Ben C. Rodgers, APA, senior vice president of finance and treasurer (Source: Hart Energy)

DENVER — As reports emerged that APA Corp. was potentially shopping some of its Permian Basin assets for a potential $1 billion payoff, Ben C. Rodgers, the company’s senior vice president of finance and treasurer, displayed a remarkably good poker face.

But that doesn’t mean he didn’t drop some hints during his discussion of the company’s thoughts on the Permian Basin and its need to pay down debt, at the EnerCom Denver conference on Aug. 19.

Sources cited by Reuters said on Aug. 19 that the company was exploring the potential sale of Apache’s Permian Basin assets in Texas and New Mexico.

APA is engaged in a divestiture campaign after buying Callon Petroleum for $4.5 billion on April 1. As part of the deal, APA took out term loans totaling about $2 billion. The company owes an additional $4.8 billion in debt, according to Rodgers’ presentation.

“We've already made progress on paying those off with over $1 billion of asset sales this year,” Rodgers said, adding that there is “more to come.”

In July, APA closed the sale of Midland Basin, Austin Chalk and Eagle Ford Shale assets and interests for about $700 million. APA said the deal included 24,000 net royalty acres across several counties in the Midland Basin, and 237,000 net acres in the East Texas Eagle Ford and Austin Chalk plays.

WildFire Energy acquired the Eagle Ford and Austin Chalk acreage, which made up the bulk of Apache’s divestitures.

“We are good stewards with our capital, and we do what we say we're going to do through investing in a very diverse portfolio,” Rodgers said.

While Rodgers made no direct mention of an additional sale, Rodgers gave some insight into APA’s view of the Permian and the company’s role there.

Permian mania

For one, APA sees a lot of the Permian’s core acreage has been developed.

“Permi-mania … we’re like in year 12 or 13 of a huge horizontal drilling shift that happened really in 2009, 2010 in the Permian,” Rodgers said.

Much of what the E&P community has done in the past year or so, including APA, has been to more prudently spend capital while managing rig counts. Alluding to Exxon Mobil’s acquisition of Pioneer Natural Resources and Occidental Petroleum’s purchase of CrownRock, he said he sees “rig count moderation … through consolidation.”

“You saw that even with us on Callon,” he said, adding that the assets have continued to exceed expectations.

APA, like other companies, has “done what we can as an industry” and high-graded its inventory while factoring in fewer gains in efficiency.

“As you start to step out from that core acreage, we think that these efficiency gains are going to be challenged,” he said. “Not that there won't be any. We fully expect, as there has been the last 15 years of new technology to push that, but there is the potential that you start to see less growth coming from the U.S.”

Rodgers also noted that the U.S. Energy Information Administration’s statistics bear out that, while the Bakken and Eagle Ford shales are showing declines, the Permian will continue to lead U.S. oil production—just not indefinitely.

“It's been relatively flat, not a material amount of efficiency gains over the last 12 months,” he said. “They're drilling longer laterals.”

The Permian constitutes the “growth wedge” for U.S. production and, when the Permian “starts to flatten, you'll see that the U.S. oil production growth is going to moderate here in the coming years.”

