(Source: Shutterstock)

The company behind a technology using fermentation to create oil-eating bugs, or microbes that release subsurface hydrogen, aims to commercialize its tech within 12 months to 24 months, its newly named chief told Hart Energy.

Gold H2, a spinoff of Houston-based industrial biotech company Cemvita, is lining up several pilot projects—including in the U.S., Asia and Europe—following successful field trial results in the Permian Basin in 2022.

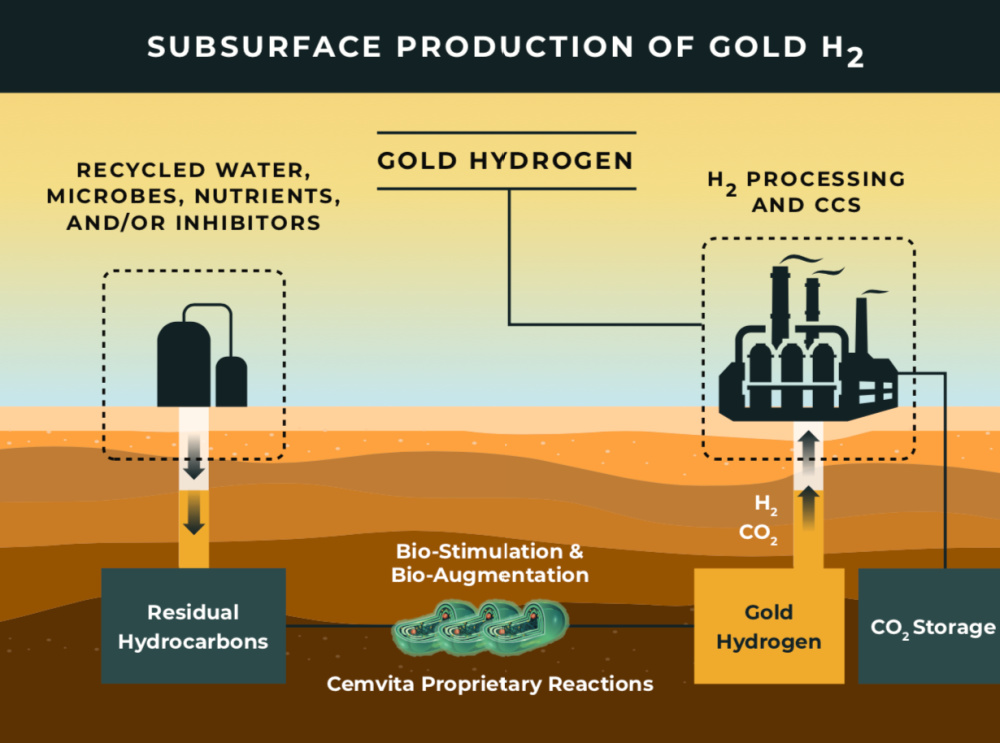

Since then, Gold H2 has increased its portfolio of microbes and expanded its technological capabilities to reach more oil reservoirs, Gold H2 CEO Prab Sekhon said. It also created a mobile fermentation unit that can be deployed anywhere and hooked up to a water injection system to produce the microbes onsite.

“It’s pretty much a few beer kegs put in this beautiful box that’s automated in which we’re cooking up these bugs. We’re building colonies [and] we’re injecting them in the ground,” Sekhon said.

Under the right conditions, depleted oil reservoirs can be transformed into hydrogen producers, or a subsurface biorefinery as Sekhon calls it. Ideally, the targeted reservoirs have temperatures between 130 F and 180 F, total dissolved solvents concentration of less than 100,000 ppm, little to no hydrogen sulfide production within the last five years and an average permeability of over 25 millidarcies with a porosity of more than 12%. The conditions are guidelines, not rules.

“Our target is to hit as many reservoirs as we can,” he said.

The company is also targeting unconventional reservoirs as it chases residual oil for its microbes to munch on and produce hydrogen as a byproduct with its waterflooding-type application with injectors and producers.

Sekhon, a former NextEra Energy Resources executive who began his career at Hess Corp. developing innovative development strategies in the Bakken, is now putting his oil and gas expertise to work at Gold H2. He stepped into the CEO role in May as the company looks to scale and commercialize the nascent technology.

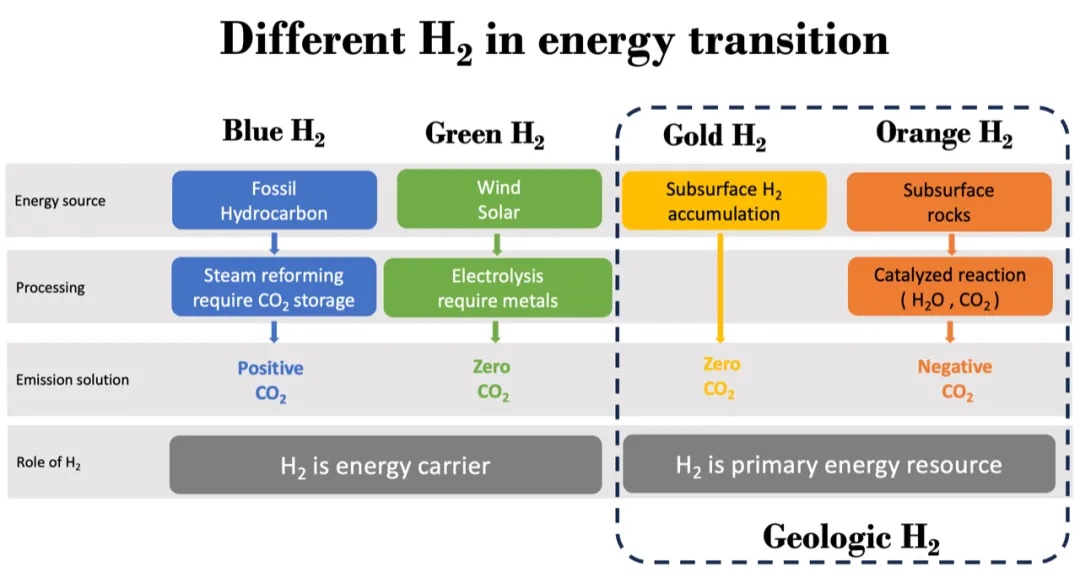

Hydrogen has been praised for its decarbonization potential. It can essentially serve as a drop-in fuel to replace fossil fuels or as a feedstock for energy storage and to generate electricity.

