Marathon Oil Corp. had been looking at merger offers for more than a year when ConocoPhillips rang on April 25.

Marathon Oil Corp. had been looking at merger offers for more than a year when ConocoPhillips rang on April 25 and named a price on May 17, according to a Securities and Exchange Commission (SEC) filing.

The pair signed an all-stock deal the evening of May 28, valuing Marathon at $22.5 billion, including $5.4 billion of net debt.

Two other publicly held bidders had been told just days before that, if they were serious, they needed to act fast, according to the S-1/A filing July 17.

ConocoPhillips wasn’t talking to Marathon before April 25, according to the filing.

The backstory

In March 2023, Marathon Chairman, President and CEO Lee Tillman chatted with an unidentified, public E&P generally on industry outlooks. Later that month, the E&P’s executive contacted Tillman about a potential combination.

Marathon hired M&A adviser Morgan Stanley for its feedback. The potential suitor submitted a non-binding all-stock offer in June 2023. It followed up with what would have been an 11% premium to Marathon’s 10-day average stock price of early July 2023.

Within a few weeks, Marathon determined that the premium wasn’t enough and ended the conversation. In addition, the other E&P’s stock price had declined.

In mid-August, another E&P, also publicly traded, got in touch.

Tillman and that E&P talked several times into November.

Meanwhile, a rumor had surfaced in mid-October that Marathon, publicly held Devon Energy Corp. and privately held CrownRock LP were talking about merging, according to Bloomberg.

Later that month, Reuters reported ConocoPhillips was looking at CrownRock.

ConocoPhillips Chairman, President and CEO Ryan Lance said in an earnings call on Nov. 2 that the company “remains steadfast in our returns-focused value proposition and cost-to-supply principles, which creates a high bar for M&A.”

Also on Nov. 2, Tillman said in an earnings call that “any transaction of scale is going to have to tick all of the boxes.”

On Devon’s Nov. 8 earnings call, CEO Rick Muncrief told analysts that “right now, we see one of the greatest, most clearcut opportunities [to increase shareholder value] is just [by] ourselves with our share repurchases.”

In any dealmaking, “we’re going to have a high bar, be very disciplined and be very thoughtful and make sure we can sell that to shareholders—that it’s the right thing to do,” Muncrief added.

CrownRock goes to Occidental

On Dec. 1, Marathon and the second unidentified E&P signed a confidentiality agreement and Marathon began its due diligence, according to the SEC filing.

But, after several meetings, this second E&P withdrew. It continued to say it was interested but didn’t provide an offer.

Meanwhile, Occidental Petroleum won a bid for Permian-focused CrownRock instead, announcing it on Dec. 11.

Months later, on April 8, the second E&P’s CEO got in touch with Tillman and wanted to reinitiate discussions.

Tillman replied that Marathon spent a good bit of time evaluating a deal in 2023, so the board would need a written offer, including transaction terms, to restart the conversation.

He added that this E&P’s “current production mix” had “challenges and risks” that created concern among board members.

The conversation ended.

The first E&P resurfaced on April 10, telling Tillman it wanted to talk again. Like before, Tillman said Marathon had spent a lot of time looking into a potential deal and wanted a written offer.

Then the second E&P returned on April 29, again wanting to talk. Again, Tillman said the board would need a written offer.

ConocoPhillips arrives

ConocoPhillips showed up on April 25, wanting to talk. Tillman told ConocoPhillips’ Ryan Lance that the board would need written confirmation of interest. The pair met on May 9.

Meanwhile that same day, the first E&P delivered a non-binding indication of interest to Marathon, offering a 16% premium to Marathon’s May 8 closing price, “an improvement to [its] July 19, 2023, proposal.”

It included two Marathon nominees to the board, but Marathon would hold neither the chairman or CEO post in the combined company.

Also on May 9, the second E&P delivered a non-binding offer with a 5% premium to the May 8 close. It added that the combined company would have 12 directors—five of them named by Marathon and one of those five would be the lead independent director.

Also, it offered that the combined company’s executive team would include two executive vice president positions for Marathon.

The numbers come in

After Lance and Tillman met on May 9, the two companies immediately began due diligence.

Meanwhile, Tillman let the other two E&Ps know on May 17 that their offers were being reviewed as well, clearly stating “there were other potential interested parties.” He added that each of the other two “should consider submitting an enhanced proposal.”