Scattered assets

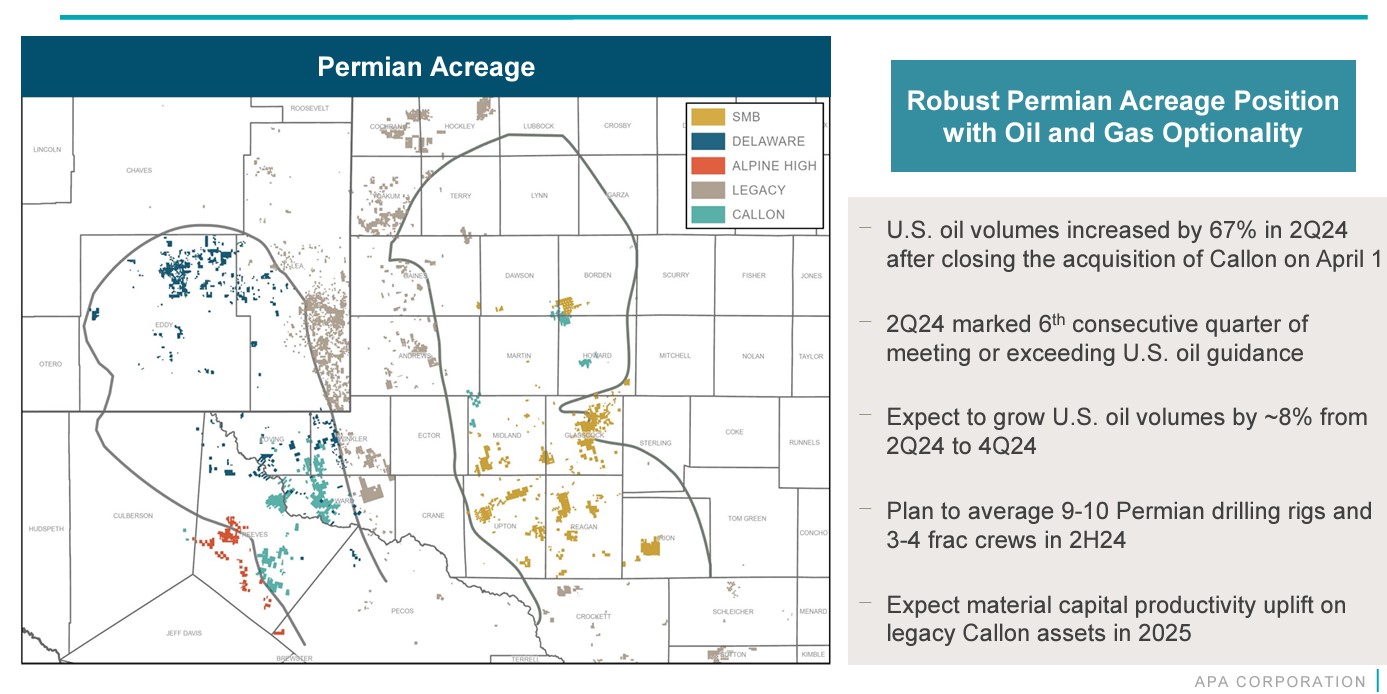

Apache’s Permian acreage is scattered throughout the basin.

Apache’s leasehold in the Permian Basin includes assets in the nearly 5,000 wells covering a gross acreage position of 3.7 million acres with exposure to numerous plays primarily located in the Midland Basin, the Central Basin Platform/Northwest Shelf, and the Delaware Basin, as of Dec. 31.

Reuters reported that APA is considering divesting assets in the Northwest Shelf, the Northern Shelf and the Central Basin Platform in New Mexico and Texas. The sites produce more than 22,000 boe/d combined, of which roughly 60% is oil.

Rodgers said that APA has a large scalable asset base with legacy production, including “a lot of conventional assets.”

“But unconventional assets are clearly our focus [given what] came with the Callon acquisition,” he said. “From an asset perspective here, expect to run nine to 10 rigs for the rest of this year.”

While APA spends 75% of its capex in the Permian—with the rest of its spend directed to Egypt, the North Sea and emerging developments in Alaska and Uruguay, among other areas—a partnership with TotalEnergies offshore Suriname may mean less spending elsewhere.

“Again, that [capex] will shift if there's an FID [final investment decision] in Suriname,” he said. “It's going to shift our capital focus as well as the potential for continued growth in Egypt.”

For now, the Permian has been “humming” the past couple of years for APA, Rodgers said. APA recently reported its sixth consecutive quarter of exceeding production guidance in the basin.

“We expect that to continue into the future,” he said. “The second quarter proved that we really know what we're doing with the Callon assets.”

And APA also has methodically updated its synergies it expects to realize from the deal, first in January at $150 million; then up in May to $225 million; and in August, $250 million.

“The point is that we think that we're going to do very well with the Callon assets,” Rodgers said.

Recommended Reading

NatGas Shouldering Powergen Burden, but Midstream Lags, Execs Warn

2025-02-14 - Expand Energy COO Josh Viets said society wants the reliability of natural gas, but Liberty Energy CEO Ron Gusek said midstream projects need to catch up to meet demand during a discussion at NAPE.

FERC Chair: Gas Needed to Head Off US Grid’s ‘Rendezvous with Reality’

2025-03-13 - Federal Energy Regulatory Commission Chairman Mark Christie is pushing natural gas to feed U.S. electrical grids before a “rendezvous with reality” occurs.

Vår Energi Makes Third Oil Discovery in Barents Sea

2025-02-27 - Vår Energi has discovered a third offshore oil reserve in the Goliat area of the Norwegian Continental Shelf as part of an exploratory collaboration with Equinor.

Guyana Exported a Total of 225 Crude Cargoes in 2024

2025-01-14 - Guyana, Latin America's newest oil producer, is now the region's fifth largest crude exporter after Brazil, Mexico, Venezuela and Colombia.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.