However, the costs remain high for some of the least carbon-intense forms of hydrogen. Developers of hydrogen produced by fermenting microbes found in depleted oil wells believe it can be among the least expensive ways to produce hydrogen. Developers of so-called white hydrogen, which is naturally occurring subsurface hydrogen, have said the same.

Digging for hydrogen

Earlier this year, the U.S. Department of Energy awarded $20 million to 16 projects to explore geologic hydrogen stimulation and reservoir management.

“With funding from ARPA-E, project teams from across the nation will explore the possibility of accelerating the production and extraction of natural hydrogen, transforming our understanding of this critical energy resource while accelerating solutions we need to lower energy costs and increase our nation’s energy security,” said Advanced Research Projects Agency-Energy (ARPA-E) Director Evelyn N. Wang in a statement announcing the awards.

The U.S. Geological Survey and Colorado School of Mines also established this year a joint industry program to study the potential of geologic hydrogen resources. BP, Chevron and Petrobras are among the partners. A startup called Koloma, which is backed by Bill Gates’ Breakthrough Energy Ventures, is also chasing geologic hydrogen.

“You got low carbon intensity from green hydrogen, but it’s extremely expensive. Gray hydrogen is cheaper, but it’s polluting like crazy. And then you’ve got two options that kind of hit the mark,” Sekhon said, referring to white and gold hydrogen.

While the cost is low for geologic hydrogen, it comes with exploration risks, he added, noting it’s not like drilling a shale well. “These are more conventional type reservoirs where you’re going to probably miss 90% of the time. If you take that into consideration, that makes your costs go up. The other thing is with white hydrogen, or natural hydrogen, your infrastructure isn’t necessarily in place. So, you have to think about, is this near an offtaker?”

Going for gold

Gold H2 is targeting old uneconomic oil fields with existing infrastructure that can be retrofitted—changing out wellheads and replacing tubing.

“You’re harnessing the Earth’s heat for any thermal needs of these bugs [microbes] to essentially eat oil, digest and create hydrogen,” Sekhon said. “What we’re able to do is create an extremely low carbon intensity—close to green—hydrogen. And we’re able to produce it at 80 cents a kilogram. That’s the target.”

About 60 cents of that cost is to scrub out the CO2, or rather purify the hydrogen, he added.

The process uses existing technology such as amine units and pressure swing adsorption units, which Sekhon admits are energy intensive but could be optimized to lower costs.

As part of the process, residual CO2 produced is reinjected back into the reservoir.

Gold hydrogen is still relatively new to the hydrogen game and lower on the technology readiness scale when compared to other forms of lower-carbon hydrogen.

“I think 2024 is going to be our year. This is going to be the year where we deploy our pilots and we’re producing hydrogen and folks start to realize that this may be a paradigm shift for the energy industry,” Sekhon said. But, “we’re trying not to overpromise.”

Gold H2 has signed an agreement with a major company and plans to conduct a pilot, likely in California, Sekhon said, not yet revealing the company. More information is expected to be released soon.

“If the pilot is successful, it’ll be relatively easy to convert to commercial project. This could be, let’s say 20-ton to 30-ton per day hydrogen production assets,” he said. Gold H2 is also working on deals with two companies in Asia and another in Eastern Europe for pilots. “We’ve got a lot of irons in the fire right now.”

The pilots will be spaced out so that learnings from each can be applied to the others.

Gold H2 is open to working with more companies as it moves to optimize its technology.

“Get in touch. If you have some fields that you’re interested in trying the technology out on, we’ll be more than happy to work with you,” he said. “You have an opportunity to be on the forefront and be an early adopter of a technology that could, I think, rejuvenate your asset and give you another 10 to 20 years of life.”

Recommended Reading

Improving Gas Macro Heightens M&A Interest in Haynesville, Midcon

2025-03-24 - Buyer interest for Haynesville gas inventory is strong, according to Jefferies and Stephens M&A experts. But with little running room left in the Haynesville, buyers are searching other gassy basins.

Permian to Drive Output Growth as Other Basins Flatten, Decline–EIA

2025-01-14 - Lower 48 oil production from outside the Permian Basin—namely, the Bakken and Eagle Ford shales—is expected to flatten and decline in coming years, per new EIA forecasts.

More Uinta, Green River Gas Needed as Western US Demand Grows

2025-01-22 - Natural gas demand in the western U.S. market is rising, risking supply shortages later this decade. Experts say gas from the Uinta and Green River basins will make up some of the shortfall.

In Inventory-Scarce Permian, Could Vitol’s VTX Fetch $3B?

2025-03-28 - With recent Permian bids eclipsing $6 million per location, Vitol could be exploring a $3 billion sale of its shale business VTX Energy Partners, analysts say.

Chord Drills First 4-Mile Bakken Well, Eyes Non-Op Marcellus Sale

2025-02-28 - Chord Energy drilled and completed its first 4-mile Bakken well and plans to drill more this year. Chord is also considering a sale of non-op Marcellus interests in northeast Pennsylvania.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.