BPX CEO Kyle Koontz (center) tours the company’s Grand Slam centralized processing facility in the Permian Basin. (Source: BPX)

BP’s U.S. shale segment is seeing far stronger results than they expected from recompletion projects in the South Texas Eagle Ford Shale.

BPX Energy, BP’s onshore U.S. oil and gas business, is seeing “triple-digit plus” returns from Eagle Ford refracs and EUR uplifts “we didn’t really predict in shale,” BP CEO Murray Auchincloss said during the company’s Feb. 11 earnings call.

Auchincloss called Eagle Ford refracs “the most interesting” space the company is watching across its U.S. shale footprint right now.

“The refracs and downspacing are actually creating more flow than the original motherbores,” he said.

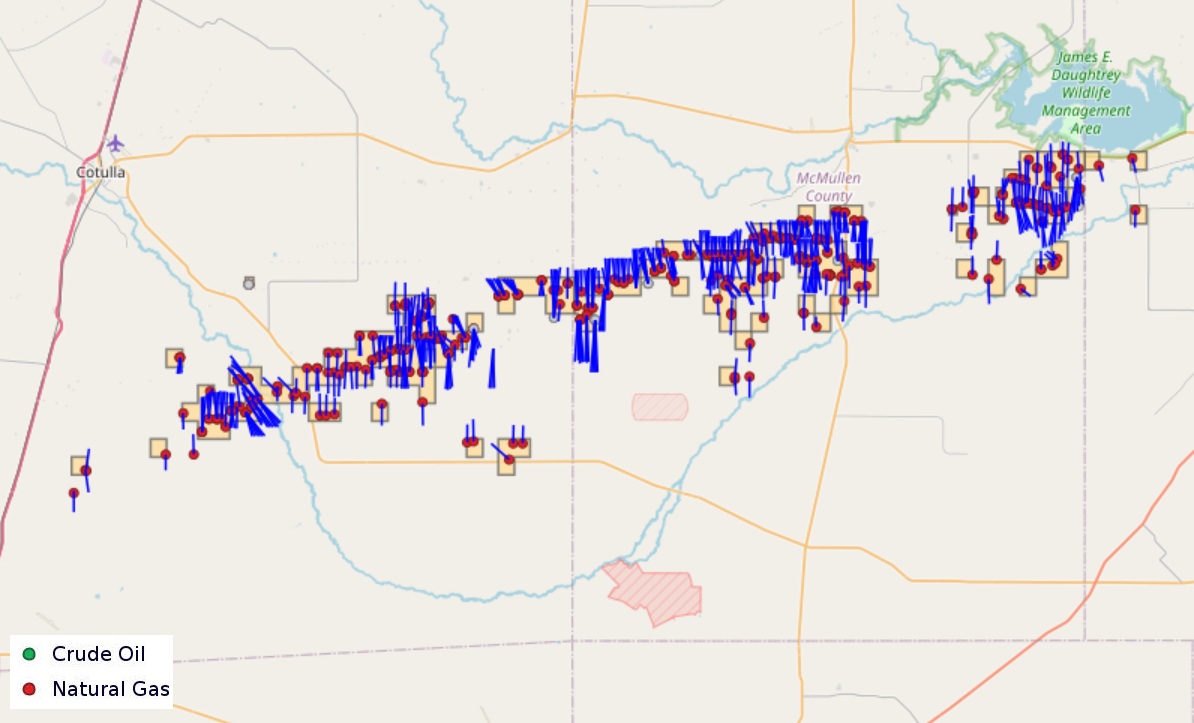

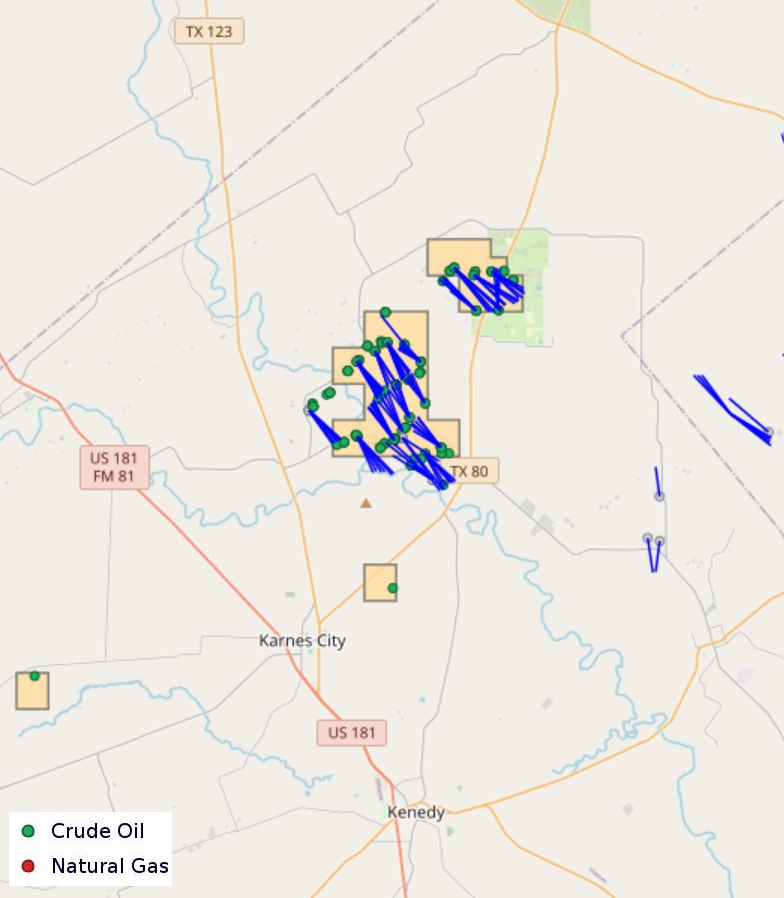

BPX has a large footprint across the Eagle Ford’s oil and natural gas windows. The company has producing Eagle Ford assets in Karnes, La Salle, Live Oak, McMullen and Zavala counties, Texas, according to Texas Railroad Commission (RRC) data.

The company produced approximately 43.89 MMBoe from the Eagle Ford in the 12 months ending November 2024, according to the RRC’s most recent data.

Eagle Ford oil output totaled 8.01 MMbbl, mostly from Karnes, McMullen and La Salle counties; Gas volumes totaled 215.28 Bcf.

BPX is one of several South Texas operators leaning into refracs, re-entries, recompletions or other re-do jobs to breathe new life into legacy wells with declining production.

Other E&Ps touting Eagle Ford refracs include ConocoPhillips, Devon Energy, Crescent Energy, Baytex Energy and privately held Verdun Oil.

Verdun Oil, backed by private equity firm EnCap Investments, started developing a refrac strategy around 2018, when the company completed what it says was the first full linear isolation refrac job in the Eagle Ford.

A cemented linear refrac involves installing a new liner inside the wells’ existing casing, which covers all the previous fracs. The well is then fracked as if it were a new project.

The other main type of refrac—bullhead refracs—do not direct frac fluid and are less costly alternatives to a full linear isolation refrac project.

Not every well makes sense for a refrac. Verdun has singled out wells with lateral lengths of around 6,000 ft that were completed before 2016 for refracs.

