Rig crews work on an Eagle Ford well drilled in 2015 in Lasalle County, Texas. Canadian operator Baytex Energy is joining a growing number of E&Ps recompleting wells in the shale play. (Source: Tom Fox/Hart Energy)

Canadian operator Baytex Energy is joining the growing ranks of E&Ps working on refrac projects in the Eagle Ford Shale.

Producers in South Texas call them re-fracs, re-entries, re-completions and other variations, but their purposes are the same—to re-enter a declining well to pump new life out of it through modern drilling techniques.

Calgary-based Baytex Energy, which has a deep portfolio of Canadian light and heavy oil assets, got much deeper in the Eagle Ford Shale through a $2.2 billion acquisition of Houston-based Ranger Oil Corp. last year.

Some of the Eagle Ford’s largest operators—ConocoPhillips, Marathon Oil, Devon Energy, BPX and SilverBow Resources, among others—are extending their drilling programs with refracs in South Texas.

Baytex completed a lower Eagle Ford refrac on the Medina Unit No. 3H in the first quarter of 2024. Now, the company “is evaluating additional refrac opportunities to supplement our 2025 capital program,” Baytex reported in earnings after markets closed July 25.

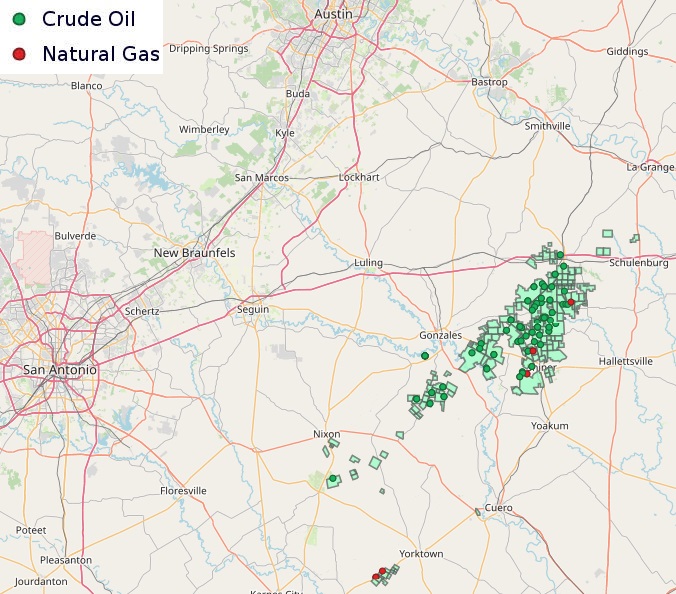

Baytex’s acquisition of Ranger added 162,000 net acres and 741 undrilled locations across the Eagle Ford’s black oil, volatile oil and condensate windows. The Ranger assets complemented Baytex’s existing non-operated position in the Karnes Trough play.

After integrating Ranger’s assets last year, Baytex started submitting data on its first new horizontal wells in the Eagle Ford earlier this year, Texas Railroad Commission (RRC) filings show.

Baytex brought online 11 (10.7 net) operated lower Eagle Ford wells during second-quarter 2024, largely focused on the black oil window.

That batch included one of the company’s strongest performing oil-weighted pads yet: The three-well Pluto pad (Pluto A1H, B2H and D4H) generated an average 30-day peak production rate of 1,348 boe/d per well (1,161 bbl/d of crude oil, 104 bbl/d of NGLs, 500 Mcf/d of natural gas).

Baytex’s 2024 program also included four upper Eagle Ford wells; three were brought onstream in the first quarter and continue to deliver strong results, Baytex said.

The company continues to identify additional upper Eagle Ford and Austin Chalk drilling locations for future development.

RELATED

From South Texas to the World: International E&Ps Drill Deep in the Eagle Ford

Attack the refrac

Refrac projects, where they make sense, are delivering promising results for operators.

Selecting the right candidate for a refrac is a very important step in the process, Baytex President and CEO Eric Greager had said during the company's first-quarter earnings call.

The Medina No. 3H well had declined to the point where it was producing less than 50 boe/d before the refrac. After the refrac, production jumped to more than 700 boe/d.

Greager said it boils down to completing a new nearly 5,000-ft lateral at a discounted price of approximately US$4 million.

How to refrac, or whether to refrac at all, comes down to a question of economics: In short, will the procedure net enough additional production to move the bottom line up?

Operators must account for the time and cost of doing a refrac, spacing concerns, existing well interference and a handful of other downhole issues.

According to analysis by Enverus Intelligence Research, producers can see between 20% to 40% of the average uplift from a post-refrac well compared to a new well.

But a refrac project can cost between 70% and 80% of the total cost of drilling a new well. Operators also still have to spend money on labor and input costs, like proppant and fluid.

RELATED

Recommended Reading

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

Chevron Targets Up to $8B in Free Cash Flow Growth Next Year, CEO Says

2025-01-08 - The No. 2 U.S. oil producer expects results to benefit from the start of new or expanded oil production projects in Kazakhstan, U.S. shale and the offshore U.S. Gulf of Mexico.

Utica’s Infinity Natural Resources Seeks $1.2B Valuation with IPO

2025-01-21 - Appalachian Basin oil and gas producer Infinity Natural Resources plans to sell 13.25 million shares at a public purchase price between $18 and $21 per share—the latest in a flurry of energy-focused IPOs.

Artificial Lift Firm Flowco’s Stock Surges 23% in First-Day Trading

2025-01-22 - Shares for artificial lift specialist Flowco Holdings spiked 23% in their first day of trading. Flowco CEO Joe Bob Edwards told Hart Energy that the durability of artificial lift and production optimization stands out in the OFS space.

Talos Selects Longtime Shell Exec Paul Goodfellow as President, CEO

2025-02-03 - Shell veteran Paul Goodfellow’s selection as president, CEO and board member of Talos Energy comes after several months of tumult in the company’s C-suite.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.