon: Exploring the Permian’s Longest Laterals

Basin check-in

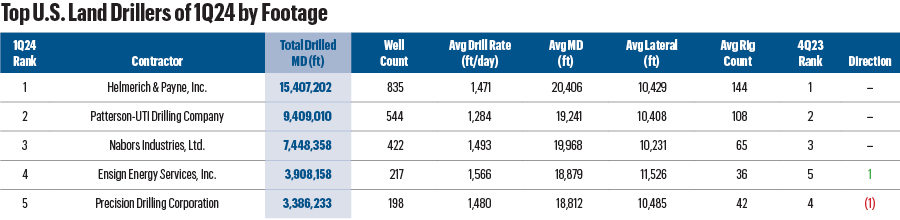

Data show that land specialists Helmerich & Payne Inc. (H&P), Patterson-UTI and Nabors Industries are doing the lion’s share of the hard work underground. Combined, the three companies drilled more than 32 million ft across the U.S. during the first quarter.

The Permian Basin, the nation’s top oil-producing region, continues to garner the bulk of U.S. onshore drilling activity.

There were 156 rigs deployed in the Delaware Basin and 114 rigs in the Midland Basin during the week ended July 19, according to most recent Enverus figures.

The onshore Gulf Coast region, including the Eagle Ford and Austin Chalk plays, had 65 active rigs.

That week, H&P had 148 rigs drilling in U.S. onshore basins. Patterson-UTI had 96 rigs while Nabors had 62 rigs.

Oilfield services companies are merging to serve an increasingly consolidated E&P customer market upstream.

H&P announced a $1.97 billion acquisition of the U.K.’s KCA Deutag in July, giving H&P greater scale in Middle East markets. KCA Deutag also has onshore operations in South America, Europe and Africa, as well as offshore contracts in the North Sea, Angola, Azerbaijan and Canada.

Last year, Patterson-UTI combined with NexTier Oilfield Solutions in a merger valued at $5.4 billion.

RELATED

Amid Flagging US Activity, OFS Sector Looks to 2025—and Overseas

Recommended Reading

Burgum: Yes to US Power Supply, Reliability; No on Sage Grouse

2025-01-16 - Interior Secretary nominee Doug Burgum said the sage grouse is neither endangered nor threatened; he'll hold federal leases as scheduled; and worries the U.S. is short of electric power and at risk of losing the “AI arms race” to China and other adversaries.

VanLoh: US Energy Security Needs ‘Manhattan Project’ Intensity

2025-02-06 - Quantum Capital Group Founder and CEO Wil VanLoh says oil and gas investment, a modernized electric grid and critical minerals are needed to meet an all of the above energy strategy.

Chevron’s Wirth: Rapid Transitions in Energy Strategy ‘Not the Right Policy Approach’

2025-03-10 - Relying on the president, whoever it is, leads to a wildly inconsistent energy policy in the U.S., Chevron CEO Mike Wirth said at CERAWeek by S&P Global.

Corrolytics Diagnoses Corrosive Microbes Before Symptoms Appear

2025-03-18 - Cleveland startup Corrolytics offers a solution to detect microbial corrosion rates on site and in near-real time—and head off a problem that costs trillions of dollars to industrial assets worldwide.

Hamm: Interior, DOE Leadership is a ‘Dream Team’

2025-02-06 - Harold Hamm, U.S. energy policy influencer and founder of wildcatter Continental Resources, said his top choices of Interior Secretary Doug Burgum and newly confirmed Energy Secretary Chris Wright will be a “dream team of unimaginable proportions.”

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.