RELATED

E&Ps Pivot from the Pricey Permian

BP gassing up

BPX is considering increasing its gas-directed rigs as natural gas prices increase, Auchincloss said.

“Gas pricing is very, very solid as we look at the second half of [2025] and into early [2026],” he told analysts.

Henry Hub spot prices averaged $3.01/MMBtu in December and $4.13/MMBtu in January, per U.S. Energy Information Administration data.

Based on forward-looking strip prices, returns from BPX’s gas holdings “now beat the returns inside the oil basins,” Auchincloss said.

In addition to Eagle Ford gas, BPX produces large gas volumes from the Permian’s Delaware Basin. The company has assets in Culberson, Loving and Reeves counties, Texas.

BPX’s third central gathering facility in the Permian came online last year and is now operating at full capacity, Auchincloss said. He said that the fourth and final gathering project is expected to start up around mid-2025.

BPX also has a large gas portfolio in the Haynesville Shale play.

Experts anticipate U.S. natural gas prices will rise as demand increases for new LNG exports and to power AI data center projects.

Around 5.6 Bcf/d of incremental gas demand is coming online within the next 12 months to fuel three new LNG projects on the Gulf Coast, according to Expand Energy CFO Mohit Singh: Venture Global’s Plaquemines plant, Cheniere Energy’s expansion at Corpus Christi, Texas, and Exxon Mobil’s long-awaited Golden Pass LNG plant.

RELATED

Recommended Reading

Analysis: Middle Three Forks Bench Holds Vast Untapped Oil Potential

2025-01-07 - Williston Basin operators have mostly landed laterals in the shallower upper Three Forks bench. But the deeper middle Three Forks contains hundreds of millions of barrels of oil yet to be recovered, North Dakota state researchers report.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

E&P Highlights: March 10, 2025

2025-03-10 - Here’s a roundup of the latest E&P headlines, from a new discovery by Equinor to several new technology announcements.

Shale Outlook: E&Ps Making More U-Turn Laterals, Problem-Free

2025-01-09 - Of the more than 70 horseshoe wells drilled to date, half came in the first nine months of 2024 as operators found 2-mile, single-section laterals more economic than a pair of 1-mile straight holes.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.