That same day, ConocoPhillips presented an all-stock offer of 0.2486 share per Marathon share—a 14% premium to the May 16 close.

It included a 4% termination fee Marathon would have to pay if it took a better offer and a 1% premium if shareholders rejected the deal. ConocoPhillips would not pay a termination fee if it walked out.

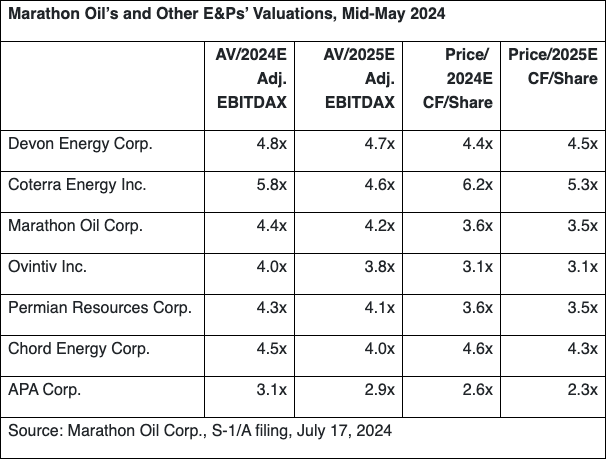

The Marathon board looked at all three offers on May 21. Management suggested there would be “significant advantages in durability” by proceeding with a ConocoPhillips deal.

Morgan Stanley and law firm Kirkland & Ellis joined the conversation.

The consensus pointed to that, “specifically, ConocoPhillips would offer scale in U.S. basins, enhanced inventory and resource life, portfolio diversity both internationally and with respect to LNG, accretion to oil mix, alignment on return of cash model and cost synergies,” the July 17 filing reported.

The board agreed, giving weight as well to “the actionability of a transaction with ConocoPhillips after the failed discussions with each of [the other two E&Ps] in 2023.”

Increasing the offer

Tillman returned to Lance on May 22 with the Marathon board’s ask for no less than 0.25 ConocoPhillips share per Marathon share, which would be a 14.5% premium to the Marathon closing price on May 21.

Tillman told Lance the board would prefer 0.255 share.

Lance called Tillman later that day, agreeing to the 0.255 share. The offer was now a 16.8% premium.

Tillman reached out to the second of the two E&Ps that had first suggested a deal, telling it on May 23 that Marathon “was in receipt of multiple offers and that [the second E&P’s] proposal was not sufficient.”

He told this to the first E&P too on May 24.

The second E&P asked how much time it had. Marathon “reiterated that time was of the essence,” the SEC filing reported. It also sent each of the initial bidders a draft merger agreement.

Meanwhile, Marathon asked ConocoPhillips for a lower, 2.5% termination fee and required ConocoPhillips to pay a termination fee if the Federal Trade Commission (FTC) rejected the combination.

ConocoPhillips replied with a 3.75% termination fee if the Marathon board canceled the deal and a 0.75% termination fee if Marathon shareholders rejected it. It declined to pay a fee if the FTC blocked the deal.

The evening of May 28, Marathon and ConocoPhillips closed the deal, announcing it before markets opened May 29.

Since then, Devon Energy made a winning $5 billion cash and stock offer for Williston Basin-focused Grayson Mill Energy.

ConocoPhillips and Marathon Oil were each integrated E&Ps—thus, “oil majors”—before spinning out their midstream and downstream assets and becoming “independent” oil and gas producers, meaning their operations are E&P only.

Marathon became independent in 2011; ConocoPhillips in 2012.

Recommended Reading

Aris CEO Brock Foresees Consolidation as Need for Water Management Grows

2025-02-14 - As E&Ps get more efficient and operators drill longer laterals, the sheer amount of produced water continues to grow. Aris Water Solutions CEO Amanda Brock says consolidation is likely to handle the needed infrastructure expansions.

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

How DeepSeek Made Jevons Trend Again

2025-03-25 - As tech and energy investors began scrambling to revise stock valuations after the news broke, Microsoft Corp.’s CEO called it before markets open: “Jevons paradox strikes again!”

Pair of Large Quakes Rattle Texas Oil Patch, Putting Spotlight on Water Disposal

2025-02-19 - Two large earthquakes that hit the Permian Basin, the top U.S. oilfield, this week have rattled the Texas oil industry and put a fresh spotlight on the water disposal practices that can lead to increases in seismic activity, industry consultants said on Feb. 18.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.